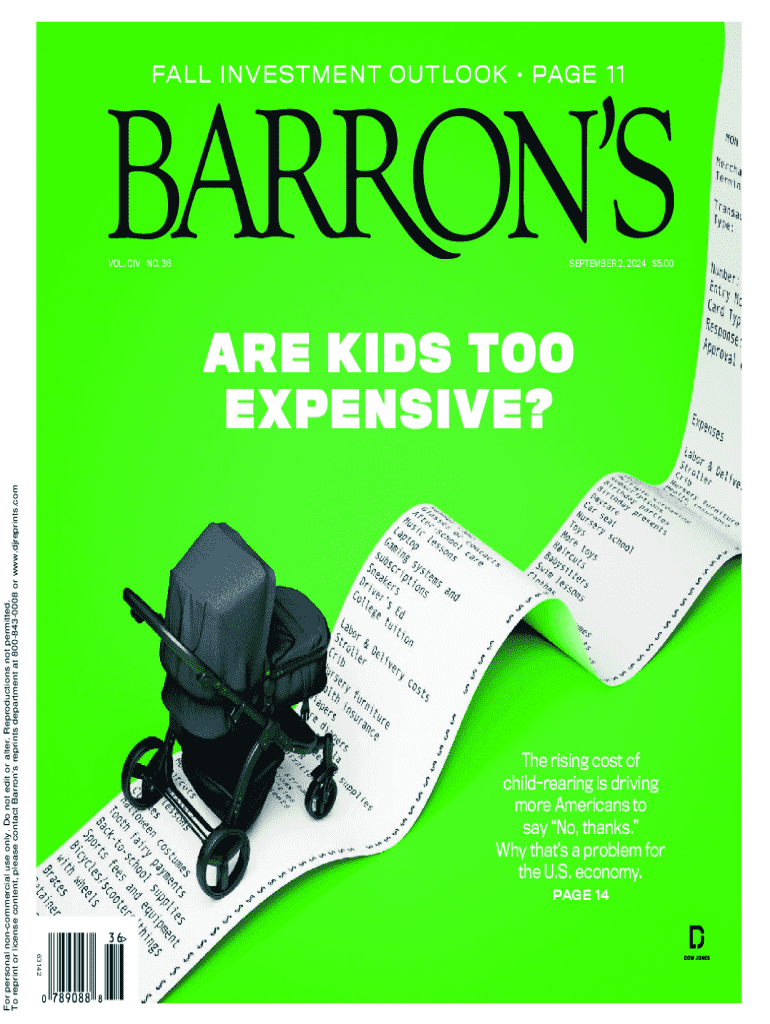

Get the free ARE KIDS TOO EXPENSIVE?

Get, Create, Make and Sign are kids too expensive

Editing are kids too expensive online

Uncompromising security for your PDF editing and eSignature needs

How to fill out are kids too expensive

How to fill out are kids too expensive

Who needs are kids too expensive?

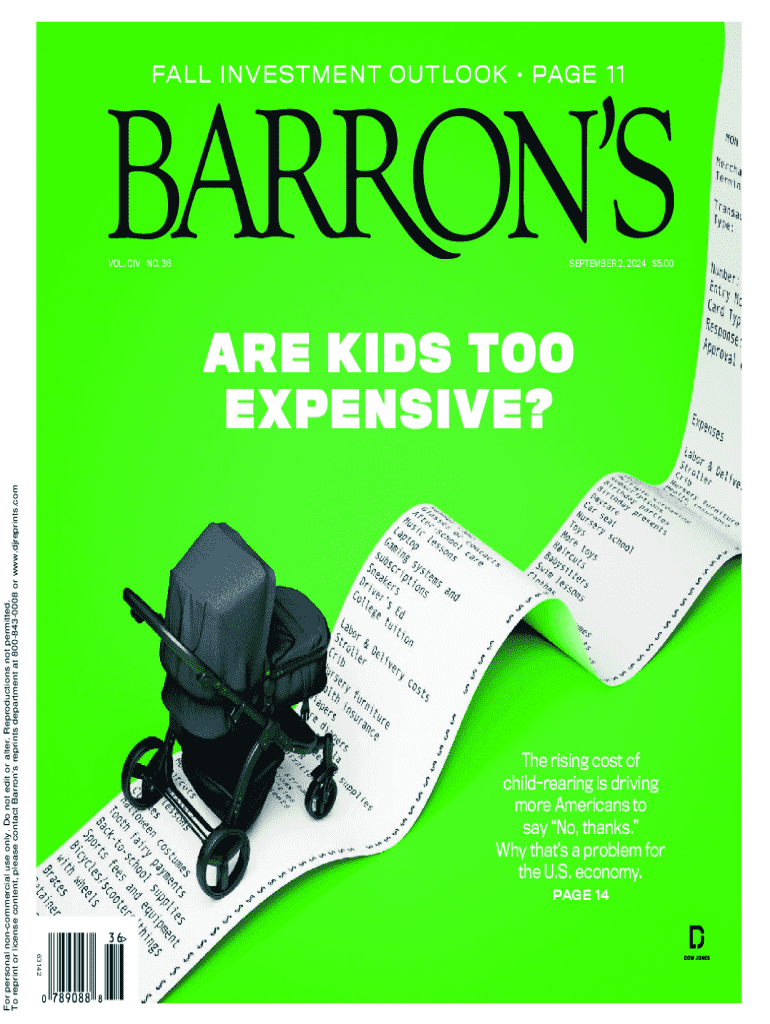

Are Kids Too Expensive?

