Get the free Online efile GRAPHIC p rint

Get, Create, Make and Sign online efile graphic p

How to edit online efile graphic p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online efile graphic p

How to fill out online efile graphic p

Who needs online efile graphic p?

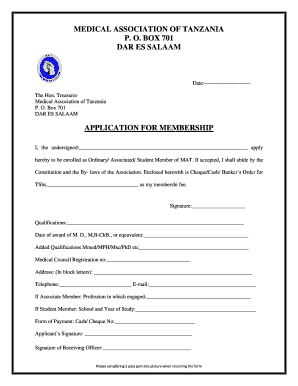

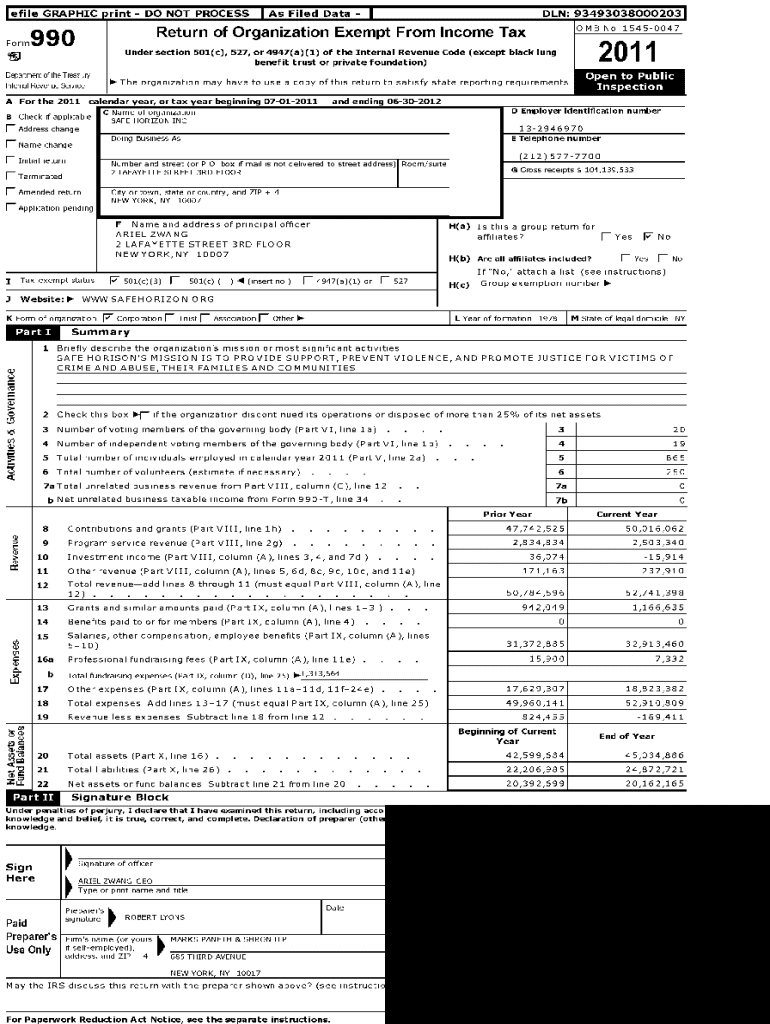

A comprehensive guide to the online efile graphic P form

. Understanding the online efile graphic P form

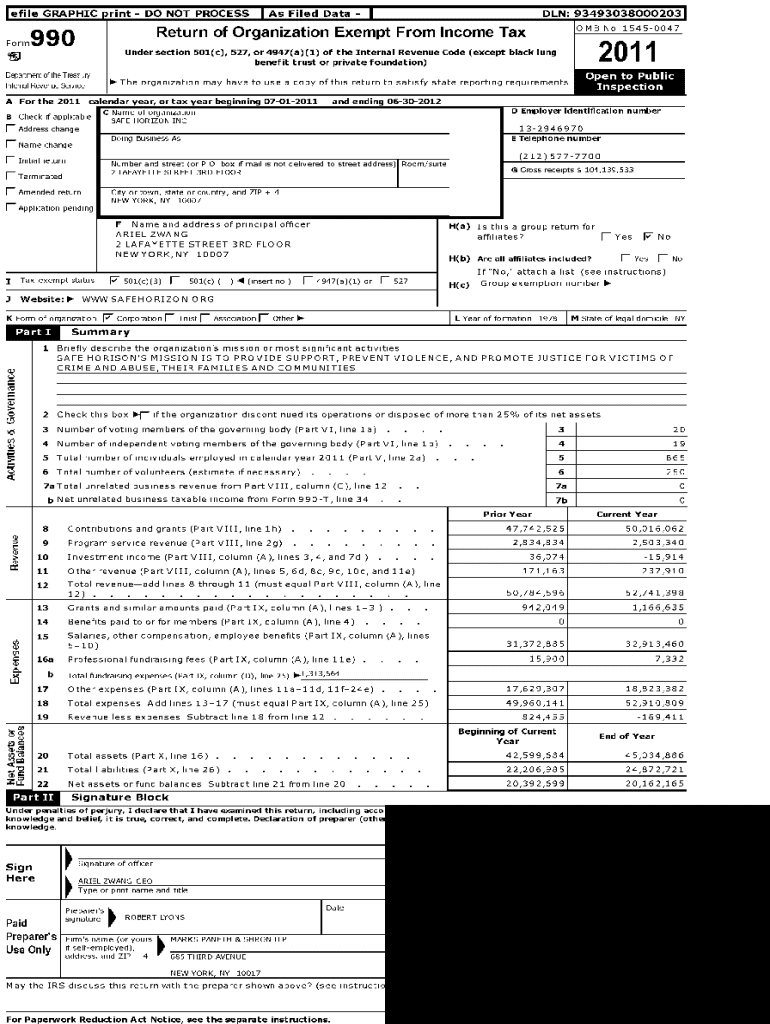

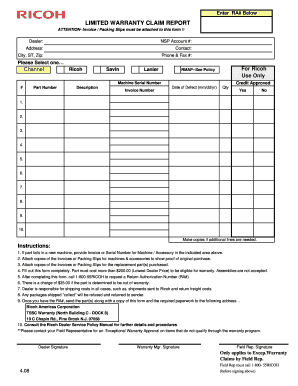

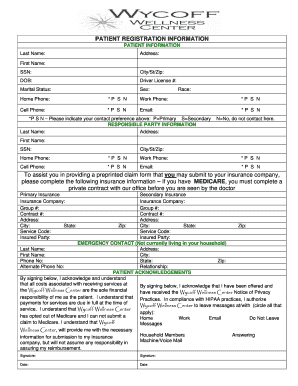

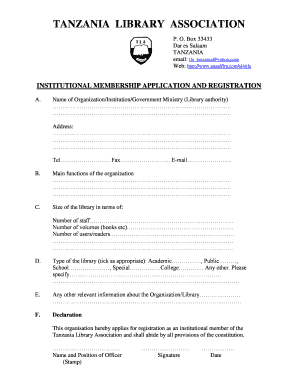

E-filing has revolutionized how forms are submitted and documents are managed, offering a more efficient and streamlined process for individuals and businesses alike. The online efile graphic P form is a specific template designed for particular e-filing needs, making it essential for various applications.

The Graphic P Form serves a vital purpose in ensuring that specific data is collected and processed accurately for both tax and regulatory compliance. Individuals, organizations, and professionals who require precise documentation must utilize this form to fulfill their obligations without hassle.

. Key features of the online efile graphic P form

One standout feature of the online efile graphic P form is its interactive tools that facilitate a smooth user experience. By leveraging these tools, users can complete the form quickly and effectively, ensuring that all necessary fields are filled without confusion. This interactivity leads to reduced errors and increased confidence in submissions.

Furthermore, managing documents could not be more seamless with the online efile graphic P form on pdfFiller. Users can easily edit, sign, and share the form utilizing a single cloud-based platform, eliminating the need for multiple applications and enhancing workflow efficiency.

