Get the free Motilal Oswal Nifty India Defence Index Fund Regular-Growth

Get, Create, Make and Sign motilal oswal nifty india

How to edit motilal oswal nifty india online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motilal oswal nifty india

How to fill out motilal oswal nifty india

Who needs motilal oswal nifty india?

Comprehensive Guide to the Motilal Oswal Nifty India Form

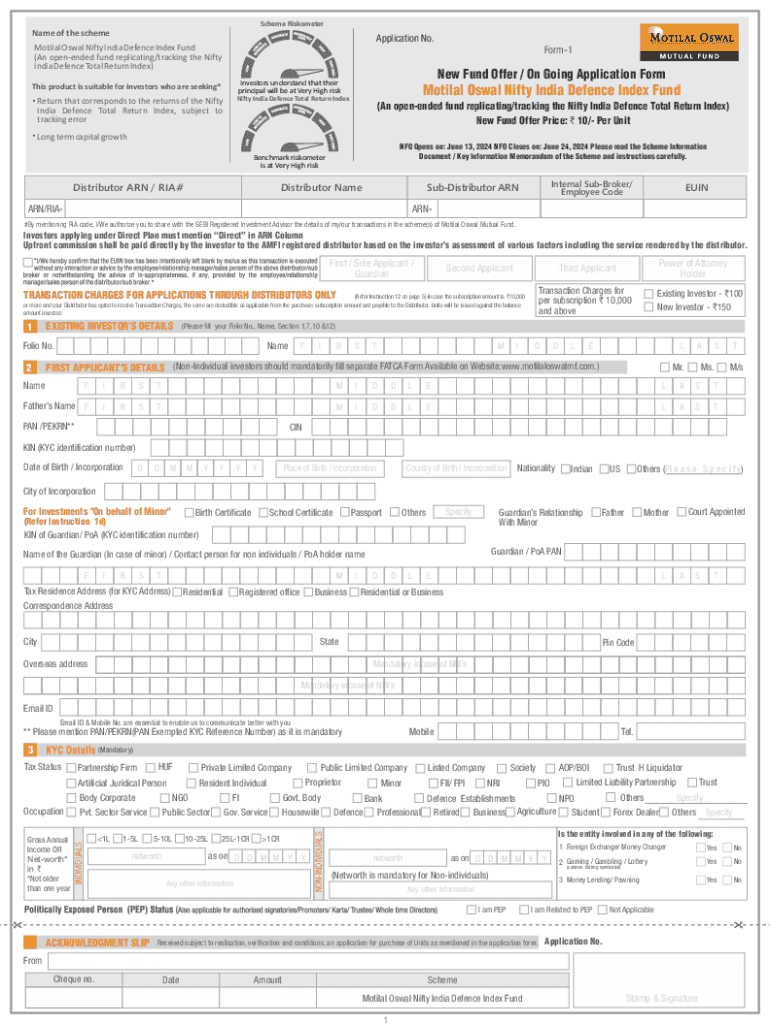

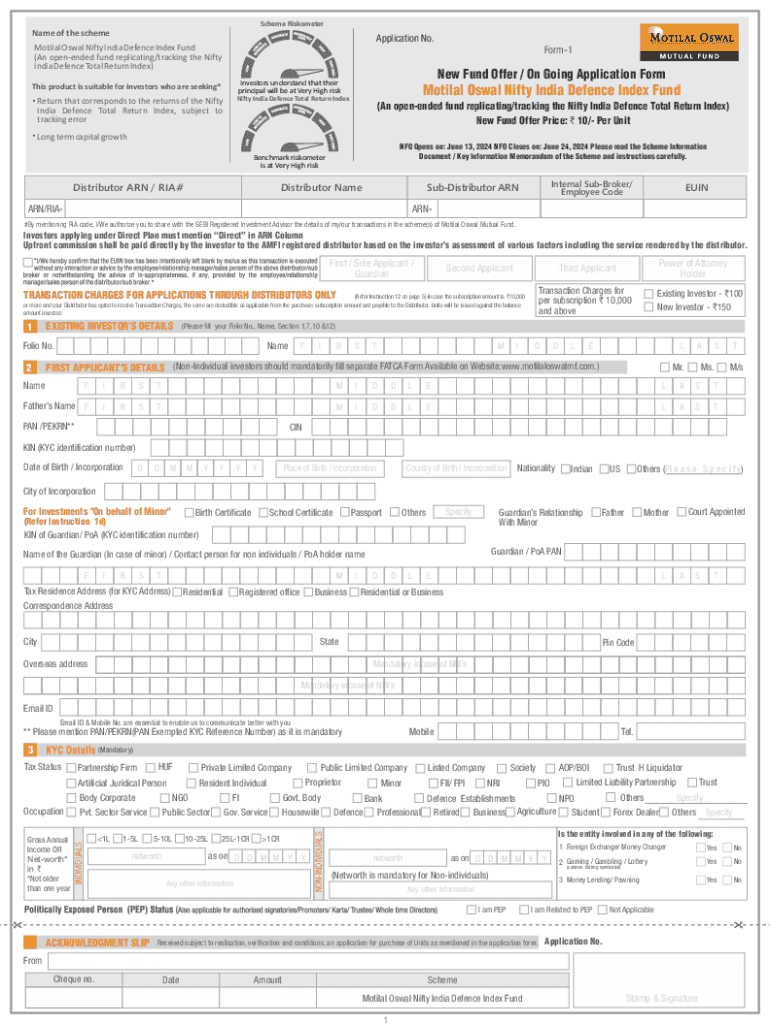

Overview of the Motilal Oswal Nifty India Form

The Motilal Oswal Nifty India Form is designed to facilitate investments in India's leading index, the Nifty 50. Its primary purpose is to streamline the investment process, enabling users to document their personal and financial information accurately, while expressing their investment preferences.

Key features of the Motilal Oswal Nifty India Form include easy navigation, a user-friendly interface, and the option for e-signature, which allows for efficient submissions. Accurate completion of the form is critical; it ensures compliance with regulations and helps in tailoring investments to meet individual goals.

User guide for accessing the form

Accessing the Motilal Oswal Nifty India Form is straightforward, with options available both online and via PDF downloads. For online access, visit the Motilal Oswal website, navigate to their investment section, and look for the Nifty India Form link. Alternatively, the form can also be downloaded as a PDF for offline completion.

Once downloaded, you can navigate through the form interface to complete your information seamlessly. Understanding the layout and sections will make the filling process more efficient.

Detailed instructions for filling out the form

Filling out the Motilal Oswal Nifty India Form requires attention to detail. The required information is divided into several categories: personal information, financial details, and investment preferences.

To navigate effectively, you can follow these step-by-step instructions. Start with Section 1, where you input your personal information; then, move on to Section 2 to complete your financial affidavit; finally, Section 3 will specifically address your investment goals.

To avoid common mistakes, double-check all entries, ensure all sections are filled, and verify that your information is accurate before submission.

Editing and managing the form

Once you've completed your Motilal Oswal Nifty India Form, you may want to edit or manage your document. Using pdfFiller, you can easily edit your form with various tools available on the platform.

Additionally, saving and storing your document can be done using cloud-based options offered by pdfFiller, allowing for easy access and version control. Each edit is saved in document history, helping you track changes efficiently.

