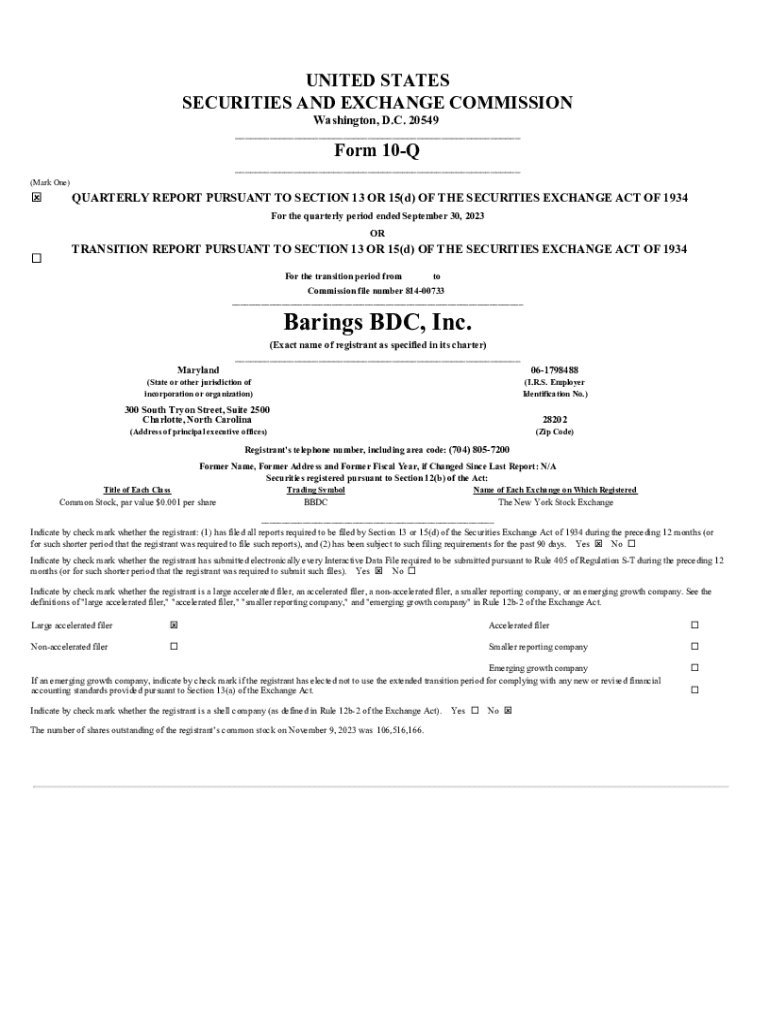

Get the free Unaudited Consolidated Balance Sheet as of September 30, 2023 and Consolidated Balan...

Get, Create, Make and Sign unaudited consolidated balance sheet

Editing unaudited consolidated balance sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unaudited consolidated balance sheet

How to fill out unaudited consolidated balance sheet

Who needs unaudited consolidated balance sheet?

Understanding the unaudited consolidated balance sheet form

Understanding the unaudited consolidated balance sheet

A consolidated balance sheet is a comprehensive financial statement that aggregates the assets, liabilities, and equity of a parent company and its subsidiaries. It provides a clear view of the overall financial position of a business entity, helping stakeholders understand how different business components contribute to financial health. The unaudited aspect indicates that this statement has not undergone a formal audit process, which emphasizes a need for caution when interpreting the provided data.

While unaudited consolidated balance sheets offer valuable insights, the absence of an audit means that the numbers have not been verified for accuracy, which can lead to significant discrepancies if financial controls are weak. Stakeholders—including investors and management—must discern how this affects decision-making, especially in comparison to audited statements that promise higher reliability.

Key features of the unaudited consolidated balance sheet form

Filling out the unaudited consolidated balance sheet form requires precise information. Each section holds critical data needed for stakeholders to gauge organizational health. Key pieces of information include the company’s name, reporting period, and the identification of all subsidiaries included in the consolidation process, ensuring transparency in the data provided.

The typical layout of an unaudited consolidated balance sheet is structured to reflect coherence and clarity. It often starts with the company's assets, followed by liabilities and lastly the equity section. Such organization aids in presenting financial data succinctly, allowing users to quickly understand fiscal standings.

Step-by-step guide to filling out the unaudited consolidated balance sheet form

Filling out the unaudited consolidated balance sheet form requires gathering data from various subsidiary financial statements. Start by collating complete financial statements from each subsidiary to ensure accurate consolidation. It is crucial to adhere to accounting standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards) to maintain consistency and transparency.

To complete the assets section, one should categorize assets into current and non-current. Current assets may include cash, accounts receivable, and inventories, while non-current assets could encompass property, plant, and equipment. Summarizing these into a dedicated section makes it easier for users to assess liquidity.

