Get the free WI 53226

Get, Create, Make and Sign wi 53226

How to edit wi 53226 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wi 53226

How to fill out wi 53226

Who needs wi 53226?

A comprehensive guide to the Wi 53226 form

Understanding the Wi 53226 form

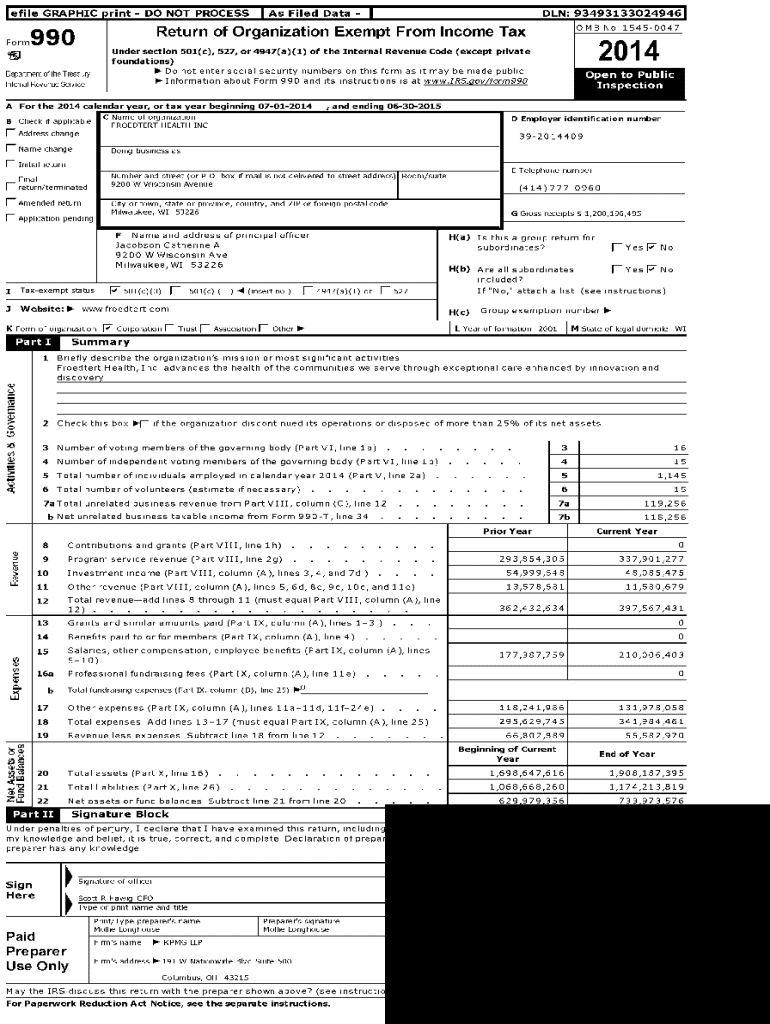

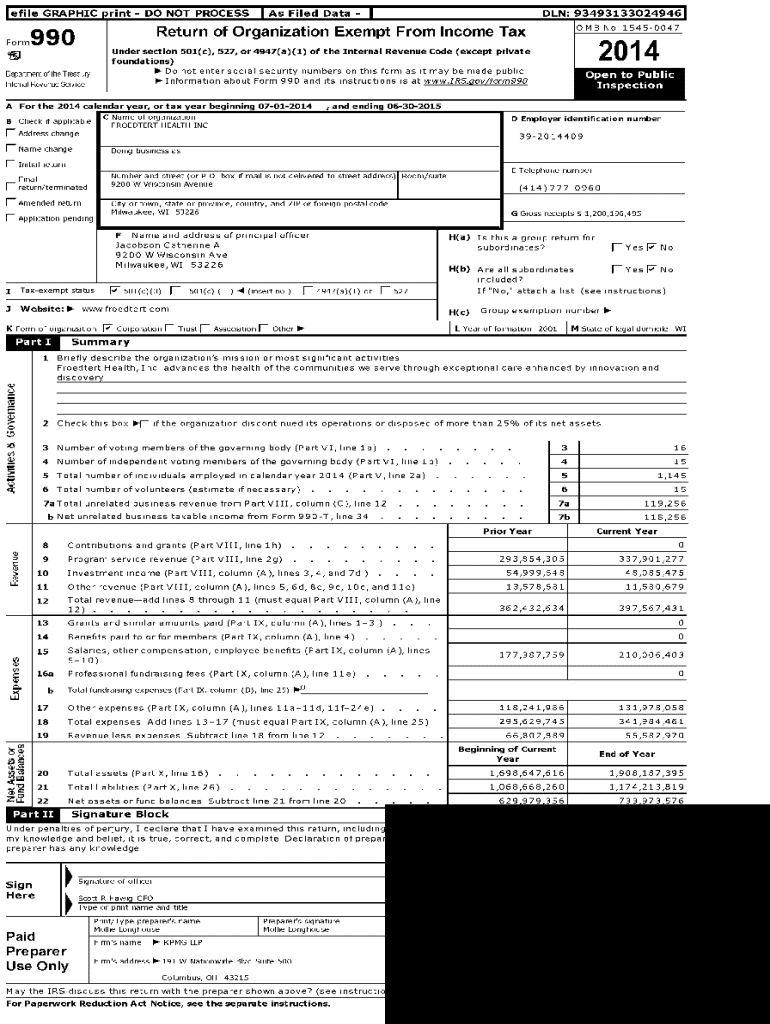

The Wi 53226 form, also known as the 'Wisconsin Department of Revenue Statement of Non-resident Ownership—Form WI-53226', serves a critical function in the realm of Wisconsin taxation. This form provides essential disclosures regarding income generated from partnerships or other entities involving non-residents. Its primary purpose is to ensure proper reporting and withholding of Wisconsin tax for non-resident partners to prevent tax evasion and ensure compliance with state laws.

In Wisconsin, the accurate completion of the Wi 53226 form is vital for both tax administrators and non-resident entities. It facilitates the state’s ability to track and collect taxes owed from non-residents earning income within its borders, helping maintain the integrity of the state’s revenue system.

When to use the Wi 53226 form

Understanding when to utilize the Wi 53226 form is fundamental for compliance. This form should be filed under specific scenarios, such as when a non-resident partner or owner receives income from a partnership located in Wisconsin. Common situations requiring the use of this form include partnerships that distribute income to partners who live outside the state, ensuring that withholdings are correctly calculated for non-residents.

Accessing the Wi 53226 form

