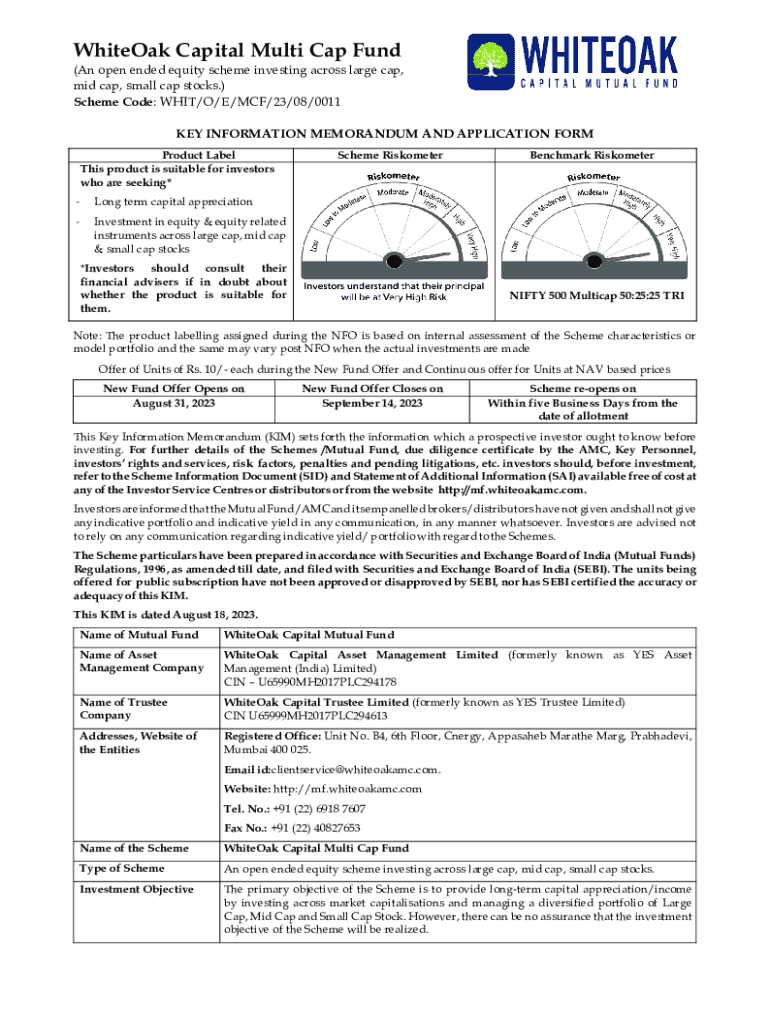

Get the free WhiteOak Capital Multi Cap Fund

Get, Create, Make and Sign whiteoak capital multi cap

How to edit whiteoak capital multi cap online

Uncompromising security for your PDF editing and eSignature needs

How to fill out whiteoak capital multi cap

How to fill out whiteoak capital multi cap

Who needs whiteoak capital multi cap?

Whiteoak Capital Multi Cap Form - How-to Guide

Overview of multi cap funds

Multi cap funds are mutual funds that invest in stocks across various market capitalizations—large, mid, and small-cap stocks. This diversity allows investors to take advantage of the growth potential from different segments of the market, optimizing overall returns while reducing risk.

Investing through multi cap funds can be particularly important for achieving a well-rounded investment portfolio. By spreading investments across various market segments, investors can mitigate the impact of volatility associated with specific sectors or capital ranges. The Whiteoak Capital Multi Cap Fund exemplifies these characteristics, focusing on balanced growth.

