Get the free Form 424B2 - Prospectus Rule 424(b)(2) - ADVFN

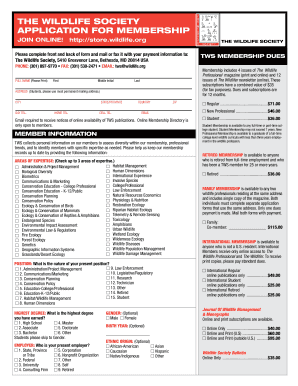

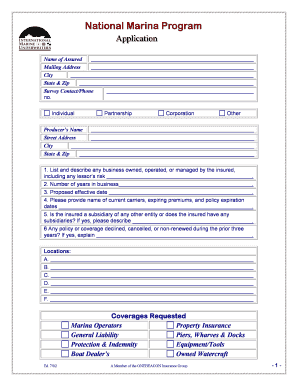

Get, Create, Make and Sign form 424b2 - prospectus

Editing form 424b2 - prospectus online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 424b2 - prospectus

How to fill out form 424b2 - prospectus

Who needs form 424b2 - prospectus?

Form 424B2 - Prospectus Form: A Complete How-to Guide

Understanding the 424B2 prospectus form

The 424B2 prospectus form is a critical document utilized in the financial markets, helping companies disclose important information about their securities offerings. It is designed as an integral part of the registration process with the Securities and Exchange Commission (SEC). The primary purpose of the form is to provide potential investors with a comprehensive overview of the investment opportunity, detailing not just the merits but also the risks involved.

In financial reporting and securities regulation, the significance of the 424B2 form cannot be overstated. By mandating a standardized disclosure process, it ensures that all pertinent information is accessible to investors, thus promoting informed decision-making. This level of transparency is vital for maintaining trust in the financial markets.

When is the 424B2 form required?

A 424B2 filing is required during various situations, primarily when a company plans to issue securities after an initial registration statement has been filed. This form particularly comes into play when a company needs to provide updated information regarding the offering, such as revised prospectus material or changes in the intended use of proceeds. Typically, these filings occur during initial public offerings (IPOs) or subsequent offerings, ensuring that investors have the most current data.

Compliance is paramount; thus, organizations must meet specific deadlines for submitting their 424B2 forms, usually tied to the offering’s timeline. This necessitates careful planning and coordination within the company’s financial and legal teams to ensure timely submissions.

Who should use the 424B2 form?

The target audience for the 424B2 form primarily consists of publicly traded companies engaging in securities offerings. It is particularly relevant for firms in finance, technology, healthcare, and any sector that seeks public investment. Whether a well-established corporation or a startup planning an IPO, adhering to the 424B2 requirements is essential for regulatory compliance and investor relations.

In scenarios where companies are looking to raise capital, utilizing the 424B2 form is crucial. It safeguards the company's interests by ensuring that all material information is disclosed to the market, thus positioning them favorably in the eyes of both investors and regulatory bodies.

Key components of the 424B2 form

Understanding the essential sections of the 424B2 form is key to assembling a complete and compliant prospectus. Among the primary sections, you will find the Cover Page, Prospectus Summary, Risk Factors, Use of Proceeds, and Financial Statements. Each of these sections serves a specific purpose and must be completed with care and accuracy.

The Cover Page typically includes the name of the issuing company, the type of securities being offered, and relevant transaction details like pricing and offering size. The Prospectus Summary distills the complex information into an at-a-glance view of the offering, capturing essential aspects such as business objectives and key financial metrics.

Risk Factors are critical; they outline possible challenges and risks associated with the investment, allowing investors to make an informed choice. The Use of Proceeds clearly articulates how the funds raised will be allocated, which is vital for building investor confidence. Lastly, the Financial Statements provide a snapshot of the company's financial health, crucial for assessing the investment potential.

Detailed breakdown of each section

In filling out the Cover Page, companies must be precise. It should detail the security type, name of the issuer, and managerial details. Meanwhile, in the Prospectus Summary, it’s essential to touch upon the company’s operational history, market opportunities, and strategic goals, condensed into a concise narrative.

Investors pay keen attention to the Risk Factors section; therefore, it should encapsulate every conceivable risk, ranging from market risks to regulatory changes, ensuring transparency. The Use of Proceeds section should specify intended applications of raised funds, such as project financing, and operational costs, reinforcing trust with potential investors. Finally, the Financial Statements should include, at a minimum, the latest balance sheet, income statement, and cash flow statement, enabling investors to perform their analyses effectively.

