Get the free % I Bret Toyne

Get, Create, Make and Sign i bret toyne

Editing i bret toyne online

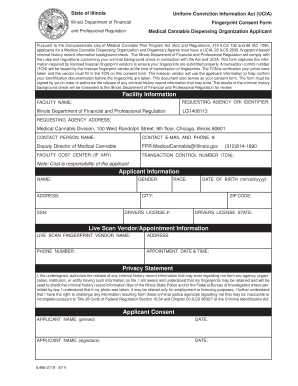

Uncompromising security for your PDF editing and eSignature needs

How to fill out i bret toyne

How to fill out i bret toyne

Who needs i bret toyne?

Navigating the Bret Toyne Form for Homeownership Success

Meet Bret Toyne: Your trusted guide to homeownership

Bret Toyne brings a wealth of knowledge and experience in the mortgage and real estate sectors, positioning himself as a trusted resource for homebuyers. With years of navigating the complexities of home financing, Bret has honed a personalized approach that prioritizes client education and empowerment. Whether you’re a first-time buyer or looking to refinance, Bret's insights can simplify the often overwhelming journey to homeownership.

His commitment to exceptional service involves understanding each client's unique situation, which allows him to offer tailored guidance throughout the mortgage process. Bret believes that informed clients make confident decisions, and he prides himself on being available to address any questions or concerns that arise.

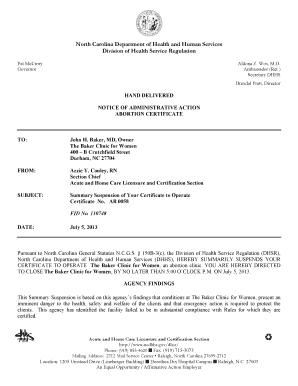

The Bret Toyne form explained

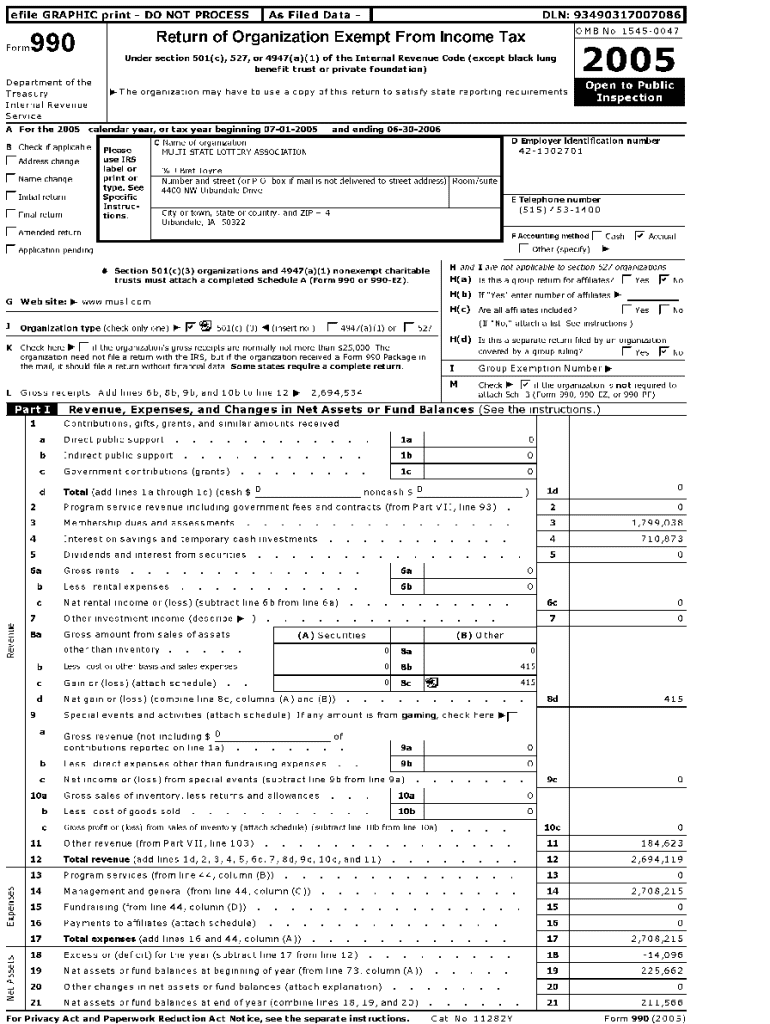

The I Bret Toyne form is an essential document used in the homeownership journey, serving various purposes in mortgage applications. This form is designed to capture critical financial information that lenders require to assess your eligibility for a loan. By providing a structured format for reporting income, assets, and liabilities, the I Bret Toyne form helps create a clear picture of a borrower’s financial situation.

