Get the free Income Tax DivisionCity of Kent

Get, Create, Make and Sign income tax divisioncity of

Editing income tax divisioncity of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax divisioncity of

How to fill out income tax divisioncity of

Who needs income tax divisioncity of?

Income Tax Division City of Form: Your Comprehensive Guide

Understanding the income tax division

The income tax division is a crucial component of local governance, primarily responsible for the administration of income tax collection within the city. Its importance lies in ensuring that tax revenues are effectively generated and allocated for public services such as education, infrastructure, and public safety. By managing these funds, the income tax division plays a vital role in budget management, helping the city fulfill its financial obligations and support community initiatives.

The income tax division offers various key services, ensuring that taxpayers receive comprehensive support. These services include thorough tax assessments, efficient payment processing, and facilitating refunds and appeals. By providing these services, the division contributes to the overall financial health of the community, ensuring that both individuals and businesses fulfill their tax obligations.

Income tax forms: overview and importance

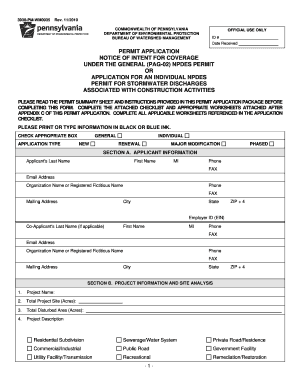

Income tax forms are essential for both individual taxpayers and businesses, with several types available depending on the filer’s needs. Common forms for individuals include the standard income tax return, while businesses may require specific corporate tax forms. Understanding the different forms and their purposes is vital for accurate tax filing.

Accurate completion of income tax forms is critical. Errors can lead to penalties, delays in processing, or even legal consequences. Timely submission is equally important; overlooking deadlines can result in late fees and interest on owed amounts. Therefore, understanding the specifics of each form plays a significant role in maintaining good standing with the income tax division.

How to access income tax forms

Accessing the income tax forms is straightforward, especially when navigating the income tax division website. Start by visiting the site and look for a designated section for forms and resources. Often, these links can be found in the main navigation or under a specific 'Taxpayer Resources' tab.

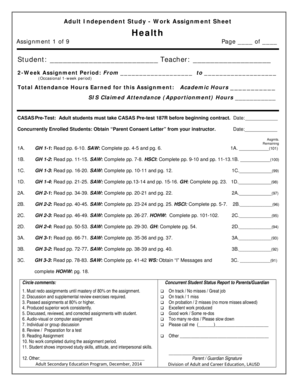

To download and print the required forms, follow these steps: First, locate the desired form by filtering through categories like individual or business forms. Click on the form link to open it. Most forms will have a 'Download' button available. Once downloaded, you can print the forms directly from your device. Always check for any specific instructions or supplemental documents that might be required for completing the form.

Step-by-step guide to filling out income tax forms

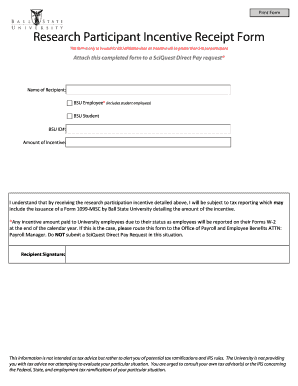

Filling out income tax forms requires precise information. Essential details typically include your personal identification, income sources, and deductions. Be ready to provide Social Security numbers, tax identification numbers, and accurate figures of your income and expenses. These pieces of information are central to ensuring successful form completion.

Common forms include the Individual Income Tax Form and Business Income Tax Form. Each has specific requirements. For instance, the Individual Income Tax Form usually asks for wages, dividends, and other income types, while business forms require detailed reports on revenue and deductibles. A critical tip for avoiding mistakes includes double-checking the reported income; misreporting can lead to audits and complications.

Navigating e-filing and online payments

E-filing has become an increasingly popular option due to its speed and convenience over traditional paper filing. The benefits of e-filing include quicker processing times and reduced chances of error, making it an attractive alternative for many taxpayers. Furthermore, e-filing allows for immediate confirmation of receipt, ensuring you have proof of timely submission.

To e-file your income tax form, follow these steps. Begin by selecting the e-filing option on the income tax division website. You will typically need to create an account or log in if you already have one. After entering your information and completing the required fields, review your submission, and confirm for electronic filing. Various interactive tools on the platform can assist throughout this process.

For payments, the income tax division provides various options, including credit and debit card payment methods, electronic checks, and direct bank transfers. Choosing a convenient payment method is crucial for taxpayers to ensure timely settlement of dues. Failure to do so can result in penalties.

Understanding your tax obligations

Every resident must be aware of their tax obligations when it comes to filing income tax returns. Generally, residents are required to file, while specific rules apply to non-residents and part-year residents. Understanding these requirements can help ensure compliance and avoid complications in tax liability.

Filing deadlines are crucial and vary depending on the taxpayer’s circumstances. Key dates often mark the beginning and end of the tax season, with penalties imposed for late or non-filing. Ensuring all tax filings are completed accurately and timely is essential for maintaining taxpayer rights and avoiding adverse consequences.

FAQs about the income tax division

As with any administrative division, common inquiries arise among taxpayers. One common question is how to check the status of a tax return. Taxpayers can often do this through the income tax division website by navigating to the return status section and entering the necessary identifying information.

Another common inquiry involves receiving a tax notice. If you receive a notice regarding your filing or tax status, it's essential to understand the message's context and respond within the stipulated time frame. For further assistance, taxpayers can utilize the contact information provided on the website or visit the office for in-person inquiries.

Filing amendments and handling disputes

At times, taxpayers may need to amend their income tax returns. Understanding how to file an amendment is crucial for correcting any errors or changes in income sources. This typically involves completing the appropriate amendment form, detailing the modifications, and submitting it to the income tax division.

Disputes with the tax division can arise regarding assessments or decisions made. Taxpayers should familiarize themselves with the process for appeals, which often involves submitting a formal request for review. Key contact points for dispute resolution can usually be found on the income tax division website.

Recent updates and announcements

Staying updated with recent changes in tax regulations and rates is critical for all taxpayers. The income tax division regularly publishes updates regarding tax rates for current and upcoming years. These updates can directly affect how much you owe and how you prepare your filings.

Additionally, important seasonal announcements regarding deadlines and new initiatives or services are often released. By keeping abreast of these announcements, taxpayers can better navigate their responsibilities and optimize their engagement with the income tax division.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income tax divisioncity of online?

How do I fill out income tax divisioncity of using my mobile device?

Can I edit income tax divisioncity of on an Android device?

What is income tax divisioncity of?

Who is required to file income tax divisioncity of?

How to fill out income tax divisioncity of?

What is the purpose of income tax divisioncity of?

What information must be reported on income tax divisioncity of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.