Get the free 1 (SI)

Get, Create, Make and Sign 1 si

Editing 1 si online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 si

How to fill out 1 si

Who needs 1 si?

A comprehensive guide to the 1 si form

Overview of 1 si form

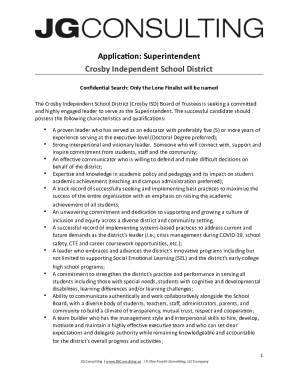

The 1 si form is a specific document used primarily for tax-related purposes, serving as a necessary request form for various financial situations. This form collects detailed information, typically from individuals or businesses, to address their tax liabilities or claims. Key features of the 1 si form include its structured format, which guides users through the required information, and its emphasis on accuracy and compliance with tax regulations.

Individuals or organizations needing to provide tax-related information, whether for deductions, credits, or other financial matters, will find themselves in need of the 1 si form. Tax professionals, accountants, and business owners should particularly be aware of this form as part of their financial reporting requirements.

Importance of the 1 si form

Filling out the 1 si form correctly is crucial as it can carry significant legal and financial implications. Errors or omissions can lead to delayed processing of claims or, worse, penalties from tax authorities for inaccurate reporting. Every detail provided in the form must be accurate as false information can invite legal scrutiny.

In addition to legal implications, financial considerations play a key role. Accurate submission of the 1 si form can determine eligibility for refunds or credits, which can have a substantial impact on an individual’s or a business’s financial health. Common mistakes to avoid when completing the form include missing mandatory fields, incorrectly calculating numbers, and failing to provide supporting documentation.

Step-by-step guide to filling out the 1 si form

Filling out the 1 si form can seem daunting, but following a structured approach makes the process manageable. Here’s how to do it effectively.

Step 1: Gather required information

Before diving into the form, collect all necessary documents. This includes identification numbers, previous tax returns, and any receipts or supporting documents related to your claim. Having all relevant information at your fingertips will streamline the completion process.

Step 2: Accessing the form

You can find the 1 si form online on official tax websites or directly through pdfFiller. Using pdfFiller not only allows you to access the form quickly but also provides an array of tools for ease of use.

Step 3: Editing the form with pdfFiller

Once you have the form, you can upload it to pdfFiller. This platform allows you to edit, add, or remove text while ensuring that your layout remains intact. Take advantage of interactive tools within pdfFiller, including autofill features that automatically input common information, to save time.

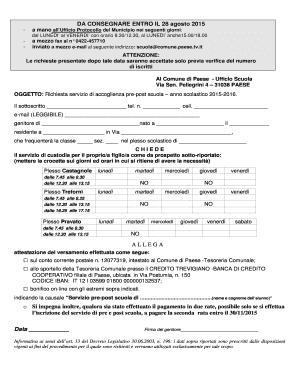

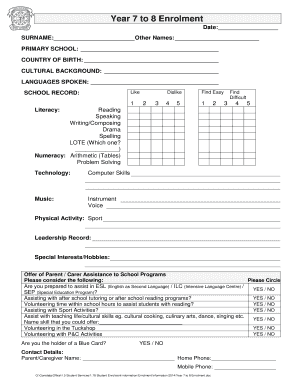

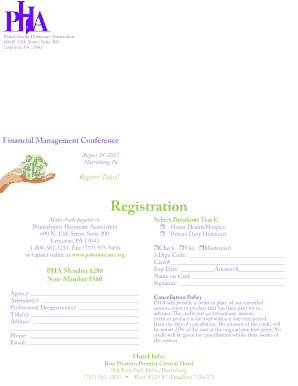

Step 4: Filling out the form

As you fill in the form, pay close attention to each section. Start with personal information, which typically includes your name, address, and identification numbers. Follow up with financial details, such as income sources and deduction claims, ensuring all figures are accurate and complete.

Step 5: Reviewing your entries

After filling out the form, utilize pdfFiller’s self-check tools to review your entries for errors. This step is crucial as it helps identify any mistakes before final submission, which can be costly if overlooked.

Step 6: eSigning the form

Once you are confident that the form is complete, add your electronic signature through pdfFiller. eSignatures carry the same legal weight as handwritten signatures, making this step essential for the form’s validity.

Frequently asked questions (FAQs)

Understanding the nuances of the 1 si form can raise numerous questions. Here are some frequently asked queries.

Additional tools and features on pdfFiller

Beyond filling out the 1 si form, pdfFiller offers numerous features to further enhance your document management experience.

Troubleshooting tips

While filling out the 1 si form, you may encounter issues that can be resolved with some basic troubleshooting tips. First, ensure that all required fields are correctly filled out before submission. Common issues include technical glitches on the pdfFiller platform or problems with document uploads.

If you continue to face challenges, reaching out to pdfFiller support can provide the assistance needed to overcome these obstacles efficiently.

Related links and resources

For users looking to navigate the landscape of the 1 si form or enhance their understanding of related processes, accessing relevant resources is key. pdfFiller consolidates a wealth of guides and templates that can directly assist in this endeavor.

Staying informed about changes or updates to the 1 si form process can help you remain compliant and aware of any potential impacts on your submissions. Utilizing these resources will empower you with the knowledge needed to triumph in your tax-related endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 1 si without leaving Google Drive?

Can I edit 1 si on an iOS device?

How do I edit 1 si on an Android device?

What is 1 si?

Who is required to file 1 si?

How to fill out 1 si?

What is the purpose of 1 si?

What information must be reported on 1 si?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.