Get the free -if"A

Get, Create, Make and Sign ifa

Editing ifa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ifa

How to fill out ifa

Who needs ifa?

Comprehensive Guide to the IFA Form: Everything You Need to Know

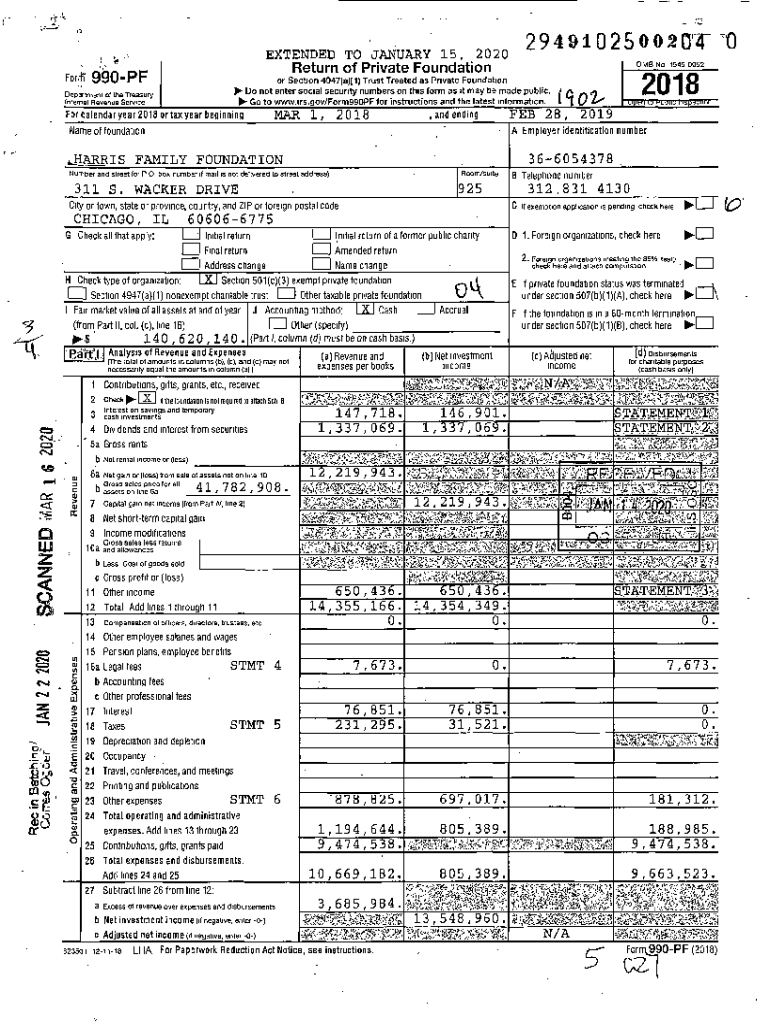

Overview of the IFA form

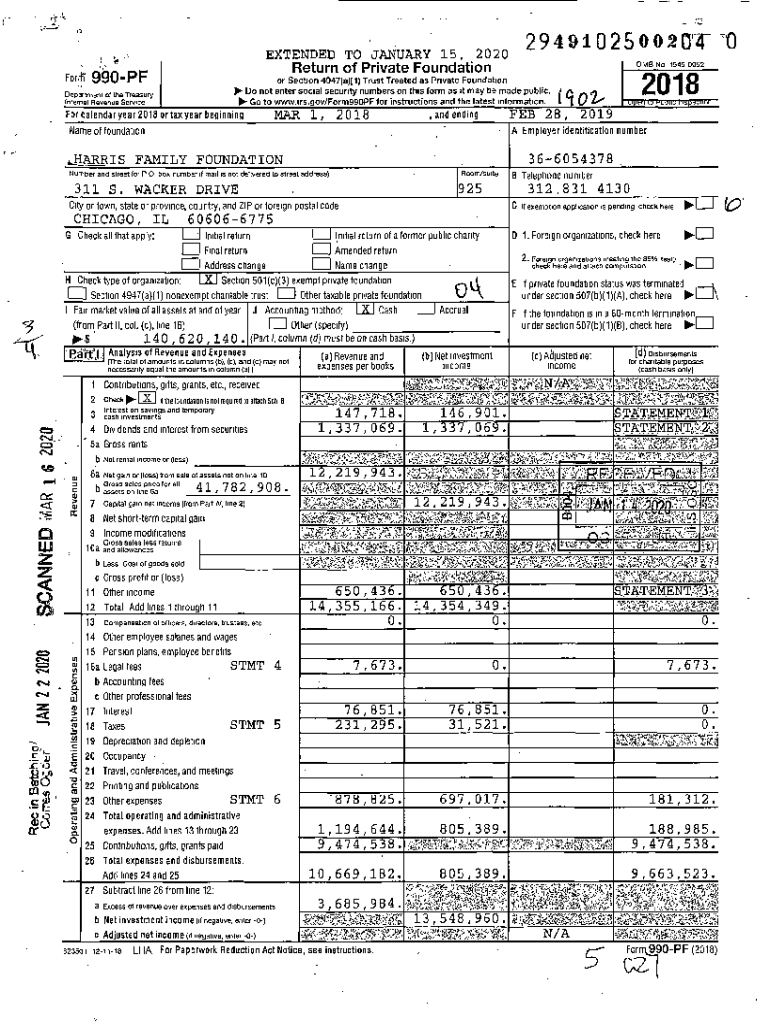

The IFA form, also known as the 'Individual Financial Application' form, serves as a critical document for those seeking financial services or products. Its primary purpose is to gather crucial personal and financial information from applicants, enabling institutions to assess eligibility for loans, credit, or investment opportunities.

The importance of the IFA form in document management cannot be overstated. It standardizes data collection, streamlining processes for both users and financial organizations. By ensuring that the right information is consistently collected, the IFA form minimizes the risk of incomplete applications and accelerates decision-making.

Understanding the components of the IFA form

The IFA form comprises several key sections integral to its functionality. Each section is designed to collect specific information necessary for financial assessments and risk evaluations.

Each component plays a vital role in determining the applicant's suitability. Personal information helps in verifying identity, financial details reflect the applicant's ability to repay loans, and authorization areas establish a legal basis for background checks.

Step-by-step guide to filling the IFA form

Filling out the IFA form correctly is crucial to ensure timely processing of your application. Start by preparing before you even begin typing.

Once prepared, begin filling out the form by addressing each section methodically.

Tips for editing and reviewing the IFA form

Editing and reviewing your IFA form before submission can prevent costly mistakes. Tools like pdfFiller make this process simple and efficient.

After editing, thorough review is essential. Here are some best practices.

eSigning the IFA form

eSigning has transformed how we handle documents, including the IFA form. It offers several advantages over traditional signing methods.

