Get the free BOX 681

Get, Create, Make and Sign box 681

Editing box 681 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out box 681

How to fill out box 681

Who needs box 681?

A comprehensive guide to the Box 681 form

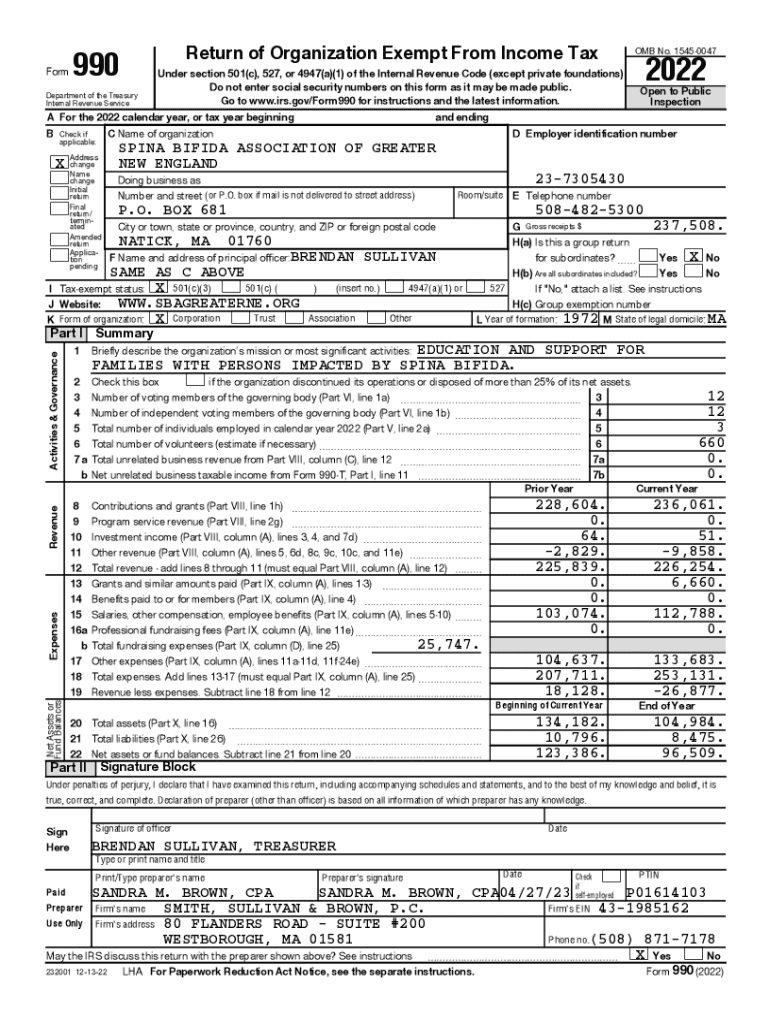

Understanding the Box 681 form

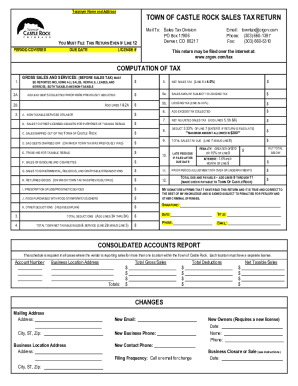

The Box 681 Form is a critical document utilized across various sectors for specific compliance and reporting purposes. It serves to standardize the collection of data relevant to regulatory or organizational requirements, ensuring that the information is recorded accurately and uniformly. This enhances efficiency and accountability, providing a clear audit trail when needed.

The importance of the Box 681 form extends beyond mere data collection; it is a crucial tool for decision-making and strategic planning. Accurate completion can affect everything from financial reporting to compliance with industry standards, significantly impacting an organization’s operations.

Who needs to use the Box 681 form?

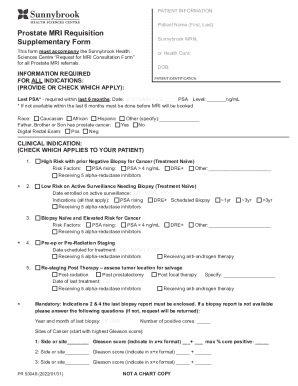

The Box 681 form is tailored for individuals and teams in diverse sectors, including finance, healthcare, and education. Anyone tasked with reporting, auditing, or regulatory compliance may find this form indispensable. It is particularly relevant when there are specific conditions or situations that require detailed information gathering or adherence to compliance protocols.

For instance, nonprofit organizations may use the form to report funding expenditures, while healthcare institutions might deploy it for patient-related data documentation to ensure compliance with regulations such as HIPAA. Its adaptable nature means that it may also be relevant for project managers documenting progress or outcomes.

