Get the free Mismanagement in asset disposal & auction process: IBBI ...

Get, Create, Make and Sign mismanagement in asset disposal

How to edit mismanagement in asset disposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mismanagement in asset disposal

How to fill out mismanagement in asset disposal

Who needs mismanagement in asset disposal?

Mismanagement in Asset Disposal Form: A Comprehensive Guide

Understanding mismanagement in asset disposal

Mismanagement in asset disposal refers to the ineffective or irresponsible handling of an organization's assets at the end of their useful life. This can include premature disposal, neglecting to follow regulatory guidelines, or failing to document the process adequately. Proper asset disposal is crucial as it not only maximizes an organization's financial recovery but also ensures compliance with legal standards and environmental sustainability.

Improper asset disposal can lead to significant financial losses, damage to reputation, and legal consequences. Common mismanagement scenarios include selling assets without proper valuation, discarding sensitive data without proper destruction, or not adhering to environmental regulations during disposal. For instance, a tech firm may dispose of outdated computers without wiping the hard drives, leaving sensitive client information vulnerable.

Real-life examples highlight the adverse effects of mismanagement. For instance, a large corporation faced penalties after it was discovered that it improperly disposed of electronic waste, violating environmental laws. This scenario underscores the importance of a structured asset disposal approach.

The asset disposal process

The asset disposal process includes a series of standard procedures designed to manage assets efficiently and responsibly. Key stages in the disposal process consist of assessing the asset's condition, conducting valuations and reporting findings, and selecting appropriate disposal methods. Organizations typically decide among several options: sale, donation, recycling, or disposal.

The assessment of assets involves a thorough inspection to determine their operational state and potential value. Following assessment, valuation and reporting help in establishing a fair market price. The chosen disposal method should align with the asset's type, its condition, and the organization's sustainability goals. For example, IT equipment might be best recycled or refurbished, whereas furniture could be sold or donated.

Selecting the right disposal method requires consideration of financial implications, social responsibility, and environmental impact, ensuring that the disposal aligns with organizational values.

Identifying risks associated with mismanagement

The mismanagement of asset disposal introduces several risks that can significantly impact an organization. Financially, mismanagement may result in lost revenue from underpriced asset sales or increased costs due to fines for legal non-compliance. Beyond financial concerns, there are legal and regulatory risks that could expose a company to lawsuits or penalties, especially if sensitive information is leaked or environmental laws are not adhered to.

Moreover, the environmental impact of improper disposal can have long-lasting repercussions, including pollution and habitat destruction. Not lastly, mismanagement can tarnish an organization's reputation, eroding stakeholder trust and customer loyalty. Hence, properly managing asset disposal is paramount to sustaining operational integrity and community goodwill.

Tools and solutions to aid in asset disposal management

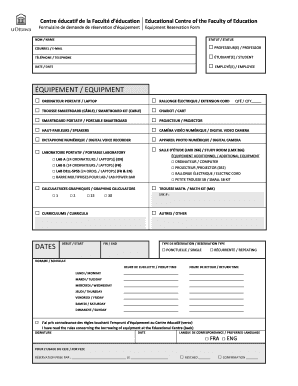

Organizations can leverage various tools to enhance their asset disposal management practices. Cloud-based management solutions have emerged as vital resources, enabling users to streamline document management processes. pdfFiller is an excellent example of such a solution, offering robust features tailored specifically for managing asset disposal forms.

pdfFiller provides comprehensive document editing capabilities, allowing users to modify asset disposal forms easily. Its eSigning functionalities ensure secure and efficient approvals, removing traditional bottlenecks in the process. Additionally, collaborative tools within pdfFiller facilitate teamwork, making it easier for teams to strategize on asset disposal collectively.

For organizations seeking proven success, a case study showcases how a tech company utilized pdfFiller to efficiently manage their asset disposal, significantly reducing their turnaround time and improving compliance with regulatory standards.

Best practices for effective asset disposal

Implementing best practices is vital for improving asset disposal processes and reducing the incidence of mismanagement. Establishing clear policies and procedures provides a framework for all employees, ensuring uniformity in handling disposed assets. Regular training sessions for staff involved in asset disposal help reinforce procedures, keeping everyone well-informed about current regulations and techniques.

Moreover, utilizing technology to enhance efficiency and accuracy in asset disposal is crucial. Tracking disposal processes through digital tools ensures detailed documentation, which is essential for audits. Continuous monitoring and evaluation of disposal practices further identify areas for improvement, bolstering compliance with industry standards and regulations. These steps minimize the chances of mismanagement, paving the way for successful asset retirement.

