Get the free .102 - PUBLIC DISCLOSURE COPY (990) (United States Anti-Doping Agency TX1021 12/31/2...

Get, Create, Make and Sign 102 - public disclosure

How to edit 102 - public disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 102 - public disclosure

How to fill out 102 - public disclosure

Who needs 102 - public disclosure?

Understanding the 102 - Public Disclosure Form: A Comprehensive Guide

Understanding public disclosure forms

Public disclosure forms serve as vital tools for promoting transparency within various sectors, including government, nonprofits, and corporate environments. These documents are designed to collect and disseminate crucial information that stakeholders have the right to access. At its core, the public disclosure form aims to inform the public of essential facts that may impact decision-making or raise awareness regarding specific issues.

The importance of transparency in documentation cannot be overstated. When entities disclose their information voluntarily, it fosters trust and ensures accountability. Additionally, public disclosure forms play a pivotal role in minimizing conflicts of interest and ensuring compliance with regulatory requirements. They are also instrumental in empowering individuals and communities by granting them access to information that enables informed choices.

Types of public disclosure forms

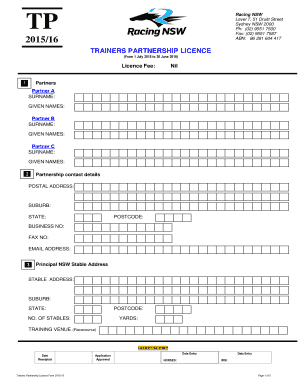

Public disclosure forms can be categorized into several types, each serving specific needs and sectors. Financial disclosure forms often require corporations and partnerships to reveal their financial standing, including revenue streams, expenditures, and other relevant fiscal data. Similarly, conflict of interest disclosure forms are crucial in settings where personal interests might interfere with professional obligations, helping mitigate potential ethical breaches.

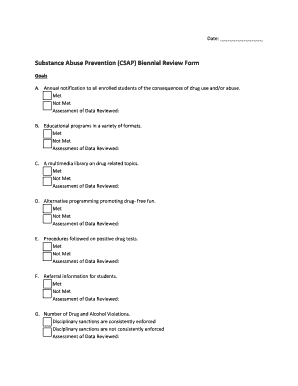

Environmental disclosure forms are another critical category, particularly for entities involved in activities that could impact public health or safety. These forms necessitate disclosure of environmental assessments, waste management practices, and compliance with health regulations. Various sectors, such as government agencies, nonprofit organizations, and corporations, have distinct disclosure requirements tailored to their particular operational landscapes.

Key components of a public disclosure form

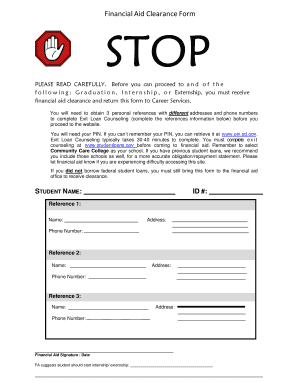

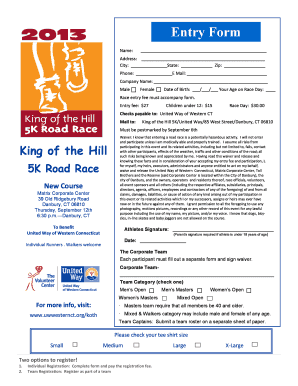

Understanding the essential components of a public disclosure form is pivotal for accurate reporting. Typically, these forms include the identifying information of the entity disclosing the information, a concise description of the information being disclosed, and a signature alongside the date of the declaration. Each of these elements plays a crucial role in validating the form and ensuring its credibility.

Accuracy and compliance are paramount when filling out these forms. Failing to provide the correct details or neglecting to adhere to formatting requirements can lead to legal implications or even penalties. Common mistakes include missing signatures or incorrect dates, which can result in rejected submissions or requests for further information. Therefore, understanding the importance of meticulousness in filling out public disclosure forms is critical.

Filling out a public disclosure form: step-by-step guide

Preparing the required information before filling out the 102 - public disclosure form is critical. Collecting both personal and organizational data will streamline the process. Understanding the context in which disclosure is being made aids in accurately portraying the situation and relevant information. Before diving into the form itself, ensure you have all necessary documents at hand, including prior disclosures and any related correspondence.

