Get the free 2020 Instructions for Form 1120

Get, Create, Make and Sign 2020 instructions for form

Editing 2020 instructions for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020 instructions for form

How to fill out 2020 instructions for form

Who needs 2020 instructions for form?

2020 Instructions for Form: A Comprehensive Guide

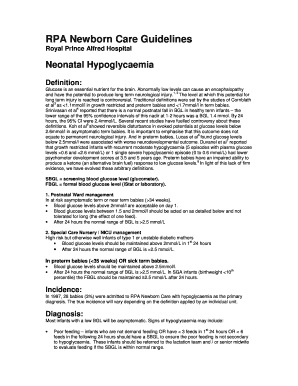

Overview of the 2020 instructions for form

Completing the 2020 form is crucial for individuals seeking to fulfill their tax obligations accurately and efficiently. The detailed instructions are designed to help taxpayers navigate the complexities of their filings, ensuring that all necessary information is reported correctly. Understanding these instructions not only maximizes potential refunds but also minimizes the risk of audits or penalties.

The 2020 form is primarily intended for individual taxpayers, including employees, self-employed workers, and small business owners. Anyone who earned income in 2020 and is required to file federal taxes should reference the 2020 instructions for form to ensure compliance with IRS guidelines.

Essential changes for the 2020 tax year

The 2020 tax year saw significant updates, most notably due to changes introduced by the COVID-19 pandemic. Many taxpayers were eligible for relief measures, including the Economic Impact Payments. These payments affected income reporting and deductions, necessitating clear instructions for accurately integrating this information into tax filings.

A major change for 2020 was the introduction of a special deduction for qualified charitable contributions, allowing taxpayers to deduct donations even if they did not itemize their deductions. Understanding these updates is essential to accurately complete the 2020 form.

Preparing to fill out the form

Before completing the 2020 form, gather all required documentation. This includes personal identification information, W-2s, 1099 forms, and any other financial records such as bank statements and receipts for deductible expenses. Having this information organized will facilitate a smoother filing process.

Tips for organization include categorizing documents by type and using folders (physical or digital) to keep everything in one place. Determine eligibility for specific deductions early to streamline your completion of the form.

Step-by-step instructions for completing the 2020 form

Each section of the 2020 form requires careful attention to detail. Generally, the form starts with personal information followed by sections for income and deductions. Understanding the specific instructions for key lines is vital for accurate reporting.

Avoid common mistakes such as miscalculating total income or failing to sign the form. Reviewing the form prior to submission can help capture potential errors.

eSigning and submitting your 2020 form

Utilizing electronic signatures (eSigning) streamlines the submission process. eSigning enhances security and expedites the filing, allowing users to sign forms without the hassle of printing and mailing. With pdfFiller, users can easily create and eSign documents with minimal effort.

To eSign your document using pdfFiller, simply upload your completed form and follow the prompts to add your signature. After eSigning, select your preferred submission option, which may include electronic filing directly with the IRS or mailing a printed copy.

Additional tools for managing your forms

pdfFiller offers a range of interactive features to help users manage their forms effectively. The editing functions allow for easy modifications, while collaboration tools enable teams to work on shared documents together, which is especially useful for business entities or partnerships filing collaboratively.

Additionally, tracking your form submission status offers peace of mind, ensuring you know when your filing has been accepted by the IRS.

Understanding tax obligations related to the 2020 form

Filing deadlines for the 2020 tax year generally fell on April 15, 2021, though extensions were available. Understanding these deadlines is pivotal to avoiding penalties. It's also important to explore tax payment options, whether choosing to pay electronically or setting up installment agreements for larger tax bills.

Penalties for late filing or payment can quickly add up, emphasizing the importance of adhering to deadlines and guidelines.

Resources for further assistance

Several resources are available for taxpayers seeking guidance. The IRS website is a valuable starting point, offering tutorials and downloadable forms. Local tax assistance programs can also provide hands-on help, particularly for low-income individuals.

Connecting with tax professionals can significantly simplify the process, especially for individuals with complex tax situations or for those filing on behalf of businesses.

Navigating unique situations

Filing for partnerships and LLCs involves additional considerations, as these entities have unique reporting requirements. Non-resident aliens may face different tax obligations, necessitating specialized understanding of tax treaties and exemptions. Furthermore, anyone needing to correct a previous tax return must follow a specific process for filing an amended return.

Understanding these unique situations allows for more precise compliance with tax laws.

Frequently asked questions (FAQs)

Clarifying common confusions can improve the filing experience. Many taxpayers wonder about specific deductions, deadlines, or how to handle unique financial situations. Having access to clear guidelines can alleviate much of the anxiety surrounding tax season.

Utilizing resources like pdfFiller can simplify the filing process, providing templates, guidance, and support for a successful experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2020 instructions for form directly from Gmail?

How do I edit 2020 instructions for form in Chrome?

Can I create an electronic signature for the 2020 instructions for form in Chrome?

What is 2020 instructions for form?

Who is required to file 2020 instructions for form?

How to fill out 2020 instructions for form?

What is the purpose of 2020 instructions for form?

What information must be reported on 2020 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.