Get the free 15 Number 2

Get, Create, Make and Sign 15 number 2

How to edit 15 number 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 15 number 2

How to fill out 15 number 2

Who needs 15 number 2?

Understanding the 15 Number 2 Form: A Comprehensive Guide

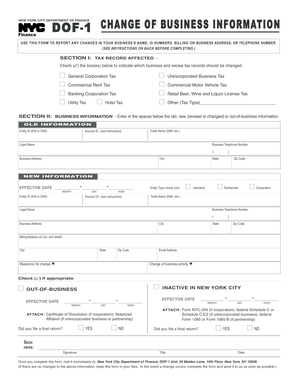

Understanding the 15 number 2 form

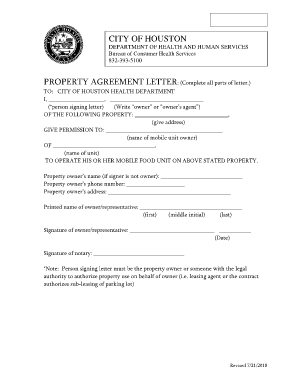

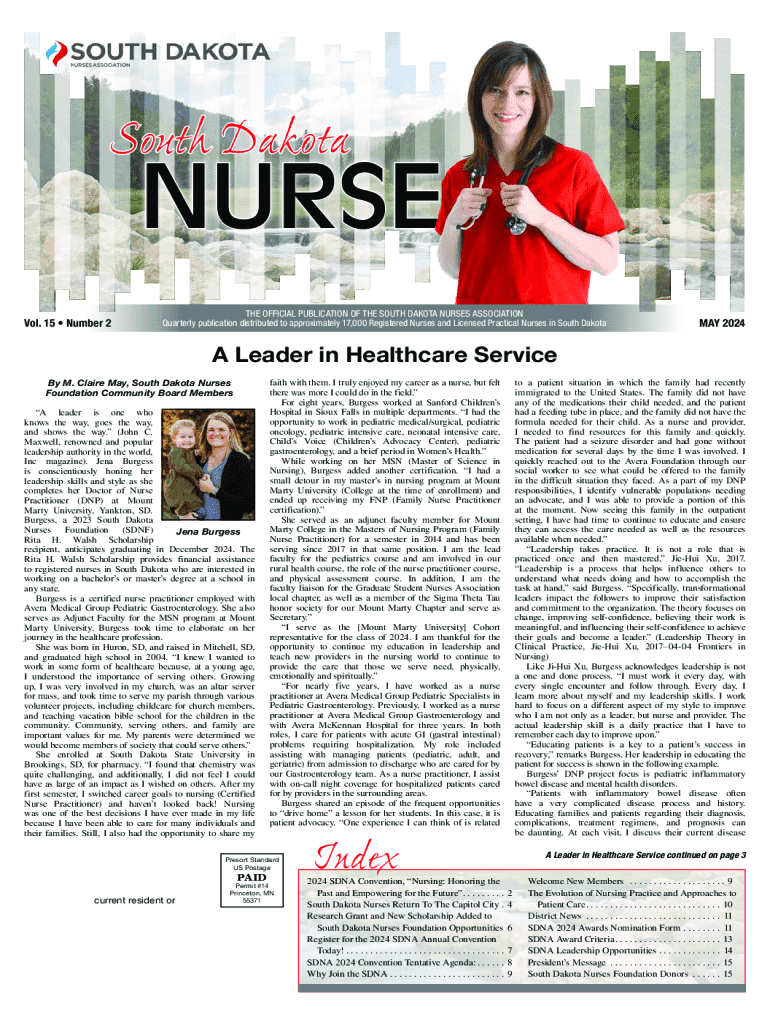

The 15 number 2 form is a crucial document in the realm of administrative operations, primarily utilized for various reporting purposes. This form offers a structured format designed for specific data submission, ensuring compliance with institutional or regulatory standards. Its significance cannot be overstated, as it streamlines processes and enhances clarity when sharing information.

Key users of the 15 number 2 form include businesses, government agencies, and individuals involved in legal or financial transactions that necessitate precise reporting. By using this form, entities can improve their organizational efficiency and decrease the likelihood of discrepancies that could lead to serious consequences.