. Step-by-step guide to using the graphic P form

First, accessing the online efile graphic P form is simple. Users need to sign in to pdfFiller's platform where they can locate the form. It is essential to download the latest version of the graphic P form to ensure compliance with current standards.

Once downloaded, users can upload the form to pdfFiller’s cloud interface, where they can start the filling process.

Next, when filling out the graphic P form, users should pay close attention to each field. Proper input ensures accuracy and reduces the likelihood of rejection upon submission. Tips include checking for consistent spelling and verifying all numerical entries.

After completing the form, users can leverage pdfFiller's editing tools for any adjustments necessary. Common edits might include correcting typos or updating figures.

Once the form is accurate, signing it electronically is the next crucial step. Users can easily create an e-signature and add it to the form, ensuring it is legally binding.

Finally, after signing, submitting the graphic P form is made straightforward with multiple options for file formats and the ability to track submission status conveniently.

. Common challenges and solutions

While navigating the online efile graphic P form, users often encounter issues such as incorrect field entries or unexpected technical glitches. For instance, if a user mistakenly fills out a field incorrectly, they should check the required format and make corrections promptly.

To address technical difficulties, it’s advisable to ensure a stable internet connection and updated browser version. In scenarios where forms remain unresponsive, refreshing the page usually resolves the issue.

FAQs are common among users, especially for questions like what to do if a submission needs to be corrected or how to save progress while filling out the form. Most platforms enable the user to go back and amend submissions, while progress can often be saved automatically within the cloud.

. Leveraging pdfFiller for collaboration

One of the key advantages of using pdfFiller is the ability to collaborate effectively with team members on the graphic P form. Users can easily share the form with colleagues and invite them to participate in real-time editing. This direct collaboration streamlines the workflow tremendously and ensures that everyone involved stays informed.

To effectively manage workflows, users can also set permissions and access levels for others, ensuring that collaboration occurs smoothly, without overcomplicating the document chain. This approach enables team discussions and edits to occur in a unified manner.

. Resources for effective document management

To gain the most from pdfFiller, users are encouraged to use keyboard shortcuts to improve their efficiency. Utilizing features like auto-save, revision history, and collaboration notes will surely enhance one's document management experience.

Best practices can also significantly elevate the document signing process. For instance, ensuring that all parties involved have visibility on document changes and updates fosters open communication and reduces misunderstandings.

Additionally, pdfFiller provides a range of related forms and templates that can be beneficial. Whether you’re looking for tax forms, business contracts, or licenses, the platform offers a library of documents ready for customization.

. User testimonials and case studies

Individual users have reported successful experiences when using the graphic P form for e-filing, citing the ease of access and the user-friendly interface of pdfFiller as significant advantages. Many teams have improved their document handling processes due to enhanced collaboration tools, leading to quicker completion times.

Success stories come from various sectors, highlighting how groups have streamlined their workflows and reduced the time spent on documentation management.

. Keeping updated with e-filing regulations

Staying informed about e-filing regulations is crucial for ensuring compliance and avoiding penalties. Recent changes affecting the graphic P form may include updates in submission deadlines or modifications in required information. By utilizing resources from regulatory bodies and law firms, users can stay up to date with necessary adjustments.

Regularly reviewing e-filing standards ensures that users understand their obligations, helping them to file correctly and on time.

. Your path to effortless document management

Creating a seamless document workflow involves adopting modern solutions like pdfFiller. With the ability to edit PDFs, eSign documents, collaborate with teams, and manage submissions all in one place, users can effectively streamline their processes. Utilizing the online efile graphic P form through this platform brings significant ease to documentation tasks that were once daunting.

With the right tools and practices in place, individuals and teams can enjoy a more efficient and error-free document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the online efile graphic p in Gmail?

Can I edit online efile graphic p on an iOS device?

Can I edit online efile graphic p on an Android device?

What is online efile graphic p?

Who is required to file online efile graphic p?

How to fill out online efile graphic p?

What is the purpose of online efile graphic p?

What information must be reported on online efile graphic p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.