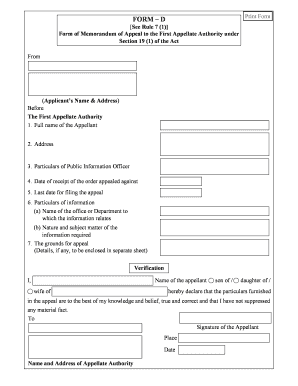

How to fill out an asset disposal form correctly

Filling out an asset disposal form correctly is crucial for ensuring proper documentation and compliance. Start by gathering all necessary information concerning the asset, including identification numbers, depreciation values, and the condition of the asset. Accuracy in reporting is vital, as incorrect information can lead to legal complications and financial discrepancies.

When completing the form, remember to include all relevant maintenance history and any prior valuations to substantiate the data being reported. Tips for eSigning and sharing the document digitally can streamline the approval process. Common errors include omitting important details or using outdated asset values, which can undermine the integrity of the form.

Using pdfFiller for asset disposal documentation provides an added advantage, allowing users to track changes, collaborate on forms in real time, and maintain clear records of all transactions.

Strategies to prevent mismanagement in asset disposal

Preventing mismanagement requires focused strategies that ensure all aspects of the asset disposal process are meticulously managed. Implementing comprehensive asset tracking systems allows organizations to maintain detailed records of all assets, which supports informed decision-making during disposal. Regular audits of disposal practices can identify inconsistencies and areas needing improvement, reinforcing adherence to policies.

Fostering a culture of accountability and transparency within the organization is also paramount. Engaging stakeholders throughout the disposal process boosts buy-in and enhances surveillance against mismanagement. For example, involving finance teams in asset valuation discussions fosters more accurate appraisals, while including management can ensure compliance with overarching organizational goals.

Challenges in asset disposal across various industries

Different industries face unique challenges in asset disposal that can complicate the process. For instance, the IT sector must contend with stringent data privacy regulations when disposing of hardware, necessitating thorough data destruction protocols. In the manufacturing industry, there are often complex supply chain considerations surrounding the disposal of machinery and equipment that may impact environmental compliance.

Healthcare, on the other hand, involves regulatory requirements around the disposal of medical waste, which can pose significant legal liabilities if not handled appropriately. Each sector must develop strategies tailored to its specific challenges while adhering to best practices in asset disposal management.

Case studies on successful asset disposal management

Examining successful case studies provides valuable insights into effective asset disposal management. In the tech industry, a leading company adopted a structured asset disposal program, resulting in a 30% reduction in costs associated with waste disposal while enhancing compliance with environmental regulations. They implemented a comprehensive tracking system that streamlined the disposal workflow and ensured detailed documentation of each disposal event.

Conversely, a retail company faced severe backlash after mismanaging asset disposal, leading to legal issues and damaged public trust. This case highlights the repercussions of inadequate disposal practices and the necessity for organizations to adopt thorough disposal strategies that include training, responsible documentation, and compliance monitoring. By analyzing these examples, organizations can glean lessons to avoid common pitfalls.

Frequently asked questions (FAQs)

Understanding common questions about mismanagement in asset disposal can enhance awareness and practices. Yes, signs of mismanagement include inadequate documentation, failure to follow regulatory guidelines, and losses from undervalued assets. It's advisable to adopt document management solutions like pdfFiller, which can streamline processes and minimize errors.

Legal implications of mismanaged assets range from monetary penalties to significant reputational damage. To prevent such issues, organizations should approach asset disposal strategically, ensuring all processes are documented and compliant with current laws. Doing so will maintain an organization's integrity and foster trust among stakeholders.

Future trends in asset disposal management

The landscape of asset disposal management is evolving, influenced by emerging technologies and sustainability trends. Innovations such as blockchain for tracking asset histories and artificial intelligence for optimizing disposal strategies are gaining momentum. These technologies promise to bolster transparency and accuracy, making disposal processes more efficient.

Additionally, increasing awareness of environmental sustainability is prompting organizations to focus on eco-friendly disposal methods, prioritizing recycling and responsible waste management. Predictions suggest that asset management practices will increasingly integrate these technologies and sustainable approaches, enhancing organizational responsibility and community engagement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mismanagement in asset disposal in Gmail?

How can I send mismanagement in asset disposal for eSignature?

Can I create an eSignature for the mismanagement in asset disposal in Gmail?

What is mismanagement in asset disposal?

Who is required to file mismanagement in asset disposal?

How to fill out mismanagement in asset disposal?

What is the purpose of mismanagement in asset disposal?

What information must be reported on mismanagement in asset disposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.