Get the free Opening a SIMPLE IRA Plan

Get, Create, Make and Sign opening a simple ira

Editing opening a simple ira online

Uncompromising security for your PDF editing and eSignature needs

How to fill out opening a simple ira

How to fill out opening a simple ira

Who needs opening a simple ira?

Opening a SIMPLE IRA Form: A Comprehensive Guide

Understanding SIMPLE IRAs

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement savings plan designed specifically for small businesses and self-employed individuals. It provides a straightforward way for employees to save for retirement while offering tax advantages to both the employer and the employee.

SIMPLE IRAs stand out for their ease of setup and maintenance, making them an appealing choice for small businesses with fewer than 100 employees. Not only do they facilitate employee participation, but they also simplify the process of employee benefit offerings.

Before you start: Preparing to open a SIMPLE IRA form

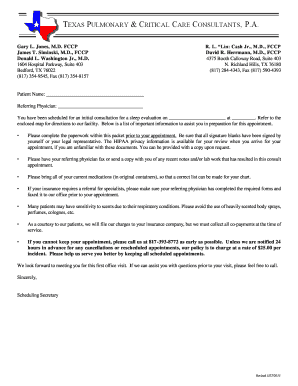

Before diving into the process of opening a SIMPLE IRA form, you first need to determine what type of SIMPLE IRA account is appropriate for your needs—whether an employer-sponsored plan or an employee-only account. This choice will influence the setup and management of the account.

Gathering the necessary information is crucial. Employers should collect details about their business structure and their Employer Identification Number (EIN), while employees will need to provide their Social Security Number (SSN) and details about their intended contributions.

Step-by-step guide to opening a SIMPLE IRA form

The first step in opening a SIMPLE IRA is choosing a financial institution that offers this type of retirement plan. Look for institutions that provide easy access to account management, good customer service, and investment options that align with your retirement goals.

