Get the free 370 State Street

Get, Create, Make and Sign 370 state street

Editing 370 state street online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 370 state street

How to fill out 370 state street

Who needs 370 state street?

370 State Street Form: A Comprehensive Guide

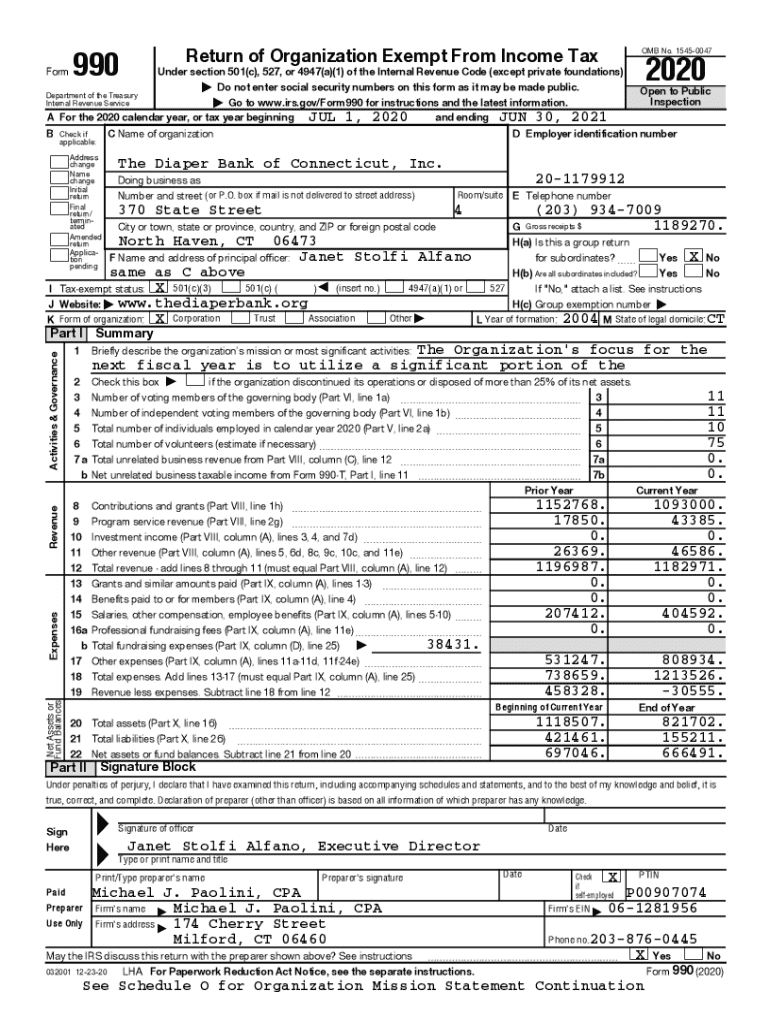

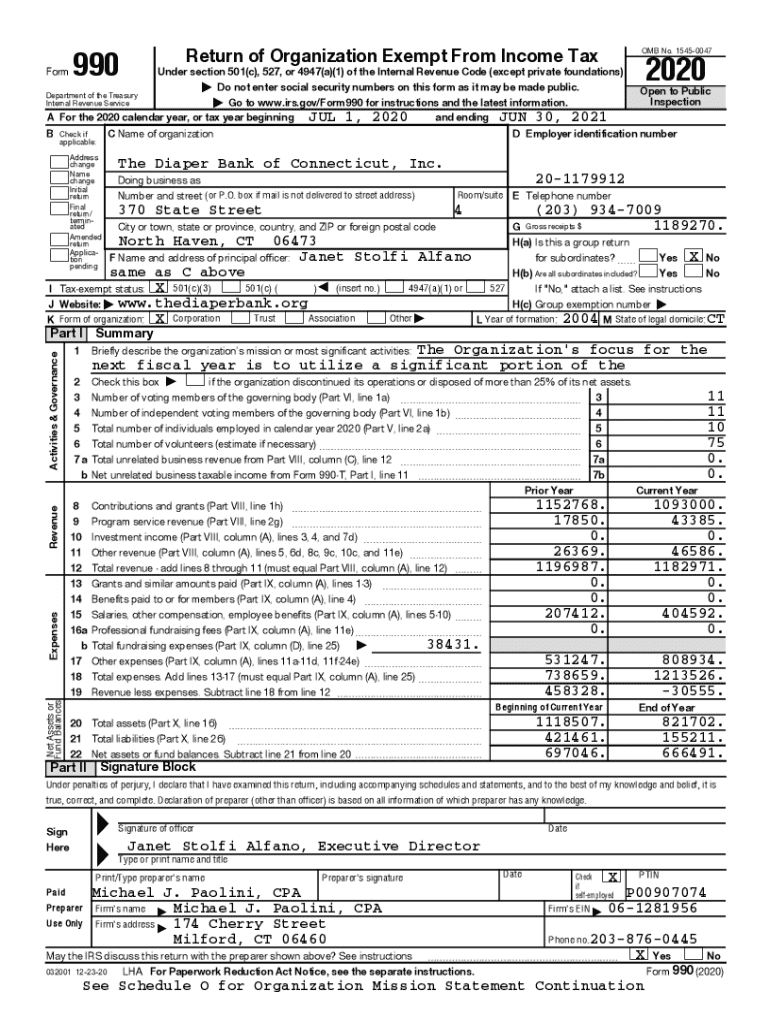

Overview of the 370 State Street Form

The 370 State Street Form is a crucial document designed for various applications within administrative and legal contexts. This form acts as a standardized way for individuals and businesses to provide necessary information related to property, zoning, and other significant data that local authorities or organizations may require.

