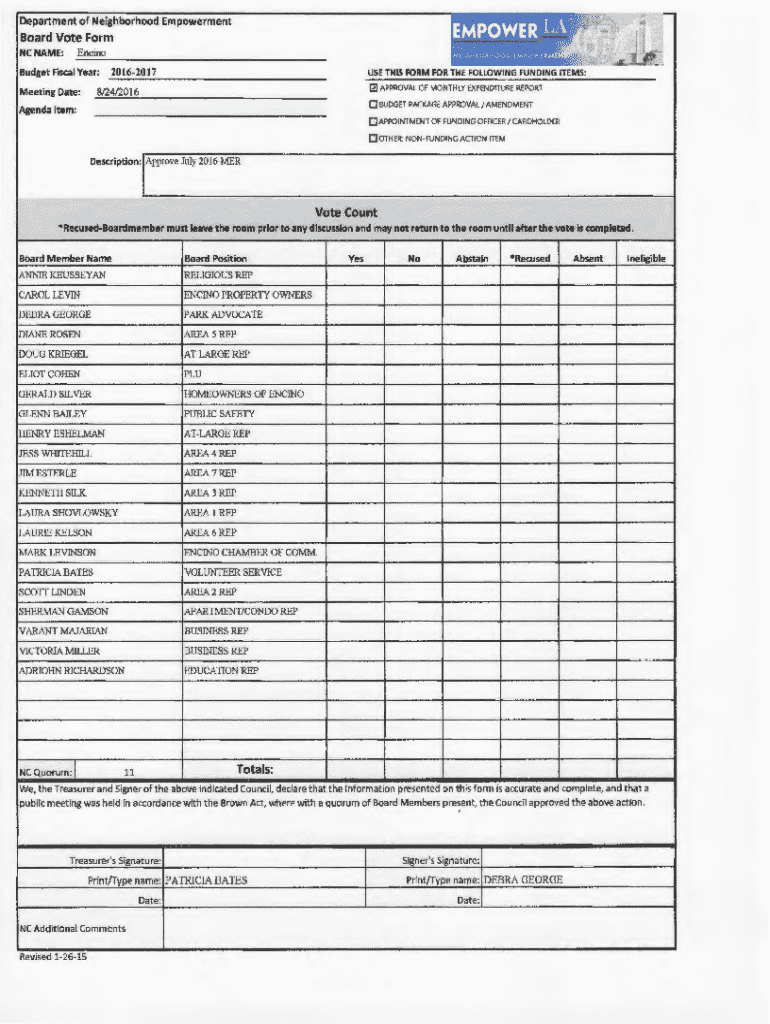

Get the free Budget Fiscal Year:

Get, Create, Make and Sign budget fiscal year

How to edit budget fiscal year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget fiscal year

How to fill out budget fiscal year

Who needs budget fiscal year?

Complete guide to budget fiscal year forms

Understanding budget fiscal year forms

A budget fiscal year form is an essential document that outlines projected income and expenditures for a specific financial year. It serves multiple purposes, primarily establishing a financial framework within which individuals and organizations can operate efficiently. The importance of this form extends beyond mere numbers; it acts as a roadmap for resource allocation, helping teams and departments monitor performance against their financial goals.

Embracing a structured approach to budgeting can significantly enhance decision-making processes, performance tracking, and strategic planning. Accurate fillings of these forms ensure that both individuals and teams remain accountable and prepared to respond to potential financial challenges.

Types of budget forms

There are several types of budget forms that cater to different financial scenarios. Each serves a unique function, allowing for tailored management of funds based on specific needs.

Key components of a budget fiscal year form

A comprehensive budget fiscal year form typically includes several key components that guide the organization in ensuring thoroughness and accuracy. The essential sections can influence financial strategy, so understanding each is critical.

In addition to these fundamental sections, budget forms may also require supporting documents such as previous financial reports, reports from stakeholders, and any relevant financial documentation. Often, signatures from authorized personnel are also necessary for validation.

Step-by-step guide to completing your budget fiscal year form

Completing a budget fiscal year form can be straightforward when approached methodically. Following a structured process ensures not only accuracy but also clarity at each stage.

Preparation phase

Before filling out the form, gather all necessary data and documents. This may involve looking at previous years’ budget forms, financial reports, and performance metrics. Identify any amendments to the budget that may have occurred as well as comparisons to previous year performances to support projections.

Filling out the form

Finalizing your budget form

Upon completion, ensure the accuracy of your budget fiscal year form using tools such as pdfFiller, which makes editing seamless. Collaborate with team members for input and feedback to cover all bases. Utilize eSignature features for faster approvals and submit the document as required.

Tips for streamlining the budgeting process

Utilizing tools like pdfFiller can greatly enhance the efficiency of budgeting processes. The platform's robust features are designed to simplify management and ensure smoother operations.

Employing best practices such as regularly reviewing financial trends, adjusting budgets for forecast variability, and setting realistic goals can also significantly improve the budgeting process. Ensuring that all relevant stakeholders are engaged throughout increases the likelihood of a successful budgeting outcome.

Common mistakes to avoid while filling budget forms

Filling out a budget fiscal year form accurately is critical. However, there are common pitfalls that many encounter, which can jeopardize the budgeting process. Being aware of these can save time and resources.

Frequently asked questions about budget fiscal year forms

As with any process, questions are bound to arise regarding the budgeting and filling out of budget fiscal year forms. Addressing these can demystify the process for many.

Additional support and tools for completing budget fiscal year forms

When diving into budget management, leveraging the right tools can make a substantial difference. There are interactive tools available that can simplify budget preparation, bringing both clarity and efficiency.

For optimal use of tools like pdfFiller, users should familiarize themselves with live chat features for real-time assistance, tap into user community insights, and make use of training resources available.

Exploring related forms and resources

It’s beneficial to understand supplementary forms that may enhance your overall budget management process. Related documentation helps in gaining a comprehensive view of financial obligations and reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the budget fiscal year electronically in Chrome?

How do I edit budget fiscal year straight from my smartphone?

How do I edit budget fiscal year on an iOS device?

What is budget fiscal year?

Who is required to file budget fiscal year?

How to fill out budget fiscal year?

What is the purpose of budget fiscal year?

What information must be reported on budget fiscal year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.