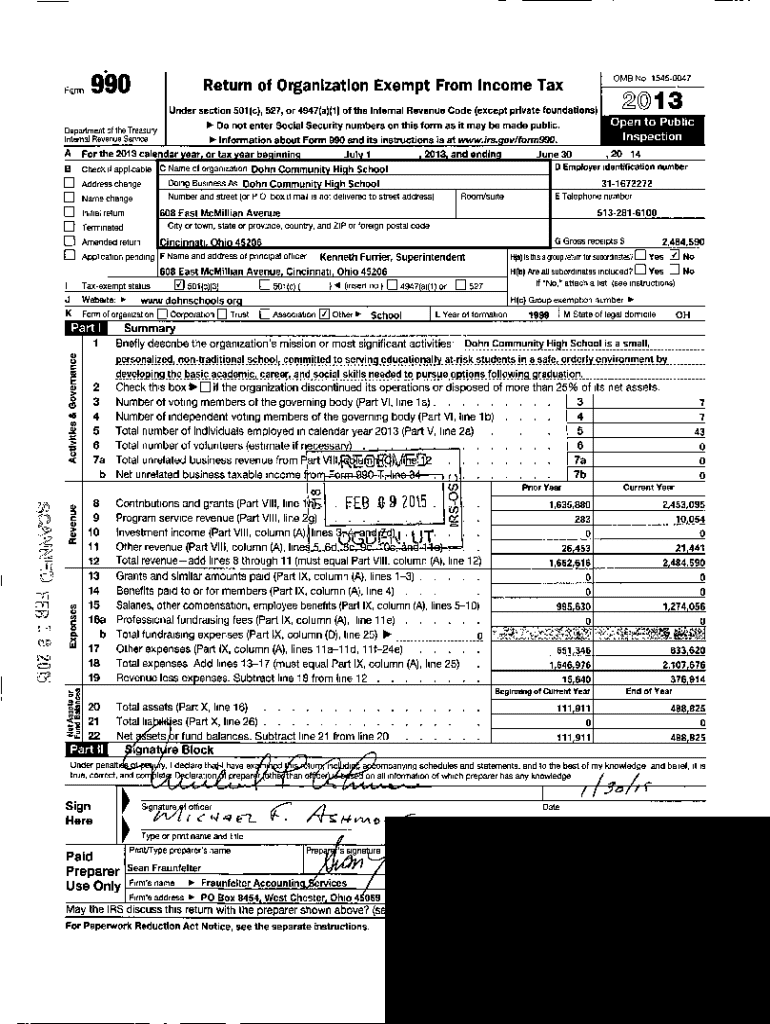

Get the free Can non-exempt charitable trust file Form 990-PF?

Get, Create, Make and Sign can non-exempt charitable trust

Editing can non-exempt charitable trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out can non-exempt charitable trust

How to fill out can non-exempt charitable trust

Who needs can non-exempt charitable trust?

Can non-exempt charitable trust form: A comprehensive guide

Understanding non-exempt charitable trusts

Non-exempt charitable trusts serve a critical role in the philanthropic landscape, allowing individuals and organizations to fund specific charitable activities while engaging in fundraising endeavors. These trusts differ significantly from their exempt counterparts, primarily in that they do not automatically qualify for federal tax exemptions. A clear understanding of their definition and purpose is essential for anyone considering the establishment of such a trust.

Several types of charitable trusts exist, each with unique characteristics. For instance, charitable remainder trusts, charitable lead trusts, and pooled income funds all represent different methods of charitable giving and asset management. Understanding these distinctions enables potential trustors to select the most fitting structure for their philanthropic goals.

The key differences between exempt and non-exempt charitable trusts hinge on tax obligations and regulatory compliance. Non-exempt trusts do not qualify for tax deductions for contributions, making it imperative to plan carefully to maximize the benefits of charitable giving.

The importance of properly forming a non-exempt charitable trust

Proper formation of a non-exempt charitable trust not only safeguards your intentions but also ensures compliance with legal regulations. The repercussions of poorly executed documentation can result in delays, legal challenges, or even disqualification of tax benefits, which can undermine charitable goals.

Moreover, organized trust management creates a framework within which the trust can operate effectively. This includes establishing clear protocols for fund distribution, oversight, and governance while promoting transparency and accountability in handling assets.

Common pitfalls include inadequate documentation, failure to comply with IRS regulations, and neglecting ongoing reporting requirements. Avoiding these issues requires attention to detail and a proactive approach to trust management.

Step-by-step guide to forming a non-exempt charitable trust

Creating a non-exempt charitable trust involves several critical steps, each contributing to the trust's success. The following steps provide a roadmap to guide you through the formation process.

Interactive tools for forming and managing your non-exempt charitable trust

Leveraging technology can significantly enhance the efficiency of managing a non-exempt charitable trust. Tools available through pdfFiller provide innovative solutions for document management.

For instance, pdfFiller's document editing tools allow users to easily create, fill, and edit trust documents from any location. This accessibility ensures that trustors can adapt their documents to evolving circumstances seamlessly.

