Get the free GROUPI PAPER1: ACCOUNTING Question No. 1 is c

Get, Create, Make and Sign groupi paper1 accounting question

Editing groupi paper1 accounting question online

Uncompromising security for your PDF editing and eSignature needs

How to fill out groupi paper1 accounting question

How to fill out groupi paper1 accounting question

Who needs groupi paper1 accounting question?

Mastering the Groupi Paper1 Accounting Question Form

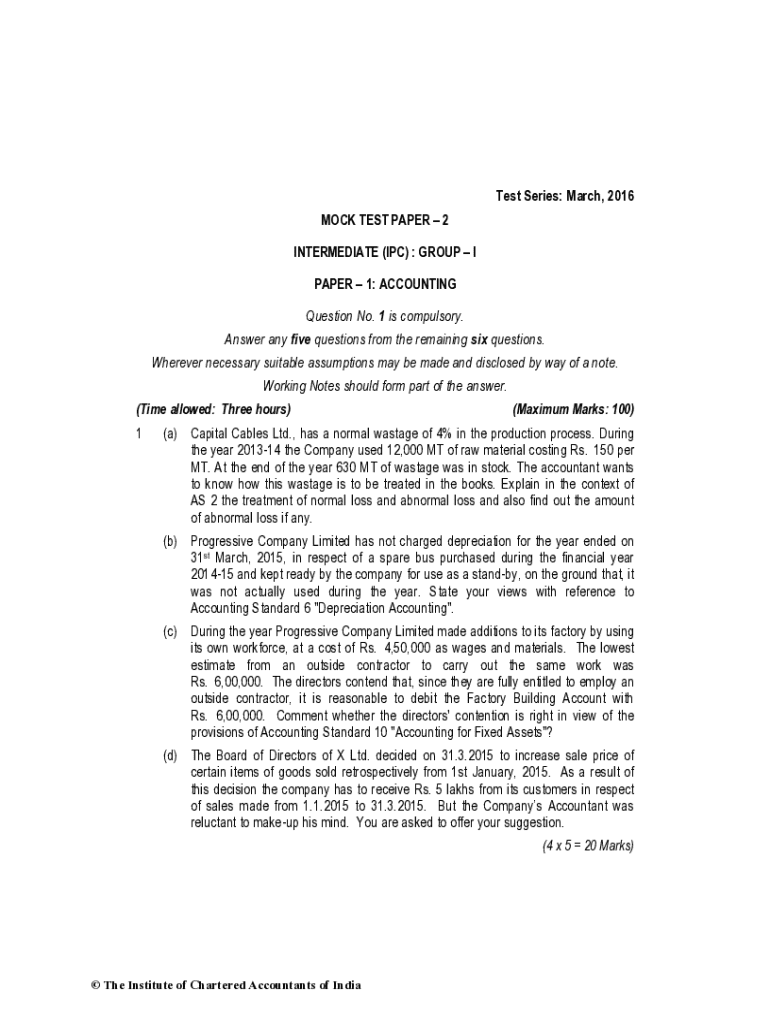

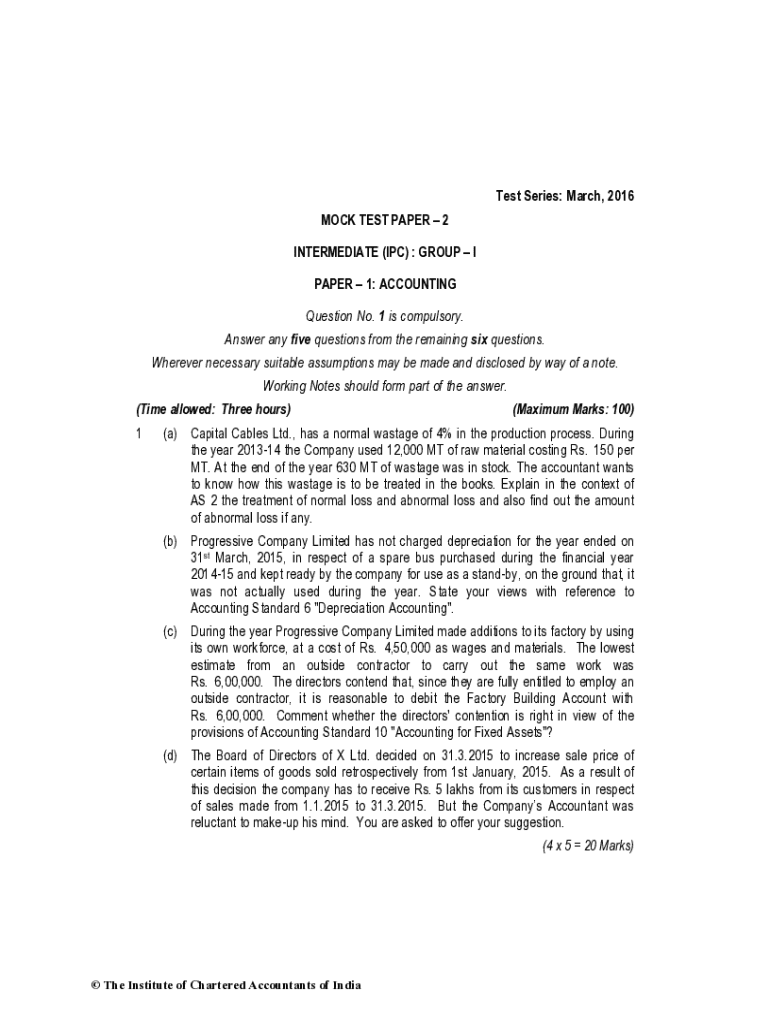

Overview of the Groupi Paper1 accounting question form

The Groupi Paper1 accounting question form is an essential document designed for evaluating accounting knowledge in both educational and professional environments. This form is pivotal for educators assessing comprehension of accounting principles, and for professionals seeking a structured method to demonstrate their expertise. Unlike other accounting forms which may focus on single-choice formats or rote memorization tasks, the Groupi Paper1 encompasses a well-rounded approach that emphasizes analytical thinking and practical application.

