Get the free Expense Equipment under $2,500 - hfs illinois

Get, Create, Make and Sign expense equipment under 2500

How to edit expense equipment under 2500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out expense equipment under 2500

How to fill out expense equipment under 2500

Who needs expense equipment under 2500?

Comprehensive Guide to the Expense Equipment Under 2500 Form

Understanding the expense equipment under 2500 form

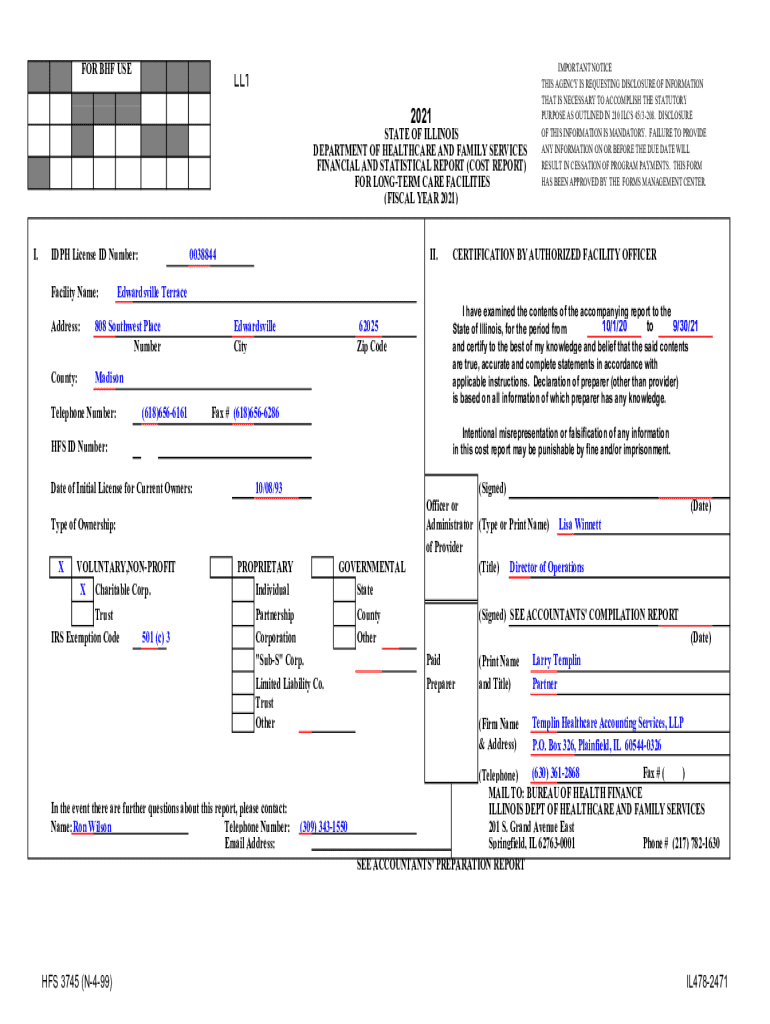

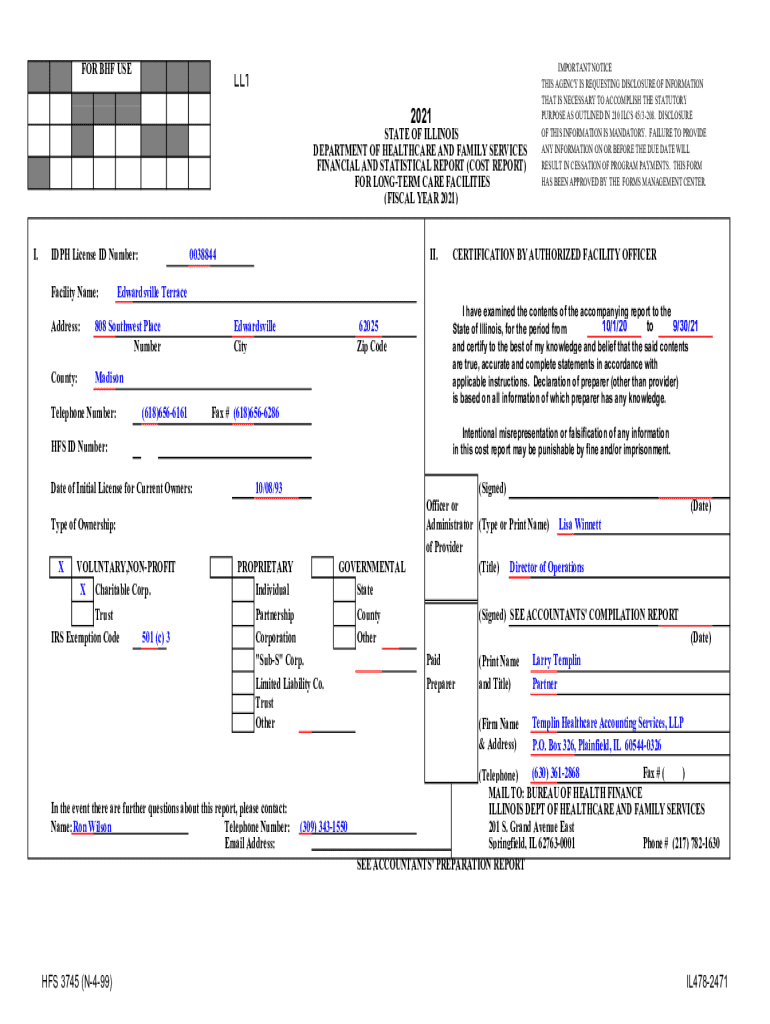

The expense equipment under 2500 form is a crucial document used by businesses and tax professionals for claiming deductions on eligible equipment purchases. This form allows individuals and companies to report equipment expenditures that fall below the $2500 limit, providing them with potential tax benefits. Understanding this form is essential for optimizing financial resources and ensuring compliance with tax regulations.

For many businesses, the ability to claim deductions on equipment purchases directly impacts cash flow and overall profitability. Accurate utilization of the expense equipment under 2500 form is vital, as it helps in tracking expenses and allows for strategic financial management.

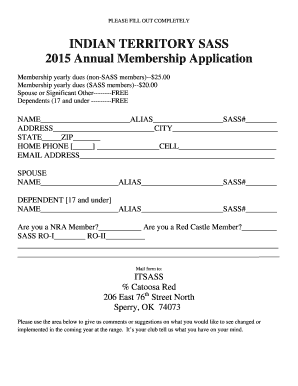

Eligibility criteria for using the form

Not every individual or organization can use the expense equipment under 2500 form. Generally, small businesses, self-employed individuals, and freelancers are eligible. Organizations like LLCs and sole proprietorships can also submit this form as part of their tax filings.

Equipments that qualify must be tangible personal property and must be used in a trade or business. This includes tools, machinery, and technology assets like computers or printers, all of which fall under the $2500 threshold. Common equipment purchases that meet this criterion often include:

