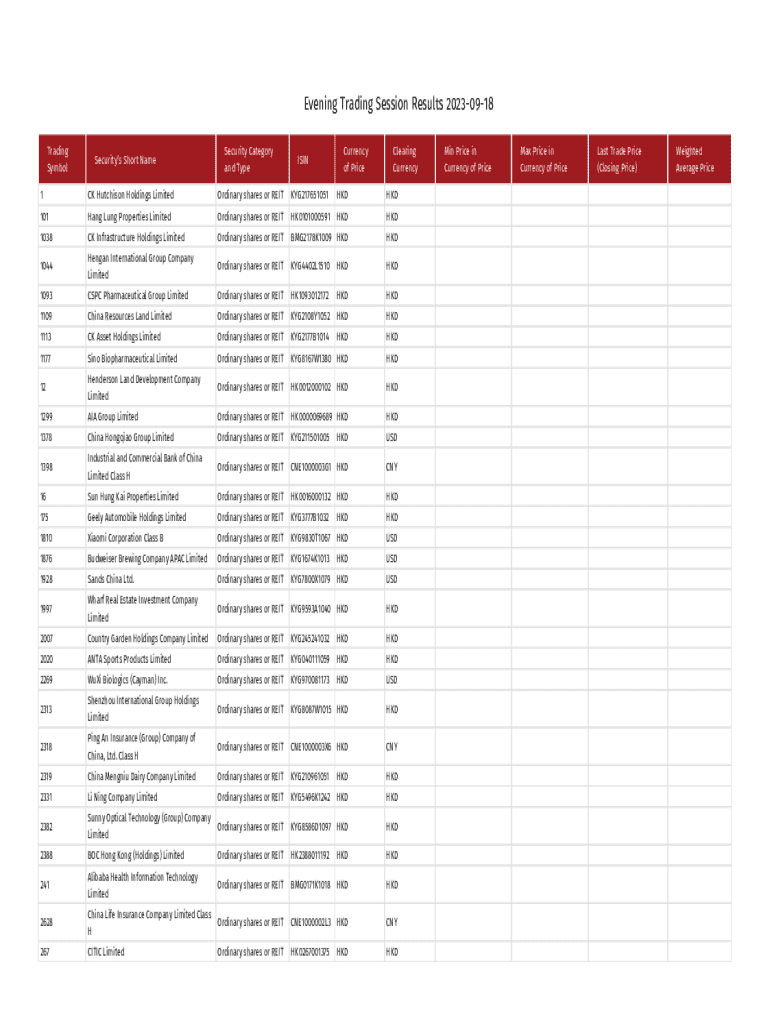

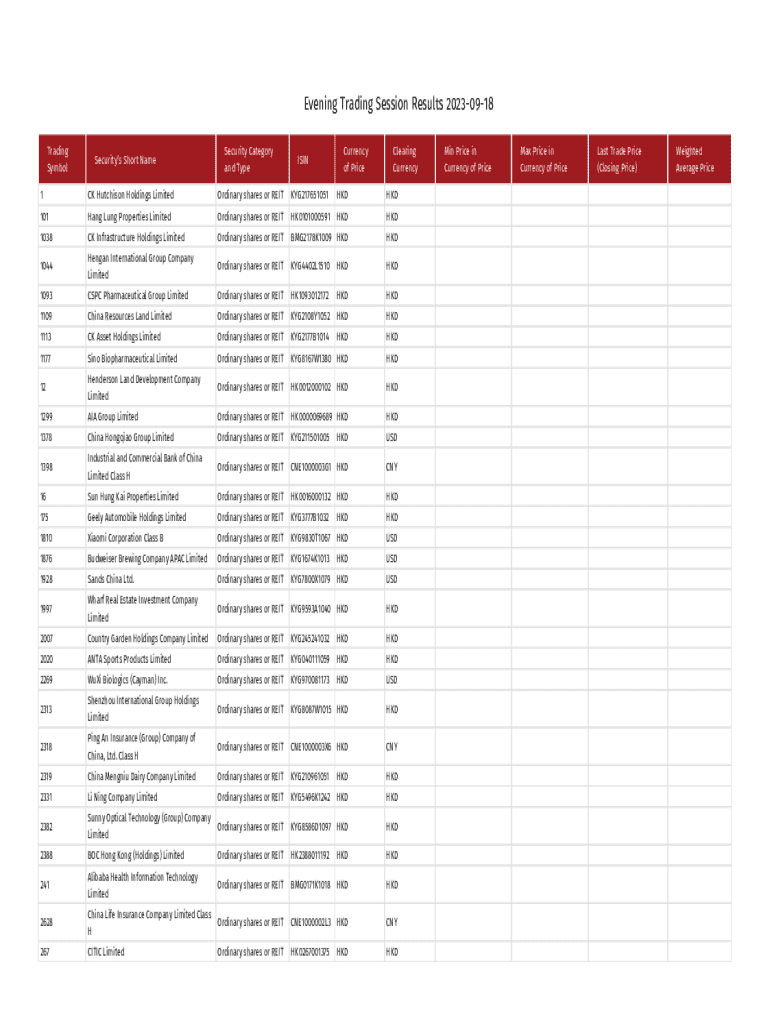

Get the free Ordinary shares or REIT

Get, Create, Make and Sign ordinary shares or reit

Editing ordinary shares or reit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ordinary shares or reit

How to fill out ordinary shares or reit

Who needs ordinary shares or reit?

Ordinary Shares or REIT Form: A Comprehensive Guide for Investors

Understanding ordinary shares and REITs

Ordinary shares, also known as common stock, represent ownership in a company. Shareholders of ordinary shares have voting rights in company decisions and participate in any dividends declared. They benefit from the company's growth, often experiencing higher returns when performing well. On the other hand, Real Estate Investment Trusts (REITs) are companies that primarily invest in income-producing real estate, allowing individuals to gain exposure to real estate without direct ownership. Investors earn dividends based on the income generated by these properties.

The core difference lies in their structure and purpose. Ordinary shares focus on corporate profitability, while REITs target property income. Investing in ordinary shares can yield high capital appreciation, but REITs usually offer regular income distributions.

How ordinary shares work

When a company issues ordinary shares, it raises capital from public investors. This process involves creating shares that investors can purchase, thus granting them partial ownership of the company. The investors' participation leads to potential profit-sharing based on the company's performance.

