Get the free The News Reporter Tax Tips 1

Get, Create, Make and Sign form news reporter tax

How to edit form news reporter tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form news reporter tax

How to fill out form news reporter tax

Who needs form news reporter tax?

Navigating the form news reporter tax form: A Comprehensive Guide for Journalists

Understanding the importance of the reporter tax form

For reporters and media professionals, understanding your tax obligations is crucial. The IRS expects reporters to report their earnings accurately and complete necessary forms to reflect their income and expenses. As a journalist, whether freelancing or working for a media outlet, knowing how to navigate the reporting process can significantly influence your financial health and compliance with federal regulations.

Beyond mere compliance, understanding your tax responsibilities allows you to optimize your deductions effectively. Reporters often incur various expenses that can be deducted, from travel costs for news coverage to office supplies. Maximizing these deductions can reduce your taxable income significantly, ultimately impacting your overall liability.

Key components of the reporter tax form

The reporter tax form includes several essential sections that reflect your income, deductions, and tax credits related to your journalism work. Specifically, it encompasses various income types such as wages, freelance earnings, and royalties. Each of these income sources needs to be accurately reported to ensure proper taxation.

Additionally, understanding what qualifies as business expenses is vital for reporters. Expenses incurred directly related to your reporting work can often be deducted from your taxable income. This section might define specific terms and provide clarification on how to categorize your reporting-related expenditures.

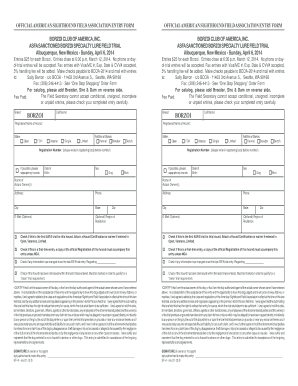

Step-by-step guide to filling out the reporter tax form

Filling out the reporter tax form accurately begins with gathering all your necessary documentation. Start by collecting income statements from your employer or freelance clients, along with receipts for any deductible expenses incurred throughout the year. This preparation is crucial, especially for freelancers who may have multiple sources of income.

Next, follow detailed instructions for each relevant section of the form. When reporting income as a freelance reporter, carefully indicate every source of income, ensuring to match received payments against reported figures, minimizing discrepancies. Once your income is documented, move on to claiming your business expenses. Common deductions include costs for research trips, equipment, and relevant software subscriptions.

Be vigilant about common pitfalls such as misreporting income, missing deductions, or not accounting for self-employment taxes properly, as these can lead to complications or IRS audits.

Editing and managing your tax forms with pdfFiller

Utilizing pdfFiller can streamline the editing and management of your reporter tax form. This platform offers users intuitive editing capabilities that allow journalists to fill, sign, and modify their documents efficiently. Its collaborative tools enable you to work seamlessly with accountants or colleagues, ensuring that your tax documentation meets all requirements.

With pdfFiller, securing your signed forms in the cloud provides peace of mind. You can access your documents from anywhere, avoiding the potential hassle of misplaced paperwork. Its user-friendly interface supports a smooth workflow, allowing journalists to complete their tax forms without unnecessary distractions.

Interactive tools for maximizing tax deductions

To assist in optimizing your tax deductions, there are several interactive tools available specifically for journalists. Tax calculators can help estimate potential returns based on journalism income, allowing you to see how various deductions might impact your overall tax situation.

Expense tracking templates can also be invaluable for keeping organized throughout the year. By using a structured approach to track your expenditures, you can ensure nothing is overlooked come tax time. Additionally, interactive FAQs can address common tax situations and provide guidance tailored to the unique experiences of reporters.

Real-life scenarios: How different reporting situations affect tax forms

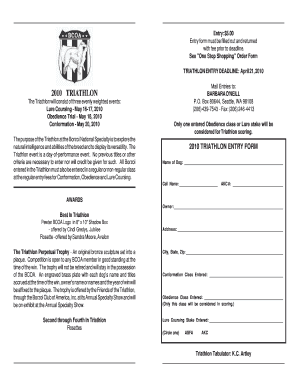

The way you fill out your reporter tax form can vary greatly depending on your employment situation. For freelancers, tax forms often require detailed listings of fluctuating income sources and numerous deductions for business-related expenses. In contrast, full-time employees typically report a stable income, with fewer deductions available.

Case studies of common expenses can illustrate how journalists navigate their tax responsibilities. For instance, a freelancer might regularly deduct travel costs for on-site reporting, whereas a staff reporter may claim fewer expenses beyond necessary work-related tools.

Navigating state-specific requirements

Tax obligations can also vary significantly depending on your location. Each state may have specific reporting requirements, tax rates, and available deductions for journalists. Familiarizing yourself with these distinctions is essential for compliance and ensuring no potential credits are overlooked.

Resources for finding state-specific tax forms and regulations include state governmental websites and local journalism associations. Understanding these varying frameworks can aid reporters in correctly filing their taxes and avoiding penalties for misreporting.

Seeking professional help

In some cases, hiring a tax professional may be beneficial, especially if your tax situation is complex or if filing previous years’ taxes is involved. A tax advisor familiar with the journalism sector can provide tailored guidance and help optimize the returns on your reporter tax form.

Utilizing pdfFiller's capabilities in document sharing can streamline the process of working with these professionals. Having ready access to your necessary documentation will ensure a timely consultation and a more efficient filing process.

Staying updated on tax law changes affecting journalists

Tax laws are subject to change, and staying informed is vital for anyone in the journalism field. Resources such as IRS announcements and industry-specific reports can help keep you apprised of important tax regulation updates.

Continuous education in tax matters guarantees that reporters remain compliant while maximizing their financial benefits. Online courses, webinars, and professional networking groups can aid ongoing learning, ensuring your tax practices are always up to date.

Frequently asked questions (FAQs) on reporter tax forms

Many reporters have similar concerns when it comes to filing taxes. This often includes questions regarding deadlines, procedures for filing as a freelancer, and what specific deductions can be claimed.

Arming yourself with knowledge about common queries can reduce anxiety at tax time. For reporters, typically, the deadline for filing is April 15th, but extensions can be applied for smaller submissions. Being organized and proactive will ease the process.

Community insights: Sharing experiences and advice

The experiences of fellow reporters can provide valuable insights and support. Engaging with professional networks or social media groups tailored for journalists enables sharing resources, tips, and lessons learned from unique situations surrounding tax responsibilities.

Personal anecdotes and testimonials from colleagues can create a sense of unity within the journalism community, demonstrating that while tax responsibilities may seem daunting, they can be navigated successfully with the right tools and peer support.

Enhancing your tax filing experience with pdfFiller tools

Overall, pdfFiller adds significant value to the tax preparation process. From editable forms to secure cloud storage, it enables users to easily manage tax-related documents without the hassle of traditional filing methods.

Utilizing pdfFiller tools not only simplifies the workflow of filling out the reporter tax form but also encourages users to engage in a more streamlined and efficient experience during tax season. Taking advantage of these resources ultimately leads to a clearer understanding of tax obligations and improved filing outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form news reporter tax directly from Gmail?

Can I create an electronic signature for signing my form news reporter tax in Gmail?

How do I edit form news reporter tax straight from my smartphone?

What is form news reporter tax?

Who is required to file form news reporter tax?

How to fill out form news reporter tax?

What is the purpose of form news reporter tax?

What information must be reported on form news reporter tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.