Get the free For the Quarterly Period Ended April 2, 2000

Get, Create, Make and Sign for form quarterly period

How to edit for form quarterly period online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for form quarterly period

How to fill out for form quarterly period

Who needs for form quarterly period?

A Comprehensive Guide to Completing the Quarterly Period Form

Understanding the quarterly period form

The quarterly period form is a vital document that businesses must complete to provide financial performance updates every three months. This form serves several purposes, including tracking financial performance, compliance with tax regulations, and aiding in strategic decision-making. Accurately reporting on a quarterly basis not only fulfills legal obligations but also helps businesses identify trends, manage cash flow effectively, and maintain financial health.

Different business entities, such as corporations, partnerships, and sole proprietorships, are generally required to complete this form. It's crucial for stakeholders, including business owners, accountants, and tax professionals, to understand its implications fully. The accuracy of the quarterly period form directly impacts a company’s credibility and financial standing.

Key sections of the quarterly period form

The quarterly period form is structured to capture essential information needed for reporting. It generally consists of four main sections, each focusing on different aspects of the business’s finances and compliance.

Step-by-step instructions for completing the quarterly period form

Completing the quarterly period form requires careful preparation. By following these structured steps, you can ensure that your submission is accurate and compliant.

Gather necessary information

To begin, collect all required documents. This usually includes financial statements, invoices, expense reports, and any previous quarter forms. Having this information organized will make the completion process smoother.

Filling out business information

In Part 1, fill out your business information precisely. Include your legal business name, the registered address, and contact information. Ensure that the details match your business registration documents.

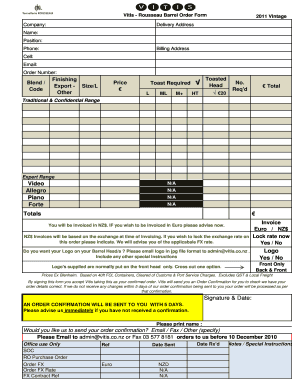

Reporting financial data

In Part 2, accurately report all financial metrics. Include total revenue generated, all costs incurred during the quarter, and any other relevant financial adjustments to derive net income. Double-check figures for accuracy to avoid common reporting errors.

Compliance and tax obligations

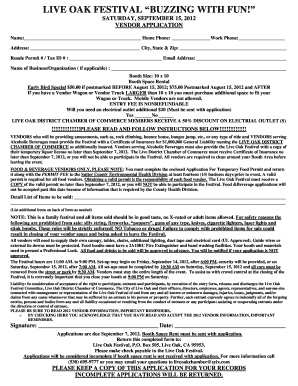

Part 3 focuses on compliance. Here, provide information related to any tax obligations, such as estimated payments made and other deductions claimed. Be aware of deadlines to ensure timely compliance to avoid penalties.

Verification steps before submission

Before submission, conduct a thorough review. Check that all sections are filled out completely and accurately. It’s advisable to have another person review the form, ensuring that no mistakes are overlooked. This verification step can save you from costly errors.

Key deadlines for filing the quarterly period form

Every quarter comes with its own set of deadlines that are crucial for businesses to adhere to. Typically, businesses must submit the quarterly period form within 30 days following the end of each fiscal quarter. Missing these deadlines can lead to fines and penalties, which can adversely affect your financial standing.

Failure to file on time can not only incur penalties but may also prompt increased scrutiny from tax authorities.

Filing options: Online vs. paper submission

Today, businesses have two main options for filing the quarterly period form: online and paper submissions. Opting for online filing through pdfFiller offers several advantageous features.

On the other hand, paper filing may involve more steps in terms of postage and physical documentation. It can also lead to longer processing times, potentially resulting in late submissions.

Additional tools and resources for managing quarterly reports

Managing quarterly reports can be streamlined with various tools and resources available on pdfFiller. Interactive tools allow businesses to create and modify forms efficiently.

Furthermore, adopting a proactive approach to compliance can greatly simplify the process of managing reports across multiple quarters.

Frequently asked questions about the quarterly period form

Encountering questions during the completion of the quarterly period form is quite common. Here are some frequently asked questions to guide you.

Common errors and how to avoid them

Filling out the quarterly period form can be daunting, and many individuals make common mistakes. Recognizing these can help mitigate errors.

Following best practices, such as maintaining a checklist during completion, will enhance the accuracy of your reports.

Best practices for document management

Efficient document management is essential for businesses handling quarterly reports. Here are effective strategies to improve organization.

Taking advantage of pdfFiller's innovative solutions will ensure that your document management practices remain effective and organized.

Resources for ongoing education and support

Staying informed about the best practices for filing and tax strategies is critical for long-term business success. pdfFiller offers educational resources that can enhance your knowledge and understanding.

Utilizing these resources can significantly improve your ability to manage a quarterly period form and ensure compliance effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my for form quarterly period directly from Gmail?

How do I edit for form quarterly period in Chrome?

How do I fill out for form quarterly period using my mobile device?

What is for form quarterly period?

Who is required to file for form quarterly period?

How to fill out for form quarterly period?

What is the purpose of for form quarterly period?

What information must be reported on for form quarterly period?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.