Get the free Long-stay single-trip travel insurance for gap-year and independent travel

Get, Create, Make and Sign long-stay single-trip travel insurance

How to edit long-stay single-trip travel insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out long-stay single-trip travel insurance

How to fill out long-stay single-trip travel insurance

Who needs long-stay single-trip travel insurance?

A comprehensive guide to long-stay single-trip travel insurance form

Understanding long-stay single-trip travel insurance

Long-stay single-trip travel insurance is designed for travelers who plan to spend an extended period in a foreign country without the intention of returning home until the trip culminates. This kind of insurance provides essential coverage for travelers staying abroad for more than a month, addressing the unique risks associated with long-term travel.

The advantages of securing travel insurance for extended trips are manifold. Firstly, it ensures coverage for medical emergencies, including hospitalization and repatriation, which can be financially devastating without insurance. Secondly, in the event of unforeseen circumstances that lead to trip cancellations or interruptions, having insurance can mitigate potential losses. Lastly, assistance with lost baggage and personal belongings offers peace of mind when navigating airports and unfamiliar settings.

Key features of long-stay travel insurance

When selecting long-stay travel insurance, understanding its key features is crucial. The primary coverage options typically include health and medical coverage. This is vital for safeguarding against unexpected health emergencies, which may require urgent medical attention. Trip cancellation and interruption coverage assists in recuperating costs linked to canceled flights, missed connections, or interruptions due to emergencies.

Emergency evacuation benefits can also be a critical component, particularly for those traveling in regions where medical facilities are limited. Additionally, various optional add-ons might enhance the insurance plan. For instance, coverage for pre-existing conditions may be available to those with ongoing health issues, adventure sports coverage is ideal for thrill-seekers, and personal liability ensures protection against potential legal claims resulting from accidents during travel.

Assessing your travel needs

To select the most appropriate long-stay travel insurance, evaluating a few critical factors will ensure that the coverage aligns with your needs. Begin by assessing destination-specific health risks. Some countries may have higher incidences of certain illnesses or may lack quality medical facilities, necessitating more robust health coverage.

Next, it's essential to understand your existing personal health coverage, especially if it extends to international travel. The duration of your stay significantly impacts your insurance requirements; typically, longer stays involve higher risk, prompting a need for comprehensive coverage. Families and groups should also consider special conditions, as group policies can vary significantly and may provide more value.

How to choose the right long-stay travel insurance plan

Choosing the right travel insurance plan can feel daunting given the myriad options available. Start by comparing the coverage and benefits of different plans. Evaluate not just the inclusions but also the exclusions, limits, and specific conditions that may apply. A thorough analysis of the policy terms will guide you in understanding what is and isn't covered, which is imperative for ensuring you're adequately protected.

Once you have a clear understanding of various plans, assess the claim processes and requirements. It's also important to consider the cost versus the benefits. A cheaper policy may seem attractive but could save money in the short term while leaving you vulnerable to significant losses in a crisis.

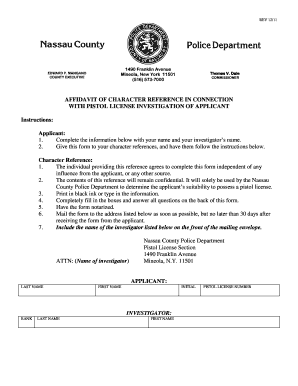

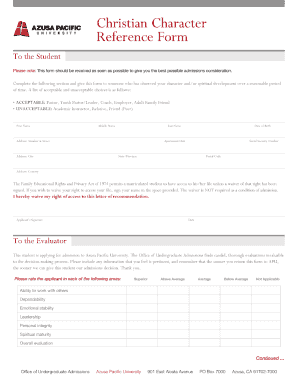

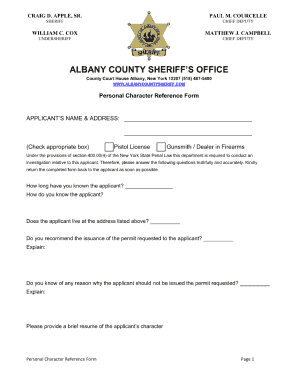

Filling out the long-stay single-trip travel insurance form

Completing the long-stay single-trip travel insurance form requires careful attention to detail. Begin with your personal information, ensuring that all names, ages, and contact details are accurately entered to prevent delays in processing or claims later on.

