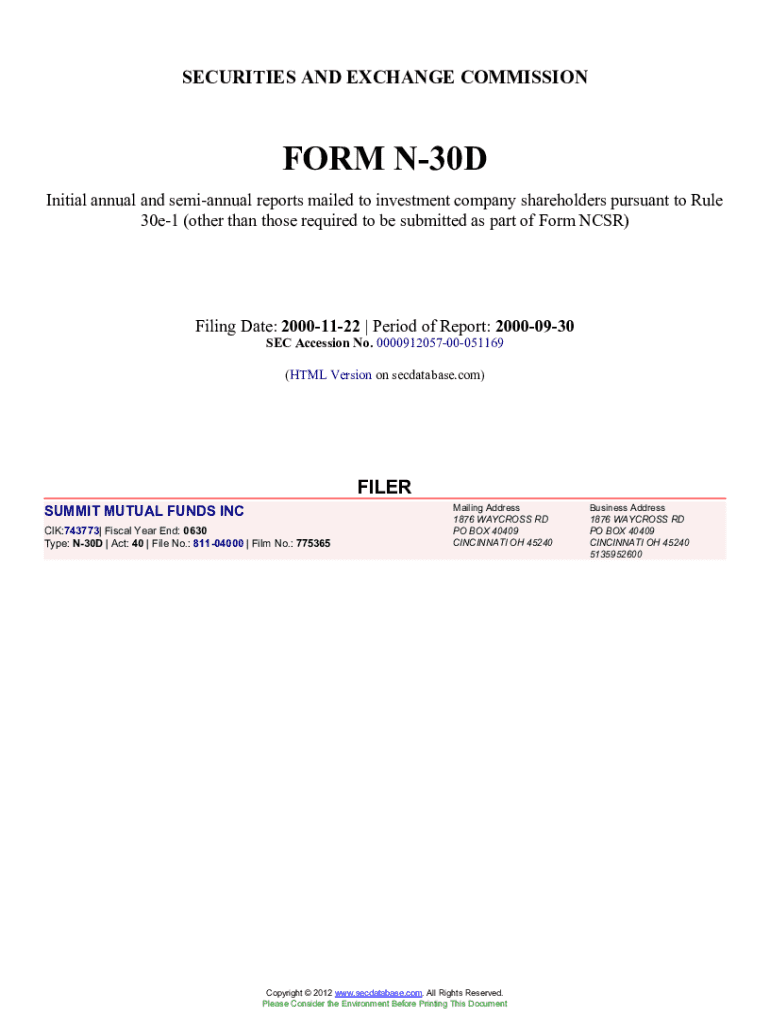

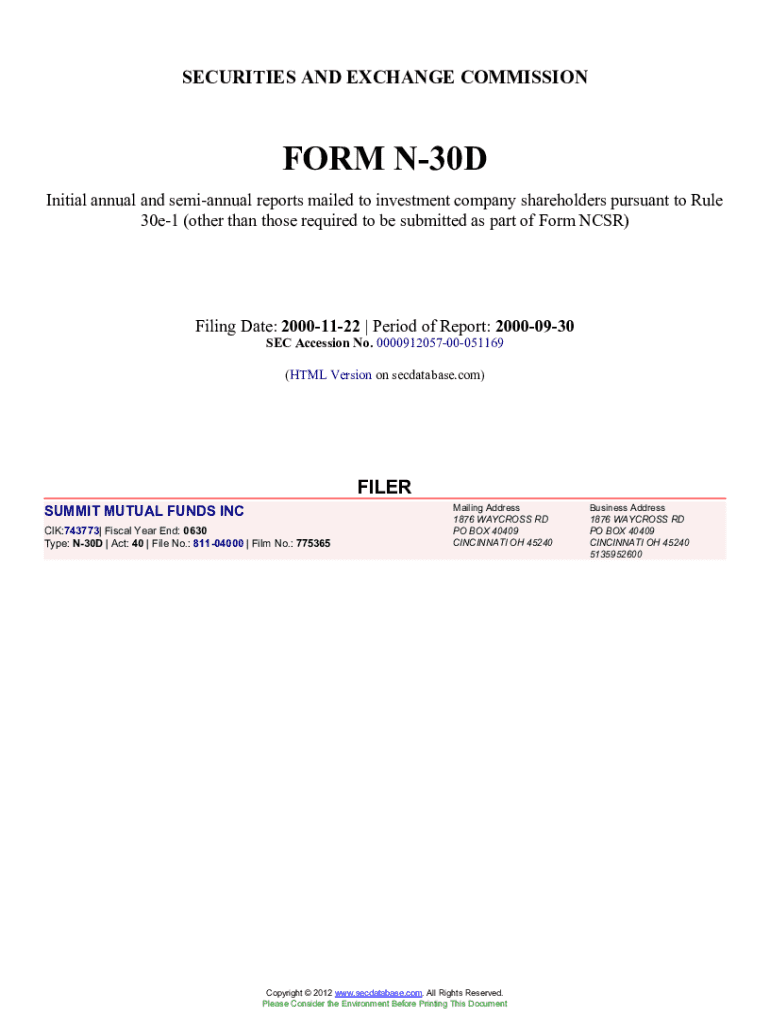

Get the free SUMMIT MUTUAL FUNDS INC (Form. Accession Number

Get, Create, Make and Sign summit mutual funds inc

Editing summit mutual funds inc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out summit mutual funds inc

How to fill out summit mutual funds inc

Who needs summit mutual funds inc?

Navigating the Summit Mutual Funds Inc Form: A Comprehensive Guide

Understanding the Summit Mutual Funds Inc Form

Summit Mutual Funds Inc has a rich history aimed at providing individual and institutional investors with diversified financial products that meet varying investment goals. Founded with the mission to facilitate optimal money management, Summit Mutual Funds offers a variety of fund options tailored to different risk appetites and investment horizons. The Summit Mutual Funds Inc Form is critical because it allows investors to formally engage with these fund offerings, reflecting their investment choices, preferences, and compliance requirements.

For investors, this form signifies not just a step in the investment journey but also a commitment that enables fund management teams to track asset allocations efficiently. It ensures adherence to regulatory standards while providing a transparent mechanism for both existing and prospective investors to interact with the fund.

Types of Summit Mutual Funds

Summit Mutual Funds offers a diverse range of funds, each designed to cater to specific financial objectives. These typically include equity funds, fixed-income funds, balanced funds, and specialty funds.

Purpose and importance of the Summit Mutual Funds form

The Summit Mutual Funds Inc Form serves several critical functions, pivotal to both investors and fund managers. Primarily, it facilitates enrollment in specific funds, ensuring that investors can easily secure their desired investment paths without ambiguity. Additionally, the form provides a systematic way to manage investment allocations, allowing for streamlined monitoring of asset distributions across various market conditions.

Moreover, compliance and transparency are key components tied to this form. By requiring detailed information, the form enhances the trustworthiness of fund transactions and adheres to the regulations set by governing financial bodies. This ensures that both investors and managers act within legal frameworks while promoting ethical management of funds.

Who needs to fill it out?

The form is vital for individuals considering mutual fund investments as well as teams managing group investments or portfolios. Individuals seeking to grow their wealth and retirement savings through these Well-invested opportunities will find the form equally essential in reflecting their unique financial situations, investment goals, and risk tolerances.

For organizations or groups pooling resources for collective investments, filling out the Summit Mutual Funds Inc Form enables a clear outline of each investor's contribution and allocation preferences, providing insight critical for joint investment strategy development.