Next, proceed to the liabilities section. Document current liabilities, such as accounts payable and short-term loans, followed by long-term liabilities including mortgages and bonds payable to provide a complete picture of future obligations.

Finally, finalize the equity section, detailing share capital, additional paid-in capital, retained earnings, and adjustments for non-controlling interests. This ensures the stakeholders see their ownership stake clearly presented.

Tips for managing and editing the unaudited consolidated balance sheet form

When creating the unaudited consolidated balance sheet, using tools like pdfFiller makes the process straightforward. The platform’s document editors allow users to upload their balance sheet forms for seamless editing. Key features support financial data formatting, allowing for quick updates to figures without cluttering the document layout.

Collaboration is another important aspect. pdfFiller provides real-time editing features where team members can leave comments on sections under review. Assigning roles, such as verificators and preparers, ensures checks and balances are maintained before finalizing the document.

Common challenges and solutions in preparing unaudited consolidated balance sheets

Preparing an unaudited consolidated balance sheet is not without its challenges. Particularly in complex corporate structures, firms with multiple entities might struggle with accurately consolidating the financial data. Special consideration must be applied to intercompany transactions, which can distort balance sheet figures. Solutions could involve regular reconciliations and the establishment of clear subsidiary reporting protocols.

Data discrepancies also frequently occur, arising from varying accounting policies across subsidiaries. Technique-wise, implementing a centralized accounting system can facilitate standardization, making consolidation more seamless. Finally, adhering to reporting standards can be daunting without an audit; however, dedicated resources and guidance can help firms remain compliant without straining their budgets.

Interactive tools for optimizing balance sheet preparation

Utilizing tools like financial calculators and templates can simplify the balance sheet preparation process. pdfFiller integrates various financial filters and formulas designed to streamline mathematical calculations, freeing the user from manual errors. By embedding these features into your workflow, calculating totals for assets or liabilities becomes less error-prone and more efficient.

Accessing expert insights through webinars or online tutorials can further enhance understanding and ensure best practices in balance sheet preparation. Engaging with experienced professionals offers not just skills to avoid common pitfalls but also a chance to update approaches in alignment with industry changes.

Case studies: Successful use of unaudited consolidated balance sheets

Organizations across various industries—such as technology, manufacturing, and services—utilize unaudited consolidated balance sheets to enhance their financial clarity and strategic planning. For instance, a technology firm showcased remarkable performance improvement by implementing regular reporting cycles with their consolidated balance sheets, leading to improved stakeholder engagement and investment interest.

Additionally, a mid-sized manufacturing company leveraged their unaudited balance sheet to secure financing, demonstrating their coherent asset management practices. By displaying financial health transparently, they built investor confidence, leading to better financing options and improved operational results.

Future trends in financial reporting

The future of financial reporting indicates a shift towards enhanced transparency and accessibility, primarily through digital formats. Organizations are increasingly adopting cloud-based solutions for their reporting, ensuring that data is readily available for analysis. This digital transition not only simplifies preparation but also allows stakeholders easy access to real-time data.

Moreover, the incorporation of AI and automation tools in financial reporting is on the rise. These technologies not only improve the speed and accuracy of compiling consolidated financial statements but also help firms in conducting predictive analysis. This trend points towards a more software-driven approach to financial management, which will likely redefine how unaudited consolidated balance sheets are prepared in the future.

Frequently asked questions (FAQs)

Individuals and teams often have queries regarding the preparation and implications of an unaudited consolidated balance sheet. A common question involves the difference between an audited and an unaudited consolidated balance sheet. The latter lacks the formal verification process, which can lead to inconsistencies in the presented data.

Another frequent inquiry pertains to how often these balance sheets should be updated. Generally, they should be prepared quarterly to capture the evolving financial condition of the organization. Concerns about penalties for inaccuracies also arise; while audit penalties may exist for inaccuracies, unaudited balance sheets do not carry the same implications, although ethical transparency should always be a priority.

Getting help with your unaudited consolidated balance sheet form

Navigating the complexities of financial statements can be overwhelming. pdfFiller offers robust support services, providing users access to online tutorials and webinars specifically tailored for financial document preparation. Additionally, connecting with financial advisors and consultants can facilitate the understanding of financial reporting principles and standards.

This ensures that individuals and teams are not just filling out forms but are also gaining insights into financial best practices, optimizing their approach to creating unaudited consolidated balance sheets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my unaudited consolidated balance sheet in Gmail?

Can I create an electronic signature for the unaudited consolidated balance sheet in Chrome?

Can I create an eSignature for the unaudited consolidated balance sheet in Gmail?

What is unaudited consolidated balance sheet?

Who is required to file unaudited consolidated balance sheet?

How to fill out unaudited consolidated balance sheet?

What is the purpose of unaudited consolidated balance sheet?

What information must be reported on unaudited consolidated balance sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.