Get the free NYPA CAPTIVE INSURANCE COMPANY

Get, Create, Make and Sign nypa captive insurance company

Editing nypa captive insurance company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nypa captive insurance company

How to fill out nypa captive insurance company

Who needs nypa captive insurance company?

Guide to the NYPA Captive Insurance Company Form

Understanding NYPA Captive Insurance

Captive insurance refers to an insurance company that is owned and controlled by the insured parties. It allows organizations to insure their risks with a tailored approach, enhancing control over risk management. For instance, a captive insurance company can help firms mitigate risks that traditional insurance companies may hesitate to cover.

The New York Power Authority (NYPA) plays a crucial role in the energy sector, providing affordable and reliable power while also managing risks associated with its operations. As it navigates complex risks inherent in energy production and distribution, NYPA utilizes captive insurance to help optimize its risk management strategy. Through captive insurance, NYPA can maintain control over its insurance programs and responsiveness to its unique operational needs.

The primary purpose of captive insurance at NYPA lies in its ability to tailor coverage specific to its risk profile. It results in cost savings, potential tax advantages, and improved cash flow management, thereby enhancing NYPA's financial stability.

Key features of the NYPA captive insurance company form

The NYPA captive insurance company form encapsulates essential information that accurately represents the nature of the risks being insured and the structure of the insurance company itself. Understanding the specific attributes of this form is critical for compliance and efficient risk management.

A significant distinction lies in how NYPA’s captive insurance is developed. Unlike traditional insurance models reliant on standard policies and underwriting processes, NYPA’s captive allows for more personalized terms and better stakeholder engagement.