Security is paramount when it comes to eSigning. pdfFiller ensures compliance with legal standards, providing peace of mind that your signed documents are valid and secure.

Collaborating on the IFA form

Effective collaboration is essential when multiple stakeholders contribute to a single IFA form. pdfFiller provides tools that facilitate teamwork.

Managing feedback and revisions can make the difference between a completed form and one that requires rework. Establish protocols for addressing comments and document changes to ensure an efficient workflow.

Managing your IFA form after completion

Once your IFA form is completed, managing it effectively is just as crucial as the filling. pdfFiller offers several solutions for storage and sharing.

Common issues and FAQs regarding the IFA form

Navigating the IFA form can present challenges. Here are common issues and frequently asked questions that can streamline your process.

Compliance and legal considerations

Ensure that your completed IFA form meets all compliance and legal requirements to avoid potential issues.

Interactive tools for managing your IFA form

pdfFiller offers various interactive tools designed to enhance the document management experience, especially for forms like the IFA.

These interactive tools not only simplify the completion process but also foster greater engagement and accuracy.

Community insights and user experiences

Learning from the experiences of others can provide valuable insights into improving your handling of the IFA form.

Additional features of pdfFiller

Beyond the IFA form, pdfFiller provides a comprehensive suite of document management solutions.

Quick access links

Efficiency is crucial in document management, which is why quick access links enhance user experience on the pdfFiller platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ifa without leaving Google Drive?

How do I edit ifa online?

How can I edit ifa on a smartphone?

What is ifa?

Who is required to file ifa?

How to fill out ifa?

What is the purpose of ifa?

What information must be reported on ifa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.