Importance of the form cannot be overstated, as it serves not only as a record of intent but also as a critical component in the evaluation of zoning requests, building permits, and other administrative tasks. Using the 370 State Street Form lowers the chances of errors and omissions, streamlining the approval processes for all parties involved.

Understanding the components of the 370 State Street Form

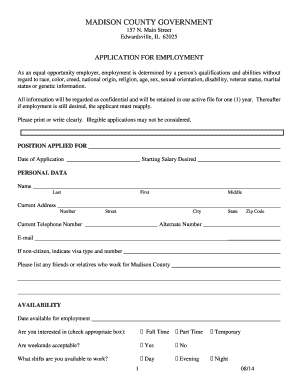

Breaking down the 370 State Street Form reveals several major sections, each aimed at capturing specific information that is essential in processing applications. The form typically consists of personal details, property information, the intended purpose of filing, and any additional requirements that may need to be met.

Accurate terminology is paramount when filling out the form. Misunderstanding or misplacing a term can lead to improper filings which may delay processing times or, in some cases, result in applications being rejected. Definitions of critical terms used within the form ensure clarity and a proper understanding for the user.

Step-by-step instructions for filling out the 370 State Street Form

Preparing to fill out the 370 State Street Form requires some prior organization. Individuals should gather necessary documents and information before getting started, as having everything in one place will facilitate smoother completion.

Pre-filling Preparation

Detailed Filling Instructions

The details for filling out each section of the form follows:

Editing the 370 State Street Form with pdfFiller

pdfFiller offers an efficient way to upload the completed 370 State Street Form, making it easy to edit. Users can seamlessly integrate their documents into the platform, giving them the ability to modify and enhance their forms with ease.

The editing tools available on pdfFiller provide options to add text and images, allowing further personalization. Users can highlight important sections, annotate details, and format the document to enhance clarity.

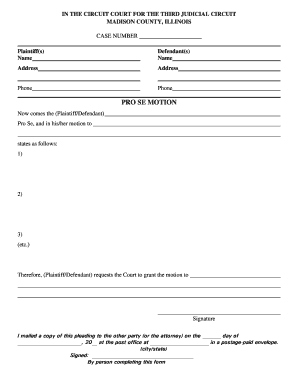

eSigning the 370 State Street Form

Having an official signature on the 370 State Street Form is vital, as it authenticates the document. It confirms that the information provided is true and accurate to the best of the signer's knowledge. Utilizing pdfFiller to eSign your document streamlines this process significantly.

Following these steps can ensure a hassle-free eSigning experience:

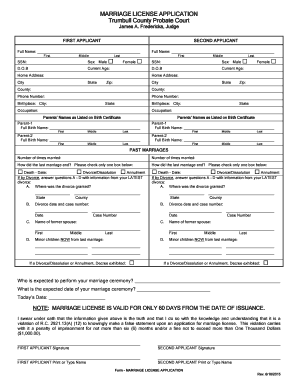

Collaborating on the 370 State Street Form

Collaboration is key when dealing with important forms such as the 370 State Street Form. pdfFiller provides features that allow individuals to effortlessly share the form with colleagues or legal counsel for review or approval.

Real-time collaboration features enable users to comment, make changes, and track updates all within the platform. This level of interaction not only enhances communication but also helps ensure that everyone involved is on the same page.

Managing the 370 State Street Form on pdfFiller

Efficient management of the 370 State Street Form is essential for ensuring quick access to documents. pdfFiller allows users to save forms securely, enabling easy organization and retrieval whenever necessary.

Utilizing pdfFiller’s cloud storage brings additional advantages, allowing users to store and manage their documents with heightened security and convenience. Here are some strategies to manage your forms effectively:

Troubleshooting common issues with the 370 State Street Form

Filling out the 370 State Street Form requires keen attention to detail. Common mistakes often arise that can complicate processing, such as missing signatures or incomplete information. Here are common errors to avoid:

Identifying and correcting errors before submission is critical, and users should take advantage of pdfFiller’s review tools to ensure everything is accurate.

Legal considerations related to the 370 State Street Form

The completed 370 State Street Form carries legal weight, meaning it must comply with local regulations and statutes. Understanding these legal implications ensures the submitted forms are valid and recognized by authorities.

Ensuring compliance involves a few strategic measures, including:

Frequently asked questions about the 370 State Street Form

Addressing common inquiries can streamline the process of using the 370 State Street Form. Here are some pertinent questions individuals may have:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 370 state street online?

How do I fill out the 370 state street form on my smartphone?

How do I complete 370 state street on an Android device?

What is 370 state street?

Who is required to file 370 state street?

How to fill out 370 state street?

What is the purpose of 370 state street?

What information must be reported on 370 state street?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.