Get the free PERSONS WITH SIGNIFICANT CONTROL REGULATIONS ...

Get, Create, Make and Sign persons with significant control

How to edit persons with significant control online

Uncompromising security for your PDF editing and eSignature needs

How to fill out persons with significant control

How to fill out persons with significant control

Who needs persons with significant control?

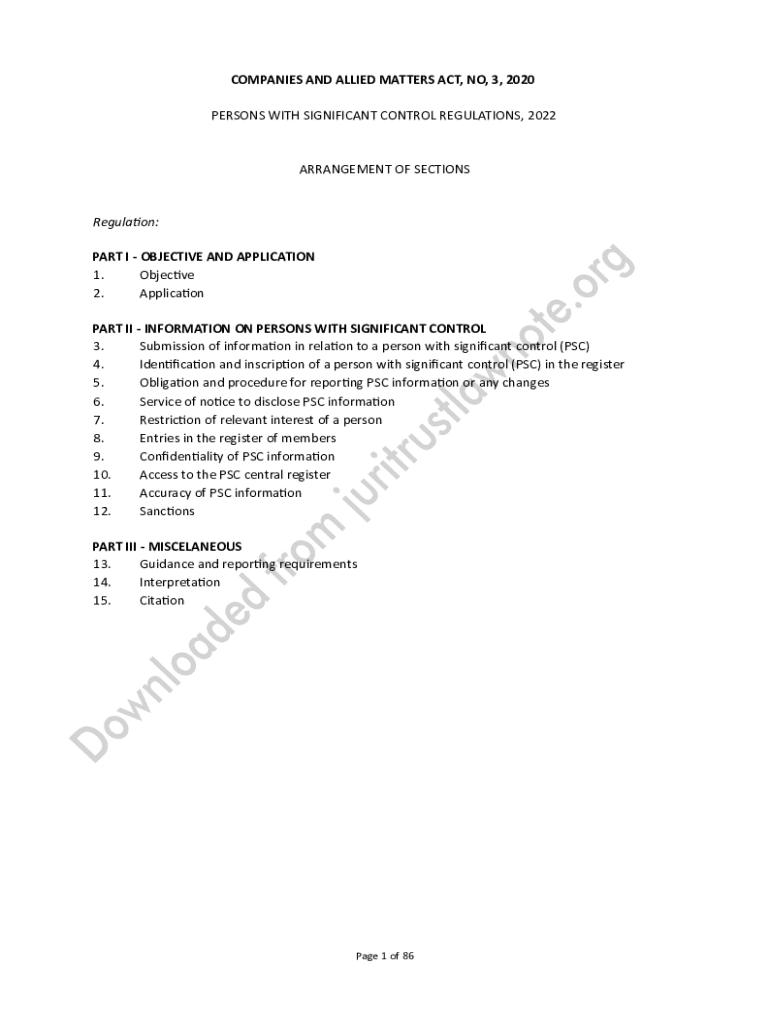

Understanding the Persons with Significant Control Form: A Comprehensive Guide

Overview of the Persons with Significant Control Form

The Persons with Significant Control (PSC) form is a critical document required for certain business entities operating within the United Kingdom. This form is essential for identifying individuals or organizations that have significant control over a company, thereby enhancing transparency in corporate governance. The PSC form serves to prevent fraudulent activities and money laundering by creating an accessible register of who has ultimate control over businesses.

Filing the PSC form is not just a bureaucratic necessity; it is a cornerstone of corporate responsibility. Inaccurate information or failure to file can lead to severe legal repercussions, including fines or restrictions placed on the business activities of non-compliant organizations. Understanding the purpose and importance of the PSC form is vital for anyone involved in company management or ownership.

Who Needs to File

Not all entities are required to file the PSC form, but a significant number of commercial organizations are mandated to do so. Generally, limited companies, limited liability partnerships (LLPs), and certain other organizations must submit a PSC form annually. Within these categories, any entity having a structure that allows individuals the ability to control the organization must ensure compliance.

The criteria for determining who qualifies as a person with significant control involves various factors such as ownership of over 25% of shares or voting rights, the right to appoint or remove the majority of the directors, and the ability to exercise significant influence or control over the company. Typical examples of individuals who may hold significant control include founders, major shareholders, and senior executives, all of whom must be accurately captured in the submitted PSC form.

Documentation required

To successfully fill out the PSC form, certain documentation is required to ensure that the data submitted is both accurate and verifiable. The primary documents include proof of identity, such as a valid passport or national ID card, as well as address verification documents like utility bills or bank statements no older than three months. These documents are essential in confirming the identities of individuals or entities claiming significant control.