Its comprehensive nature not only provides a variety of question types but also allows educators to gauge a deeper understanding of subject matter. This differentiates it from more standardized forms that often lack versatility and depth. By utilizing the Groupi Paper1 accounting question form, users can align their assessments more closely with real-world scenarios, enhancing the relevance of their evaluation.

Key features of the Groupi Paper1 accounting question form

A noteworthy aspect of the Groupi Paper1 form is its diverse array of question types, allowing for a more thorough assessment of accounting concepts. The categories include:

In addition to this variety, the form is adaptable for both educational institutions and organizations seeking to evaluate their teams. It can be seamlessly integrated with digital tools for electronic completion, making it accessible from any device. This flexibility ensures that the Groupi Paper1 accounting question form remains relevant in diverse settings.

Step-by-step guide to accessing the Groupi Paper1 form

Accessing the Groupi Paper1 form is a straightforward process. Here's a step-by-step guide to navigate this efficiently on pdfFiller:

When working on the form, it's advisable to save your progress regularly, especially in lengthy assessments, to prevent data loss.

Detailed instructions for filling out the Groupi Paper1 accounting question form

Filling out the Groupi Paper1 accounting question form involves several key sections that users must address accurately. Here’s an overview:

When answering questions, employ best practices such as being concise, ensuring that your responses are relevant to the question asked, and providing examples where applicable. Common mistakes to avoid include overlooking instructions and failing to review your answers before submission.

Tools and features for editing and managing the Groupi Paper1 form

pdfFiller offers a suite of editing tools that enhances the usability of the Groupi Paper1 accounting question form. Users can leverage features such as:

Collaboration is also a significant feature, as you can share the form for group completion. Utilizing eSignature functionalities allows for a seamless process in final submissions — ensuring that your submission remains professional and legally binding. Moreover, saving and exporting options give you the flexibility to keep a copy of your filled form for your records or future reference.

Interactive tools for enhancing the Groupi Paper1 experience

Enhancing your experience with the Groupi Paper1 accounting question form can be achieved through additional interactive tools. Utilizing calculators and spreadsheets can provide real-time insights when working through accounting scenarios in the form, helping to solidify conceptual understanding.

Additionally, accessing tutorials and guides specific to the Groupi Paper1 can equip you with strategies and examples for tackling tricky questions. Engaging with community forums allows users to exchange knowledge, share best practices, and discuss common challenges faced while completing the form.

Frequently asked questions (FAQs) regarding the Groupi Paper1 accounting question form

When using the Groupi Paper1 accounting question form, users frequently have questions about technical issues and security. Here are some common inquiries addressed:

Future developments and updates for the Groupi Paper1 form

In the continually evolving landscape of accounting and education, the Groupi Paper1 form is set to adapt alongside changing accounting standards. Upcoming features in pdfFiller tools will likely include enhancements for data analytics and integration capabilities, enabling users to analyze their performance trends over time.

User feedback will play a critical role in shaping these developments. pdfFiller encourages users to suggest improvements, ensuring that the Groupi Paper1 accounting question form remains relevant and effective in evaluating accounting knowledge.

Testimonials and success stories from users of the Groupi Paper1 form

Feedback from users highlights the positive impact the Groupi Paper1 accounting question form has had on both academic performance and professional development. Many students report that using this form has significantly improved their understanding of complex accounting principles, resulting in better exam scores.

Likewise, professionals find that the structured assessment format enables them to showcase their skills effectively during evaluations. Stories of success often include collaborative efforts among teams, where sharing and jointly completing the form has led to enhanced group understanding and camaraderie in tackling accounting challenges.

How pdfFiller stands out as your go-to solution for document management

pdfFiller has positioned itself as a leader in providing comprehensive document management solutions tailored to the Groupi Paper1 accounting question form and beyond. Its range of features — from editing PDFs to collaborative workflows — ensures that users have all the tools needed at their fingertips.

The seamless integration with cloud services enables users to access their documents anywhere, anytime, making it a perfect choice for individuals and teams on the go. Moreover, the platform empowers collaborative work environments, allowing users to engage effectively with colleagues while managing documentation through advanced features, making accounting assessment a much simpler and efficient process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit groupi paper1 accounting question from Google Drive?

How do I make edits in groupi paper1 accounting question without leaving Chrome?

How can I fill out groupi paper1 accounting question on an iOS device?

What is groupi paper1 accounting question?

Who is required to file groupi paper1 accounting question?

How to fill out groupi paper1 accounting question?

What is the purpose of groupi paper1 accounting question?

What information must be reported on groupi paper1 accounting question?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.