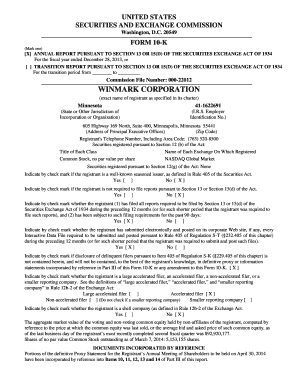

Get the free Form 10-K (NYSE:AX)

Get, Create, Make and Sign form 10-k nyseax

How to edit form 10-k nyseax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k nyseax

How to fill out form 10-k nyseax

Who needs form 10-k nyseax?

How to Fill Out and Manage the NYSEAX 10-K Form

Understanding the NYSEAX 10-K form

The NYSEAX 10-K form is a crucial annual statement that publicly traded companies in the NYSE American (formerly AMEX) are required to file with the Securities and Exchange Commission (SEC). It serves as a comprehensive overview of a company's financial performance and operational highlights over the past year.

This form is pivotal for investors and stakeholders, providing essential insights to make informed decisions. The 10-K is typically longer than quarterly reports and offers a detailed description of a company's business, financial statements, and risk factors.

Preparing to complete the 10-K form

Before diving into the completion of the NYSEAX 10-K form, companies should gather all relevant financial documents. This includes income statements, balance sheets, and cash flow statements, which form the backbone of the financial disclosures within the 10-K.

It is also critical to understand the filing deadlines for NYSEAX to avoid penalties. Typically, the 10-K must be filed within 60 to 90 days after the end of the company's fiscal year. Ensuring accurate and detailed record-keeping during the year can streamline the process and help avoid mistakes that could result in regulatory scrutiny.

Detailed breakdown of the NYSEAX 10-K sections

The NYSEAX 10-K form is segmented into several key sections, each serving a specific purpose to inform stakeholders about the company. The first section typically is the Business Overview, which describes the company's operations, industry landscape, and strategic objectives.

Following the overview, the Risk Factors section addresses various risks pertinent to the company's operations ranging from market fluctuations to regulatory changes. This transparency helps investors evaluate potential risks before making investment decisions.

Interactive tools for completing the 10-K form

Utilizing tools like pdfFiller can significantly simplify the process of completing the NYSEAX 10-K form. With pdfFiller, users can upload, edit, and eSign their 10-K documents directly within a cloud-based platform. This not only saves time but also ensures that all edits and signatures are securely stored.

Moreover, pdfFiller offers customizable templates designed specifically for the 10-K forms, which can pre-fill certain fields based on previous submissions. By leveraging these features, companies can improve efficiency and minimize errors, making the task of filing less daunting.

Common mistakes to avoid while completing the 10-K form

Filing the NYSEAX 10-K form requires diligence, and many companies falter by overlooking important sections or deadlines. A common mistake is not adhering to the exact deadlines, which can lead to fines or negative perceptions among investors.

Inaccurate reporting of financial data can lead to severe consequences, including penalties from the SEC. Furthermore, the importance of consulting with seasoned professionals cannot be overstated, as they can provide insights that ensure compliance with regulatory standards.

Post-filing considerations

After filing the NYSEAX 10-K form, it is crucial to monitor any feedback or responses from the SEC. This oversight can prevent potential issues and allow the company to respond promptly to inquiries. Moreover, holding preparation for quarterly reports (10-Q) can help ensure consistency in reporting and adherence to regulatory standards.

Ongoing communication with stakeholders is equally important, especially following public filings. Providing clarity and response to stakeholder concerns can reinforce trust and transparency, crucial for maintaining strong investor relations.

Tips for efficient document management

Managing previous filings can streamline the process of completing the NYSEAX 10-K form. Organizing prior documents allows teams to reference similar reports and maintain consistency across filings. Using pdfFiller’s cloud storage feature provides easy access to all documents, facilitating seamless collaboration.

In addition, establishing strategies for continuous updates and collaboration can keep everyone in the loop regarding document changes. This can be particularly beneficial when dealing with larger teams or during busy filing seasons.

Navigating related resources and tools

Understanding external resources available for NYSEAX filers can enhance the filing process. The SEC’s Online Filing Portal is a vital tool for submissions, providing guidelines on requirements and resources for compliance.

Additionally, employing third-party financial analysis tools can offer insights into performance metrics and help in drafting more precise reports. Various educational resources, such as webinars and tutorials on SEC regulations, can also aid companies in understanding the complexities of compliance.

Conclusion and next steps for NYSEAX filers

In conclusion, mastering the NYSEAX 10-K form is vital for regulatory compliance and fostering investor confidence. Before submitting, companies should perform a final checklist review to ensure all information is accurate and complete, including verifying the integrity of financial data.

Ensuring compliance and transparency going forward will not only protect the company’s interests but will also enhance its reputation in the financial market. Taking these steps will facilitate a smoother annual filing and maintain healthy investor relations.

Frequently asked questions (FAQs)

Understanding common questions regarding the NYSEAX 10-K form can simplify the process. Investors often wonder about timelines for filing the 10-K. Companies typically have 60 to 90 days post fiscal year-end to submit, which varies slightly based on the size of the entity.

Another frequent inquiry concerns how the 10-K influences stock prices. The disclosures within the 10-K can lead to investor reactions based on perceived financial health, ultimately affecting stock valuation. Lastly, companies should be prepared to address any errors post-filing, as amending the 10-K is possible if inaccuracies are found.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-k nyseax directly from Gmail?

How do I make edits in form 10-k nyseax without leaving Chrome?

How can I fill out form 10-k nyseax on an iOS device?

What is form 10-k nyseax?

Who is required to file form 10-k nyseax?

How to fill out form 10-k nyseax?

What is the purpose of form 10-k nyseax?

What information must be reported on form 10-k nyseax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.