Ordinary shareholders possess voting rights that allow them to influence important company decisions, including board elections and corporate policy changes. Additionally, shareholders may receive dividends, which are typically paid out after the company covers its operational costs. Dividends can fluctuate based on the company’s profitability and board decisions.

The functionality of REITs

REITs are structured as companies that own, operate, and manage income-generating real estate. Investors purchase shares in these trusts, allowing them to benefit from the real estate sector's gains without dealing directly with property management. REITs typically follow a specific investment strategy, focusing on different types of properties like residential, commercial, or industrial real estate.

There are three main types of REITs: Equity REITs, which invest in and own properties; Mortgage REITs, which provide financing for income-producing real estate by purchasing or originating mortgages; and Hybrid REITs, which combine both strategies. A key benefit of investing in REITs is their favorable tax treatment. By law, REITs must distribute at least 90% of their taxable income as dividends, allowing shareholders to enjoy regular income.

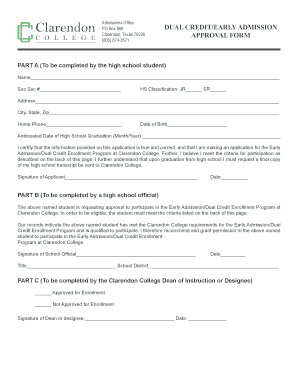

Complete guide to filling out the REIT form

Filling out the REIT form involves several essential steps to ensure accurate submission. Start by preparing the necessary documentation, such as proof of your identity and records of previous transactions. Ensure you have your tax information ready, as it will be crucial for reporting income.

