Get the free TIN: 91-1176122

Get, Create, Make and Sign tin 91-1176122

Editing tin 91-1176122 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tin 91-1176122

How to fill out tin 91-1176122

Who needs tin 91-1176122?

TIN 91-1176122 Form How-to Guide

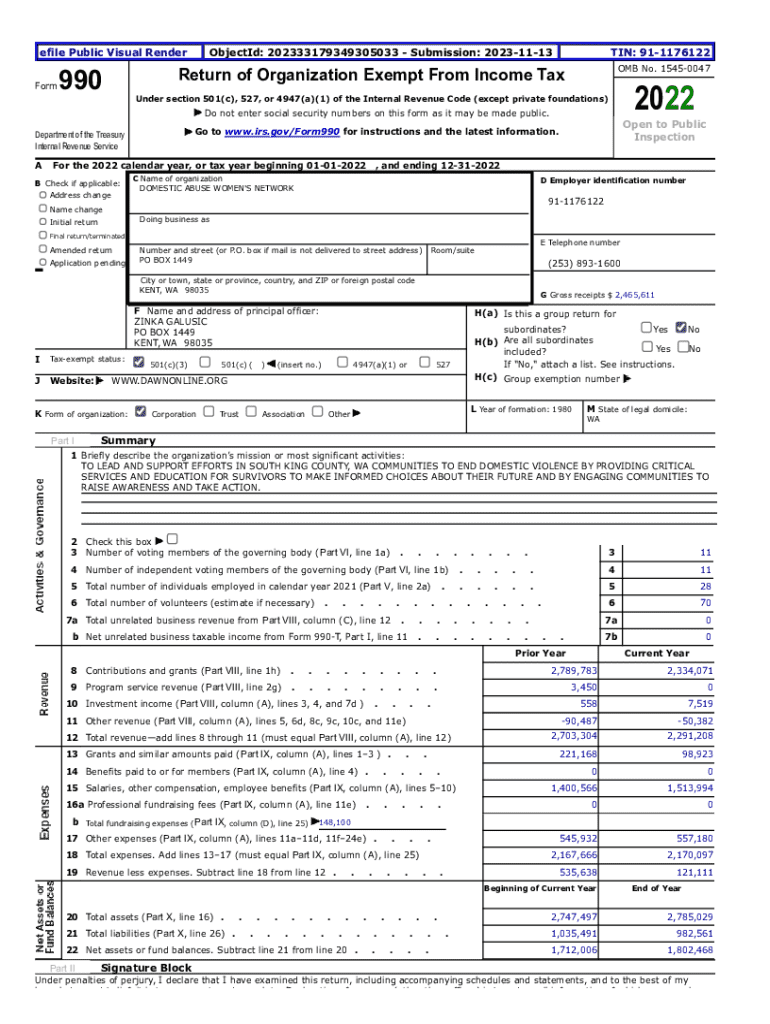

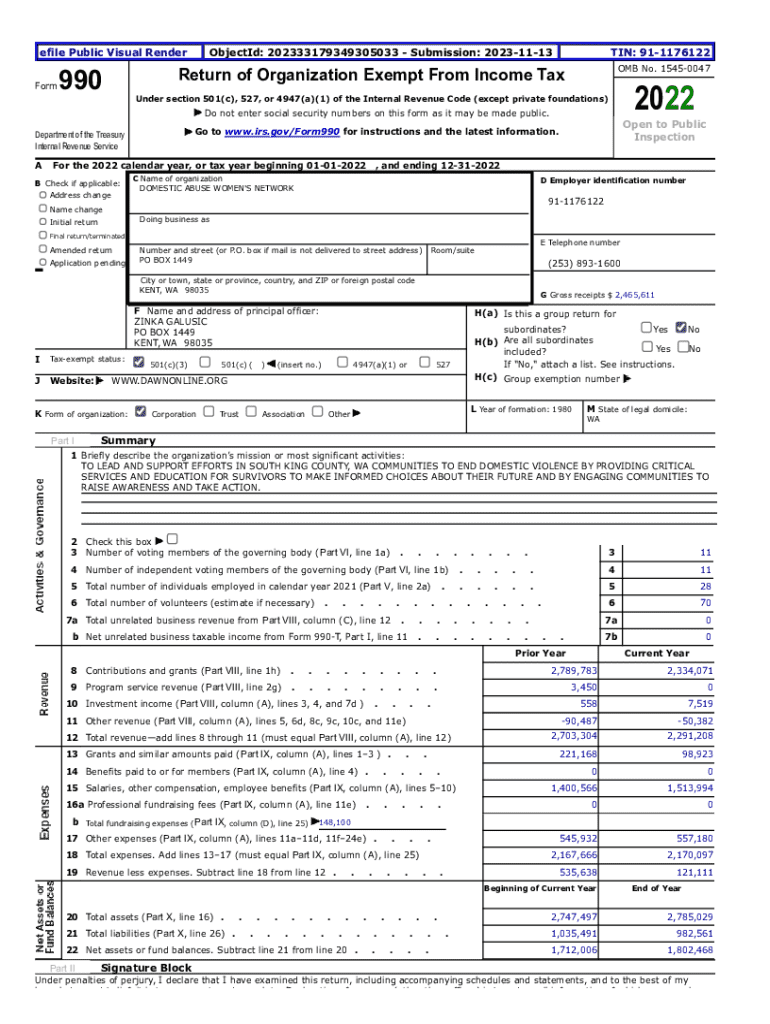

Understanding the TIN 91-1176122 Form

The TIN 91-1176122 form is a crucial document used in various tax scenarios in the United States. This form primarily functions as a Taxpayer Identification Number (TIN) documentation, commonly required by both individuals and businesses for tax reporting purposes. The proper usage of TIN 91-1176122 helps ensure compliance with tax regulations, protecting individuals and organizations from potential audits or penalties.

In legal and tax settings, the TIN 91-1176122 form is indispensable for establishing a taxpayer’s identity for the IRS. The targeted users of this form include freelancers, small business owners, and anyone else required to report income or transactions that could necessitate the completion of a tax return.

Preparing to fill out the TIN 91-1176122 form

Before diving into filling out the TIN 91-1176122 form, it's essential to gather all necessary information. This includes personal identification details, like your full name, address, and Social Security Number (SSN), or Employer Identification Number (EIN) if applicable. Accuracy here is paramount, as even minor errors can lead to significant issues down the line.

Understanding the various sections of the TIN 91-1176122 form is also critical. The form comprises specific segments that require pertinent information related to your personal or business identity. Familiarizing yourself with common terms associated with the form, such as TIN, will make the process smoother.

Step-by-step guide to completing the TIN 91-1176122 form

Filling out the TIN 91-1176122 is straightforward if one follows these steps carefully.

Editing and modifying the TIN 91-1176122 form online

Accessing and editing the TIN 91-1176122 form on pdfFiller is incredibly user-friendly. Start by visiting the platform's website, where you can easily find and download the form you need.

The editing tools offered by pdfFiller allow users to add text, insert images, and check boxes as needed. For team projects, pdfFiller's collaboration tools enable multiple users to input their information, ensuring comprehensive completion.