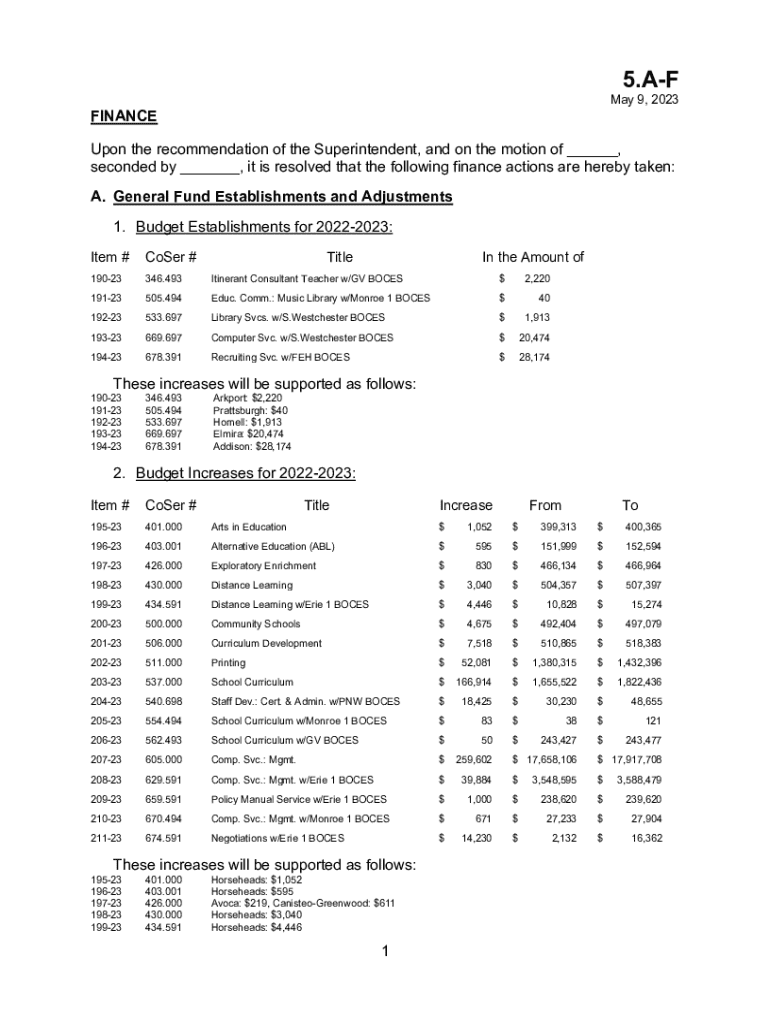

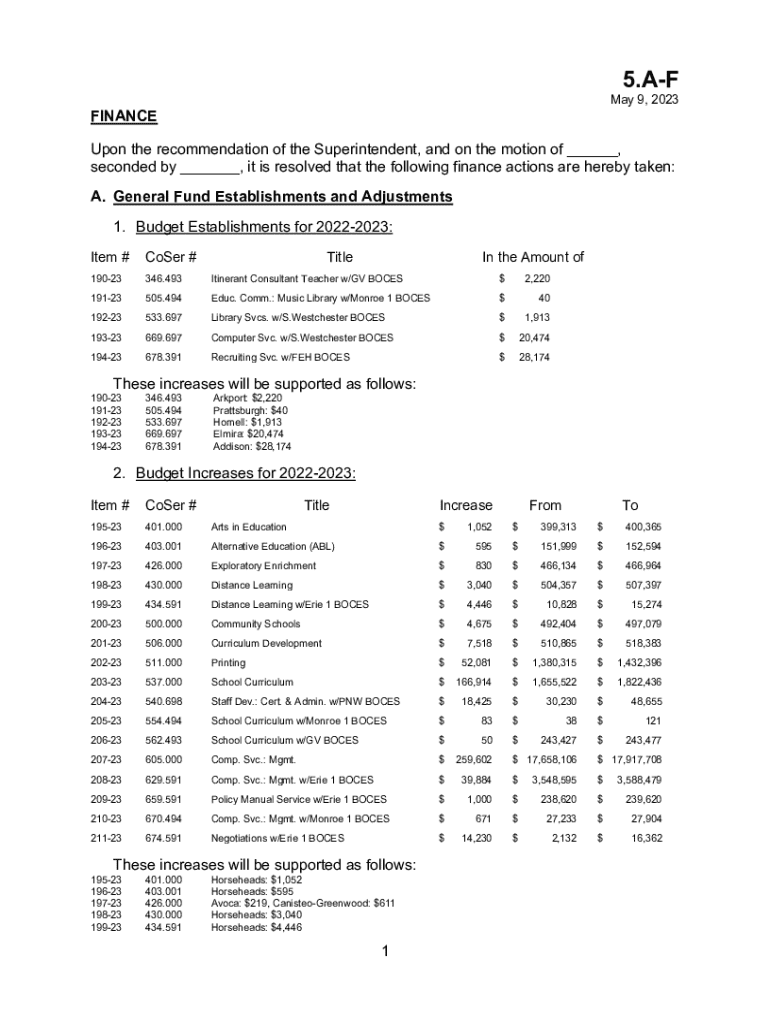

How to complete the NYPA captive insurance company form

Completing the NYPA captive insurance company form involves a structured approach. Proper preparation is essential to ensure compliance and accuracy.

Before you begin, gather necessary documentation including prior year financials, risk assessments, and organizational charts. The following steps outline the specific sections of the form.

Common mistakes include failing to provide comprehensive financial data, which could lead to delays in processing. Always double-check that the forms are complete before submission.

Interactive tools for form management

Managing the NYPA captive insurance company form can be simplified through several interactive tools available on the pdfFiller platform. These tools facilitate a more efficient document management process.

Using such tools not only streamlines the completion process but also enhances record management and improves overall project efficiency.

Submitting the NYPA captive insurance company form

Once the NYPA captive insurance company form is completed, the next step is submission. Understanding the submission guidelines is crucial to ensuring that your application is processed efficiently.

Typically, submissions are made directly to the NYPA risk management department. Ensure that the form is sent to the appropriate contact person provided on their website.

After submission: what’s next?

After submitting the NYPA captive insurance company form, the review process begins. This stage is critical for assessing the application and ensuring it aligns with NYPA's requirements.

Applicants should be prepared for potential outcomes during the review. Approvals typically lead to binding agreements, while denials may require additional documentation or resubmission.

After initial approval, it's the company’s responsibility to keep the captive insurance updated, reflecting any changes in operations or risk profiles.

Annual requirements for NYPA captive insurance companies

Maintaining compliance as a NYPA captive insurance company involves understanding and fulfilling annual reporting requirements. These obligations ensure transparency and allow for proper oversight.

Lastly, familiarize yourself with the state assessments applicable to NYPA captives, including tax obligations and assessments, discussed further in the FAQs section.

Documents and forms related to NYPA captive insurance

In addition to the NYPA captive insurance company form, various other documents may be required to ensure compliance and smooth operation. These forms provide the necessary framework for captives to function legally in New York.

Fortunately, resources for accessing related documents are available on the pdfFiller platform, streamlining the process of finding and managing necessary paperwork.

Common questions about NYPA captive insurance

As organizations navigate the complexities of captive insurance, several common questions often arise. Understanding the benefits and responsibilities associated with NYPA captives is crucial for informed decision-making.

Important regulations surrounding NYPA captive insurance

The landscape of captive insurance in New York is shaped by various state regulations. Awareness of these regulations is essential for effective compliance and operational success.

Contact information for assistance

If you have questions or require assistance with the NYPA captive insurance process, reaching out to the appropriate representatives is crucial.

Conclusion on utilizing captive insurance solutions

Fulfilling the requirements of the NYPA captive insurance company form accurately is a vital step in establishing effective risk management practices. The benefits of tailored insurance solutions make it a desirable option for organizations like NYPA.

Utilizing pdfFiller simplifies document management, allowing teams to edit, sign, collaborate, and submit forms from anywhere. As such, embracing this technology can enhance efficiency and compliance, proving essential for successful captive insurance operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nypa captive insurance company for eSignature?

Can I create an electronic signature for the nypa captive insurance company in Chrome?

How do I complete nypa captive insurance company on an iOS device?

What is nypa captive insurance company?

Who is required to file nypa captive insurance company?

How to fill out nypa captive insurance company?

What is the purpose of nypa captive insurance company?

What information must be reported on nypa captive insurance company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.