Understanding Whiteoak Capital Multi Cap Fund

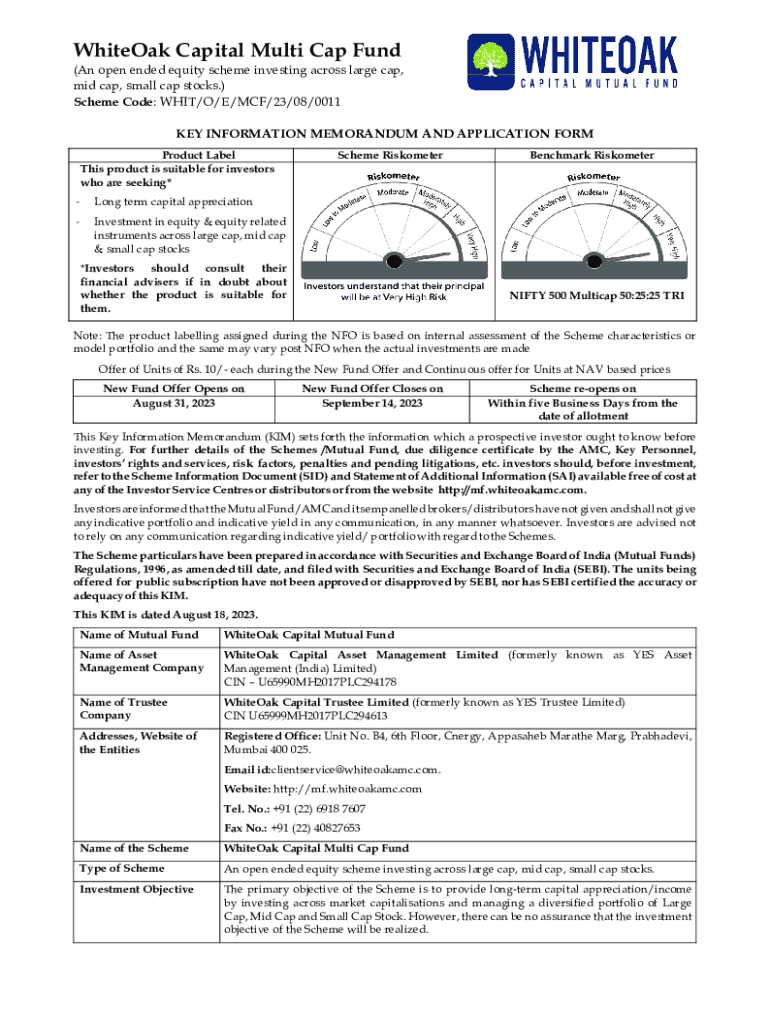

The primary objective of the Whiteoak Capital Multi Cap Fund is to achieve long-term capital appreciation through investments in equity and equity-related securities. The fund aims to provide the dual benefit of growth potential and income generation, making it an attractive option for investors seeking a balanced investment approach.

In terms of investment strategy, the Whiteoak Capital Multi Cap Fund employs a diversified asset allocation model, typically including approximately 60% large-cap stocks, 30% mid-cap stocks, and 10% small-cap stocks. This strategic allocation enhances the potential for superior returns while maintaining a level of stability.

Historically, the performance of the fund has been robust, with returns reflecting consistent outperformance against benchmark indices. The net asset value (NAV) has shown an upward trend, reinforcing investor confidence and showcasing the effectiveness of the fund management team.

The Whiteoak Capital Multi Cap Form

The Whiteoak Capital Multi Cap Form is a vital document that facilitates the investment process into the fund. This form serves primarily to collect needed personal and investment information from potential investors, ensuring a streamlined entry into the investment journey.

Key components of the form include the requirement for personal information such as name, address, and identity verification details, alongside specific investment details like contribution amounts and preferred investment modes. The form also outlines signatory requirements for electronic signing, ensuring legality and compliance.

Accessibility is another remarkable aspect of this form. It is available online in a user-friendly format and can be downloaded as a PDF for ease of use. This ensures that applicants can complete their investment documentation from any location, at any time.

Step-by-step guide to filling out the Whiteoak Capital Multi Cap Form

Filling out the Whiteoak Capital Multi Cap Form can be straightforward if you follow a systematic approach. Here’s a clear step-by-step guide to help you through the process.

Step 1 involves gathering necessary information. Ensure you have your personal details ready, including full name, address, date of birth, and identification details. Additionally, prepare financial backgrounds such as your current income, existing investments, and anticipated investment amounts.

