Get the free KKR Infrastructure Fund (KIF)

Get, Create, Make and Sign kkr infrastructure fund kif

How to edit kkr infrastructure fund kif online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kkr infrastructure fund kif

How to fill out kkr infrastructure fund kif

Who needs kkr infrastructure fund kif?

Comprehensive Guide to the KKR Infrastructure Fund KIF Form

Understanding the KKR Infrastructure Fund (KIF)

The KKR Infrastructure Fund (KIF) is a specialized investment vehicle managed by KKR & Co. Inc., focusing on infrastructure-related investments across various sectors. Established to tap into the growing global infrastructure market, KIF aims to provide a platform for investors to gain exposure to the critical assets that form the backbone of economies worldwide. KKR has a rich history of leveraging its extensive resources and expertise in the infrastructure sector, offering investors unique opportunities to participate in projects that are pivotal for sustained economic growth.

Historically, KKR has demonstrated a robust investment track record, having entered the infrastructure space in the early 2000s. Recognizing the increasing demand for quality infrastructure assets due to urbanization, population growth, and the need for modernization, KKR has positioned KIF as a strategic option for institutional and accredited investors. The infrastructure sector represents a vital component of any well-diversified investment portfolio due to its potential for stability, income generation, and growth.

Navigating the KIF Form

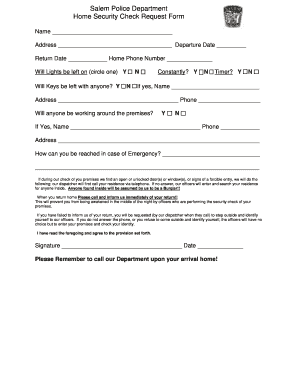

To participate in the KKR Infrastructure Fund, investors must complete the KIF Form, which serves as an essential document indicating their intentions to invest. Accessing the KIF Form is straightforward. Users can find the form hosted on the pdfFiller platform. This user-friendly document management tool simplifies the process of filling out and submitting the KIF Form.

It is essential to understand the requirements for the KIF Form. Investors must gather specific documents, such as proof of identity, financial statements, and accreditation verification. Additionally, they should meet eligibility criteria, which typically include having a certain net worth or income level. These measures ensure that investments in KIF are made by qualified individuals capable of assuming the inherent risks of infrastructure investments.

Step-by-step instructions for completing the KIF Form

Completing the KIF Form is a detailed process that requires accurate information. Here’s a guide to help you fill out each section efficiently:

To avoid common pitfalls, double-check your entries for accuracy and ensure all sections are filled out completely. Missing information or incorrect data can lead to delays in the processing of your KIF Form.

Enhancing your experience with pdfFiller

pdfFiller provides powerful editing tools that enhance your experience while completing the KIF Form. Users can easily make changes to text, add annotations, or highlight critical information, ensuring clarity and accuracy. Once you complete the KIF Form, pdfFiller also offers seamless options for eSigning your document, providing a legally binding signature without the hassles of printing, scanning, or faxing.

With pdfFiller, you can also integrate various cloud services, making it easy to access your KIF Form from anywhere, which is ideal for investors managing multiple projects.

Exploring the benefits of investing in the KKR Infrastructure Fund

Investing in the KKR Infrastructure Fund presents numerous advantages to investors seeking to diversify their portfolio. One notable benefit is the potential for substantial returns through cash distributions and capital appreciation. Infrastructure assets tend to generate stable, long-term cash flows, making them a solid addition to any investment strategy.

Diversification within the infrastructure sector is another significant advantage. Infrastructure spans various areas such as transportation, renewable energy, utilities, and telecommunications, spreading risk across different economic conditions. Moreover, KIF employs risk mitigation strategies to protect investors from volatility, enhancing downside protection. This approach becomes increasingly relevant in inflationary periods, as infrastructure investments can provide a natural hedge against rising prices.

Understanding the share class and other structural information

KKR Infrastructure Fund offers various share class options catering to different investor needs and preferences. Each share class may have distinct fee structures, investment minimums, and distributions policies, allowing flexibility for investors based on their financial situations.

Investors can track the fund's performance by reviewing historical NAV (Net Asset Value) per share and accessing the KIF's monthly reports, which provide insights into the fund’s performance, distributions, and overall market trends.

Profiles of KKR management and governance team

The success of the KKR Infrastructure Fund is attributed to its experienced management and governance team, which comprises industry experts with diverse backgrounds in infrastructure finance, project management, and strategic investments. Key members bring a wealth of knowledge, having been involved in landmark projects globally. Their expertise not only enhances KIF's investment strategies but also ensures that the fund operates with transparency and ethical practices.

This well-rounded management approach is crucial for maintaining investor trust and confidence in the fund’s performance.

Tax considerations for KIF investors

Taxes on investment returns can significantly impact an investor's net gains from KIF. It is imperative for investors to be aware of tax reporting requirements specific to their jurisdictions. The taxation on distributions, capital gains, and any potential sale of shares can vary widely depending on local tax laws.

Consulting a tax professional is advisable to develop a personalized tax strategy that aligns with KIF investments, ensuring compliance and optimization of tax obligations.

Advanced insights into private infrastructure investment

The evolution of private infrastructure investment has gained momentum, offering unique opportunities for exposure to crucial projects that are often less correlated with public markets. As traditional funding sources in infrastructure dwindle, private funds like KIF play an essential role in financing necessary infrastructure upgrades and expansions.

These trends indicate a promising horizon for KIF investors, as infrastructure becomes integral to addressing global challenges, including climate change and urbanization.

FAQs about the KIF and pdfFiller

Investors often have questions regarding the KKR Infrastructure Fund and the KIF Form submission process. Some of these include queries about eligibility requirements, the best practices for filling out the form, or how to resolve frequent technical issues when using pdfFiller.

Utilizing the resources available from both KKR and pdfFiller can enhance your experience and ensure a successful investment in the KKR Infrastructure Fund.

Next steps after submitting the KIF Form

After you have submitted the KIF Form, you can expect a confirmation of receipt from KKR, followed by an assessment of your application. This is an important step in the investment process, where KKR reviews submissions for completeness and adherence to eligibility criteria.

Staying informed and engaged with your investment fosters a more proactive investment approach as you navigate the dynamic infrastructure landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in kkr infrastructure fund kif without leaving Chrome?

How do I fill out the kkr infrastructure fund kif form on my smartphone?

How do I complete kkr infrastructure fund kif on an Android device?

What is kkr infrastructure fund kif?

Who is required to file kkr infrastructure fund kif?

How to fill out kkr infrastructure fund kif?

What is the purpose of kkr infrastructure fund kif?

What information must be reported on kkr infrastructure fund kif?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.