Detailed breakdown of the form sections

The expense equipment under 2500 form consists of multiple sections that require precise information. The first section involves Basic Information, where you'll input your personal or business details. It’s crucial to ensure that all entered data is accurate and reflects your identity clearly, as any inconsistencies could delay processing.

Section 2 is dedicated to Equipment Details, which involves specifying the type of equipment, its cost, and the purchase date. This section emphasizes the importance of detailing each entry accurately, as misreported costs can lead to erroneous tax filings.

Finally, Section 3 requires users to select the appropriate expense categories. Wrong category selections can have financial implications, such as audits or denied claims, making it imperative to choose wisely.

Step-by-step guide to filling out the form

Before diving into filling out the form, it’s essential to prepare adequately. Start by gathering all necessary documents and receipts related to your equipment purchases. Key information to have ready includes invoices, payment records, and any previous equipment tax deductions to reference.

Begin by completing the Basic Information section. Ensure that all fields are filled out with the correct personal or business information. After this, you’ll move to Equipment Details, where you’ll specify the equipment type, its cost, and purchase date. Double-check each detail as precision here is crucial.

In Step 3, select the appropriate expense category. Be deliberate in your choice and justify your costs with accompanying documentation. Lastly, it’s vital to review and verify all information before submitting your form to avoid common mistakes related to incorrect dates or figures.

