Get the free Estate of: John D Billek

Get, Create, Make and Sign estate of john d

Editing estate of john d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate of john d

How to fill out estate of john d

Who needs estate of john d?

Estate of John Form: A Comprehensive How-to Guide

Understanding the Estate of John Form

The Estate of John D Form is a crucial document in estate planning, specifically designed to facilitate the smooth management and distribution of assets after one’s passing. Its primary purpose is to provide a clear outline of the deceased's assets and liabilities, ensuring that beneficiaries can easily navigate the complexities of estate management. Estate planning plays a vital role in safeguarding one's assets and ensuring that designated beneficiaries receive what they are entitled to.

Understanding the legal context in which the Estate of John D Form operates is essential. Various laws and regulations at both federal and state levels affect how estates are handled. Notably, estate management regulations can vary significantly from state to state, influencing everything from tax implications to processes for asset distribution.

Detailed step-by-step guide to completing the Estate of John Form

Completing the Estate of John D Form requires meticulous attention to detail. Here’s a comprehensive guide to help you through the process.

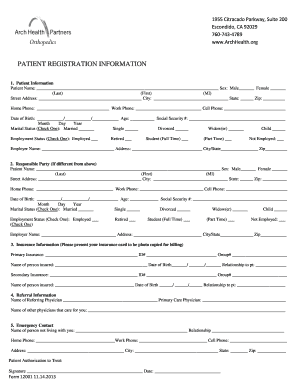

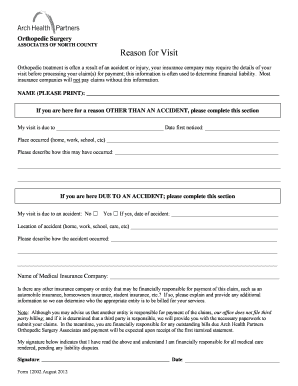

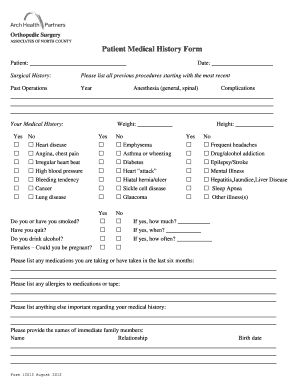

Gathering necessary information

Before beginning to fill out the form, gather essential documents and information. This includes personal identification, details of all assets and liabilities, and the contact information of potential beneficiaries.

Section-by-section breakdown

When filling out the Estate of John D Form, it's vital to categorize the information correctly:

Common challenges and solutions

Filling out the Estate of John D Form can be prone to errors, which might delay the estate processing. Common mistakes include inaccuracies in asset valuation and failing to provide complete information regarding beneficiaries.

To rectify mistakes, it's crucial to understand the processes in place. Amending an already submitted Estate of John D Form can typically be done through an addendum, ensuring all amendments are documented and submitted timely, keeping state-specific regulations in mind.

Digital tools and features to enhance form management

In today’s digital landscape, utilizing online platforms can significantly simplify the process of estate management. pdfFiller, for instance, offers a range of editing capabilities tailored for the Estate of John D Form.

Best practices for managing your estate documents

Once the Estate of John D Form is completed, proper management of the document is critical. Secure storage is recommended, considering potential future legal implications or audits.

Staying informed about legal changes in your state that may affect your estate plan is equally important to ensure your document remains valid and effective.

Case studies and real-life applications

Examining diverse case scenarios can illuminate the practicality of the Estate of John D Form. For instance, a scenario involving a homeowner with multiple properties could showcase the complexities involved in accurately declaring assets and determining fair beneficiary distribution.

Insights from estate planners indicate the significance of accurately completing the form to avoid family disputes and ensure smooth transitions of assets after death.

Harmful myths and misconceptions about estate planning

Misunderstandings around estate planning often deter individuals from pursuing proper documentation. One common myth is that only wealthy individuals need an estate plan. In reality, anyone with assets, regardless of their value, should consider having a well-drafted estate plan of which the Estate of John D Form is a vital part.

Clarifying the role of estate forms can help alleviate fears. Completing a form provides a structured approach to asset management and distribution, bringing peace of mind to both the individual and their beneficiaries.

Conclusion and next steps after form completion

After submitting the Estate of John D Form, ensure that you take additional steps to keep your estate plan on track. This might include notifying your beneficiaries about your estate plan and ensuring that they know where to find the necessary documents.

Maintaining an updated estate plan requires ongoing communication with your financial advisors and revisiting your documentation periodically, particularly following major life changes.

Why choose pdfFiller for your Estate of John Form needs

pdfFiller stands out as a comprehensive document management solution that simplifies the estate planning process. Its access-from-anywhere benefits enhance the user experience, making it easy to manage the Estate of John D Form and related documents securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my estate of john d in Gmail?

How do I edit estate of john d in Chrome?

Can I edit estate of john d on an Android device?

What is estate of john d?

Who is required to file estate of john d?

How to fill out estate of john d?

What is the purpose of estate of john d?

What information must be reported on estate of john d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.