Get the free Consolidated Financial Statements ICF Group

Get, Create, Make and Sign consolidated financial statements icf

How to edit consolidated financial statements icf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consolidated financial statements icf

How to fill out consolidated financial statements icf

Who needs consolidated financial statements icf?

Understanding the consolidated financial statements ICF form

Understanding consolidated financial statements

Consolidated financial statements aggregate the financial results of a parent company and its subsidiaries into a single set of financial reports, providing a comprehensive overview of the company's financial health. Such statements are crucial for stakeholders to assess the overall financial position and performance of the entire corporate group.

They typically include three key components: the income statement, balance sheet, and cash flow statement. The income statement shows revenues, expenses, and profits, while the balance sheet lists assets, liabilities, and shareholders' equity, giving a snapshot of financial stability. Finally, the cash flow statement outlines cash inflows and outflows, revealing the company's liquidity and operational efficiency.

In financial reporting, the relevance of consolidated financial statements cannot be overstated as they provide a clear picture of a corporate group's performance, enabling investors, analysts, and management to make informed decisions.

Introduction to the ICF form

The Integrated Corporate Framework (ICF) form is a standardized reporting tool designed for consolidating financial statements. Its primary purpose is to streamline the reporting process among different entities within a corporate group, ensuring consistency and accuracy in the financial statements submitted.

The ICF form distinguishes itself from other financial forms by providing a comprehensive layout that encompasses all necessary disclosures for full financial transparency. Unlike typical financial forms that might focus solely on individual entities, the ICF captures the collective performance and position of those entities as a unified whole.

When to use the ICF form

Utilizing the ICF form is essential during specific scenarios such as mergers and acquisitions, where a holistic view of the financial implications of the business combination is necessary. This form ensures that all relevant financial data from the merging entities is accurately consolidated.

Additionally, it is crucial for annual financial reporting, when companies need to present their comprehensive financial health to stakeholders. Understanding the reporting requirements set out by regulatory bodies ensures compliance and helps avoid potential penalties or issues down the line.

Timing is another critical consideration; the ICF form must be submitted within specific deadlines to comply with financial regulations and maintain stakeholder trust.

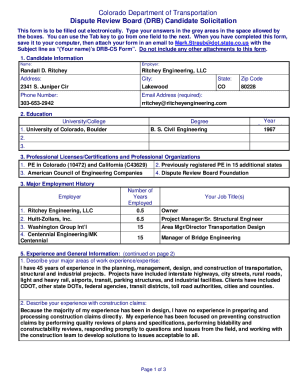

Step-by-step guide to filling out the ICF form

Filling out the ICF form requires attention to detail and accuracy. The form consists of several key sections that must be completed comprehensively. The first section involves providing parent company information, including the name, address, and registration details.

The second section focuses on subsidiary details, where each subsidiary's financial data must be accurately reported. This includes revenues, expenses, and asset figures necessary for proper consolidation.

When completing each section, it is vital to adhere to formatting guidelines and to avoid common mistakes such as misreporting figures or omitting required entries. Implementing best practices ensures the accuracy and reliability of the financial statements you report.

Editing and customizing your ICF form

Editing your ICF form can be a streamlined process using tools like pdfFiller. This platform provides diverse online editing features that make it easy to adjust the form based on your company's specific needs.

Users can add or remove sections according to their requirements and customize headers and footers to represent their brand accurately. Collaboration tools within pdfFiller allow multiple team members to work on the same form in real-time. This functionality greatly enhances workflow efficiency while ensuring that everyone is on the same page, literally and figuratively.

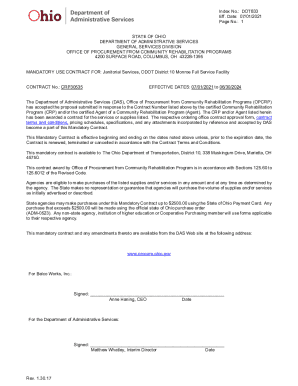

eSigning the ICF form

Including eSignatures in financial documentation is crucial for ensuring authenticity and legal compliance. The ICF form should be signed electronically to meet regulatory requirements efficiently. With pdfFiller, eSigning the ICF form is straightforward, allowing users to add their signature securely and efficiently.

To ensure legal compliance, it is vital to follow specific steps within pdfFiller's platform to execute an eSignature correctly. This process guarantees that the electronically signed form retains its integrity and security, maintaining the validity of the document.

Managing your ICF form after completion

Once you have completed the ICF form, effective management is essential. pdfFiller offers various options for saving and exporting documents, allowing users to choose their preferred format, especially PDF, for secure distribution.

Additionally, sharing capabilities facilitate seamless communication with stakeholders, ensuring that everyone involved has access to the necessary financial information. Maintaining a version history within pdfFiller helps track changes and updates, which is vital for audits and future reference.

Troubleshooting common issues

While using the ICF form, it’s not uncommon to encounter certain challenges. Common issues may include difficulty in navigation, data entry errors, or problems with electronic signing. Addressing these issues promptly is essential for maintaining the integrity of the reporting process;

pdfFiller provides users with support options and access to resources to troubleshoot these common hurdles. Users can easily reach out for assistance, ensuring they can navigate these challenges efficiently.

Future trends in consolidated financial reporting

The evolution of technology is significantly impacting financial reporting practices. As digital tools advance, consolidation processes will likely become more efficient, enabling real-time financial reporting capable of providing instant insights. Emerging regulations will continue to shape how organizations report consolidated statements, making adherence paramount.

Furthermore, automation will play an increasingly vital role in financial documentation, reducing the potential for human error and expediting the reporting process. As companies adapt to these trends, embracing new technologies will become essential for maintaining competitive advantage in an ever-evolving regulatory environment.

Leveraging pdfFiller for financial documentation efficiency

pdfFiller stands out as a premier platform for managing financial forms and the ICF form specifically. Its features cater to the unique needs of financial documentation, allowing users to edit, sign, and collaborate seamlessly.

Integration options with other financial software enable businesses to sync data effortlessly, further enhancing reporting capabilities. Testimonials from users reflect the efficiency and effectiveness of pdfFiller in streamlining financial reporting, demonstrating its significance in today’s corporate landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my consolidated financial statements icf in Gmail?

How do I edit consolidated financial statements icf on an iOS device?

How do I fill out consolidated financial statements icf on an Android device?

What is consolidated financial statements icf?

Who is required to file consolidated financial statements icf?

How to fill out consolidated financial statements icf?

What is the purpose of consolidated financial statements icf?

What information must be reported on consolidated financial statements icf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.