Get the free Nourishing Hope 990 FY23

Get, Create, Make and Sign nourishing hope 990 fy23

How to edit nourishing hope 990 fy23 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nourishing hope 990 fy23

How to fill out nourishing hope 990 fy23

Who needs nourishing hope 990 fy23?

Nourishing Hope 990 FY23 Form: A Comprehensive Guide

Overview of the Nourishing Hope 990 FY23 Form

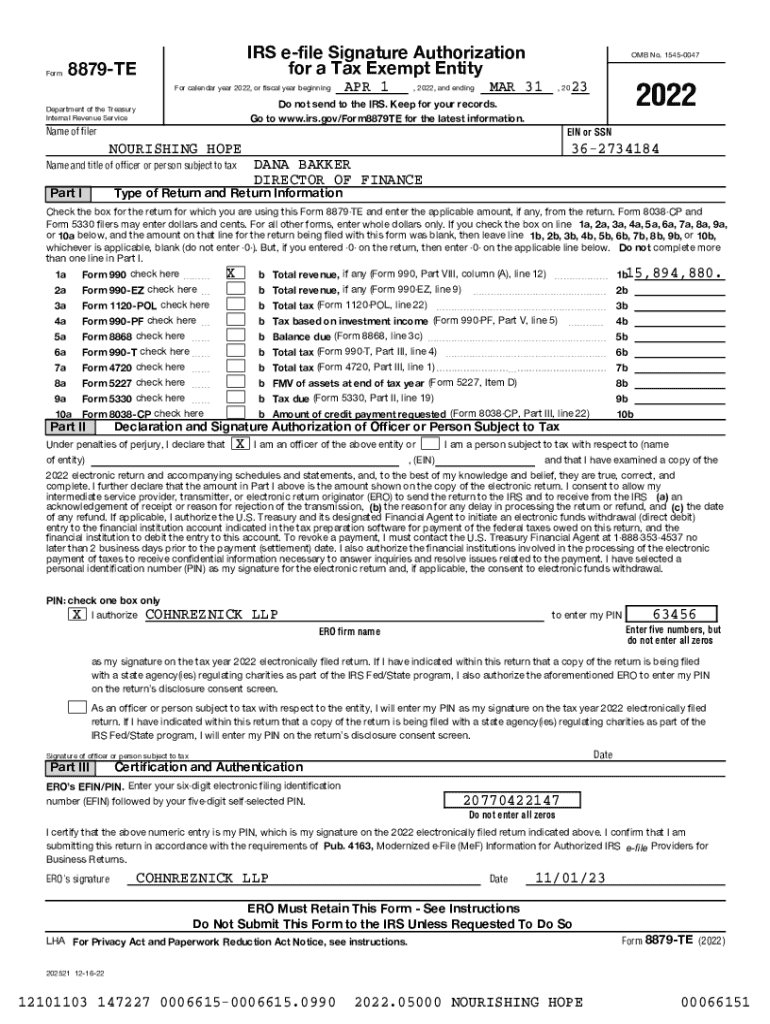

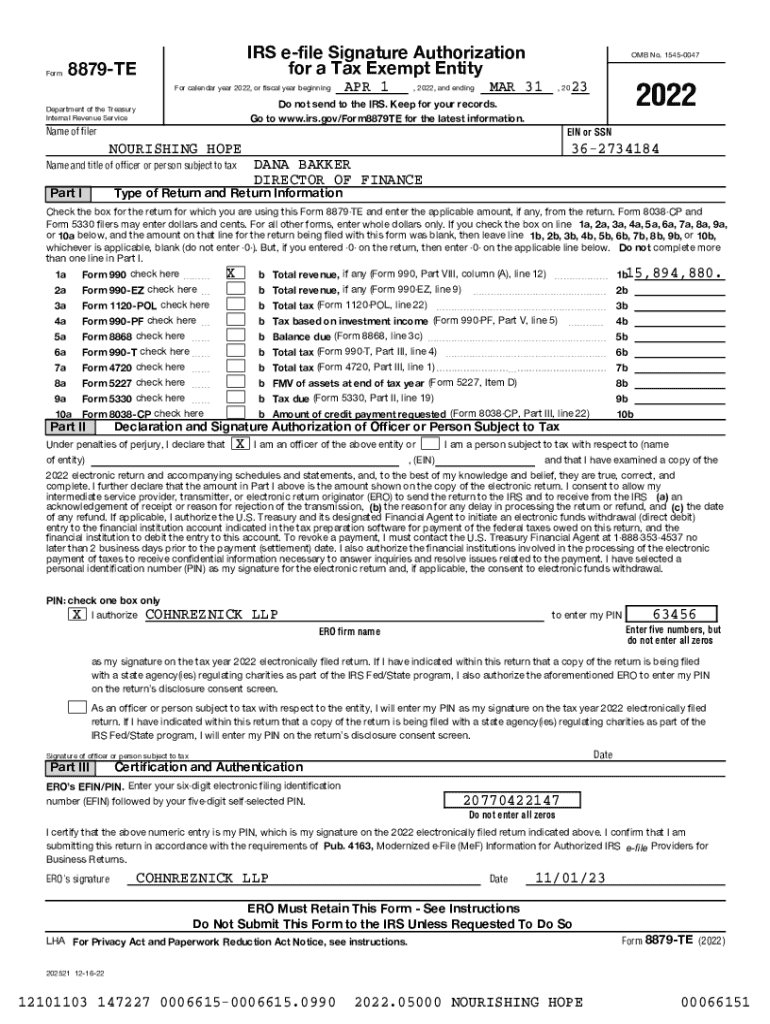

The Nourishing Hope 990 FY23 Form is a crucial document used by non-profit organizations to report their financial activities, governance structure, and operational impact to the IRS and the public. This form not only outlines the organization's mission and achievements but also serves to enhance transparency and accountability, providing stakeholders with insights into the organization’s management, funding, and effectiveness.

The importance of the Form 990 lies in its role as a public accountability tool. It allows potential donors, regulators, and the public to scrutinize a non-profit's financial health and operational practices. The FY23 version of the form includes specific features that cater to emerging reporting standards, ensuring organizations remain compliant under evolving IRS requirements.

Understanding the structure of the form

The Nourishing Hope 990 FY23 Form is structured into multiple parts, each focusing on different aspects of the organization’s profile. Understanding this structure is essential for accurate filing and effective communication of the organization's impact.

The significance of each section lies in its contribution to a complete picture of the organization’s operations, facilitating informed decisions from stakeholders regarding support or investment.

Step-by-step instructions for filling out the form

Filling out the Nourishing Hope 990 FY23 Form is a detailed process that requires specific organizational information. Before starting, it's essential to consolidate and gather the necessary information to ensure a smooth completion.

In guiding through the form section by section, it’s vital to accurately report revenue, carefully document expenses, and provide insights into your activities and their impact. Common pitfalls include overlooking minor discrepancies in financials or misreporting activity metrics, both of which could lead to compliance issues.

Interactive tools for form completion

Using pdfFiller to complete the Nourishing Hope 990 FY23 Form offers several interactive features that simplify the process significantly. One of the main advantages is the auto-fill options that help minimize repetitive data entry across different sections of the form.

These interactive tools not only enhance the efficiency of the process but also increase the accuracy of the information being reported, ensuring stakeholders can trust the data provided.

Tips for ensuring accuracy and compliance

