Get the free Income Tax Ready Reference

Get, Create, Make and Sign income tax ready reference

How to edit income tax ready reference online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax ready reference

How to fill out income tax ready reference

Who needs income tax ready reference?

Your Comprehensive Guide to the Income Tax Ready Reference Form

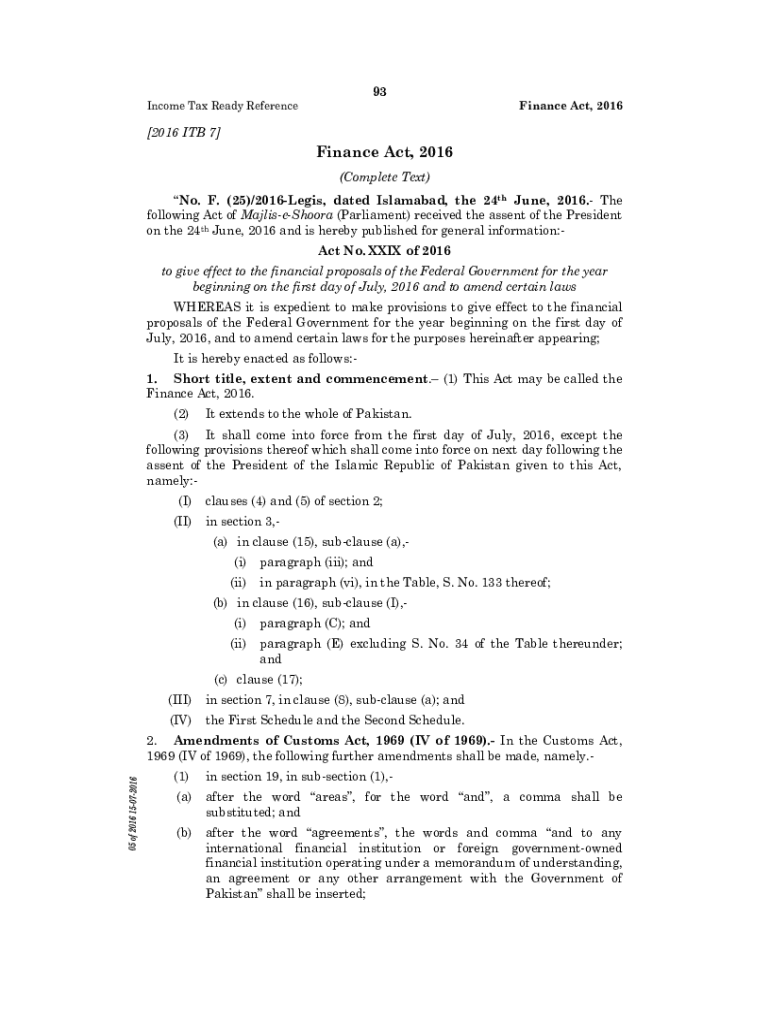

Overview of the income tax ready reference form

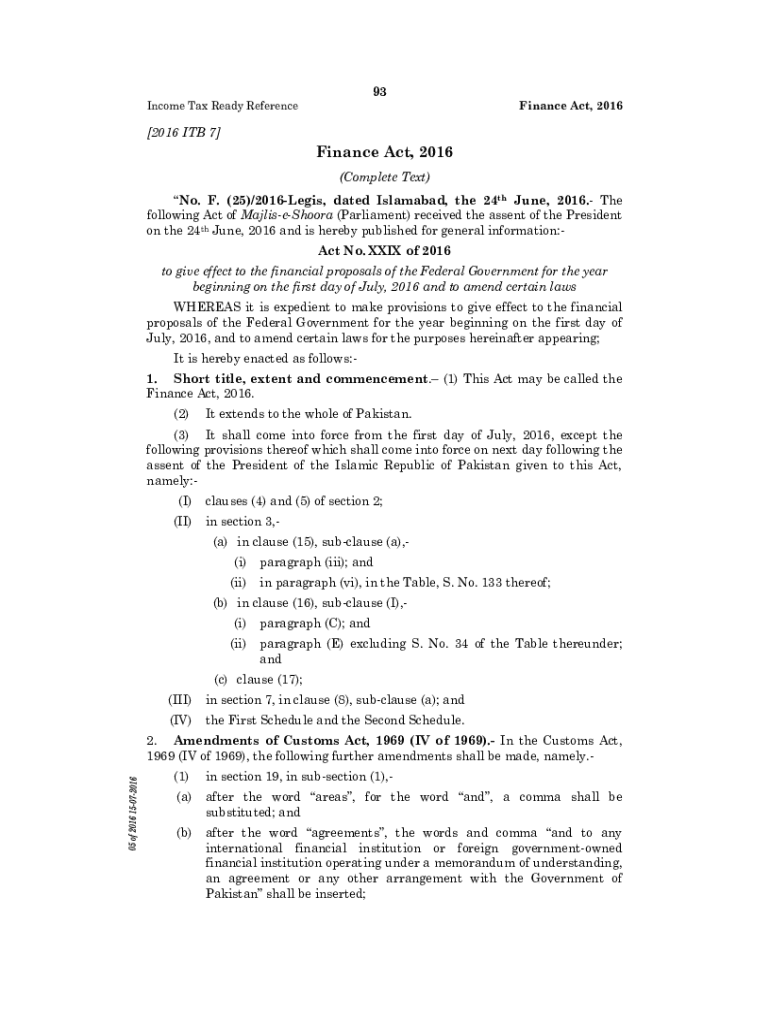

The income tax ready reference form serves as a crucial tool for taxpayers preparing for the annual tax filing process. Designed to streamline information collection and organization, this form helps filers ensure they have all necessary details at their fingertips before completing their returns. Utilizing this form is essential for maintaining clarity and accuracy in a potentially complicated process, reducing the likelihood of errors and delays.

For tax filers, the importance of this form cannot be overstated. It simplifies the compilation of vital information like income, deductions, and credits, allowing for a smoother filing experience. Furthermore, it promotes accountability by encouraging thoroughness in the preparation process. The form’s key features include sections for listing income sources, a checklist for needed documentation, and standardized guidelines for deductions and tax credits, all aimed at making the tax filing journey more efficient.

Recent updates and changes

Tax Year 2024 has brought several noteworthy updates regarding the income tax ready reference form. It's essential for filers to stay aware of these changes to ensure compliance and optimize their filing experience. This year, new legislation may affect deductions for certain expenses and credits for energy-efficient home improvements, reflecting ongoing adjustments in tax policy to encourage sustainability and economic recovery.

Additionally, the IRS has streamlined the process of reporting income from side gigs or freelancing through clearer guidelines on what constitutes taxable income, especially for those engaged in gig economy roles. These changes impact the filing processes by necessitating a more comprehensive understanding of one's income sources, thus guiding taxpayers to accurately report without overlooking these evolving tax nuances.