Reviewing and correcting the TIN 91-1176122 form

Before submission, reviewing the TIN 91-1176122 form is vital to avoid common mistakes. For example, misplacing information or misunderstanding section requirements can lead to unnecessary delays.

Utilizing pdfFiller's error-check features simplifies this process. The platform offers built-in tools for error detection, ensuring that fields are filled out correctly, saving time on revisions.

Submitting the completed TIN 91-1176122 form

Once the TIN 91-1176122 form is accurately filled out and reviewed, submission can take two main forms. The first option is online submission, which is often quicker and saves on postage. Alternatively, users can choose to print and mail their forms, customer preferences depending on convenience.

After submission, tracking your forms can help you confirm receipt. Check with your tax authority or utilize tracking features offered by the mailing service to ensure your form is processed efficiently.

Frequently asked questions about the TIN 91-1176122 form

Accessing support for advanced issues

In more complex financial situations, seeking professional assistance is advisable. Expert advice can clarify any vague areas of the tax process, ensuring you make informed decisions.

pdfFiller also retains dedicated support resources. Users can access customer support through various channels, as well as an extensive library of tutorials to navigate their forms successfully.

Success stories: Users share their experience

Many individuals and small teams have found success navigating the TIN 91-1176122 form with pdfFiller's intuitive platform. Users often share testimonials emphasizing how the tools simplify the process of form completion and ensure accuracy.

From freelancers who have streamlined their income reporting to small business owners managing their tax obligations more efficiently, the role of pdfFiller in simplifying these processes is evident and significant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tin 91-1176122 from Google Drive?

Can I sign the tin 91-1176122 electronically in Chrome?

How do I complete tin 91-1176122 on an iOS device?

What is tin 91-1176122?

Who is required to file tin 91-1176122?

How to fill out tin 91-1176122?

What is the purpose of tin 91-1176122?

What information must be reported on tin 91-1176122?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.