Get the free 4 Stock Deal Creates $17 Billion Chancellor

Get, Create, Make and Sign 4 stock deal creates

Editing 4 stock deal creates online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4 stock deal creates

How to fill out 4 stock deal creates

Who needs 4 stock deal creates?

Understanding the 4 Stock Deal Creates Form: A Comprehensive Guide

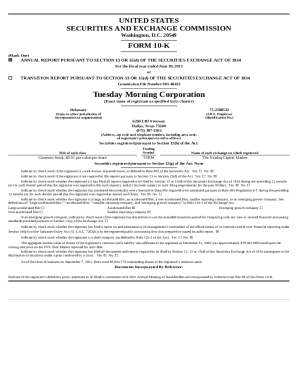

Understanding stock deals: An overview

Stock deals represent a crucial mechanism in the landscape of corporate transactions. When companies seek to merge or acquire one another, stock deals allow for ownership exchanges that can vastly change the structural and economic dynamics of the involved entities.

The significance of stock deals in mergers and acquisitions cannot be overstated. These arrangements often facilitate not only the sharing of resources but also the potential for innovation and improved market standing. For instance, acquiring a company through stock increases synergy, allowing firms to integrate operations more seamlessly.

The 4 Stock Deal Creates Form: A deep dive

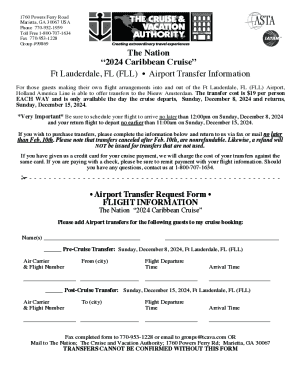

The 4 Stock Deal Creates Form serves as a foundational document used during the structuring of a stock deal. Its primary purpose is to outline the parameters of the transaction, detailing share exchanges, valuations, and the parties involved.

Typically, documents required for the 4 Stock Deal Creates Form include corporate resolutions, share purchase agreements, and any necessary disclosures that pertain to financial conditions or regulatory approvals. Each element must be carefully crafted to ensure that all aspects of the deal are compliant with laws and regulations.

Navigating the form layout can seem daunting, but understanding its sections is key to effective completion. The form may include headings for identifying parties, transaction terms, share distribution, and pricing strategy among others.

Filling out the 4 Stock Deal Creates Form

Completing the 4 Stock Deal Creates Form involves a clear sequence of steps to ensure accuracy and compliance. Begin by identifying all parties involved in the transaction, ensuring that each is correctly represented.

Next, gather necessary financial data such as valuations of both companies, any existing stock options, and other metrics essential for determining fair value. This financial detail is critical to accurately filling out transaction specifics.

Follow this by entering stock transaction details, ensuring all parameters are well-defined, including pricing mechanisms and terms of buy/sell agreements. Privacy and compliance requirements, such as notarization, must be observed to protect all parties involved.

Editing and signing the stock deal form

Editing the stock deal form can be efficiently executed using pdfFiller. With a straightforward interface, users can upload their documents, make necessary edits, and format details to meet their needs.

Adding signatures digitally simplifies the finalization process. Once the form is complete, e-signatures can be incorporated, ensuring the integrity of documents while streamlining the flow of approvals.

It’s crucial to prioritize document security during this stage. pdfFiller offers encryption features to protect sensitive information. Ensuring data protection throughout the editing phase is essential to maintain trust and confidentiality.

Collaborating on stock deal documentation

Collaboration is vital when working on stock deal documentation. pdfFiller's collaborative tools allow teams to invite other stakeholders for review and editing, creating an environment of collective input and feedback.

Real-time feedback enables quicker decision-making, while version control features safeguard against losing historical changes. Best practices for maintaining transparent communication among team members, such as setting clear timelines and responsibilities, will lead to successful documentation.

Managing your stock deal forms

Once the forms are completed and signed, proper organization and storage of these documents are crucial. pdfFiller allows users to store completed forms in a cloud-based platform that facilitates easy access and retrieval.

Best practices for document management include labeling files accurately, categorizing them appropriately, and maintaining a consistent naming convention. This strategy simplifies tracking changes and monitoring audit trails, ensuring accountability.

Tax implications of stock deals

Stock transactions often carry significant tax implications. Understanding the taxation framework related to stock deals is essential for both individuals and corporations involved. Capital gains taxes may apply during dispositions, impacting net gain.

Engaging in prudent tax planning can mitigate liabilities. For instance, investors should familiarize themselves with stock basis, as it affects the taxable gain on sold shares. Strategic timing of transactions can also influence tax outcomes.

Case studies: Successful stock deals using the form

Examining several successful stock deals can provide valuable insights on how the 4 Stock Deal Creates Form has been utilized effectively. One notable example includes a merger between two tech giants which resulted in a combined market cap increase.

From these cases, key lessons emerge. Firstly, meticulous planning and documentation can prevent misunderstandings. Secondly, leveraging platforms like pdfFiller simplifies processes and fosters efficient communication, key elements in executing successful transactions.

Behind the scenes: The role of financial advisors in stock deals

Financial advisors play an indispensable role in guiding companies through stock transactions. Their expertise can significantly normalize complex negotiation territories, ensuring that both sides align their financial aspirations.

When entering a stock deal, consulting a financial advisor is advisable. These professionals offer insights into market conditions and assist with valuations essential for determining share pricing, ultimately leading to more favorable outcomes.

Future trends in stock transactions

The landscape of stock transactions is rapidly evolving, particularly due to advances in technology. The demand for digital platforms like pdfFiller to manage documentation is on the rise, emphasizing the need for efficient, accessible solutions.

Furthermore, as remote work becomes more prevalent, the significance of remote document management increases. This shift hints at future trends where technology will enhance the speed and efficiency of executing stock deals, likely integrating AI-driven insights for better decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 4 stock deal creates from Google Drive?

How can I fill out 4 stock deal creates on an iOS device?

Can I edit 4 stock deal creates on an Android device?

What is 4 stock deal creates?

Who is required to file 4 stock deal creates?

How to fill out 4 stock deal creates?

What is the purpose of 4 stock deal creates?

What information must be reported on 4 stock deal creates?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.