To be eligible to complete the 15 number 2 form, applicants or responsible parties should meet certain criteria, including the provision of accurate data regarding their financial or personal circumstances affected by the form’s purpose.

Preparation steps for filling out the 15 number 2 form

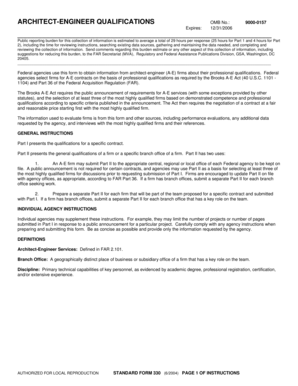

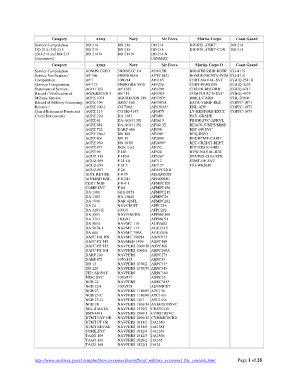

Before diving into the completion of the 15 number 2 form, the first step involves gathering all required information. This preparatory phase is essential to ensure a smooth and efficient submission process. Necessary documents typically include identification forms, financial statements, and any pertinent legal approvals.

These documents can be located in personal records, financial institutions, or online government databases, making it crucial for users to familiarize themselves with different resources.

Understanding each section of the 15 number 2 form is vital for accurate completion. The form generally consists of three main sections, each addressing different aspects of the respondent's information:

Step-by-step guide on filling out the 15 number 2 form

Filling out the 15 number 2 form requires careful attention to detail. Here's a box-by-box guide to help you navigate the form smoothly.

To ensure clarity and accuracy, consider these tips while completing the form: review the filled-out sections thoroughly, and if available, use digital tools like pdfFiller to check for completeness. These tools can highlight any missing fields or formatting issues.

Editing and modifying your 15 number 2 form

Should you need to make changes after submission, it’s essential to follow the correct procedures for amendments. Firstly, identity the specific details that need to be corrected and refer to the form’s guidelines on how to initiate a change.

There are several common scenarios that might require changes to the 15 number 2 form, including an incorrect entry or a change in personal circumstances. Proper documentation should be provided to substantiate any amendments required.

Signing and submitting the 15 number 2 form

After filling out the form, it’s time to sign and submit. The e-signature process has simplified this step significantly. For instance, users can utilize functions available on platforms like pdfFiller to eSign their documents securely.

The advantages of using a digital signature include faster processing times and reduced paperwork, along with the assurance of document integrity. Once the form is signed, users have the option to submit it electronically or, depending on requirements, through physical mail.

Managing and tracking your 15 number 2 form

Once submitted, managing and tracking your 15 number 2 form becomes important. Digital storage solutions offer significant benefits when it comes to organizing documents. Utilize cloud-based systems to securely store your forms, making them easily accessible whenever needed.

Tracking your submission status is also important. Many agencies provide online portals for users to verify receipt of their forms. Keeping a close eye on the form’s status ensures that any issues can be addressed promptly before they escalate.

Best practices for filling out the 15 number 2 form

To navigate potential pitfalls, familiarity with common mistakes associated with the 15 number 2 form is crucial. Errors such as incomplete sections, incorrect personal details, and late submissions can hinder processing.

Remaining informed about updates to the 15 number 2 form and its requirements is crucial. Utilizing reliable sources affiliated with the form can aid in maintaining compliance and preventing oversight.

Frequently asked questions (FAQs)

Several inquiries frequently arise regarding the 15 number 2 form. Individuals often seek clarity on how to resolve issues encountered while filling out the form and seek specific guidance about completing particular fields correctly.

Related forms and resources

In addition to the 15 number 2 form, there are several other forms and resources that may be necessary, depending on your unique circumstances.

Access to interactive tools on platforms like pdfFiller can also enhance the user experience, facilitating efficient form management. Customer support is available for additional assistance, ensuring you can navigate through any challenges with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 15 number 2 online?

Can I create an electronic signature for the 15 number 2 in Chrome?

How can I fill out 15 number 2 on an iOS device?

What is 15 number 2?

Who is required to file 15 number 2?

How to fill out 15 number 2?

What is the purpose of 15 number 2?

What information must be reported on 15 number 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.