Next, detail your trip information. Clearly indicate your destination(s) and the anticipated duration of travel. Be specific when selecting coverage to match your unique needs, and carefully review your payment information to ensure a smooth transaction. It's imperative to avoid common mistakes such as typos in personal information or omitting details about pre-existing health conditions, as these can invalidate your coverage.

Editing and managing your insurance document

Once the travel insurance form is filled out, you may need to edit and manage the document over time. pdfFiller offers a convenient platform for digital access and editing of documents. Utilizing a cloud-based solution ensures that you can access your insurance details anytime, anywhere, which is particularly beneficial when traveling.

The steps to review and modify your insurance information are straightforward: simply log in to your pdfFiller account, locate the document, and make the necessary changes before saving it. If you’ve completed a hard copy, scan it to your device and upload it. Finally, securely eSigning your travel insurance form can provide an additional layer of security and authenticity that online travel insurance companies often require.

Tips for a smooth insurance claim process

In the event of a claim, having a proactive approach will streamline the process. Document your trip meticulously: keep copies of all tickets, accommodation details, and records of any incidents. This is crucial since most insurance providers require thorough evidence to validate claims.

Understanding claim requirements and timelines specified in your policy can prevent any unfortunate surprises later on. Be prepared with the necessary documentation like police reports for lost items, medical reports for health claims, and timely submission of your claims. In the case of an emergency overseas, knowing how to contact your insurance provider for assistance is vital for a quick resolution.

Resources and tools for long-stay travelers

Utilizing resources readily available can greatly enhance your travel experience. With pdfFiller, you can take advantage of interactive features for document management that simplify the editing and signing of travel insurance. Additionally, links to destination health profiles can provide insight into local healthcare options, while travel blogs and community forums can offer invaluable support from fellow travelers.

Staying updated on travel insurance policies and regulations is essential, especially given the dynamic nature of travel and health advisories. Regularly checking travel advisories from reputable sources will ensure that you have the latest information when preparing for international journeys.

Staying informed about travel insurance best practices

Travel insurance is constantly evolving, and staying informed about current trends is crucial. Factors such as advancements in global health threats or updated government guidelines can influence your insurance needs. Frequent travelers should consider an annual review of their travel insurance options to adapt to changing circumstances, ensuring continued coverage and peace of mind.

Engaging with user forums dedicated to travel insurance can also uncover invaluable insights, tips, and support from experienced travelers. This community-driven knowledge can unveil new resources to enhance your travel experience.

Why pdfFiller is your partner in travel insurance management

pdfFiller stands out as a premier solution for your travel insurance management needs. With seamless document creation and management capabilities, you can easily handle your insurance paperwork from anywhere, which is particularly crucial while on the go.

The platform's cloud-based technology offers real-time access to your documents and any updates you might need to make while traveling. Moreover, real testimonials from users attest to the platform’s effectiveness in simplifying their document management tasks, underscoring pdfFiller’s role as a valuable partner for travelers navigating the complexities of insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my long-stay single-trip travel insurance directly from Gmail?

How do I edit long-stay single-trip travel insurance online?

How do I fill out the long-stay single-trip travel insurance form on my smartphone?

What is long-stay single-trip travel insurance?

Who is required to file long-stay single-trip travel insurance?

How to fill out long-stay single-trip travel insurance?

What is the purpose of long-stay single-trip travel insurance?

What information must be reported on long-stay single-trip travel insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.