Get the free (Signed) SEE ACCOUNTANTS' PREPARATION REPORT - hfs illinois

Get, Create, Make and Sign signed see accountants preparation

Editing signed see accountants preparation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out signed see accountants preparation

How to fill out signed see accountants preparation

Who needs signed see accountants preparation?

A Comprehensive Guide to the Signed See Accountants Preparation Form

Understanding the signed see accountants preparation form

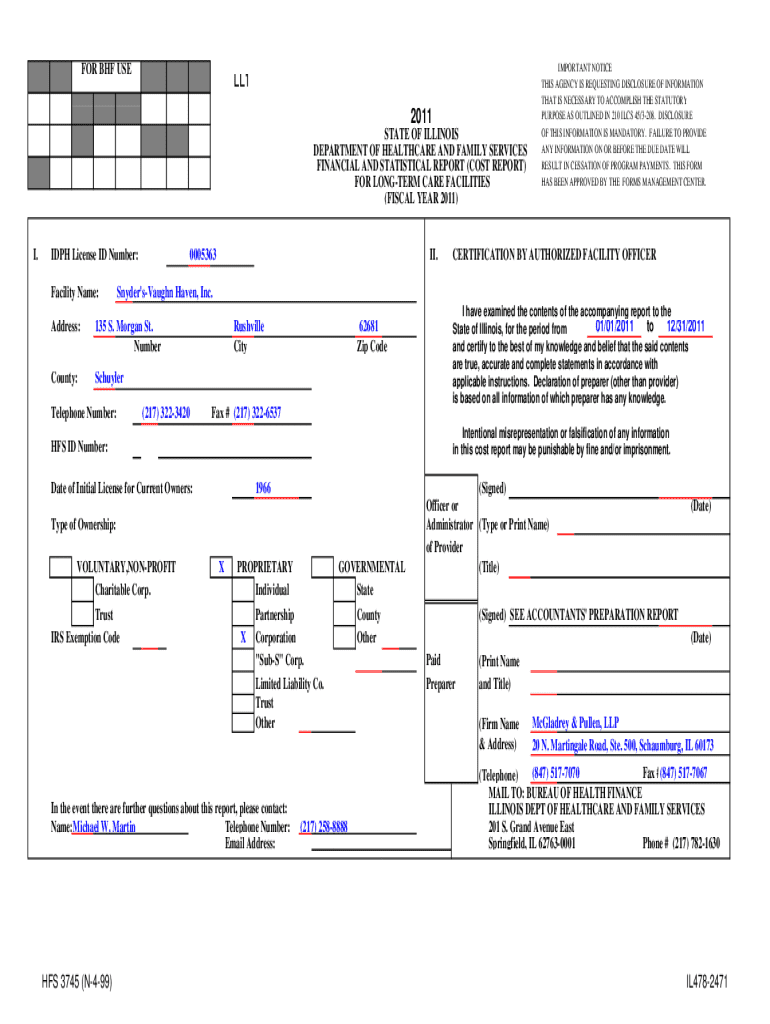

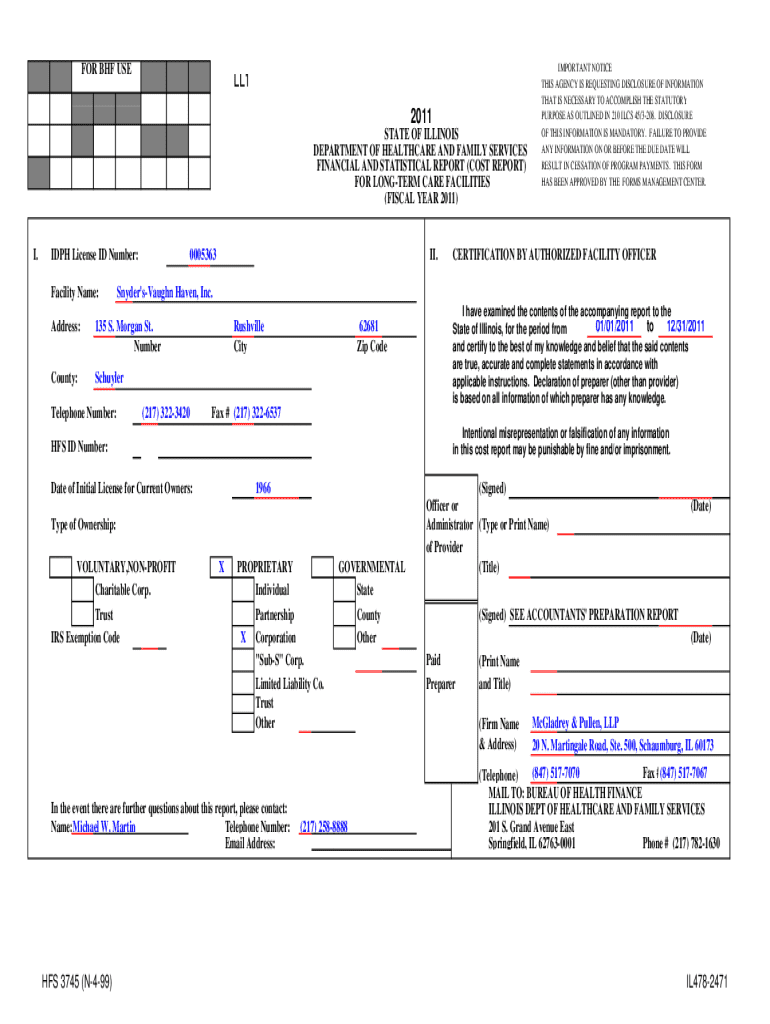

The Signed See Accountants Preparation Form is a crucial document used to signify the acknowledgment and understanding of the services provided by an accountant or accounting firm. This form highlights that clients have communicated and engaged with their accountants regarding financial activities, ensuring transparency and accountability in financial reporting. Its primary role lies within tax preparation and audits, where it serves as evidence that preparers have adhered to professional standards while compiling financial data.