Step-by-step guide to completing the 424B2 form

Creating a 424B2 form begins with gathering necessary information. To streamline this process, companies should compile all required documents—including financial records, strategic plans, market analysis reports, and legal disclosures—prior to starting the fill-out process. Organizing this information can save time and reduce errors, ensuring that all data needed is at your fingertips.

Next, the actual filling out of the form requires meticulous attention to detail. Start by completing the Cover Page with precise data. Follow with the Risk Factors, ensuring you elaborate on all potential investment risks clearly. It's vital to substantiate the descriptions with factual data and avoid vague language.

When completing the Financial Statements, ensure that all figures are accurate and in compliance with generally accepted accounting principles (GAAP). A common pitfall to avoid is insufficient or vague disclosures, which can lead to regulatory scrutiny. Before submission, review the completed form thoroughly, checking for grammatical errors and verifying the accuracy of financial figures.

Editing and reviewing your work

Thorough proofreading is essential, not just for clarity but also for compliance. Companies are encouraged to develop a review checklist before submission. This checklist can include ensuring all sections are complete, documenting any changes from prior filings, and confirming alignment with the latest SEC regulatory requirements.

Common challenges and solutions

While preparing the 424B2 form, several challenges can emerge, particularly regarding regulatory understanding. Companies might find themselves uncertain about specific requirements, leading to incomplete or erroneous filings. Another frequent issue is the difficulty in gathering timely and accurate financial data, which can delay the entire process.

To mitigate these issues, it is recommended to engage professional consultants specializing in regulatory compliance for guidance. Utilizing technology and integrated document management systems can significantly enhance data collection and organization. Such systems also help keep historical records for easy reference.

eSigning and managing your 424B2 form

The signing of the 424B2 form is a significant step in the filing process, as electronically signing the document may carry legal implications. Properly executed signatures confirm that individuals take responsibility for the accuracy and legality of the information contained in the filing. It’s crucial for companies to ensure the signatories hold the appropriate authority to bind the organization.

pdfFiller offers a seamless eSigning process which simplifies this critical component. By utilizing pdfFiller, signatories can electronically sign the form with just a few clicks. To facilitate collaboration, teams can leverage pdfFiller’s platform to draft, edit, and finalize the form asynchronously, ensuring all inputs are captured efficiently.

Storing and accessing your completed form

Once your 424B2 form is signed, managing the document securely is paramount. pdfFiller provides users with cloud storage options, ensuring that completed forms are easily accessible while maintaining data security. Companies should adopt best practices for document management, such as using strong passwords and enabling two-factor authentication to protect sensitive information.

Additional insights on the 424B2 prospectus form

Keeping abreast of updates and changes in regulations surrounding the 424B2 prospectus form is crucial for compliance. Companies must monitor trends that may influence prospectus filings, including changes in financial reporting requirements and evolving SEC guidelines. Understanding these shifts can help organizations preemptively adjust their procedures.

Noteworthy case studies illustrate successful filings utilizing the 424B2 form. For instance, a well-known tech startup that adjusted its disclosures based on feedback from initial investors significantly improved its market reception during its subsequent offering. Companies can glean valuable lessons from such real-world applications, enhancing their own filing strategies.

Leveraging pdfFiller for document management

Choosing pdfFiller as a document management solution has numerous advantages. Its distinct features enable users to create, edit, and manage forms like the 424B2 seamlessly from anywhere with internet access, making it ideal for teams that operate in various locations. The platform supports comprehensive collaboration, which aligns well with the needs of individuals and teams who customize documents frequently.

Interactive tools available within pdfFiller enhance form-filling efficiency. Users can annotate documents, insert signatures, and track changes, streamlining the collaborative process significantly. Moreover, the platform prioritizes compliance and security, ensuring that all user data is protected, thus alleviating concerns regarding sensitive information management.

FAQs about the 424B2 prospectus form

Navigating the complexities of the 424B2 form can lead to several questions among first-time filers. Common inquiries generally revolve around filing procedures, deadlines, and required information. Companies contemplating their first filing often wonder about the necessary steps to ensure compliance and avoid pitfalls.

To assist newcomers, it’s essential to highlight key takeaways. Familiarizing oneself with both the content and structure of the form while consulting with regulatory experts can mitigate risks. Additionally, seeking resources, such as seminars or online guides, can provide valuable insights and enhance overall preparedness for the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form 424b2 - prospectus electronically in Chrome?

How can I edit form 424b2 - prospectus on a smartphone?

How do I fill out the form 424b2 - prospectus form on my smartphone?

What is form 424b2 - prospectus?

Who is required to file form 424b2 - prospectus?

How to fill out form 424b2 - prospectus?

What is the purpose of form 424b2 - prospectus?

What information must be reported on form 424b2 - prospectus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.