Get the free Claims Commission

Get, Create, Make and Sign claims commission

How to edit claims commission online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claims commission

How to fill out claims commission

Who needs claims commission?

Claims Commission Form: How-to Guide Long Read

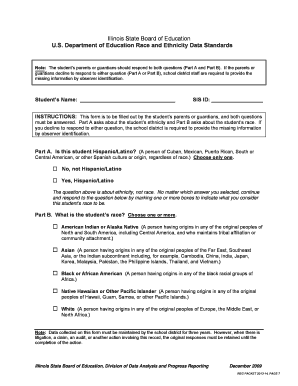

Understanding the claims commission form

A Claims Commission Form serves as a formal document used to file a claim for compensation or benefits from a specific commission. Designed to facilitate the process of submitting claims, this form helps individuals navigate the administrative aspects of obtaining due benefits. Understanding its purpose is essential for anyone looking to pursue their rights effectively.

The Claims Commission plays a pivotal role in the claims process, acting as an intermediary between the claimant and the responsible agency. By using this form, individuals can properly present their case, providing the necessary information and documentation required for review and resolution. Its significance cannot be overstated, as it essentially initiates the process of potential remuneration.

Preparing to file your claim

Before you begin filling out your Claims Commission Form, it’s crucial to gather all necessary information. Having the right documents on hand will not only streamline the filing process but also increase the likelihood of your claim being processed smoothly.

Organizing your information is equally important. Consider creating a dedicated folder, either physically or digitally, where you can store all related documents. This approach will make it easy to access everything when you start completing your Claims Commission Form.

Identifying eligibility requirements

It's essential to understand who can file a claim using the Claims Commission Form. Generally, individuals who directly suffer losses, injuries, or damages can submit claims, but specific eligibility requirements may vary by jurisdiction and type of claim.

Common reasons for filing claims often include accidents, workplace injuries, disputes with vendors, or product malfunctions. Familiarizing yourself with these reasons can help in determining if you are eligible to file, thus paving the way for a more focused and effective claims process.

Step-by-step guide to completing the claims commission form

Once you have all the necessary information, the next step is to access the Claims Commission Form. This document can typically be obtained online, downloaded, or requested from your local claims office. Many jurisdictions now offer digital access, allowing you to fill out the form at your convenience.

Filling out the Claims Commission Form requires attention to detail. Begin with your personal information; most forms will request your name, address, and contact information. In the description of your claim section, provide a clear and concise explanation of your situation, including dates, locations, and pertinent details. Remember to also attach supporting documentation; this is critical for a successful claim.

To avoid common mistakes, double-check your entries and ensure all relevant fields are completed. Missing or incorrect information can cause delays in processing, or worse, denials of your claim.

Submitting your claims commission form

Once you have completed your Claims Commission Form, it's time to submit it. There are typically several options available for submission: online through eFiling systems, by mailing the form, or delivering it in person to your local office.

Be aware of deadlines when filing your claim. Each jurisdiction may impose specific time frames in which claims must be submitted, and missing these deadlines could result in reduced chances of receiving benefits.

After submitting, expect certain processing times. Claims Commission offices will typically notify you upon receipt and provide guidance on next steps in the process, so keep an eye on your communication channels for updates.

Interaction with the claims commission

Tracking the status of your claim is an important aspect of the process. Many Claims Commissions offer online portals where you can check your claim’s progress. Regularly checking this can alleviate anxiety and keep you informed about potential decisions or additional requirements.

Should the Claims Commission request additional information, it’s essential to respond promptly. Requests could vary from needing more documentation to clarifications on your submission. Providing the needed information efficiently and quickly can help expedite the review process.

Important considerations post-submission

After the submission, you may need to contend with denials or potential appeals. Understanding why claims are denied is crucial; common issues include insufficient evidence or missed deadlines. If your claim is denied and you believe it to be unjust, pathways for appeals are typically outlined by the Claims Commission.

Follow the outlined steps to appeal a decision carefully. Each claim has specific instructions that can range from providing additional documentation to formally requesting a review. It's important not to become discouraged; many successful claims come after appeals.

Be prepared for common issues that might arise during the claims process. Having answers to FAQs and understanding typical obstacles can bolster your confidence and readiness to handle the claims situation.

Resources and tools for successful claim filing

Leveraging interactive tools, especially available on the pdfFiller platform, can greatly enhance your claims process. Features like editing and signing tools allow users to fill out and modify PDFs seamlessly, significantly reducing errors and improving efficiency.

In addition to document management tools, having access to additional support channels is vital. Visit your Claims Commission's contact section or the pdfFiller website for FAQs, live chats, and more resources that can assist you in resolving any questions regarding your claim.

Legal framework governing claims

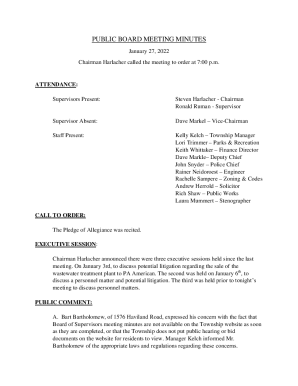

Each Claims Commission operates within a specific legal framework that dictates how claims are submitted, processed, and appealed. Familiarizing yourself with the jurisdictional laws and regulations is necessary for ensuring your claim is compliant with requirements.

As part of your claims process, it’s also useful to stay updated on public meeting notices regarding claims commission updates. Changes in commission rules or procedures can impact your filing or claims strategy, so regular monitoring is advisable.

Conclusion

Successfully navigating the claims filing process through the Claims Commission Form can greatly enhance your chances of receiving desired outcomes. pdfFiller empowers users to manage their documents efficiently, offering robust tools for editing, eSigning, and collaboration. By utilizing these resources, you can make the claims process much smoother and less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claims commission without leaving Google Drive?

How can I send claims commission to be eSigned by others?

How can I fill out claims commission on an iOS device?

What is claims commission?

Who is required to file claims commission?

How to fill out claims commission?

What is the purpose of claims commission?

What information must be reported on claims commission?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.