Get the free MPF Scheme Brochure

Get, Create, Make and Sign mpf scheme brochure

Editing mpf scheme brochure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mpf scheme brochure

How to fill out mpf scheme brochure

Who needs mpf scheme brochure?

A comprehensive guide to the MPF scheme brochure form

Overview of the MPF scheme

The Mandatory Provident Fund (MPF) is a compulsory retirement savings scheme in Hong Kong designed to provide financial security to workers in their retirement years. Established in 2000, the MPF aims to ensure that employees save a portion of their monthly salary which will accumulate over time, providing a nest egg for when they retire. This initiative not only benefits the individual but also strengthens the social safety net, reducing future reliance on government welfare.

The MPF scheme offers several key benefits, including the potential for investment growth, tax deductions on contributions, and employer matching contributions. Individual participants can accumulate savings that grow over time, thus providing financial stability in retirement. Increasing awareness about the scheme's features and benefits is essential, which is where the MPF scheme brochure form plays a critical role.

Overview of the MPF scheme brochure form

The MPF scheme brochure form serves as an essential informational resource, guiding individuals and teams through the various options available within the MPF. It outlines not only fund options, but also highlights investment risks and potential returns, making it easier for members to make informed decisions regarding their retirement savings.

Understanding the key features of the MPF scheme brochure form

The MPF scheme brochure includes several crucial elements that every member should understand. First and foremost are the fund options, which comprise various types of investments, including equities, bonds, and mixed funds. Each comes with its own set of risks and potential returns, so it's imperative for individuals to select the fund that aligns with their financial goals and risk appetite.

Additionally, the brochure details contribution rates, showing mandatory rates depending on an individual's income. Eligibility for withdrawal is also outlined, such as conditions surrounding retirement, permanent departure from Hong Kong, or total incapacity. With this information, members can better navigate their options and grasp the implications of their contributions.

Having an MPF scheme brochure at hand fosters transparency and promotes informed decision-making. With so many options available, individuals can review the essential elements of their retirement planning through the lens of clarity, helping to secure their financial future.

Step-by-step guide to accessing the MPF scheme brochure

Accessing the MPF scheme brochure form is straightforward and can be accomplished in just a few steps. First, you'll need to visit the official MPF website or your designated provider’s platform. This website serves as a comprehensive hub for all information pertaining to the MPF scheme.

Once you are on the homepage, navigate to the MPF scheme brochure section. Most sites feature a user-friendly layout, with easily identifiable links or tabs leading you to key resources. After finding this section, you will typically see options to download the brochure in various formats such as PDF or DOCX.