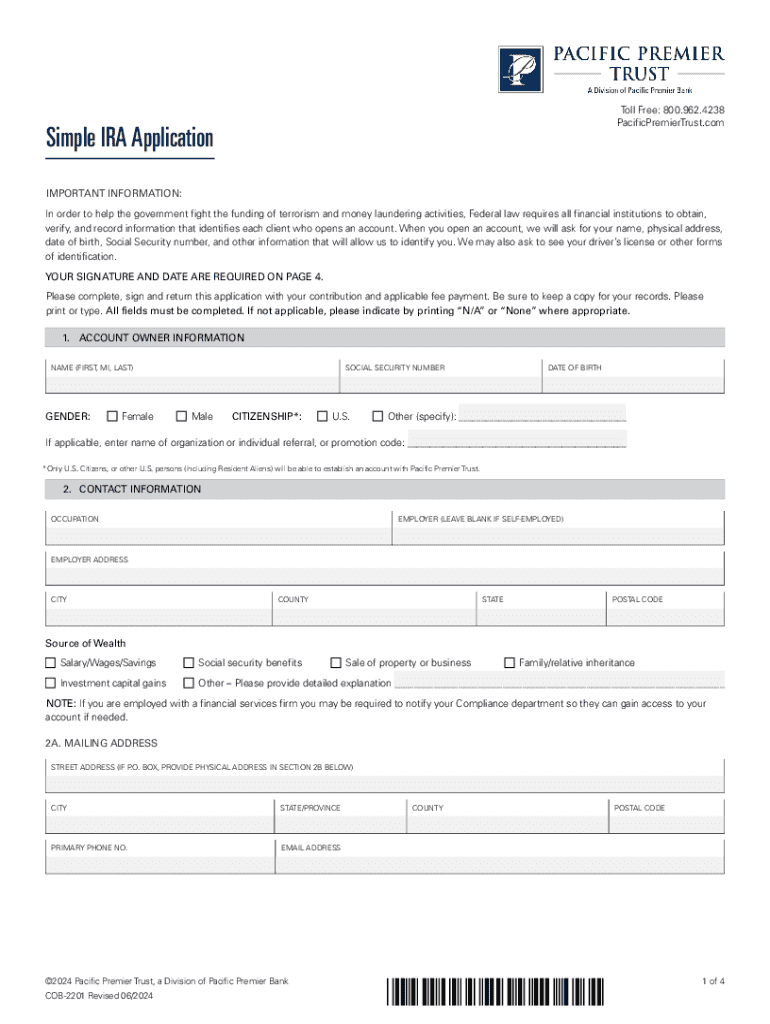

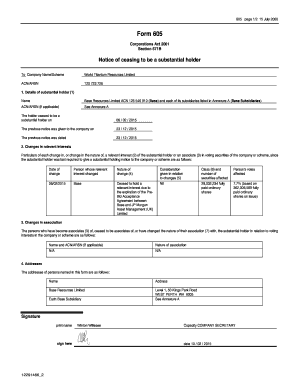

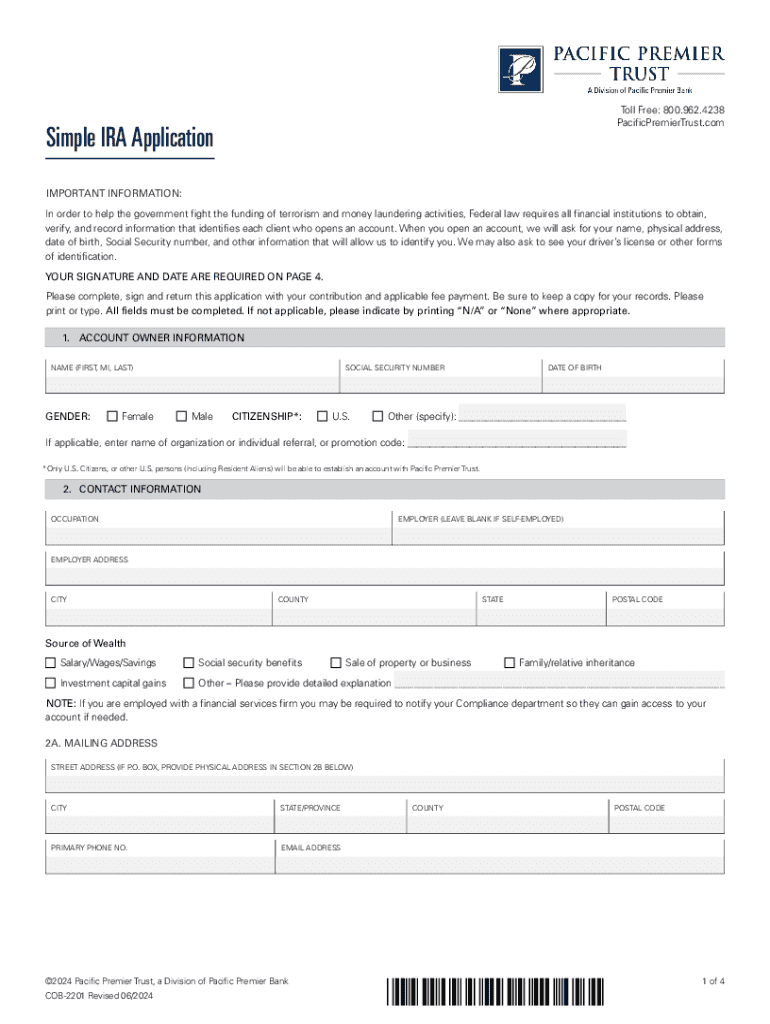

Once you’ve selected a financial institution, the next step is to complete the SIMPLE IRA plan document. Common sections required in this form include basic information about the employer, a statement of intent, and details regarding contributions.

Filling out the SIMPLE IRA form: Detailed instructions

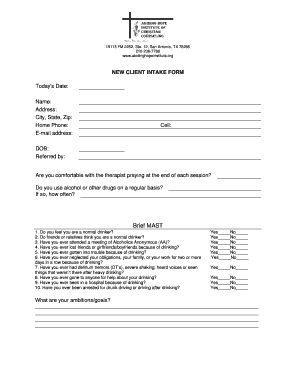

When filling out the SIMPLE IRA form, it's essential to navigate through several sections meticulously. The sections typically include contact information, contribution elections for employees, as well as employer contributions and matching details.