In Step 2, you’ll focus on completing the form accurately. Pay close attention to interactive fields and follow any specific instructions to avoid common pitfalls like incorrect information or omissions. This lays the foundation for a successful submission.

Step 3 is all about reviewing your information. Create a checklist to confirm the accuracy and completeness of your submission before finalizing it. This avoids any delays due to errors.

Finally, in Step 4, sign the form using the eSigning process via pdfFiller, ensuring compliance with electronic signature standards, which validates your submission.

Editing and managing your form

Once you've submitted the Whiteoak Capital Multi Cap Form, you may find the need to edit your submission or manage your documentation. This process can easily be facilitated using the tools available on pdfFiller.

To edit your submission, utilize pdfFiller’s editing tools that allow modifications to your form. This capability offers flexibility for updates due to personal changes or corrections without having to fill out the form anew.

Moreover, saving your completed forms for future use is essential. pdfFiller allows you to store documents securely in the cloud, offering easy access whenever needed. Additionally, its collaborative features let you share documents with team members for feedback or assistance, enhancing the overall investment process.

Frequently asked questions (FAQs)

Understanding the nuances of your investment is crucial. Here are some frequently asked questions regarding the Whiteoak Capital Multi Cap Form that may clarify any uncertainties.

After submitting the Whiteoak Capital Multi Cap Form, you will receive a confirmation regarding the processing of your investment. Typically, once processed, your units in the fund will be allocated based on the date of the submitted application.

To track the status of your investment, you can log into your investor portal or use the contact details provided in your confirmation email for direct inquiries. It's essential to know the minimum investment amount required; typically, this may range around ₹5,000, but confirming the details directly is advised.

Keep in mind that some fees or charges may be associated with your investment. These can include management fees or other related charges, which should be detailed in the fund’s documentation. Redeeming units from the Whiteoak Capital Multi Cap Fund follows the standard mutual fund process; you can submit your redemption request through the investor portal.

Tools for effective investment management

To maximize the effectiveness of your investments in the Whiteoak Capital Multi Cap Fund, utilizing various tools is beneficial. Investment calculators, for instance, can provide insights on evaluating potential returns whether you choose a systematic investment plan (SIP) or lump-sum investment.

Performance trackers become invaluable for regularly monitoring the NAV and other performance metrics of your fund. This ongoing assessment is critical for making adjustments based on market trends or personal financial goals.

Likewise, risk assessment tools can help you understand your risk profile in relation to fund performance. Identifying your risk tolerance levels will empower you to make informed decisions that align with your overall investment strategy.

Community insights and support

Engagement with community forums and discussion boards can greatly enhance your investment experience. These platforms allow investors to connect, share experiences, and gain insights from peers who may have faced similar scenarios.

Access to professional guidance, including financial advisors, provides an additional layer of support. Having a dedicated source for personalized advice can help clarify any complex aspects of your investment in the Whiteoak Capital Multi Cap Fund.

Keeping abreast of recent market trends affecting multi cap funds is essential for strategic decision-making. Regularly engage with market analysis and commentary to better understand how economic shifts may influence the fund's performance.

Final thoughts on investing in the Whiteoak Capital Multi Cap Fund

Investing in the Whiteoak Capital Multi Cap Fund presents a strategic opportunity for individuals looking to diversify their investment portfolios while aiming for potential growth. Understanding the nuances of the investment form and being equipped with the right knowledge and tools can make a significant difference.

Investors should weigh the long-term potential against market fluctuations to devise a suitable investment approach. With resources like pdfFiller at your disposal, managing your documentation and making informed decisions is easier, allowing you to focus on your investment strategy and objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my whiteoak capital multi cap in Gmail?

Where do I find whiteoak capital multi cap?

How do I make edits in whiteoak capital multi cap without leaving Chrome?

What is whiteoak capital multi cap?

Who is required to file whiteoak capital multi cap?

How to fill out whiteoak capital multi cap?

What is the purpose of whiteoak capital multi cap?

What information must be reported on whiteoak capital multi cap?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.