Get the free IRS Form 990 for 2020

Get, Create, Make and Sign irs form 990 for

Editing irs form 990 for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 990 for

How to fill out irs form 990 for

Who needs irs form 990 for?

IRS Form 990 for Form: A Comprehensive Guide for Nonprofits

Understanding IRS Form 990

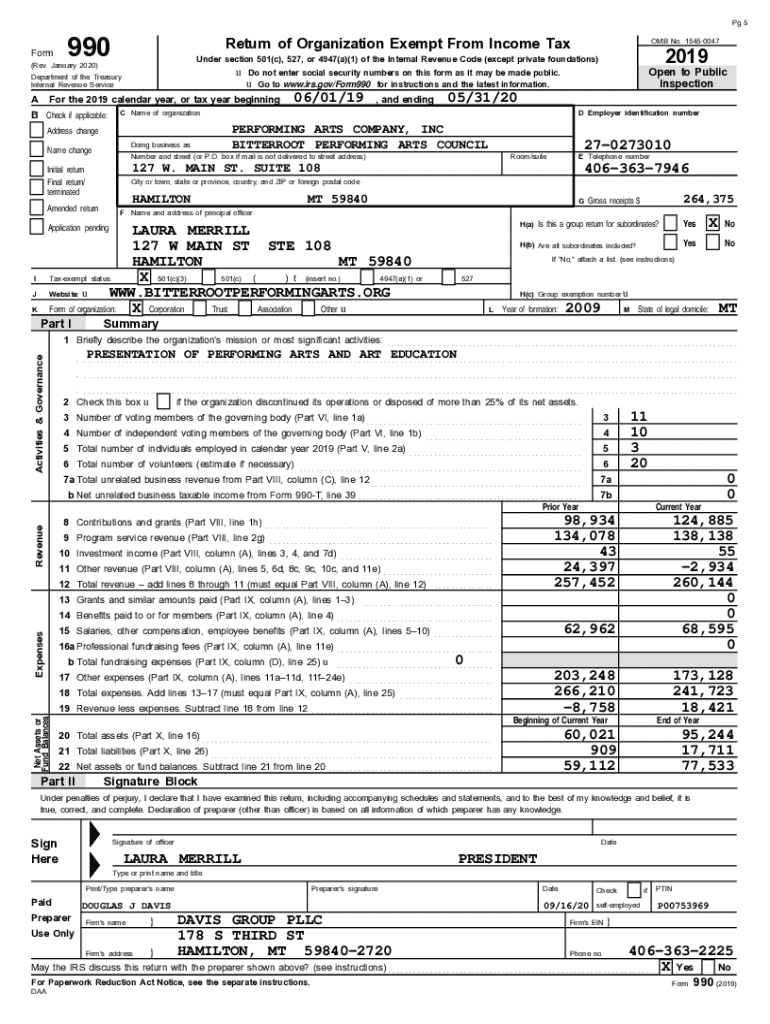

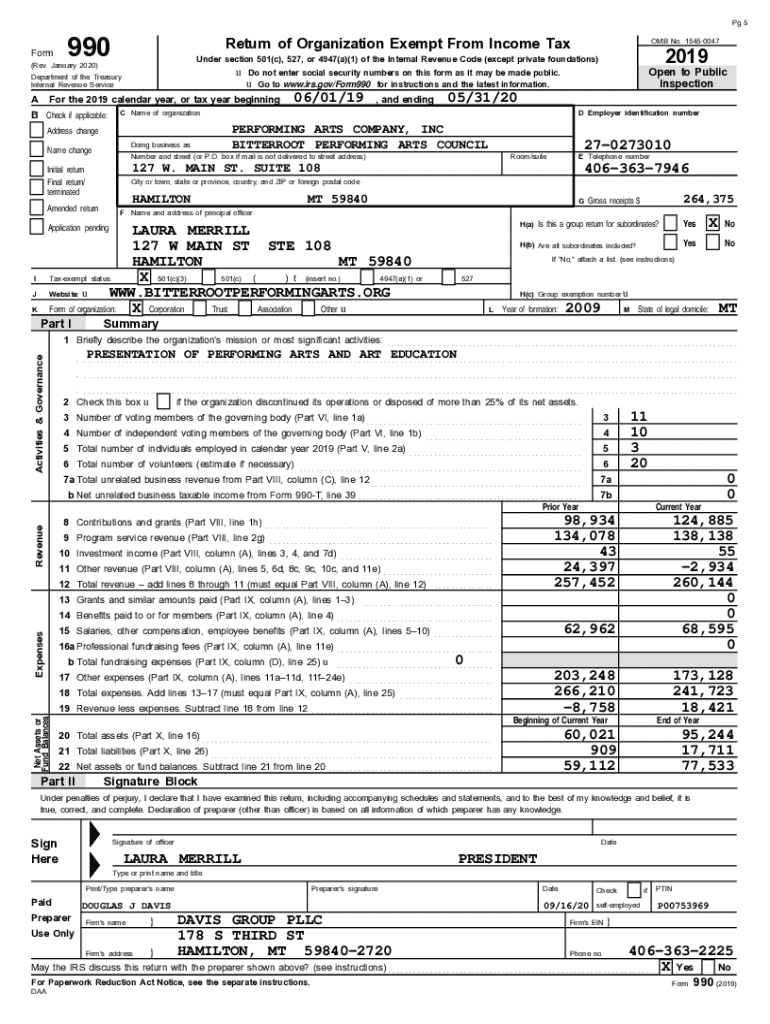

IRS Form 990 is the annual information return that most tax-exempt organizations must file with the Internal Revenue Service (IRS). This form serves as a public record that provides insights into the finances and operations of nonprofits, ensuring transparency and accountability. By detailing revenue, expenditures, and organizational structure, Form 990 plays a critical role in maintaining public trust.

The importance of Form 990 cannot be overstated for nonprofits. It acts as a key tool for donors, grantmakers, and regulators to evaluate an organization's financial health and operational effectiveness. This form not only fulfills IRS requirements but also enhances fundraising efforts by showcasing an organization’s commitment to transparency.

Various types of organizations are required to file Form 990, including charities, foundations, and other federally tax-exempt entities. The specific form version to use can depend on the organization’s revenue and tax-exempt status level.

Accessing Form 990

Finding IRS Form 990 can be straightforward if you know where to look. The official IRS website is the primary source, where you can access the latest forms, filing instructions, and updates. You can also utilize additional resources like Candid Learning, which offers tools to help organizations understand their filing obligations.

Historical Form 990s and 990-PFs can be located through both the IRS website and organizations like Candid. These repositories allow stakeholders to review previous filings, crucial for research and evaluation purposes.

Filling out Form 990

Completing IRS Form 990 involves gathering a variety of essential information to ensure compliance and accuracy. Organizations need to provide identification details, financial data—such as income and expenses—and describe their program service accomplishments, which detail how funds are used to fulfill their mission.

To efficiently complete Form 990, follow a systematic approach:

Be mindful of common mistakes that can arise during this process, such as failing to report all income, forgetting to sign the form, or not including required schedules.

Using Form 990 for evaluation and compliance

Form 990 is indispensable for charity evaluation and research. Many donors and grantmakers use these forms as a primary tool for assessing an organization's financial health and accountability. By analyzing Form 990, stakeholders can gain insights into how effectively a nonprofit utilizes its resources to achieve its mission.