To ensure accuracy, be mindful of common mistakes such as misspelled names or incorrect SSNs, as they can delay processing. Utilize tools like pdfFiller to make revisions, sign electronically, and streamline your filing experience. This proactive approach can save time and alleviate stress during tax season.

Managing your SIMPLE IRA post-submission

After successfully submitting your SIMPLE IRA form, the next crucial step is to fund your account. It’s important to adhere to timely deposits to maximize the benefits of your contributions and keep your employees motivated to participate.

As an employer, effective communication with your employees is vital. This includes sending notices about enrollment procedures and maintaining transparency about contribution options and deadlines to encourage consistent participation in the plan.

Operational compliance for SIMPLE IRAs

Compliance is critical when managing SIMPLE IRAs. Employers must understand their annual reporting requirements, including submitting Form 5500 to the IRS for certain plan details. Adhering to deadlines will help avoid penalties and ensure the plan runs smoothly.

Regular monitoring of the plan is essential. This includes adjusting contributions based on business performance or changing employee circumstances and conducting periodic reviews of employee participation to ensure the plan remains beneficial.

Understanding contributions: Employee and employer roles

Employees can contribute up to $15,500 to their SIMPLE IRA accounts for 2023, with a $3,500 catch-up contribution for those age 50 or older. Understanding these limits is crucial for maximizing retirement savings and ensuring the account is well-funded.

Employers have the option to contribute through matching contributions or a fixed percentage of employee deferrals. It’s important to strategize matching contributions in a way that not only incentivizes employees but also aligns with the company's budget and tax considerations.

Common challenges and how to navigate them

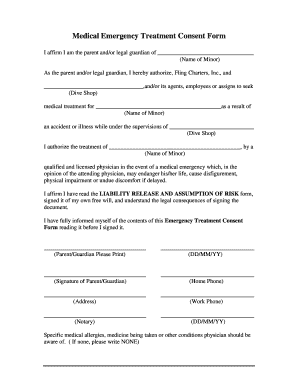

Navigating the complexities of managing a SIMPLE IRA can present challenges. One common issue arises when employees wish to stop their contributions. Employers have specific obligations to follow, such as notifying affected employees and ceasing deductions promptly.

Additionally, understanding how to modify or even terminate a SIMPLE IRA plan is essential. Employers need to be aware of the legal considerations involved, ensuring that they comply with the regulations that govern retirement plans.

Resources for further assistance

For individuals and employers looking for more information about SIMPLE IRAs, it's critical to reference official IRS guidelines. There are also numerous online tools available for managing and editing SIMPLE IRA forms, which can streamline the documentation process.

Leveraging reliable financial institutions can also provide valuable support in navigating the specifics of SIMPLE IRAs, ensuring adherence to all necessary regulations and maximizing the benefits of the plan.

Interactive tools and features on pdfFiller

pdfFiller offers an array of interactive tools that cater to users navigating the SIMPLE IRA form process. From editing and signing documents online to collaborating with team members, these features enhance your overall document management experience.

With pdfFiller, users can track submissions and follow up effectively in the cloud, ensuring that every aspect of the SIMPLE IRA form completion is streamlined and recorded accurately, making it easier to maintain compliance and stay organized.

Frequently asked questions

Many individuals considering a SIMPLE IRA may wonder if they can open this plan in conjunction with other retirement accounts. The answer is yes, you can contribute to a SIMPLE IRA even if you have other retirement plans, though total contributions must adhere to the specified limits.

Questions regarding penalties for early withdrawal are common as well. It's essential to remember that withdrawing funds before age 59½ typically incurs a 25% penalty, making it crucial to understand your financial planning strategy when utilizing a SIMPLE IRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my opening a simple ira directly from Gmail?

Can I create an electronic signature for the opening a simple ira in Chrome?

Can I create an electronic signature for signing my opening a simple ira in Gmail?

What is opening a simple ira?

Who is required to file opening a simple ira?

How to fill out opening a simple ira?

What is the purpose of opening a simple ira?

What information must be reported on opening a simple ira?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.