Get the free JA Clark Charitable Trust - Trustees' Report and Financial ...

Get, Create, Make and Sign ja clark charitable trust

Editing ja clark charitable trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ja clark charitable trust

How to fill out ja clark charitable trust

Who needs ja clark charitable trust?

A comprehensive guide to the JA Clark charitable trust form

Overview of the JA Clark charitable trust form

The JA Clark charitable trust form serves as a pivotal document for establishing a charitable trust aimed at supporting various philanthropic endeavors. Its primary purpose is to facilitate the creation of a legally recognized entity that can manage and distribute funds for charitable purposes. Completing this form correctly is essential for both individuals and organizations seeking to formalize their charitable intentions and ensure adherence to legal requirements.

For individuals and organizations alike, the JA Clark charitable trust form provides a structured approach to defining the trust's objectives, selecting beneficiaries, and managing trust assets. The distinguishing features of this form include its adaptability to various charitable activities, clarity in its required sections, and compliance with regulations that govern charitable trusts.

Understanding charitable trusts

A charitable trust is a fiduciary arrangement that allows for the distribution of assets for a charitable cause. Key characteristics of charitable trusts include the requirement that their proceeds benefit the public or a specific segment of it, and they are exempt from certain taxation compared to other types of trusts. However, they can also have limitations, including strict regulatory oversight and the need to adhere to specific charitable purposes.

Both individuals and organizations fully capable of establishing charitable trusts. Individuals typically create these trusts to support causes that resonate personally with them, while organizations may set them up as part of their corporate social responsibility initiatives. This flexibility allows a wide range of contributors to engage in meaningful charity work.

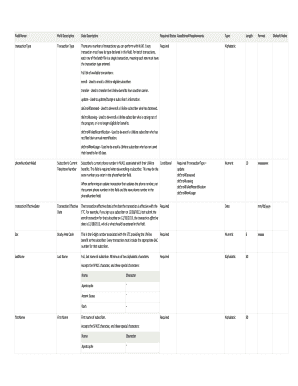

Essential components of the JA Clark charitable trust form

The JA Clark charitable trust form consists of several essential components that must be completed accurately. Understanding each section's purpose ensures that the trust is appropriately established and can function effectively.

How to fill out the JA Clark charitable trust form

Filling out the JA Clark charitable trust form is a meticulous process that requires attention to detail. Begin by gathering all necessary documents and information about the trust, including the granter's information, the beneficiaries, and the intended charitable cause.

When filling out each section, ensure you follow these detailed instructions:

Avoid common mistakes such as leaving sections incomplete or using vague language, as these can lead to delays or complications in the trust's establishment.

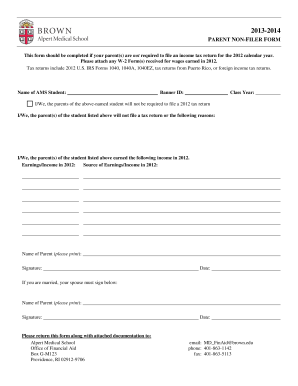

Editing, signing, and submitting the form

Once the JA Clark charitable trust form has been completed, utilizing pdfFiller's document management tools can streamline the editing and signing processes. With pdfFiller, you can easily revise any section online, ensuring that the final submission is polished and accurate.

The eSignature process through pdfFiller simplifies the signature requirements, providing a secure and efficient way to validate the document without the need for physical meetings. Important considerations for submission include identifying the ideal entity where the completed form will be submitted, which typically is a local or state government office overseeing charitable organizations.

Be aware of timeframes and deadlines associated with submissions. Delays in submitting the JA Clark charitable trust form might affect the timely approval of the trust.

Managing your charitable trust after form submission

After submitting the JA Clark charitable trust form, ongoing management is crucial for the trust's success. Keeping meticulous financial records and documentation helps maintain transparency and builds trust with beneficiaries and regulators alike.

Establishing a robust system for tracking financial history is essential, including donations received, distributions made, and operational expenses incurred. Moreover, understanding reporting requirements, such as annual returns required by the IRS and state law, ensures compliance and avoids potential penalties.

Charitable activities supported by the trust

The JA Clark charitable trust can support a variety of charitable activities. Fund distributions might be directed toward public education, health initiatives, community welfare projects, or specific organizations aligned with the trust's stated purpose.

Assessing the effectiveness of these charitable initiatives is essential for measuring the trust's impact on the community. The role of trustees is significant as they oversee the implementation of activities, ensuring alignment with the trust's mission and fostering transparency in financial dealings.

Legal and governance considerations

Understanding the governing documents of the JA Clark charitable trust is vital for effective management. These documents outline the trust’s framework and the procedures for making amendments if necessary. The roles and responsibilities of trustees should be clearly defined to ensure they understand their obligations towards managing the trust's assets.

Regulatory compliance and oversight are also critical. Trustees must remain aware of federal and state laws governing charitable organizations, including rules about fund allocation, record-keeping, and reporting. Regularly reviewing these requirements can prevent potential legal issues.

FAQs about the JA Clark charitable trust form

It's common for users to have questions about the JA Clark charitable trust form. Here are some frequently asked questions that provide clarity.

Examining financial aspects of charity management

Managing the financial aspects of a charitable trust is a core responsibility of trustees. A thorough analysis of income and expenditure is essential for sustainable operation. This includes tracking donations, grants received, and operational expenses to assess the overall health of the trust.

Transparency in financial reporting is equally important. Regular reporting not only helps maintain accountability to beneficiaries but also allows potential donors to understand how their contributions are utilized. Evaluating the charitable impact based on financials can guide future directions for charitable activities and improve decision-making processes.

Conclusion and next steps

Establishing and managing a charitable trust through the JA Clark charitable trust form is a rewarding journey that requires careful planning and execution. Once the trust is established, it is crucial to prepare for long-term management to ensure it thrives and fulfills its charitable mission. Utilizing pdfFiller can enhance document management processes, allowing for greater flexibility and efficiency in editing, signing, and collaborating related to the trust.

By staying organized, understanding legal obligations, and actively managing charitable activities, individuals and organizations can maximize their impact and contribute positively to their communities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ja clark charitable trust in Chrome?

How do I edit ja clark charitable trust on an iOS device?

How do I edit ja clark charitable trust on an Android device?

What is ja clark charitable trust?

Who is required to file ja clark charitable trust?

How to fill out ja clark charitable trust?

What is the purpose of ja clark charitable trust?

What information must be reported on ja clark charitable trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.