Its importance lies in its role in streamlining the mortgage application process. By collecting all necessary information in one place, it reduces the back-and-forth communication typically required to clarify information, allowing for a quicker decision from lenders. Not only does it enhance the efficiency of the process, but it also increases your chances of approval.

How the Bret Toyne form fits into your homebuying journey

Integrating the I Bret Toyne form into your homebuying journey involves several key steps. Initially, you will need to gather your financial documents, including tax returns, bank statements, and proof of income, which will feed directly into this form. As you fill it out, ensure that each section is completed thoroughly to avoid any processing delays.

When comparing the I Bret Toyne form with other required documents, like the credit report or pre-approval letter, it is unique in that it consolidates data into a single document. This allows both buyers and lenders to have critical financial insights at a glance, facilitating smoother communication. Lay the groundwork with this form, and you will find that subsequent steps, like finalizing your mortgage application and closing the deal, become significantly easier.

Detailed instructions on filling out the Bret Toyne form

Filling out the I Bret Toyne form requires attention to detail. Here’s a structured breakdown of the key sections to guide you:

Common pitfalls during this process include forgetting to disclose certain income sources or misreporting liabilities. Double-check your entries to ensure accuracy, and consider consulting Bret Toyne or another trusted advisor if you have questions about specific items.

To enhance the efficiency of completion, leverage PDF editing tools to fill in the form digitally. This can streamline the process and reduce the chances of errors significantly.

Enhance collaboration with teams using the Bret Toyne form

Collaboration is crucial when multiple parties are involved in the homebuying process. The I Bret Toyne form can be easily shared among team members, ensuring that everyone is on the same page. Using platforms like pdfFiller, teams can work together to review and edit the form simultaneously. This not only saves time but also minimizes the likelihood of miscommunication.

Effective communication strategies include setting clear roles in the document completion process. Assign responsibilities for various sections of the form based on each team member’s strengths. Regular check-ins can also help address any questions quickly, ensuring that each person's contributions are aligned with the overall goal of timely application submission.

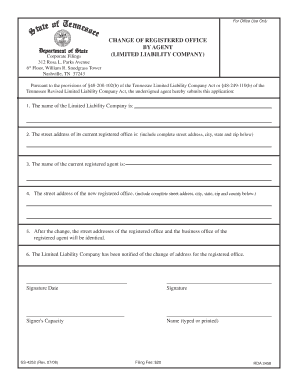

eSigning made simple: signing the Bret Toyne form

The signature process can often be a bottleneck in document processing. However, with pdfFiller’s eSigning capabilities, signing the I Bret Toyne form is straightforward and secure. Start by reviewing the completed form to ensure all information is accurate. Once ready, navigate to the eSigning feature within the platform to initiate your signature.

Follow these step-by-step instructions for a hassle-free experience:

eSigning ensures compliance with legal standards while providing security features such as encryption and audit trails, reassuring you that your signed documents are protected throughout the process.

Editing the Bret Toyne form for accuracy

After completing the I Bret Toyne form, it’s crucial to ensure accuracy before submission. pdfFiller offers robust editing tools that allow users to make changes easily. Whether you need to update an income amount or correct a spelling mistake, using pdfFiller’s intuitive editing features can save time and reduce frustration.

Handling updates or corrections post-submission requires a thoughtful approach. Firstly, communicate with your lender about any changes that need to be made. It's essential to provide updated documentation alongside the revised form to maintain transparency and trust. Remember that keeping records of all communication can also protect you if any discrepancies arise.

