Get the free 990-PF - Tax Return

Get, Create, Make and Sign 990-pf - tax return

Editing 990-pf - tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-pf - tax return

How to fill out 990-pf - tax return

Who needs 990-pf - tax return?

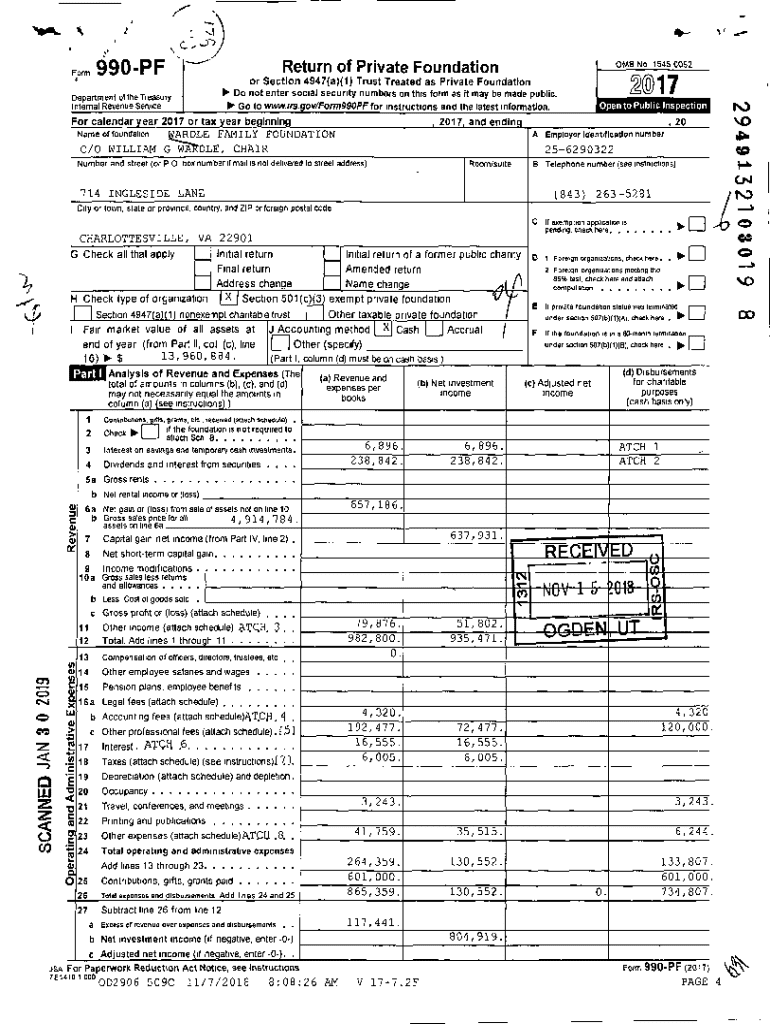

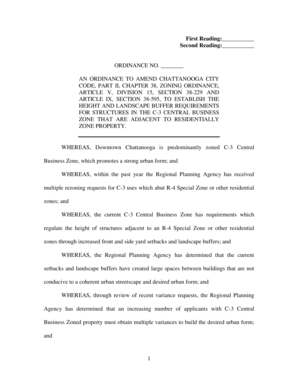

Understanding Form 990-PF: The Tax Return Form for Private Foundations

Understanding Form 990-PF

Form 990-PF is a crucial document that private foundations must file annually with the Internal Revenue Service (IRS). This form provides detailed information about the foundation's financial activities, governance, and accomplishments throughout the year. It serves as a public record of how foundations utilize their resources to fulfill their charitable missions.

The significance of Form 990-PF cannot be overstated. For foundations, this form operates not only as a compliance requirement but also as a transparency tool, demonstrating their commitment to philanthropy and responsible management of funds. Furthermore, it is utilized by grant seekers and the public to assess the foundation’s impact and financial health.

Who must file Form 990-PF?

Private foundations are defined as non-profit organizations established by individuals, families, or corporations, primarily to manage donated funds and support charitable activities. They are required to file Form 990-PF if they have gross receipts of over $100,000 in a tax year or if they have assets worth over $250,000.

Most foundations must comply with this requirement; however, there are exceptions. For instance, some smaller private foundations might not be required to file if their assets and gross receipts fall below these thresholds. Additionally, certain religious organizations may qualify for exemptions.

Key deadlines and filing dates

The annual deadline for submitting Form 990-PF is typically the 15th day of the 5th month after the end of the foundation's fiscal year. For example, if the fiscal year ends on December 31, the form must be filed by May 15 of the following year. Adhering to this deadline is vital to prevent late filing penalties.

For foundations with a fiscal year that does not align with the calendar year, it's important to track the specific deadlines based on their fiscal year-end. Additionally, forms can be extended if filed for through Form 8868, which gives an extra six months, ensuring that they meet their requirements without rushing.

Comprehensive breakdown of Form 990-PF

Form 990-PF is structured into several key sections, each serving specific purposes: Identification of the Foundation, Financial Data, Statement of Program Service Accomplishments, Report of Activities, and Supplemental Information.