The section-by-section breakdown of the form simplifies the completion process. Start with the entity identification; ensure the name and relevant registration numbers are included. Next, move to the information disclosure sections, being transparent but concise in your language. Finally, complete the signature and date fields to authenticate the document. Use clear, concise writing throughout to prevent ambiguity.

Editing and managing your public disclosure form

Utilizing pdfFiller’s robust toolset for document management enhances the public disclosure form workflow. With features specifically designed for editing PDFs, users can ensure that all necessary amendments are made promptly. The ability to store documents in a cloud-based environment means easy access from anywhere, facilitating collaboration and review for teams irrespective of their location.

Collaborating with team members is made seamless with pdfFiller. The platform allows for real-time comments and discussions, enabling comprehensive feedback from multiple stakeholders before finalizing the document. Version control features are particularly useful for tracking changes and ensuring all parties are aligned with the most up-to-date information.

Signing and submitting your public disclosure form

The process of eSigning represents a seamless solution for digital signatures, enabling users to finalize their public disclosure form quickly. Electronic signatures carry the same legal weight as traditional signatures while offering convenience and efficiency. pdfFiller simplifies this process, allowing users to engage in a step-by-step eSigning process that is intuitive and straightforward.

Once signed, submission guidelines dictate the best practices for sending your public disclosure form. Opting for digital submission generally proves more efficient than traditional paper, especially in today’s fast-paced environment. After submission, keeping records is essential for future reference and compliance audits, ensuring that all relevant documentation is preserved.

Common issues and troubleshooting

Addressing common issues at the outset of your public disclosure form submission can save considerable time. Missing information is a frequent problem that can lead to delays or rejections. Double-check that all sections are completed, and any required documents are attached. Additionally, formatting errors often present obstacles; pay careful attention to the guidelines to ensure compliance.

Utilizing customer support available through pdfFiller can provide additional clarity and resolve potential challenges. Frequently asked questions (FAQs) can also serve as a valuable resource, helping users navigate the intricacies of the public disclosure form more effectively.

Best practices for maintaining compliance

Staying updated on the latest disclosure regulations is critical for any entity interacting with public disclosure forms. Regularly reviewing previously submitted forms enables organizations to ensure accuracy and compliance with evolving standards. Implementing automated reminders for upcoming disclosures minimizes the risks of missed deadlines, enhancing overall efficiency.

Establishing a routine for monitoring changes in regulations within specific sectors, such as those affecting corporate partnerships or nonprofit institutions in Texas, can prevent potential lapses in compliance. Leveraging resources such as professional associations can provide insights and updates relevant to public disclosure requirements.

Enhanced features of pdfFiller

The unique tools offered by pdfFiller support comprehensive public disclosure form management, ensuring users can navigate forms smoothly and efficiently. Integration capabilities with other software systems mean that organizations can incorporate pdfFiller into their existing workflows seamlessly, enhancing productivity. User testimonials reflect the positive experiences many have had, underscoring the importance of reliability and ease of use in managing disclosure forms.

By optimizing public disclosure reporting processes through these enhanced features, individuals and teams can focus more on delivering accurate information to stakeholders rather than being bogged down by cumbersome paperwork. The intuitive interface further encourages user adoption, ensuring that everyone involved can operate with confidence.

Encouraging transparency and ethical standards

Public disclosure forms are integral to upholding ethical governance standards in various sectors. By encouraging transparency, they help build trust between entities and the public. Open communication fosters a culture of accountability, and when organizations commit to disclosing relevant information, they contribute to a more informed society, especially in regions like Texas, where regulatory standards can be stringent.

Ultimately, promoting transparency and ethical standards through public disclosure is not just about compliance; it's about valuing the trust of constituents and stakeholders. When organizations prioritize transparency, they solidify their reputation and create a foundation for long-term relationships built on trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 102 - public disclosure for eSignature?

How do I make edits in 102 - public disclosure without leaving Chrome?

How can I edit 102 - public disclosure on a smartphone?

What is 102 - public disclosure?

Who is required to file 102 - public disclosure?

How to fill out 102 - public disclosure?

What is the purpose of 102 - public disclosure?

What information must be reported on 102 - public disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.