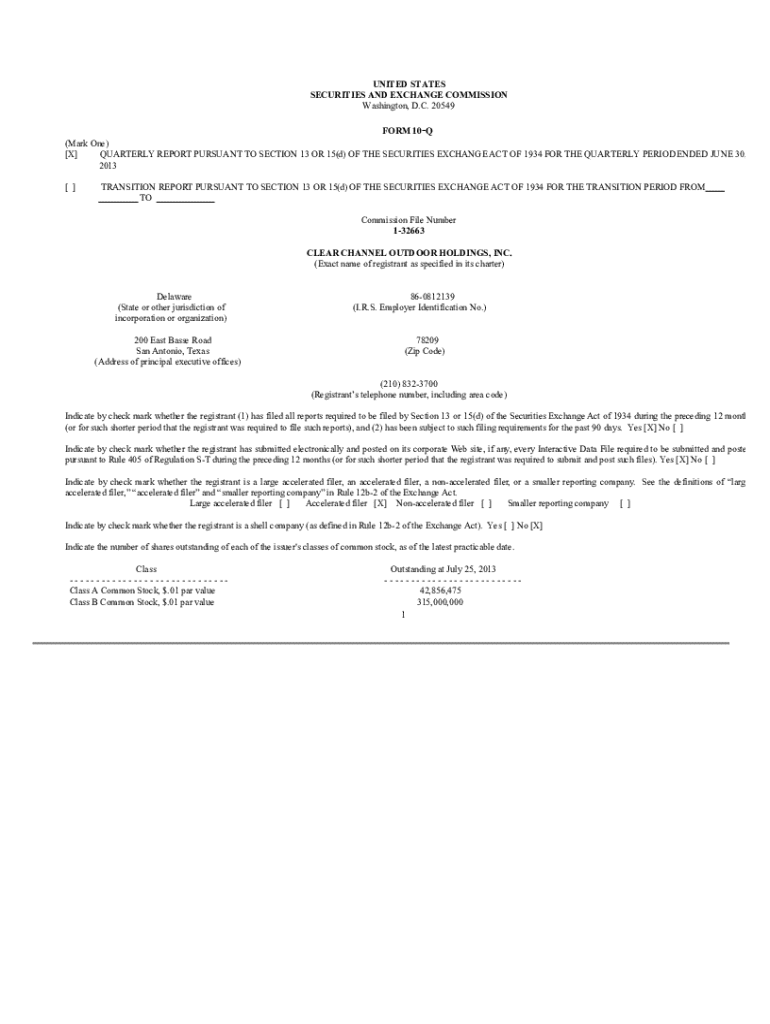

Get the free Condensed Consolidated Balance Sheets as of June 30, 2013 and December 31, 2012

Get, Create, Make and Sign condensed consolidated balance sheets

How to edit condensed consolidated balance sheets online

Uncompromising security for your PDF editing and eSignature needs

How to fill out condensed consolidated balance sheets

How to fill out condensed consolidated balance sheets

Who needs condensed consolidated balance sheets?

Understanding the Condensed Consolidated Balance Sheets Form

Understanding condensed consolidated balance sheets

A condensed consolidated balance sheet consolidates the financial position of a parent company and its subsidiaries into a streamlined format. This form highlights the financial state of the entire group at a specific point in time, providing essential details while omitting extensive disclosures found in full balance sheets.

Stakeholders such as investors, regulators, and creditors use these condensed balance sheets to grasp the financial health of a business quickly. The importance lies in effectively communicating critical financial information without overwhelming details, enabling quicker decision-making.

The format of a condensed consolidated balance sheet

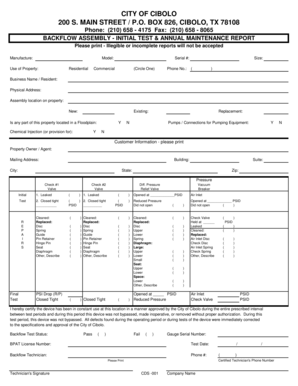

Formatting a condensed consolidated balance sheet requires adhering to established conventions to ensure clarity. The standard layout includes sections for assets, liabilities, and equity. Each section is typically arranged in order of liquidity for assets and due dates for liabilities.

Common metrics used in these reports include current ratios for assessing liquidity and debt to equity for understanding financial leverage. Proper categorization and layout are vital as they enable quick analysis and comparison across periods and companies.

Filling out the condensed consolidated balance sheets form

Filling out this form involves several critical steps. First, you must gather all relevant financial documents, such as recent statements of cash flows and previous balance sheets. Ensuring the accuracy of this data is crucial for a reliable financial representation.

Entering information into the condensed form requires careful breakdown by asset classes, appropriate allocation of liabilities, and an accurate reflection of equity structures. For instance, ensure that the value listed under assets aligns with the total liabilities plus equity, confirming the accounting equation holds true.

Editing and managing your condensed consolidated balance sheets

After filling out the condensed consolidated balance sheets form, tools like pdfFiller streamline management and revisions. Its powerful editing features allow users to modify text and figures directly within the document, ensuring updates are made in real-time.

Moreover, pdfFiller’s digital signature capabilities enable secure signing, providing a convenient way to authenticate documents electronically. Collaboration features such as sharing options and real-time comments allow teams to work together efficiently, improving the overall financial reporting process.

Finalizing and distributing your condensed consolidated balance sheets

Once the condensed consolidated balance sheets are complete, reviewing the document is essential. Use a finalized checklist to ensure all figures are correct. Peer reviews can catch discrepancies, ensuring that stakeholders receive accurate reports.

Exporting options allow users to share the document in various formats, including PDF and Excel. Clear communication strategies are necessary when distributing these forms, emphasizing critical figures and trends that stakeholders should note.

Best practices for maintaining accurate condensed consolidated balance sheets

Maintaining accurate financial records requires routine updates and reviews. Establishing a scheduled review can help teams remain compliant and informed about changes in financial conditions. This periodic assessment ensures that any significant changes in financial status are promptly recorded.

Leveraging technology can enhance financial reporting accuracy. Cloud-based platforms streamline data entry, making it easier to update files and share information securely. Tools offered by pdfFiller, like templates and automated reminders, can facilitate this process.

Understanding regulatory and compliance considerations

Adhering to relevant accounting standards, such as GAAP and IFRS, is crucial for compliance in financial reporting. These frameworks dictate how to present financial information and ensure transparency across financial documents, including condensed consolidated balance sheets.

To ensure compliance, documentation protocols must be strictly followed, and regular audits should be conducted. This reduces the risk of discrepancies and enhances the integrity of financial reporting, which builds trust with stakeholders.

Case studies: applications of condensed consolidated balance sheets in practice

Several industries demonstrate the effective application of condensed consolidated balance sheets. For instance, large corporations often use these forms to present financial health concisely to investors, especially when pursuing mergers or acquisitions, where financial clarity is imperative.

By analyzing case studies, businesses can draw insights regarding best practices in financial reporting. Successful reports typically focus on clarity, compliance, and thoroughness, setting a benchmark for others in the industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete condensed consolidated balance sheets online?

Can I create an eSignature for the condensed consolidated balance sheets in Gmail?

How do I fill out condensed consolidated balance sheets on an Android device?

What is condensed consolidated balance sheets?

Who is required to file condensed consolidated balance sheets?

How to fill out condensed consolidated balance sheets?

What is the purpose of condensed consolidated balance sheets?

What information must be reported on condensed consolidated balance sheets?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.