Additionally, eSigning features facilitate the approval process among stakeholders, ensuring all agreements are signed promptly. Collaborative tools provided by pdfFiller also enable teams to work together efficiently, streamlining the management processes and ensuring accountability.

Common challenges in non-exempt charitable trust formation

Establishing a non-exempt charitable trust can present various challenges that trustors must navigate effectively. Understanding these common hurdles can aid in proactive planning and resolution.

First, tax implications can complicate the formation process, particularly if trustors are unaware of the specific deductions they might miss by assuming a non-exempt designation. Consulting a tax professional can clarify these issues early on.

Additionally, navigating state-specific regulations is paramount as compliance can differ widely across jurisdictions. Each state may impose unique requirements that trustors must adhere to avoid penalties.

Finally, disputes among beneficiaries can arise, particularly if trust stipulations are ambiguous or not thoroughly communicated. Open communication and well-documented agreements are critical to minimizing these conflicts.

FAQs on non-exempt charitable trusts

Related content and further reading

Understanding the broader context of charitable trusts can enhance your ability to make informed decisions. The role of nonprofits in society, for instance, highlights the impact that well-structured charitable trusts can have on community development.

Comparing charitable trusts to alternative philanthropic tools, such as donor-advised funds, can illuminate pathways for effective philanthropy and asset management.

Additionally, staying abreast of trends in charitable giving and trust management is essential for adapting your trust’s operations to reflect the evolving landscape of philanthropy.

Conclusion: Navigating your non-exempt charitable trust journey

Ultimately, establishing a non-exempt charitable trust involves careful planning and execution. Reiterating the importance of clearly defined purposes, structured governance, and compliance ensures that your charitable mission remains intact.

Seeking professional assistance can be invaluable, especially in complex situations where legal and tax implications may arise. The combination of intuitive document management tools from pdfFiller and expert advisory services positions trustors for success in their philanthropic endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my can non-exempt charitable trust directly from Gmail?

How do I edit can non-exempt charitable trust straight from my smartphone?

How do I fill out can non-exempt charitable trust using my mobile device?

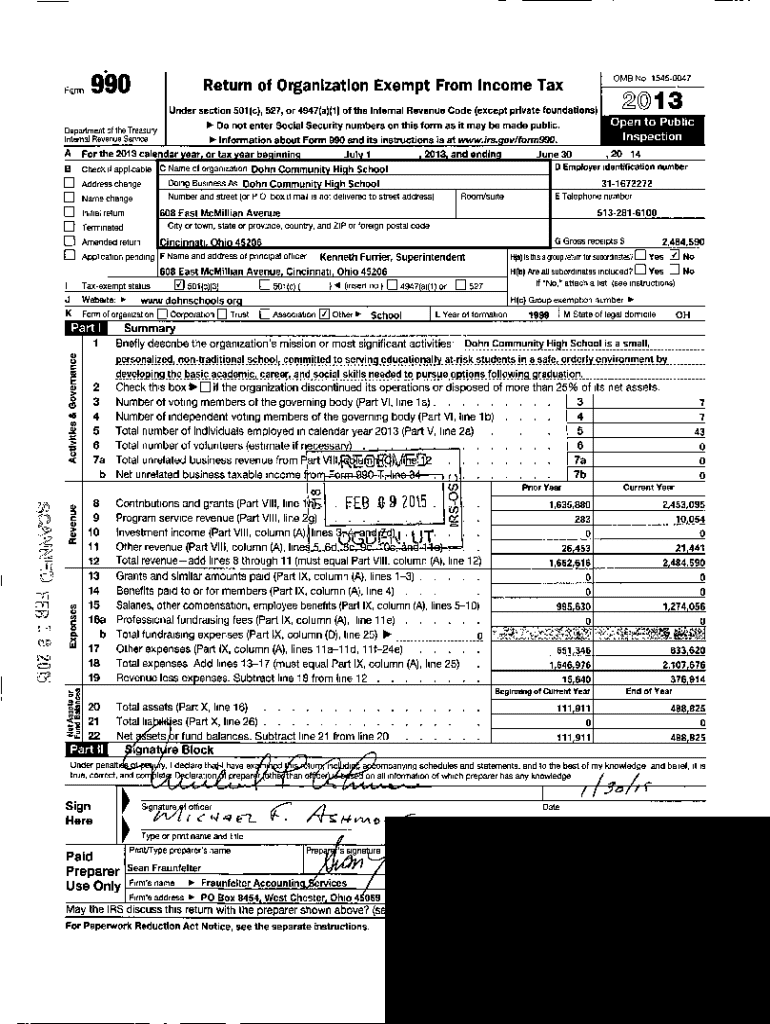

What is a non-exempt charitable trust?

Who is required to file a non-exempt charitable trust?

How to fill out a non-exempt charitable trust?

What is the purpose of a non-exempt charitable trust?

What information must be reported on a non-exempt charitable trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.