Common mistakes to avoid include inputting incorrect personal information or neglecting to report all sources of income. Ensure all details are accurate to prevent delays in processing your form.

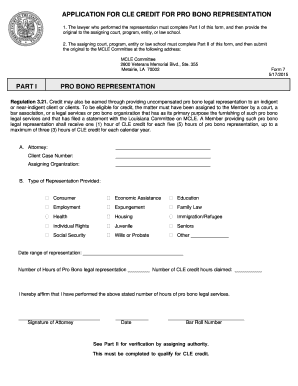

Utilizing pdfFiller for managing your ordinary shares and REIT forms

pdfFiller streamlines the process of managing your investment documentation, making it easier to handle forms related to ordinary shares and REITs. With its user-friendly interface, investors can easily edit PDFs, fill out forms, and eSign documents securely.

Accessing your forms anytime and anywhere is a significant advantage, enabling investors to manage their documentation on the go.

Interactive tools for evaluating your investment

Investing in ordinary shares or REITs requires strategic evaluation to maximize returns. Several online tools can help investors calculate potential returns on their investments, comparing yields from ordinary shares and REITs.

These tools provide essential insights, guiding investors in their decision-making process.

Regulatory considerations for ordinary shares and REIT investments

Investors need to be aware of regulatory requirements governing both ordinary shares and REITs. The Securities and Exchange Commission (SEC) oversees many aspects of these investments, ensuring transparency and fair practices.

For REITs, compliance with specific regulations, such as the requirement to distribute at least 90% of earnings, is critical for maintaining their tax-exempt status. Ordinary shareholders have reporting obligations as well, including filing tax forms reflecting their gains or losses accurately.

Comparative analysis: ordinary shares vs. REITs

When comparing ordinary shares and REITs, understanding return potential and risk is crucial. While ordinary shares may offer higher returns during a boom, REITs tend to provide stable returns through regular income distributions. A diversified portfolio often benefits from including both investment types, balancing risk and growth.

Market performance over time also differs; REITs generally reflect fluctuations in real estate markets, while ordinary shares are influenced by broader market trends and corporate earnings. Different investor profiles have varying levels of risk tolerance, making this comparison essential for tailoring investment strategies.

Frequently asked questions (FAQs)

User experiences: testimonials on pdfFiller

Investors using pdfFiller have reported significant improvements in managing their ordinary shares and REIT forms. The platform’s intuitive tools have made document management more efficient. Users appreciate the ease of editing and the security of eSigning documents, allowing them to focus on investment strategies rather than paperwork.

Success stories highlight the ability to streamline processes, ensuring compliance with regulatory requirements while allowing for real-time collaboration among team members.

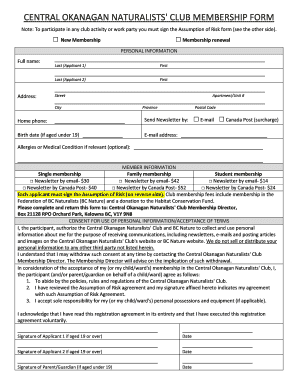

Next steps for investors

Evaluating your portfolio requires a deep understanding of whether to lean towards ordinary shares or REITs based on your financial goals. Identify your risk tolerance and income requirements to make an informed decision. Setting up an account with pdfFiller can simplify your form management, providing all the necessary tools at your fingertips.

Adopting best practices for document management in your investments can lead to more organized records and timely submissions, optimizing your investment experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ordinary shares or reit?

Can I edit ordinary shares or reit on an iOS device?

How can I fill out ordinary shares or reit on an iOS device?

What is ordinary shares or reit?

Who is required to file ordinary shares or reit?

How to fill out ordinary shares or reit?

What is the purpose of ordinary shares or reit?

What information must be reported on ordinary shares or reit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.