Moreover, compliance with filing regulations is essential. The IRS mandates that Form 990 be publicly disclosed, promoting transparency. Organizations that neglect to file may face penalties ranging from fines to losing their tax-exempt status, underscoring the importance of timely and accurate submissions.

Interactive tools for managing Form 990

Utilizing sophisticated tools can significantly streamline the process of managing Form 990. For instance, pdfFiller offers functionalities that allow users to edit forms, collaborate in real time, and document signing via eSignature features.

Cloud-based document management solutions can transform how organizations handle Form 990, making it easy to store, retrieve, and share these critical documents with stakeholders across various platforms. This ensures that everyone involved in the filing process has access to the most up-to-date information.

FAQs about IRS Form 990

As you navigate the complexities of IRS Form 990, you may have questions. Here are some commonly asked ones:

Additional insights and resources

Enhancing your understanding of Form 990 can significantly benefit your organization in many ways. Staff-recommended resources can assist in demystifying the complexities surrounding the form. For instance, understanding the nuances of related forms like Form 990-EZ, Form 990-N, and Form 990-PF can be critical for nuanced organizational needs, whether they involve small nonprofits or larger charitable foundations.

Additionally, nonprofits can leverage Form 990 data when seeking grants. Foundations or organizations looking to fund projects often reference past filings to gauge prior successes and methodologies, ensuring aligned values between funders and applicants.

Navigating the IRS file and FAQ systems

The IRS provides a Tax Exempt Organization Search tool that allows access to important information about various nonprofits and their filings. This tool can be invaluable for conducting research on potential partners or funding opportunities.

If you have specific inquiries about Form 990, submitting questions to the IRS can clarify uncertainties and ensure that your organization remains compliant with all regulations. Consider reaching out through specified IRS contact methods or utilizing the Information Center on their site.

Staying informed

Remaining updated on changes to Form 990 and related regulations is vital for nonprofit leaders. Signing up for newsletters that focus on nonprofit management can provide insights and updates about IRS requirements, best practices, and case studies.

Pay attention to any recent changes and updates regarding Form 990 definitions, filing deadlines, or requirements to optimize your preparation strategies and ensure compliance for your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irs form 990 for online?

How do I make changes in irs form 990 for?

Can I sign the irs form 990 for electronically in Chrome?

What is irs form 990 for?

Who is required to file irs form 990 for?

How to fill out irs form 990 for?

What is the purpose of irs form 990 for?

What information must be reported on irs form 990 for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.