Understanding the financial impact of parenthood

Raising a child from birth to age 18 can cost well over $200,000, depending on where you live and how you choose to parent. This figure incorporates a multitude of factors that contribute to the hefty price tag of parenthood. Parents need to be mindful of both the essential expenses, which include food, clothing, and healthcare, along with additional costs like childcare, education, and extracurricular activities.

The cost factors to consider

When considering whether kids are too expensive, it's crucial to differentiate between immediate costs and long-term financial planning. The initial expenses include newborn essentials like crib, stroller, and infant healthcare. Parents should also be aware of future costs, including college savings accounts and potential debts from education.

Geography plays a critical role in these costs. Parents in urban areas often face significantly higher costs, especially for housing and childcare. For example, in cities like San Francisco and New York, earning a decent living while raising a child can feel like a monumental task. Conversely, rural families might experience lower costs but could face other challenges, such as fewer resources for early childhood education.

How inflation affects parenting budgets

Inflation rates have consistently risen over the decades, impacting the cost of raising children significantly. Historical data shows that these rates can affect key expenses profoundly, especially housing and groceries. As prices continue to increase, parents today find their budgets stretched thinner than previous generations did.

Parents must keep inflation in mind when planning for their children's future. Budgeting for factors like increased tuition fees, healthcare costs, and living expenses needs to include an understanding of how inflation will change these costs over time. Various economic reports suggest that educational costs may continue to rise at a rate faster than inflation, making early financial planning imperative.

Why are kids so expensive?

Many misconceptions surround the costs associated with raising children. A prevalent myth suggests that modern parents face unprecedented financial burdens compared to their predecessors. However, while the actual dollar amount has certainly increased, the value placed on these expenditures might differ. Today’s parents tend to invest heavily in areas like education and enrichment activities, making the experiences richer but also pricier.

New parents today often face the reality of higher levels of debt, from student loans to mortgages, which further complicates the financial landscape. These factors cumulatively contribute to the perception that children are a financial burden. Yet, it's vital to unpack these misconceptions, recognizing that joy and fulfillment gained from parenthood can resonate far beyond the costs incurred.

Comparing single-child and multi-child expenses

The cost of raising multiple children often incurs a unique set of expenses that can differ from parenting a single child. Economies of scale come into play, where certain costs do not necessarily double with each added child. For instance, clothing and toys may be handed down, and family packages for activities or groceries often provide savings. However, expenses for education and childcare might remain constant or even increase.

Evaluating whether the costs associated with raising multiple children are worth it can be subjective. While the financial aspect is one consideration, parents also weigh the emotional and developmental benefits of having siblings, shared experiences, and family dynamics that can promote strong bonds.

Planning for child-related expenses

Creating a budget for parenthood can seem daunting, but it is essential. Begin by categorizing potential expenditures to gain a clearer picture of financial priorities. Essential expenses should be the starting point, with funds allocated for groceries, clothing, and healthcare. Additionally, setting aside money for future costs, like college tuition or potential high school expenses, can help ease financial stress later on.

Incorporating savings strategies, including establishing an emergency fund and investing in insurance plans, can be beneficial. This foresight can protect families from unforeseen expenses that may arise, such as medical emergencies or sudden changes in household income.

Alternative perspectives on the cost of raising kids

While some may view children solely as a financial burden, a broader perspective reveals the intangible rewards of parenting. The love, joy, and future contributions to society that children bring often outweigh the financial strain. Assessing the long-term investment nature of parenthood allows for a clearer view of its value.

Despite the financial pressures, societal attitudes should support parenting rather than dissuade it. Government programs and community resources can help alleviate some of the burdens associated with raising children, allowing for a more balanced approach to family life.

Conclusion: Making informed decisions about parenthood

Making informed decisions about parenthood requires understanding the various costs involved and strategizing to manage them. As parents, empowerment comes from knowledge and proper planning. Tools like pdfFiller can be incredibly valuable for families to create budgets, document plans, and collaborate on financial strategies together.

Utilizing digital tools provides modern convenience, allowing parents to manage their financial documents with ease, including eSigning agreements and collaborative budgeting efforts. Engaging with these resources can streamline the financial journey of parenting.

Community voices and experiences

Real-life experiences from parents can provide valuable insights into the real costs of raising children. Many share common concerns regarding how to manage expenses effectively while ensuring their children have access to quality education and enrichment opportunities. Additionally, connecting with support networks—whether online or in-person—can provide emotional and financial assistance in navigating parenthood.

Community resources such as local parenting groups, financial advising resources, and government programs designed to assist families can significantly ease the burden of parenting costs. Sharing experiences and tips from fellow parents can open up new views on budgeting and creative expense management.

Interactive tools

Employing interactive budget calculators and templates can significantly enhance financial planning for families. Customizable financial plans and expense trackers available on pdfFiller can help parents visualize their expenses, allowing them to plan accordingly and adjust as necessary. These resources enable parents to take a proactive approach toward budgeting and managing their finances.

Collaborative tools designed for couples and families can ensure everyone is involved in the financial planning process, fostering unity in managing expenses. By involving all family members, your approach to budgeting becomes a shared responsibility rather than a burden.

Contact and support options

pdfFiller is dedicated to helping families manage their documents effortlessly. With a user-friendly platform, parents can find solutions for their document needs, negotiating the often-complex world of parenthood finance. For support with pdfFiller's features and how they can assist family planning, reaching out is easy.

Whether you have questions about filling out specific forms related to schooling, healthcare, or budgeting, pdfFiller is there to help you navigate your unique needs as a parent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete are kids too expensive online?

How do I make edits in are kids too expensive without leaving Chrome?

Can I edit are kids too expensive on an iOS device?

What is are kids too expensive?

Who is required to file are kids too expensive?

How to fill out are kids too expensive?

What is the purpose of are kids too expensive?

What information must be reported on are kids too expensive?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.