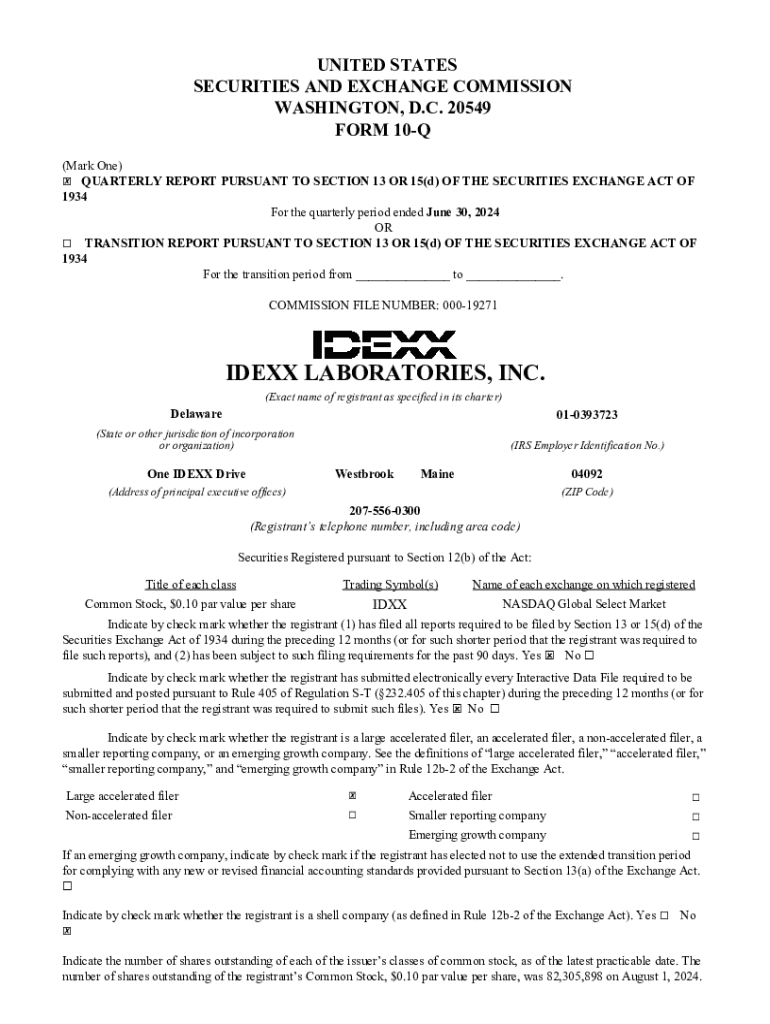

Get the free 10 par value per share, was 82,305,898 on August 1, 2024

Get, Create, Make and Sign 10 par value per

How to edit 10 par value per online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10 par value per

How to fill out 10 par value per

Who needs 10 par value per?

Understanding 10 Par Value Per Form: A Comprehensive Guide

Understanding Par Value

Par value refers to the nominal value of a security as determined by the issuing company. Its significance lies in its representation of the minimal value of a company's shares and bonds for accounting purposes. Historically, par value has played a crucial role in financing, as it establishes the basic criteria for valuations and serves as a benchmark for investors.

The role of par value in financial documents

Par value plays a pivotal role in financial documents, particularly in stock certificates, where it indicates the formal value assigned to shares. This valuation significantly affects legal implications during trading. It also impacts financial statements, particularly balance sheets, where par value is recorded under stockholder equity.

Practical insights on 10 par value

A $10 par value indicates that each share of stock has a nominal value of ten dollars, which is often applicable in the context of preferred stock. Common situations where this might apply include companies looking to standardize stock issuances or ensure a comfortable buffer against fluctuating market values.

Calculating and analyzing par value

Determining the par value of stock typically involves consulting a company’s charter or articles of incorporation, as they provide definitive information regarding the nominal value assigned. When stocks are issued above par value, additional paid-in capital (APIC) comes into play, which is crucial for understanding a company’s equity situation.

Importance of par value in investing

For investors, understanding par value is integral for evaluating stock performance and making investment decisions. A $10 par value can indicate a certain level of stability and credibility in a firm's financial structure. Furthermore, when the selling price equals par value, implications for future sales, dividends, and liquidity must be considered.

Regulatory and compliance considerations

Issuing shares at par value requires adherence to specific regulations that vary by jurisdiction. Legal guidelines dictate how and when shares can be issued, the minimum par value allowed, and the requirements for disclosures to shareholders and regulators.

Interactive tools for managing par value stocks

Utilizing technology can enhance the management and understanding of par value stocks. With solutions like pdfFiller, users can seamlessly edit, sign, and collaborate on important documents related to stock issuance, making it easier to maintain compliance and organize records.

FAQs about par value and stock issuance

Many questions arise when discussing par value, especially concerning how it influences stock dynamics. Some common inquiries include the typical par value for common stocks, its effect on shareholder equity, and whether companies can alter the par value of their stock.

Educational videos and resources

To deepen your understanding of par value and its implications, numerous online resources are available. Engaging with video content and practice problems can significantly enhance comprehension of these financial concepts, providing users with insightful explanations and real-world applications.

Support and assistance

For individuals and teams navigating the complexities of documentation associated with par values, utilizing a platform like pdfFiller can streamline the process. Their customer support offers valuable assistance for addressing issues related to stock forms, ensuring compliance and accuracy in documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 10 par value per in Gmail?

How do I fill out 10 par value per using my mobile device?

How do I fill out 10 par value per on an Android device?

What is 10 par value per?

Who is required to file 10 par value per?

How to fill out 10 par value per?

What is the purpose of 10 par value per?

What information must be reported on 10 par value per?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.