Accessing the Wi 53226 form is straightforward, primarily through the official Wisconsin Department of Revenue website. Here, users can download the latest version of the form, ensuring they are using an up-to-date document tailored to current state regulations.

Where to find the form

The official resource for the Wi 53226 form can be found [here](). Alternatively, the form is also available in various tax preparation software and platforms, enhancing its accessibility for those preparing taxes.

Alternative access methods

Users looking for more convenient options can download the Wi 53226 form as a PDF. Additionally, tools like pdfFiller provide online access, allowing users to fill out and manage the document directly within their cloud storage.

Step-by-step instructions for filling out the Wi 53226 form

Filling out the Wi 53226 form correctly is crucial for compliance and ensures that withholding taxes are appropriately calculated. Here is a breakdown of the essential information required to complete the form:

Detailed filling instructions

To fill out the Wi 53226 form accurately, follow these detailed instructions for each section:

Avoid common pitfalls by double-checking names and tax identification numbers; clerical errors can lead to significant issues later on. Taking time to ensure accuracy improves the chances of a smooth processing experience.

Tips for accurate submission

To enhance the accuracy of your Wi 53226 form submission, consider the following best practices:

Editing the Wi 53226 form with pdfFiller

pdfFiller provides an intuitive interface for users who need to edit their Wi 53226 form. With accessible tools, it becomes easy to annotate, fill, and modify the document as needed without hassle.