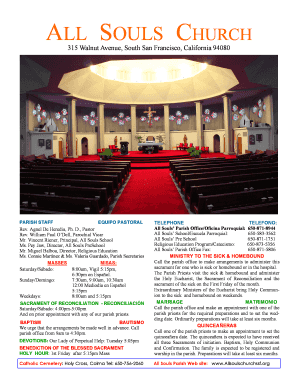

Editing, signing, and submitting your form

Using pdfFiller to manage your forms can streamline the process significantly. With features that allow for easy editing and signing, you can ensure that your expense equipment under 2500 form is both accurate and professionally presented. The benefits of accessing this cloud-based solution include having all your documents securely stored and easily editable from anywhere.

Once your form is complete, you have several submission options. Depending on your preferences and resources, you can submit your form online or by mail. To keep track of your submission, make sure to follow up on the status, confirming that your documentation has been received and processed.

Common challenges and how to overcome them

When navigating the equipment classification for the expense equipment under 2500 form, complexity often arises. Determining if an item qualifies under the set threshold requires careful consideration. Misclassifying equipment can lead to issues during auditing. To avoid these complications, maintain a comprehensive checklist to review your items against qualifications.

Additionally, before filing your form, it’s crucial to review your work thoroughly. Having a checklist of common mistakes, such as incorrect totals, missed fields, or wrong classifications, can ensure that your submission is error-free.

The significance of timely submission

Submitting the expense equipment under 2500 form on time is crucial. Clearly understanding deadlines is essential for ensuring the eligibility of your deductions. Late submissions can lead to penalties, which not only result in financial loss but also complicate future tax filings.

When aiming for timely submission, it’s best to mark your calendar with relevant deadline dates to avoid any unintentional delays. Consistent planning and awareness of the submission schedule can safeguard against potential setbacks.

FAQs on the expense equipment under 2500 form

As many individuals and organizations navigate the intricacies of the expense equipment under 2500 form, several common questions arise. For instance, what exact types of items qualify? Generally, any tangible property primarily used in business operations is eligible. Another frequently asked query concerns the supporting documentation required. Retaining invoices and payment records is advisable to substantiate your claims.

Inquiries often arise about how frequently one can submit this form per year. As a guideline, the form can be submitted alongside your tax return, typically on an annual basis or whenever qualifying equipment purchases are made.

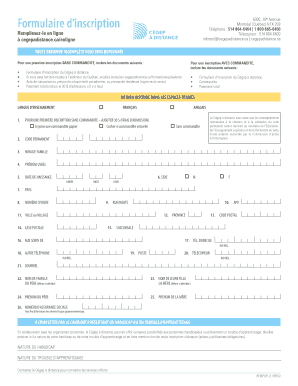

Leveraging pdfFiller for document management

pdfFiller's integration with various cloud storage solutions greatly enhances document management. This enables users to access and edit their forms anytime, simplifying the record-keeping and submission processes. With pdfFiller, you don't just fill out forms; you manage a digital library of important documents.

Moreover, collaboration features within pdfFiller encourage team-based efforts on form completion. Teams can work together in real-time on the expense equipment under 2500 form, making the process not only efficient but also fostering transparency and teamwork.

Key takeaways on utilizing the expense equipment under 2500 form

Gaining a strong grasp of the expense equipment under 2500 form can play a significant role in minimizing tax liabilities and enhancing financial health. This form serves as a tool not only for expense tracking but also for understanding the nuances of equipment purchases related to tax regulations.

Ultimately, using pdfFiller for managing this form can further aid in maximizing efficiency. Its user-friendly interface allows for seamless edits, electronic signatures, and collaboration—all vital components in today’s fast-paced business environment. The journey of successfully utilizing the expense equipment under 2500 form begins with understanding its structure, maintaining accurate records, and leveraging the right tools for management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get expense equipment under 2500?

How do I edit expense equipment under 2500 in Chrome?

How do I fill out expense equipment under 2500 on an Android device?

What is expense equipment under 2500?

Who is required to file expense equipment under 2500?

How to fill out expense equipment under 2500?

What is the purpose of expense equipment under 2500?

What information must be reported on expense equipment under 2500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.