Preparing to file: essential considerations

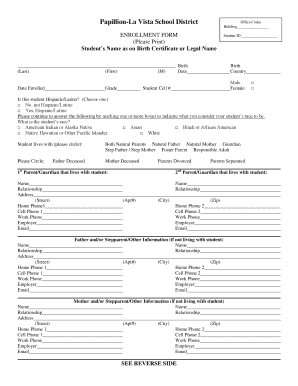

Determining who should utilize the income tax ready reference form is crucial. Primarily, individuals preparing their personal tax returns can benefit significantly from this document. Small business owners also find it invaluable, especially for keeping track of income streams and business-related deductions. Moreover, tax professionals can use this form as a standardized checklist when assisting clients, ensuring that all aspects of the client's financial situation are captured in the filing process.

Before filling out the income tax ready reference form, filers must gather essential documentation. This includes income statements such as W-2s and 1099 forms and any necessary documentation for deductions, like receipts for medical expenses, charitable donations, and prior year tax returns. Understanding relevant tax codes and regulations is also integral; being familiar with updates and comprehensive tax laws ensures individuals maximize their deductions while remaining compliant.

Step-by-step guide to completing the form

Completing the income tax ready reference form can be straightforward if approached methodically. The first step is to gather all required information. This includes taxpayer identification details such as your name, Social Security Number (SSN), and address. Additionally, you will need to choose your filing status, whether single, married filing jointly, or head of household.

Next, report your income carefully. This involves inputting data from your W-2s, 1099 forms, and any other relevant income documentation. Common sources of income include wages, self-employment earnings, and investment income. Make sure no income sources are omitted, as this can lead to issues down the road.

Once income is reported, you'll address deductions and credits next. Filers should understand the difference between standard deductions and itemized deductions. While many opt for standard deductions for simplicity, itemizing may yield greater savings in certain situations. It’s essential to also explore applicable tax credits, as they can directly reduce your tax liability.