eSignature and compliance

Adding an eSignature to your Motilal Oswal Nifty India Form is increasingly important in document management. It not only provides a seal of authenticity but also complies with various regulatory requirements.

The legal validity of eSigned documents is recognized in many jurisdictions, making them as binding as traditional signatures. To eSign your form using pdfFiller, simply follow the eSignature prompts provided in the editing tool.

Collaborating with teams

Collaboration is vital, especially when multiple team members contribute to the Motilal Oswal Nifty India Form. pdfFiller simplifies this process by allowing you to share the form for team review.

This level of collaboration not only enhances the quality of submissions but also fosters better communication within teams.

Frequently asked questions (FAQs)

Users often have queries regarding the Motilal Oswal Nifty India Form. Encountering issues while filling out the form is common, but troubleshooting can help resolve most problems swiftly.

Additional tools and resources

Investing wisely requires the right tools. In addition to filling out the Motilal Oswal Nifty India Form, pdfFiller offers various tools for investment analysis, such as portfolio management options, return calculators, and expense ratios.

These resources not only enhance your investment decisions but also empower you to stay informed in an ever-changing market.

Expert insights and updates

Staying updated on the latest trends in Nifty investments is crucial. As the market evolves, understanding regulatory changes that may impact Nifty India investors becomes essential.

These insights serve to fortify your investment confidence and adaptability in a dynamic economic landscape.

Connecting with Motilal Oswal

Establishing a connection with Motilal Oswal is key to addressing any inquiries or support needs related to the Nifty India Form. For customer support, users can access various contact avenues.

Engaging with customer support not only resolves issues but also builds a lasting relationship with your financial advisor, enabling you to navigate your investment journey more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute motilal oswal nifty india online?

How do I make changes in motilal oswal nifty india?

Can I create an electronic signature for signing my motilal oswal nifty india in Gmail?

What is motilal oswal nifty india?

Who is required to file motilal oswal nifty india?

How to fill out motilal oswal nifty india?

What is the purpose of motilal oswal nifty india?

What information must be reported on motilal oswal nifty india?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.