Ensuring accuracy and compliance while filling out the Nourishing Hope 990 FY23 Form is paramount. An internal review process is crucial to catch mistakes before the form is submitted. This means having multiple stakeholders involved in the review can significantly enhance the reliability of the data.

These practices not only minimize the risk of mistakes but also promote a culture of transparency and accountability within the organization, cultivating trust among stakeholders.

Filing and submission process

The submission of the Nourishing Hope 990 FY23 Form should adhere to specified deadlines. Non-profits typically must file their Form 990 by the 15th day of the fifth month after the end of their fiscal year; thus, it’s essential to mark your calendars accordingly.

Understanding these details can alleviate last-minute filing stress and ensure compliance with IRS timelines.

Managing post-submission queries

After filing the Nourishing Hope 990 FY23 Form, organizations may experience various follow-up queries from the IRS. Being well-prepared to handle these inquiries is vital for maintaining good standing with the IRS.

Establishing a proactive response strategy strengthens the organization's credibility and responsiveness to regulatory bodies.

Leveraging the form for enhanced organizational strategy

The Nourishing Hope 990 FY23 Form is not just a compliance document; it serves as a strategic tool for non-profits. Analyzing the information presented in the form can inform a variety of organizational strategies and operational decisions.

By actively employing the insights derived from the Nourishing Hope 990 FY23 Form, organizations can foster growth, build relationships, and improve overall effectiveness.

Frequently asked questions about the Nourishing Hope 990 FY23 Form

Navigating the Nourishing Hope 990 FY23 Form can lead to various questions, especially for first-time filers. Addressing these inquiries can help ensure smooth filing and compliance.

Resources, including IRS guidelines and workshops, are available to support organizations through the filing process and clarify any concerns about reporting requirements.

Utilizing pdfFiller for a seamless document management experience

pdfFiller provides a comprehensive suite of tools designed to streamline documentation for non-profits. By leveraging pdfFiller for the Nourishing Hope 990 FY23 Form, organizations can maximize efficiency and reduce the effort associated with managing forms.

Real-life success stories illustrate how various non-profits have optimized their documentation processes using pdfFiller, showcasing the platform's effectiveness in enhancing operational efficiencies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nourishing hope 990 fy23?

Can I create an eSignature for the nourishing hope 990 fy23 in Gmail?

How can I edit nourishing hope 990 fy23 on a smartphone?

What is nourishing hope 990 fy23?

Who is required to file nourishing hope 990 fy23?

How to fill out nourishing hope 990 fy23?

What is the purpose of nourishing hope 990 fy23?

What information must be reported on nourishing hope 990 fy23?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.