The importance of the Signed See Accountants Preparation Form extends beyond basic compliance; it forms a foundational element in maintaining legal integrity in financial documentation. By signing this form, parties confirm that they are aware of the nature of the accounting services, including any limitations and responsibilities. This leads to fewer disputes in the case of audits or legal inquiries, effectively shielding both the clients and the accountants.

Legally, the form serves as an agreement, outlining rights, responsibilities, and aspirations between clients and their accountants. Misunderstanding or miscommunication about financial situations is significantly reduced, ultimately enhancing trust in the professional relationship.

Key components of the signed see accountants preparation form

To effectively utilize the Signed See Accountants Preparation Form, users need to understand its essential components. This form typically requires detailed personal identification, financial information, and specific details about the accountant and their firm. Accurate formulation of these components is crucial for ensuring legitimacy and compliance.

Filling out common sections accurately—like services requested, fee structures, and engagements—is also crucial. For illustration, consider examples of completed forms, which demonstrate how thoroughness in filling each section can aid in clarity and streamline the accounting process.

Step-by-step guide to completing the signed see accountants preparation form

Completing the Signed See Accountants Preparation Form can be straightforward with a systematic approach. Here's a step-by-step guide to navigate through the process efficiently.

Tips for effective use of the signed see accountants preparation form

To maximize the efficacy of the Signed See Accountants Preparation Form, certain best practices should be observed. Common mistakes often arise during the form completion process, such as incomplete sections or typographical errors. Here are a few tips to help you navigate these potential pitfalls.

By adhering to these guidelines, individuals and teams can enhance their experience with the Signed See Accountants Preparation Form, ensuring compliance and accuracy.

Frequently asked questions about the signed see accountants preparation form

Navigating the nuances surrounding the Signed See Accountants Preparation Form can generate questions and concerns. Below are frequently asked questions that can clarify the form's usage and requirements.

Legal and compliance considerations

The Signed See Accountants Preparation Form is not just a formal template; it is integral to the larger framework of regulatory compliance in finance. Understanding the legal implications and compliance issues tied to this form is vital for any business or individual seeking accounting services.

Certified Public Accountants (CPAs) play a vital role in preparing the Signed See Accountants Preparation Form. They must ensure that all engagements comply with Generally Accepted Accounting Principles (GAAP) and related legal standards. The independence and ethical considerations that accountants must maintain while preparing the form emphasize the need for transparency and repute in accounting practices.

Clients should understand these regulatory frameworks to better navigate any potential issues. A firm grounding in ethical compliance protects clients and accountants alike, fostering a healthier, more transparent professional relationship.

Advanced topics on the signed see accountants preparation form

While the essentials of the Signed See Accountants Preparation Form are crucial, advanced knowledge in this area enhances understanding significantly. Differentiating between preparation and compilation engagements often provides better clarity on the type of services rendered by accountants.

The form also engages with broader accounting standards, including the AICPA's AR-C guidance, shaping the landscape of financial reporting and compliance. Staying alert to future changes in regulations regarding signed preparation forms is vital, as amendments can affect how financial statements are prepared and audited, thereby impacting both accountants and their clients.

Case studies and scenarios

Real-world examples can illustrate the impacts of proper and improper form use. For instance, a client who adhered closely to the guidelines of the Signed See Accountants Preparation Form was able to provide clarity during an audit, demonstrating consistent communication and documentation practices.

On the other hand, cases where forms were incorrectly submitted led to extended delays in audits and increased scrutiny, highlighting the necessity of meticulous attention to detail. Moreover, success stories using pdfFiller’s tools for improved document management showcase the positive impacts of streamlined processes. These examples underline the importance of proper form preparation in protecting individual and organizational interests.

Interactive tools and resources available on pdfFiller

pdfFiller stands out as a versatile platform that simplifies filling, editing, and eSigning documents, including the Signed See Accountants Preparation Form. Users can access a variety of interactive tools designed to enhance productivity and document management.

Appendix

In conclusion, understanding the Signed See Accountants Preparation Form is vital for individuals and teams who need to navigate the complexities of financial documentation. The resource not only demystifies key segments of the form but also offers practical insights and tools available through pdfFiller.

For further assistance, a sample of the Signed See Accountants Preparation Form PDF allows users to familiarize themselves with its layout and sections. Additionally, a glossary of key terms relevant to the form can empower users to grasp the terminology with confidence, making the accounting landscape more navigable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify signed see accountants preparation without leaving Google Drive?

How do I execute signed see accountants preparation online?

Can I create an electronic signature for signing my signed see accountants preparation in Gmail?

What is signed see accountants preparation?

Who is required to file signed see accountants preparation?

How to fill out signed see accountants preparation?

What is the purpose of signed see accountants preparation?

What information must be reported on signed see accountants preparation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.