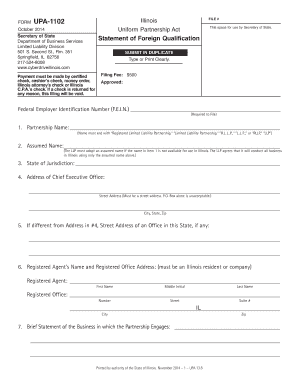

Managing your Bret Toyne form: a comprehensive solution

Managing your I Bret Toyne form and all related documents is simplified with pdfFiller. The platform’s document storage capabilities allow you to keep everything organized in one accessible location. You'll find that being able to track your forms helps you stay on top of deadlines and ensure nothing slips through the cracks.

Additional benefits include customizable folders for different stages of your homebuying process, allowing you to categorize documents by type, date, or lender. This organized approach significantly reduces stress, providing peace of mind throughout your ownership journey, and enabling you to focus on the bigger picture of finding your dream home.

Your homeownership journey: it doesn’t have to be overwhelming

Navigating the mortgage application process can present challenges, including misunderstanding terms, unexpected costs, or documentation errors. The I Bret Toyne form ultimately alleviates much of this stress by simplifying data collection and enhancing communication with lenders. When equipped with the right tools and resources, such as those found on pdfFiller, the experience transforms from daunting into manageable.

Utilizing features like real-time collaboration, eSigning, and easy document management helps mitigate the overwhelming moments that potential homebuyers often face. Integrating these strategies into your process ensures that you’re not lost in the minutiae but instead focused on finding a home that fits your life’s aspirations.

Mortgage calculators: strategize your finances alongside the Bret Toyne form

Using mortgage calculators can significantly inform your financial decisions as you complete the I Bret Toyne form. These tools allow you to estimate monthly payments based on your loan amount, interest rate, and term length, providing clarity on what you can afford.

By integrating calculated decisions into your homeownership strategy, you can avoid overextending financially. Use pdfFiller’s PDF tools to print out or save your calculations, making them easily accessible for future reference. Understanding your financial capabilities in advance leads to confident decision-making as you engage with lenders and complete your application.

Personalized support: Bret Toyne’s commitment to you

Bret Toyne offers unparalleled support throughout the homebuying process, ensuring resources are readily available for his clients. He understands that each person’s journey is unique, which is why he prioritizes individualized assistance tailored to your specific circumstances. From providing one-on-one consultations to curating informational resources, Bret's dedication shines through.

Feedback from clients highlights the positive impacts of using the I Bret Toyne form and the guidance provided. Many clients report feeling more confident in their applications, thanks to the clarity and direction that Bret offers. This commitment to client education not only empowers individuals but also fosters enduring relationships as they navigate the complexities of homeownership.

Success stories: real clients, real results

Many clients have successfully navigated their homebuying journey with the help of the I Bret Toyne form alongside Bret Toyne’s guidance. Take, for instance, the story of Sarah and Tom, a young couple who felt overwhelmed by the buying process. By utilizing the form, they streamlined their documentation and felt empowered to ask critical questions about their financing.

With personalized support and a clear action plan, they succeeded in obtaining their mortgage and closing on their dream home within a few months. Their experience underlines the efficacy of the I Bret Toyne form in demystifying the mortgage process, showcasing how it can transform what once seemed daunting into a structured, manageable path.

Taking the first step: how to get started with the Bret Toyne form

Getting started with the I Bret Toyne form is simple, especially with the tools offered by pdfFiller. Begin by accessing the form on the pdfFiller website, where you can fill it out directly online. The platform's user-friendly interface allows for seamless navigation, ensuring you can complete your application without unnecessary distractions.

Once you have the form open, follow the instructions highlighted in each section to supply the required information. This initial step is critical to building a strong foundation for your mortgage application and streamlining the process with your lender, so take your time, and don’t hesitate to reach out for assistance when needed. Your journey towards homeownership begins with the I Bret Toyne form, and the support of Bret Toyne and pdfFiller can make all the difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit i bret toyne from Google Drive?

How can I send i bret toyne for eSignature?

Can I sign the i bret toyne electronically in Chrome?

What is i bret toyne?

Who is required to file i bret toyne?

How to fill out i bret toyne?

What is the purpose of i bret toyne?

What information must be reported on i bret toyne?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.