Get the free Refund of rental bond (Form 4) - H&H Residential Properties

Get, Create, Make and Sign refund of rental bond

How to edit refund of rental bond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out refund of rental bond

How to fill out refund of rental bond

Who needs refund of rental bond?

Refund of rental bond form: How-to guide long-read

Understanding rental bonds

A rental bond, also known as a security deposit, is a money deposit tenants provide to landlords at the beginning of a lease agreement. Typically equating to four weeks' rent, this bond is held to cover any potential damages to the property or unpaid rent during the tenancy. Securing a rental bond can protect landlords from financial loss and provides tenants an incentive to maintain the property in good condition.

The importance of securing a rental bond cannot be overstated. It offers a safety net for landlords while ensuring tenants responsibly uphold the terms of their lease. Common reasons for bond refunds include the conclusion of the lease, damage-free condition of the property upon exit, and any disputes that may arise regarding the return of the bond after moving out.

Who can request a bond refund?

Generally, the tenant who initially paid the rental bond is entitled to request a bond refund. However, eligibility may vary based on state-specific regulations. In cases of multiple tenants, such as shared housing situations, typically any tenant listed in the rental agreement can claim a refund, provided their names are on the bond.

Landlords also play a role in the bond refund process, as they can dispute the refund claim if they believe that damages have occurred or rent is outstanding. Unique situations, such as claims made by underage tenants or misunderstandings regarding the bond's ownership, may complicate the process and require additional considerations.

Preparation before starting the bond refund process

Before initiating the bond refund process, it’s crucial to prepare thoroughly. Gather all necessary documentation, which typically includes the rental agreement, payment receipts of the bond, and any relevant correspondence with your landlord or property manager. This paperwork acts as vital evidence in the refund process.

Understanding the state-specific rental laws is another critical step. Each state has its own regulations governing rental bonds and the associated refund processes. Additionally, conducting a property condition assessment is beneficial. Use a checklist to ensure you've inspected every part of the rental unit, noting any issues that could affect the bond refund.

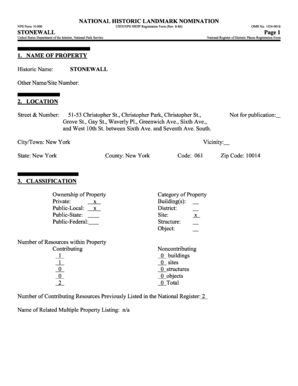

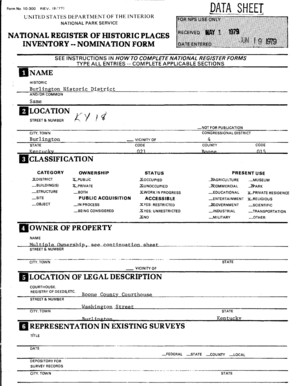

How to complete the refund of rental bond form

Accessing the refund of rental bond form is the next step. Most states provide templates online, often available through state housing authority websites or directly on pdfFiller. Focus on the key sections of the form including the tenant's information, bond information, and the reason for your refund request.

When filling out the form, ensure accuracy in each section. Common mistakes include incorrect dates, mismatched addresses, or incomplete information. Each detail matters for a seamless processing experience. A thorough review of your entries can save you from unnecessary delays.

Submitting the bond refund request

Next, you need to submit your bond refund request. Methods of submission can vary by state but typically include options for online submission via forms like pdfFiller or traditional methods such as mailing in a hard copy of the request. Familiarize yourself with your chosen method and ensure you follow it accurately.

Once submitted, tracking your submission status is essential. Utilize your state’s online system, if available, to confirm the receipt of your request. This step can help manage expectations regarding processing times.

Fast track refund process

Some states offer a fast track refund process for bond claims, which can significantly expedite the return of your funds. To be eligible for fast track refunds, landlords and tenants usually need to meet specific criteria, such as providing a meticulously maintained property with no disputes present.

The steps involved generally include completing a specific fast-track application form and submitting it along with your regular refund request. The timeline for approval under this process is often much shorter—sometimes within days—depending on state regulations and workload at the housing authority.

Handling discrepancies in bond refund requests

In instances where your landlord disagrees with your bond refund request, it’s vital to address discrepancies calmly and professionally. Understanding the Notice of Claim (NOC) process can be incredibly beneficial in these situations, as it outlines the landlord's objections clearly.

In response to a NOC, you should prepare a reasoned response, ideally backed by evidence from your documentation. If disputes persist, considering mediation services can facilitate a more amicable resolution without escalating to formal disputes.

Bond dispute process

If mediation does not resolve the disagreement and you believe your claim is justified, you may need to consider filing a formal dispute. The first step in this process is typically to notify your local housing authority and outline your specific issues regarding the bond refund.

Follow through each step of the dispute resolution process as outlined by your state, which may involve concise timelines, document submissions, and potentially a hearing. Possible outcomes include a full refund, partial refund, or denial based on presented evidence.

FAQs about the refund of rental bond form

Many common questions arise during the bond refund process. For instance, how long does it typically take to receive a bond refund? This timeline varies by state but can range from two weeks to several months depending on processing workloads.

Useful tools and resources

Using interactive resources like pdfFiller can immensely simplify the document management process, including the refund of rental bond forms. Their platform allows easy access to templates and guides tailored to your needs.

Additionally, familiarize yourself with your state’s rental laws regarding bonds, which can often be found on official government websites. For further questions, establishing contact with local tenant advocacy groups can provide invaluable support.

Best practices for future bond transactions

To ensure future bond transactions are successful, maintaining well-organized records throughout your tenancy is key. This includes keeping digital copies of your rental agreements, receipts for bond payments, and a log of communications with your landlord.

Understanding your rights as a tenant is crucial for navigating rentals effectively. Before moving out, preparing your property for inspection can minimize disputes and increase the likelihood of full bond recovery. Follow a detailed checklist of tasks to enhance your standing during exit inspections.

User testimonials and case studies

Real-life experiences shed light on how tenants manage their bond refunds. Many have successfully navigated the refund process using tools like pdfFiller to manage their documentation efficiently, resulting in faster payouts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my refund of rental bond in Gmail?

How do I edit refund of rental bond in Chrome?

How do I edit refund of rental bond straight from my smartphone?

What is refund of rental bond?

Who is required to file refund of rental bond?

How to fill out refund of rental bond?

What is the purpose of refund of rental bond?

What information must be reported on refund of rental bond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.