To aid organizations in completing this form, each part requires specific types of information. For instance, Part I focuses on the foundation’s basic identification details, while Part II involves all financial data, including assets, revenues, and expenses. The Statement of Program Service Accomplishments provides a narrative about the foundation's goals and measurable outcomes.

Additional filing requirements

State-specific guidelines may vary, influencing how foundations report and what additional documents must accompany Form 990-PF submissions. Some states require supplementary forms that go beyond federal requirements, ensuring compliance with local regulations.

In terms of associated forms, Schedule B must be included if the foundation receives contributions exceeding certain thresholds. Schedule C is crucial for foundations involved in political lobbying or campaigns, documenting these activities to maintain compliance. Additionally, any unrelated business income must be reported appropriately, as it could impact the foundation’s tax-exempt status.

Common mistakes and penalties for late filing

Filing Form 990-PF correctly is vital, as errors can lead to significant penalties. Common mistakes include incorrect financial reports, inaccuracies in spelling or details of contributors, or omissions of required schedules. Each of these errors can impact the form's validity and the foundation’s obligations.

The IRS imposes penalties for late filings based on the organization’s size, starting with a minimum penalty of $20 per day, with a cap set at $10,500. It’s essential for foundations to track deadlines and set internal reminders to avoid these pitfalls. If a deadline is missed, foundations should take immediate action to submit the corrected forms as soon as possible to minimize penalties.

Filing Form 990-PF electronically

E-filing has gained popularity among private foundations, providing several advantages over traditional paper filing. The electronic process is typically more straightforward, reduces errors through autofill features, and allows for immediate confirmation of receipt by the IRS. Additionally, e-filing can expedite the processing time for approval.

To successfully e-file Form 990-PF, foundations can use various IRS-approved software platforms. Choosing the right tool ensures that the forms are accurate and dossier in the right format, reducing the risk of penalties associated with inaccurate submissions.

Using pdfFiller for Form 990-PF

pdfFiller provides a unique solution for filing Form 990-PF by empowering users with comprehensive editing and e-signing capabilities. This cloud-based service allows organizations to collaborate on documents, ensuring everyone involved in the process is on the same page.

The platform enhances the filing experience with user-friendly features such as template availability, allowing for efficient data entry into the designated areas of the form. Additionally, collaboration tools enable seamless communication, making it easier to gather required information quickly and accurately.

FAQs around Form 990-PF

Common queries about Form 990-PF often pertain to eligibility, information gathering, and potential amendments. Understanding these can ease the filing process for foundations.

Many wonder how to confirm if their foundation qualifies for Form 990-PF. The key is awareness of their foundation type and revenue — as most private foundations do qualify. Before filing, it’s crucial to gather specific documentation, including financial records and data concerning contributions. If revisions are necessary after submission, an amendment can be filed; this flexibility allows foundations to ensure accuracy over time. Finally, foundations that do not have income might still need to file an informational return, clarifying their activities during the reporting period.

Pro tips for completing your Form 990-PF

Completing Form 990-PF can be simplified with a thorough approach. Start by creating a checklist of required documents, including prior years’ filings, financial statements, and records of contributed services. This preparation will save valuable time and reduce the likelihood of errors.

Leveraging recommended resources, such as IRS instructions, can provide additional insight into completing sections correctly. Furthermore, the use of deadline reminders, possibly integrated into management software, can ensure timely submissions. This systematic approach can ultimately improve the accuracy and efficiency of the filing process.

Recent changes and updates to Form 990-PF

Legislation surrounding tax filing evolves regularly, impacting Form 990-PF requirements. For the 2024 tax year, be aware that significant revisions are being introduced to enhance transparency and compliance for private foundations. These changes include more detailed reporting on grants and contributions, focusing on the foundation’s impact within communities.

Foundations must remain vigilant about adapting to these evolving requirements, as failure to comply could result in penalties or loss of status. Being proactive ensures that foundations not only remain compliant but also support the broader charitable landscape effectively.

Success stories: Foundations that navigated Form 990-PF

Many foundations have successfully navigated the Form 990-PF process through careful planning and execution. For instance, a mid-sized foundation documented its grant-making initiatives effectively, showcasing their community impact in their filings. The foundation received positive feedback from stakeholders and beneficiaries alike, highlighting transparency and accountability as key to their success.

Lessons learned from these organizations include the critical importance of collaboration in completing the form and the necessity of thorough documentation throughout the year. By engaging team members in the preparation process, these foundations ensured accuracy and met IRS requirements without stress.

Conclusion

Successfully filing Form 990-PF is vital for private foundations, directly impacting their operations and public perception. Utilizing tools like pdfFiller can streamline the process, simplifying both the completion and submission of this essential document.

The importance of accurate reporting cannot be understated; it plays a significant role in maintaining tax-exempt status and fostering trust with donors and stakeholders. Embracing available technologies ensures that foundations can focus more on their charitable missions rather than the intricacies of tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 990-pf - tax return directly from Gmail?

How do I edit 990-pf - tax return online?

Can I create an electronic signature for signing my 990-pf - tax return in Gmail?

What is 990-pf - tax return?

Who is required to file 990-pf - tax return?

How to fill out 990-pf - tax return?

What is the purpose of 990-pf - tax return?

What information must be reported on 990-pf - tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.