When collecting supporting documents, it's critical to ensure that all information is current and not misleading. This can involve direct communication with the individuals identified in the PSC form to ensure they are aware their information is being submitted. Keeping this documentation organized is important for both legal compliance and corporate governance.

What to file: Completing the form

Completing the PSC form involves meticulous attention to detail. Each section requires specific information regarding the individual with significant control. Generally, the first section requests personal details such as full name, date of birth, and nationality. Following this, the individual must declare their nature of control, detailing aspects like shareholding percentages and voting rights. Additionally, any other relevant details about their relationship with the company should be articulated clearly.

A common mistake when filling out the PSC form is neglecting to include complete information or failing to verify the data provided. Each piece of information should be double-checked to avoid discrepancies, which could result in non-compliance. Ensuring accuracy is essential to maintain the integrity of public records and avoid future complications.

Step-by-step instructions for filing

Filing the PSC form can be straightforward if approached methodically. Here's a concise guide to ensure proper submission: First, access the PSC form online through the relevant governmental website. Carefully fill out each section according to the data required, ensuring that all entries are accurate and complete. Once you have finished, take the time to review your submission thoroughly to prevent any errors or omissions.

Next, submit the form via the designated online portals or, depending on your jurisdiction, possibly Microsoft Teams or email. After submission, you'll typically receive a confirmation. Keep this confirmation for your records as proof of filing and stay updated on any future requirements, especially considering any legal changes that may affect your obligations.

Language selection and accessibility

Ensuring that the PSC form is accessible to a broad audience is essential. Various language options are often provided, allowing users to complete the form in their preferred language. This is particularly important for international companies or those located in multilingual regions.

Accessibility features are also critical; they should cater to individuals with disabilities, ensuring that electronic forms can be navigated easily. These features can include screen reader compatibility, text size adjustments, and simplified navigation prompts, making the PSC form more user-friendly.

New obligations and updates

Filing requirements for the PSC form are subject to change, and it is crucial for all organizations to stay informed about recent updates. Recent changes may include the introduction of new categories of individuals who may be considered as having significant control or adjusted filing timelines. It is advisable to regularly check for legislative updates from official government sources, ensuring compliance with all current regulations.

Organizations must also heed the deadlines for compliance to avoid any potential fines or restrictions. Understanding the implications of these changes can impact your business's operational strategies, particularly if you rely heavily on external financing or partnerships.

Interactive tools and resources

The use of technology simplifies the process of preparing the PSC form and ensures accuracy. Online tools specifically designed for document preparation can provide user-friendly options to guide individuals and teams through every step of the process. These tools may offer checks for common errors and might streamline document collection and collaboration.

An FAQ section addressing common concerns can be especially useful for first-time filers, allowing them to find clarity on specific issues without sifting through extensive documentation. Further, sample forms and templates can serve as references, helping to assure that all necessary information is accurately captured and presented.

Managing your documentation

Organizing and managing documentation related to the PSC form is essential for both compliance and smooth corporate operations. This includes storing completed forms securely and ensuring that they are accessible when needed. Digital storage solutions can offer secure access to these critical documents from anywhere, especially beneficial for teams working remotely or in different geographical locations.

In addition to these storage solutions, best practices for record-keeping should be established. Regular reviews and updates are crucial, particularly when there are changes in control or ownership that need to be reflected in the PSC filings. Maintaining an organized system will also streamline future submissions and keep your business in alignment with its filing obligations.

Collaboration features

Collaboration is key when filing the PSC form, especially for larger organizations with multiple stakeholders. Digital solutions such as pdfFiller empower users to invite team members to collaborate on documents effectively. This feature encourages transparency and accountability, as all contributions can be tracked and reviewed by necessary parties.

Utilizing tools that allow feedback and edits directly on the PSC form can enhance the quality of submissions significantly. Strategies for effective document management involve clearly defining roles within your team and ensuring that everyone understands their responsibilities in the process of completing and filing the PSC form.

Troubleshooting and support

Filing the PSC form can present challenges, and it’s important to know how to resolve common issues that may arise. Typical problems include incomplete filings, incorrect information, or difficulties in submitting electronically. Proactive measures like double-checking all entries and utilizing checklists can mitigate many of these issues.

Should complications persist, having contact information for customer support or more detailed assistance resources can be extremely beneficial. Many online platforms also provide extensive help sections that can guide users through the most common obstacles encountered during filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my persons with significant control directly from Gmail?

How can I modify persons with significant control without leaving Google Drive?

How do I fill out persons with significant control on an Android device?

What is persons with significant control?

Who is required to file persons with significant control?

How to fill out persons with significant control?

What is the purpose of persons with significant control?

What information must be reported on persons with significant control?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.