Key features of the Box 681 form

Each section of the Box 681 form is designed with a specific purpose in mind. Generally, the form includes sections for personal information, financial data, and compliance-related queries. The clear delineation of sections allows users to easily navigate the form and fill it out accurately.

Key features include required fields for essential data, optional sections for additional notes, and checkboxes to streamline responses. Clarity in the design promotes user engagement and simplifies the completion process.

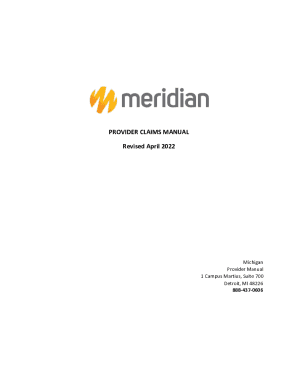

Integrating with PDF tools, such as pdfFiller, enhances the utility of the Box 681 form, allowing users to edit, sign, and manage the document efficiently. Using a cloud-based platform offers synergy in document management, making collaboration and accessibility far easier.

Step-by-step guide to filling out the Box 681 form

Before starting the Box 681 form, it is essential to prepare properly. This includes gathering all necessary information and documents that will be required to complete the form accurately. Additionally, users should ensure they meet the eligibility criteria for submitting the form.

Step 1 involves accessing the Box 681 form through pdfFiller. Users can locate the form by searching within the platform. Once found, it can be selected to begin the filling process. Accessing it through a well-organized platform like pdfFiller simplifies navigation.

Step 2 is filling out the form, where each section must be completed with the required information. It is advisable to read each prompt carefully and provide responses that are accurate and complete. To avoid common errors and omissions, users should use clear and concise language.

Step 3 involves reviewing entries thoroughly. Mistakes can have serious consequences, so careful checks of all information against source documents are crucial to ensure accuracy. This step acts as a safeguard against potential compliance issues.

Step 4 allows users to save and export the completed form in various formats like PDF or Word, making it easy to share or print. Clear instructions for exporting can be found on pdfFiller, ensuring users can easily save their work.

Editing and customizing the Box 681 form

pdfFiller’s editing tools enable users to add additional information or notes seamlessly to the Box 681 form. This functionality is especially useful for individuals who may need to provide clarifications or extra context regarding their submissions.

Furthermore, best practices recommend maintaining clarity and common formatting within the document. Users should strive to make necessary edits while adhering to form regulations so that the document remains acceptable for its intended purpose.

Signing and sharing the Box 681 form

eSigning the Box 681 form with pdfFiller is straightforward and enhances document security. Users can follow a step-by-step guide to add a digital signature to the document efficiently. Digital signatures are legally binding, providing an additional layer of verification and assurance for all parties involved.

When it comes to sharing the completed form, pdfFiller offers a variety of secure sharing options. Ensuring confidentiality and security during the document-sharing process is vital, as sensitive information may be included in the Box 681 form.

Managing and storing your Box 681 form

To maximize efficiency, organizing documents within pdfFiller is vital. Users should categorize and create folders in a manner that sections off different types of forms, making them easy to locate when needed. Tags can also be effectively utilized to enhance search capabilities.

Additionally, tracking the status and revisions of the Box 681 form supports proper management. Monitoring changes is crucial for compliance, and keeping a reliable record can serve as a reference for future submissions or audits.

Troubleshooting common issues with the Box 681 form

Common errors users may encounter while filling out the Box 681 form range from missing fields to inaccuracies in data entry. Addressing these issues involves understanding prompts fully and verifying information against source documents. A careful review of entries can help prevent pitfalls that might later affect compliance.

For users needing help or support, pdfFiller provides readily available resources. Self-help articles, FAQs, and options for contacting support can be invaluable for troubleshooting problems effectively.

Frequently asked questions about the Box 681 form

Many users have misconceptions regarding the requirements and completion of the Box 681 form. Clarifying these misunderstandings can improve efficiency and compliance. For example, understanding that the form's nuances vary by sector can prevent errors.

For those seeking additional information, pdfFiller offers resources that are easily accessible, including various guides related to the Box 681 form. Utilizing these resources can greatly improve users' understanding and overall experience.

Case studies and practical applications

Real-world scenarios demonstrate the effectiveness of using the Box 681 form. For instance, a local nonprofit utilized the form to streamline their reporting process, subsequently improving transparency with stakeholders. Similarly, a healthcare provider adopted the form to ensure compliant documentation of patient data, consequently enhancing trust in their processes.

pdfFiller supports diverse needs through functionality that adapts to various form requirements. This versatility illustrates how a single document can fulfill different purposes across sectors, emphasizing the need for robust document management solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit box 681 from Google Drive?

How do I complete box 681 online?

Can I edit box 681 on an Android device?

What is box 681?

Who is required to file box 681?

How to fill out box 681?

What is the purpose of box 681?

What information must be reported on box 681?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.