How to edit the form

Editing the Wi 53226 form through pdfFiller involves minimal steps. After uploading your form, utilize the 'Edit' feature to add or revise information. The platform supports various formats, ensuring flexibility for users.

Adding custom annotations

Using pdfFiller, users can easily add comments or text boxes to clarify specific details or provide supplementary information.

Formatting options

Adjusting the layout and style of the Wi 53226 form enhances clarity and presentation. pdfFiller allows users to manipulate font size, color, and alignment, ultimately improving readability.

Signing the Wi 53226 form

After completing the form, signing it appropriately is essential for legality. The eSignature process is recognized under Wisconsin law, offering a modern alternative to traditional signatures.

Options for eSigning

Wisconsin’s electronic signature laws provide a legal framework for eSigning forms like the Wi 53226. When using pdfFiller, the process is simplified, allowing users to sign documents securely and efficiently.

How to sign the form digitally

Signing digitally on pdfFiller is straightforward. Simply select the 'Sign' option, follow the prompts to create your signature, and apply it to the Wi 53226 form. Ensure the signature is placed in the designated areas for compliance.

Ensuring legal compliance

To verify your electronic signature’s validity, keep informed of the current laws in Wisconsin regarding digital signatures. Resources are available from state agencies that can provide guidance.

Managing and storing your completed Wi 53226 form

Upon completion, effectively managing and storing your Wi 53226 form is essential for future reference and compliance. Various storage options can safeguard your documents.

Safe storage options

Opting for cloud storage solutions provides an effective way to keep your completed forms secure and accessible. Platforms like pdfFiller offer integrated storage, enabling you to manage all your documents in one place.

Sharing the form

Sharing your completed Wi 53226 form can be done securely through pdfFiller’s sharing options. This feature allows users to invite others to review or sign the document without compromising data security.

Tracking changes and versions

Utilizing pdfFiller's built-in features for document management helps users track changes and maintain version history of the Wi 53226 form, keeping all amendments organized and easily accessible.

Common FAQs about the Wi 53226 form

Even with clear instructions, users often have questions about the Wi 53226 form. A dedicated FAQ section helps address common concerns, ensuring users are well-informed.

Frequently asked questions

Some of the most common questions include queries about submission deadlines, eligibility requirements, and proper filing procedures. pdfFiller hosts tailored resources to assist users in navigating these questions effectively.

Troubleshooting issues

When filling, signing, or submitting the Wi 53226 form, users may encounter a variety of issues. Addressing these challenges early prevents complications during tax season. pdfFiller offers support tools to troubleshoot and resolve common problems.

Additional information on related forms

The Wi 53226 form is not an isolated document in the realm of taxation. It bears relevance to other related financial documents within the Wisconsin tax system.

Comparison with similar forms

Compared to forms like the WI-40, which focuses on resident individual income tax, the Wi 53226 is unique in its focus on non-resident partners in partnerships. This distinction helps streamline compliance efforts for various entities operating within the state.

Related resources

Understanding how the Wi 53226 fits into broader regulatory frameworks enhances document management and compliance strategies. Various resources from the Wisconsin Department of Revenue can provide insights into related forms and their uses in the context of state taxation.

Glossary of key terms

Understanding legal and technical terminology is vital when dealing with the Wi 53226 form. A glossary can assist in demystifying complex terms.

Connect with local resources

For additional support and guidance on the Wi 53226 form, connecting with local resources can be invaluable. The Wisconsin Department of Revenue provides essential contact points for inquiries about form submissions and tax compliance.

State-specific guidance

Visit the [Wisconsin Department of Revenue]() for comprehensive resources, including links to important documents and guides on state taxation.

Support lines and assistance

For personalized assistance, users can contact Wisconsin’s taxpayer assistance lines for help with filing questions, deadline information, and any concerns regarding the Wi 53226 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find wi 53226?

How do I execute wi 53226 online?

How do I fill out the wi 53226 form on my smartphone?

What is wi 53226?

Who is required to file wi 53226?

How to fill out wi 53226?

What is the purpose of wi 53226?

What information must be reported on wi 53226?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.