Get the free 1 t iT T P O il

Get, Create, Make and Sign 1 t it t

How to edit 1 t it t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 t it t

How to fill out 1 t it t

Who needs 1 t it t?

1 T it T Form: A Comprehensive How-to Guide

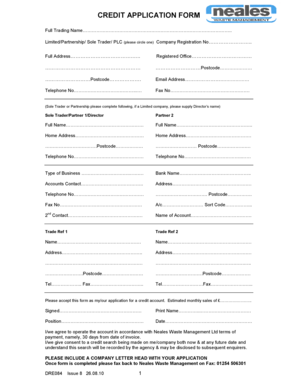

Overview of the 1 T it T Form

The 1 T it T Form is a vital document for individuals seeking to report their tuition expenses for tax credits. This form enables taxpayers to calculate their eligibility for educational tax benefits, which can significantly lower their tax liabilities. Understanding the purpose and importance of this form is crucial for those looking to maximize educational cost deductions.

Accurate completion of the 1 T it T Form is essential to avoid delays in processing or potential audits. Tax credits can lead to substantial savings, yet errors in documentation can undermine these benefits. Key concepts associated with this form include qualifying educational institutions, expenses covered, and necessary documentation.

Understanding the sections of the 1 T it T Form

The 1 T it T Form comprises several sections, each designed to gather specific information necessary for calculating tax credits. Recognizing the importance of each area ensures you provide complete and accurate information.

Common mistakes include misreporting income, failing to include all education expenses, or neglecting to provide the correct institutional details. Be meticulous throughout every section to avoid such pitfalls.

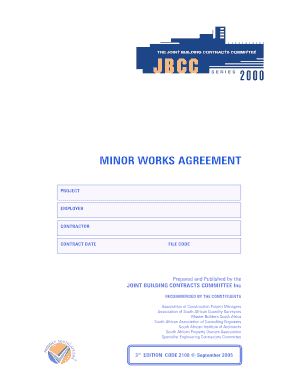

Step-by-step instructions for filling out the 1 T it T Form

Before diving into the form, ensure you’re prepared by gathering all necessary documentation, such as tuition receipts, your Social Security Number, and tax-related identifiers. Digital tools like pdfFiller can streamline the process, allowing you to edit and manage your form efficiently.

To start, open the form using pdfFiller and follow these steps:

Reviewing your form thoroughly mitigates the chances of errors that could delay your submission or lead to audits.

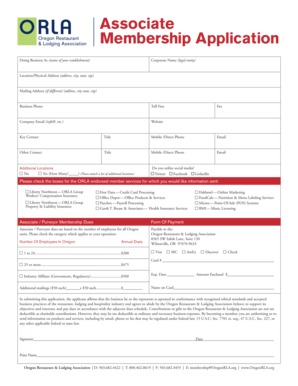

eSigning the 1 T it T Form

eSigning has become an integral part of document handling, especially for time-sensitive forms like the 1 T it T Form. eSignatures provide a legally binding, convenient method to confirm your document without the need for physical signatures.

Using pdfFiller, you can easily add your eSignature directly to the form. This process enhances compliance with regulatory standards and ensures your submission follows security protocols, protecting your sensitive data.

Managing your 1 T it T Form

After completing your 1 T it T Form, you'll want to save it securely. pdfFiller allows you to store your documents in the cloud, ensuring that your work is accessible from anywhere. You can retrieve your document at any time, ideal for last-minute revisions or consultations with tax advisors.

Frequently asked questions (FAQs)

Completing the 1 T it T Form can raise several questions, especially concerning accuracy and submission. Addressing common inquiries can streamline this process for users.

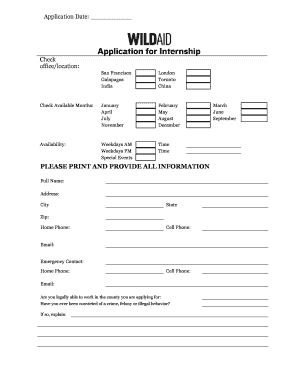

Additional tools and resources for working with the 1 T it T Form

To enhance the process of completing the form, various tools and resources are available. pdfFiller offers interactive options that demystify the complexities of tax forms, making your experience more intuitive.

Getting help with the 1 T it T Form

Navigating the intricacies of the 1 T it T Form may occasionally require external help. pdfFiller provides various support options to assist you.

Related forms and templates

In addition to the 1 T it T Form, there are other related documents that may be beneficial for your overall tax strategy. Familiarizing yourself with these forms can streamline your tax preparation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 1 t it t for eSignature?

Where do I find 1 t it t?

How do I make edits in 1 t it t without leaving Chrome?

What is 1 t it t?

Who is required to file 1 t it t?

How to fill out 1 t it t?

What is the purpose of 1 t it t?

What information must be reported on 1 t it t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.