Following this, calculate your tax liability based on reported income and deductions. Familiarizing yourself with tax brackets will aid in accurately determining how much tax you owe, while also considering other factors like additional income or deductions. After these calculations, review your form for completeness to avoid common errors—double-check calculations and ensure all fields are filled in correctly.

Filing options and submission methods

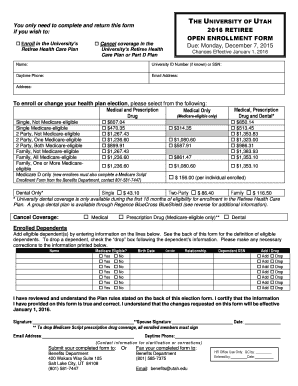

In the digital age, e-filing has become the preferred method for many taxpayers. Using resources like pdfFiller, taxpayers can submit their returns electronically with ease. E-filing provides numerous benefits including quicker processing times, instant confirmation of submission, and reduced chances of errors. To e-file using pdfFiller, follow a simple procedure: complete your form in the platform, review and sign electronically, then submit directly to the appropriate tax authority.

However, some individuals still prefer traditional mail submissions. In this case, it is vital to mail your income tax ready reference form to the correct address based on your location and your specific tax situation. Be sure to utilize a reliable mailing option to confirm your submission was received, which may involve sending it via certified mail for tracking purposes.

Post-filing actions

Once you have submitted your income tax ready reference form, the next step is to understand the timeline associated with processing your return. Typically, e-filed returns are processed faster, often within a few weeks, while mailed returns may take longer. To check the status of your return, most tax agencies provide online tools or phone services where you can track progress.

In the unfortunate event of an audit or inquiry from the tax authority, it’s essential to stay calm and organized. Keep all documentation related to your income and deductions readily available, as these will be crucial during the audit process. Consulting with a tax professional can also provide guidance and help you navigate the complexities effectively.

Safeguarding your financial information

Protecting your financial information should be a top priority, especially during tax season. Best practices include using secure networks to file your taxes, implementing strong passwords for your accounts, and regularly monitoring your financial statements for unauthorized activity. Awareness of identity theft tactics can enable you to act swiftly and protect your information.

In terms of securing your tax documents, consider utilizing a reliable cloud storage service like pdfFiller. This provides a secure way to store and manage sensitive financial documents while allowing access from any device. If you suspect your information has been compromised, it’s crucial to take immediate steps such as contacting your bank, freezing your credit, and reporting the situation to the relevant authorities.

Interactive tools and resources

pdfFiller offers various interactive tools to assist users in managing their tax forms efficiently. Features such as document editing, electronic signing, and collaboration options can significantly enhance the filing process. With cloud storage, users can access their important documents from anywhere, ensuring they are never out of reach during filing season.

Moreover, to address common queries about the income tax ready reference form, pdfFiller provides FAQs and customer support options. These resources can clarify specific aspects of the form, provide insights into tax codes, and offer assistance tailored to individual situations.

Special considerations

Tax implications can vary based on filing scenarios. Married filers often have distinct advantages or disadvantages compared to single filers, particularly concerning tax brackets and available deductions. Understanding these nuances enables couples to optimize their filing status for better tax outcomes. Furthermore, for those considering filing as nonresident or part-year residents, specific rules apply, especially in relation to income earned in different jurisdictions.

Military personnel and their families face unique tax considerations as well. Provisions exist to accommodate their special circumstances, including non-taxable income for certain allowances or benefits. Resources aimed at active duty service members can highlight relevant tax deductions and credits available to them, ensuring no potential benefits are overlooked.

Final thoughts on the process

The process of filing your taxes requires precision and diligence, and the income tax ready reference form is an indispensable tool in this effort. Leveraging platforms like pdfFiller can further streamline the experience, providing an efficient way to manage documents while ensuring compliance with tax regulations. Remaining informed about legislative changes is vital for maximizing opportunities and being prepared for any adjustments in future tax seasons.

Ultimately, the goal is to file accurately and on time, enabling taxpayers to navigate their financial responsibilities with confidence. Utilize the resources available through pdfFiller and stay proactive about understanding the intricacies of tax filing — it's an investment in your financial well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my income tax ready reference directly from Gmail?

How do I make changes in income tax ready reference?

How do I make edits in income tax ready reference without leaving Chrome?

What is income tax ready reference?

Who is required to file income tax ready reference?

How to fill out income tax ready reference?

What is the purpose of income tax ready reference?

What information must be reported on income tax ready reference?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.