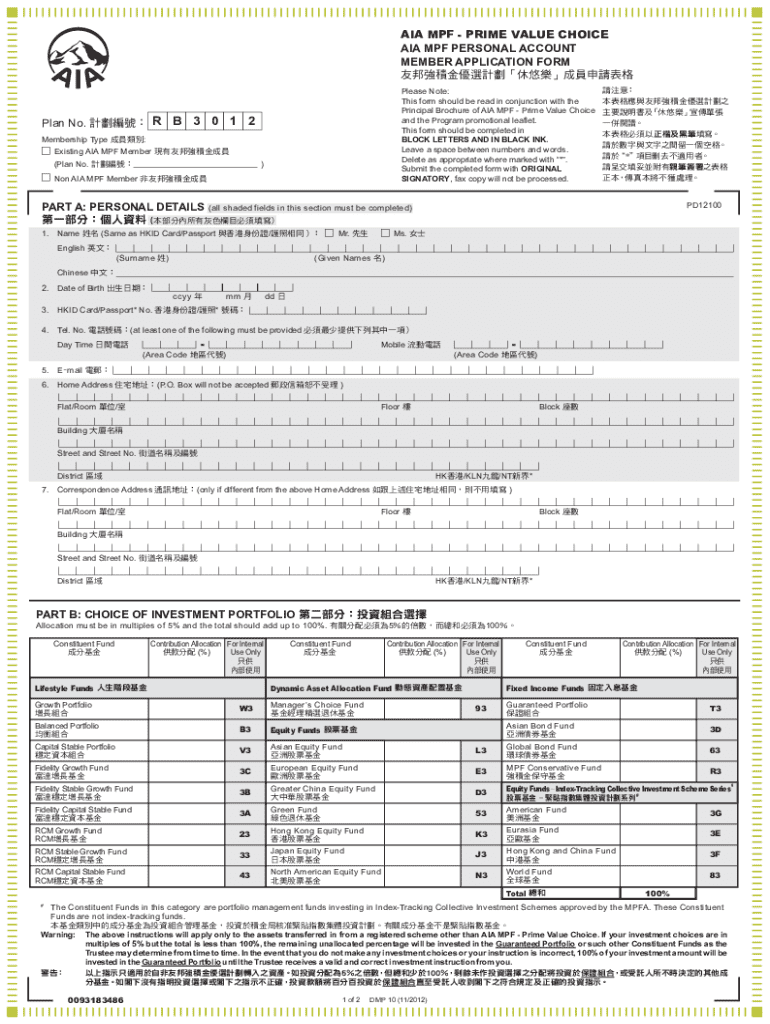

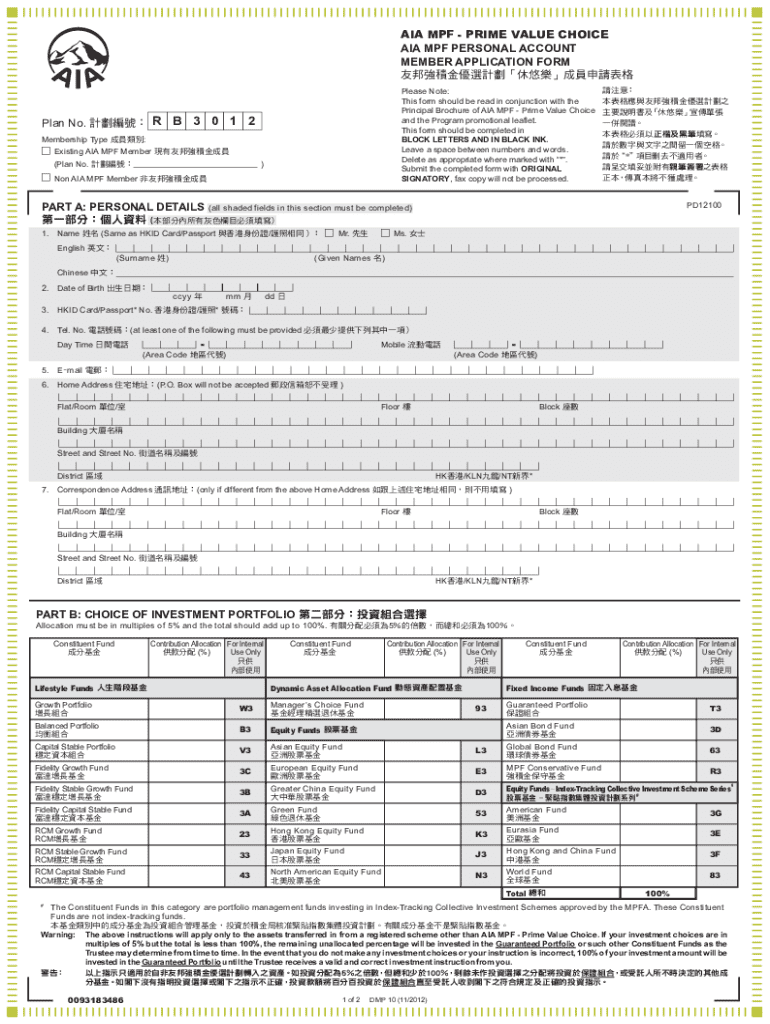

Detailed instructions on filling out the MPF scheme brochure form

Once you have accessed the MPF scheme brochure form, filling it out requires careful attention to detail. The first step is providing essential personal information, such as your name, ID number, and contact information. Accurate data is crucial as it ensures that your contributions are correctly recorded and any correspondence reaches you without delay.

Next, you will need to include employment details, like your employer’s information and job title. This allows your fund provider to maintain an accurate record of your contributions. In some sections, you may encounter complex topics like investment preferences and risk tolerance. Take your time to understand these sections — choosing the right options can significantly impact your future savings.

A common pitfall during this process is rushing through the form. Ensure you don’t skip any required fields, as this could lead to delays or complications down the line. Double-check your entries before submitting the form to safeguard your investment.

Editing and managing your MPF scheme brochure form

Once you have completed the MPF scheme brochure form, using tools like pdfFiller can greatly enhance document management. First, upload your completed form to the platform. pdfFiller offers a range of editing features, enabling you to make adjustments seamlessly if you realize you missed something or want to update information.

Moreover, e-sign capabilities integrated into pdfFiller facilitate the signing of documents electronically. This feature is not only time-saving but legally valid in Hong Kong, which means you can confidently proceed with your submission knowing that your electronic signature holds the same weight as a handwritten one.

Collaborating with stakeholders on your MPF scheme brochure form

As you manage your MPF scheme brochure form, collaboration may be necessary, particularly if you're working with team members or financial advisors. pdfFiller allows you to share your completed form with others efficiently, enabling co-editing and feedback directly on the document.

Utilizing features like track changes and comments can enhance the collaborative process. This ensures that all stakeholders have visibility into suggested alterations or considerations. By fostering communication in this manner, everyone can review the most recent version of the document, significantly reducing the risk of misunderstandings.

Common questions and troubleshooting

As with any form, questions may arise during the process. Some frequently asked questions about the MPF scheme brochure form include how to address issues related to incomplete submissions or discrepancies in contributions. In such cases, promptly reach out to your fund provider for assistance. They can offer guidance on how to rectify any problems efficiently.

To ensure the accuracy of your submission, it helps to systematically verify all information. Take a few moments to cross-check your entries and, if possible, have someone else review the form. This added measure can help catch any errors early, making your experience smoother.

Keeping updated on MPF regulations and changes

It’s crucial to stay informed about the latest developments in the MPF system, especially as regulations may change over time. Staying updated can influence your investment strategies and decisions. Numerous resources, including the official MPF website, provide timely updates and alerts on regulatory changes, ensuring you make informed financial decisions.

Accessing updates and changes to investment regulations can also be done through newsletters and notifications from your fund provider. Regularly reviewing these updates not only enhances your knowledge but allows you to adjust your approach to investing within the MPF.

Conclusion and next steps

The MPF scheme brochure form is an invaluable resource for all individuals participating in Hong Kong's retirement savings initiative. By understanding how to access, fill out, and manage this form, you take proactive steps toward securing a more stable financial future. Utilize tools like pdfFiller to streamline the process, enhance collaboration, and ensure compliance with all necessary regulations.

Arming yourself with the right information and using effective document management platforms can lead to confident decision-making regarding your retirement savings. Your future financial security is worth the effort in completing the MPF scheme brochure form correctly!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mpf scheme brochure from Google Drive?

How do I complete mpf scheme brochure on an iOS device?

How do I edit mpf scheme brochure on an Android device?

What is mpf scheme brochure?

Who is required to file mpf scheme brochure?

How to fill out mpf scheme brochure?

What is the purpose of mpf scheme brochure?

What information must be reported on mpf scheme brochure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.