Step-by-step guide to complete the Summit Mutual Funds Inc Form

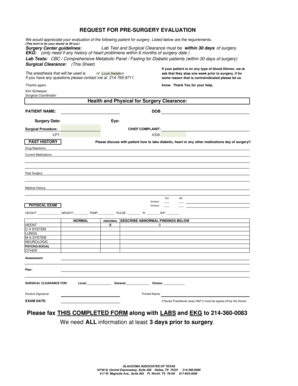

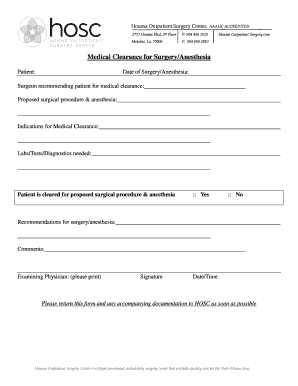

Completing the Summit Mutual Funds Inc Form can seem intimidating, but with the right preparation, it becomes a systematic process. Begin by gathering all required information, which includes personal details such as your name, address, and contact information, as well as financial specifics like investment goals and existing investments. Being organized will streamline the process and prevent unnecessary delays.

Navigating the form sections

A closer look into the various sections of the form reveals critical components:

Tips for accurate completion

To ensure your form is filled out correctly, it’s important to adopt a meticulous approach. Double-checking your information can prevent costly errors. Common pitfalls include omitting necessary details or entering inaccurate financial figures. A strategy of read-throughs or showcasing the form to a colleague for additional perspective can greatly help in catching mistakes.

Interactive features of pdfFiller for form editing

pdfFiller offers interactive features that streamline the editing process for your Summit Mutual Funds Inc Form. Users can easily add, delete, or modify information all within a user-friendly PDF interface. This service empowers individuals to customize their forms to fit their unique investment profile without the need for additional software.

eSigning the Summit Mutual Funds form

Integrating eSigning capabilities means you can remove the hassle of printing, signing, and scanning the form. Simply follow the steps to add a digital signature, which not only saves time but also enhances the security and authenticity of your submission. ESigning aligns well with contemporary practices, proving to be more efficient and reliable than traditional signing methods.

Managing your completed Summit Mutual Funds Inc Form

Once your form is completed, effective management of this document is crucial. pdfFiller allows you to save and store your document securely on its cloud platform. This feature ensures easy access and organization of all your forms, allowing you to retrieve them whenever necessary, aiding in the ongoing management of your investment portfolio.

Collaborative features

For teams planning to make collaborative investment decisions, the sharing capabilities of pdfFiller allow users to effortlessly distribute the completed form to financial advisors or other stakeholders. The platform also supports comments and feedback, fostering an interactive environment that can enhance investment strategy development.

Troubleshooting and FAQs

While using the Summit Mutual Funds Inc Form through pdfFiller, some users may encounter common issues, such as misunderstood sections or technical difficulties navigated during the process. Familiarizing yourself with the sections beforehand can alleviate confusion and improve your overall experience.

Frequently asked questions

Post-submission inquiries often revolve around the next steps in fund management. For example, users frequently ask about how to track their investment performance after submitting their forms. Being proactive in knowing who to contact for assistance regarding follow-up requirements can further streamline your investment experience.

Maximizing your investment with Summit Mutual Funds

Understanding your rights as an investor is pivotal when engaging with Summit Mutual Funds. Investors are protected by various guidelines and regulations designed to ensure transparency and fairness in fund management. Being aware of these rights can empower your investment choices and instill greater confidence in the decisions being made on your behalf.

After submitting your form, staying engaged with your investment is equally important. Regularly tracking performance reports and assessing market conditions can reveal opportunities for reinvestment and diversification. This ongoing engagement not only helps mitigate risks but often leads to more lucrative outcomes as financial markets evolve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete summit mutual funds inc online?

Can I sign the summit mutual funds inc electronically in Chrome?

How do I fill out the summit mutual funds inc form on my smartphone?

What is summit mutual funds inc?

Who is required to file summit mutual funds inc?

How to fill out summit mutual funds inc?

What is the purpose of summit mutual funds inc?

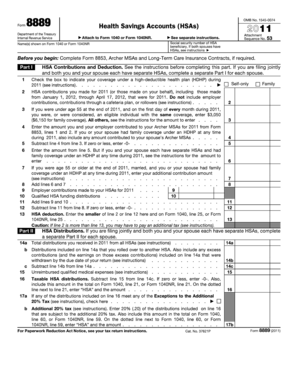

What information must be reported on summit mutual funds inc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.