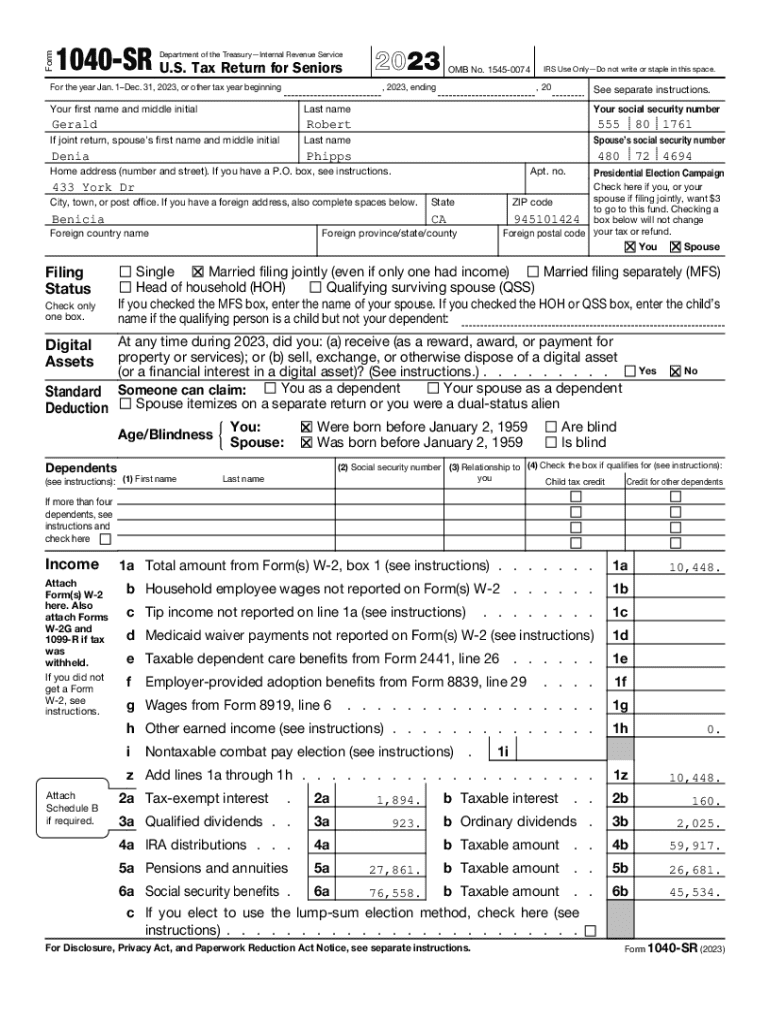

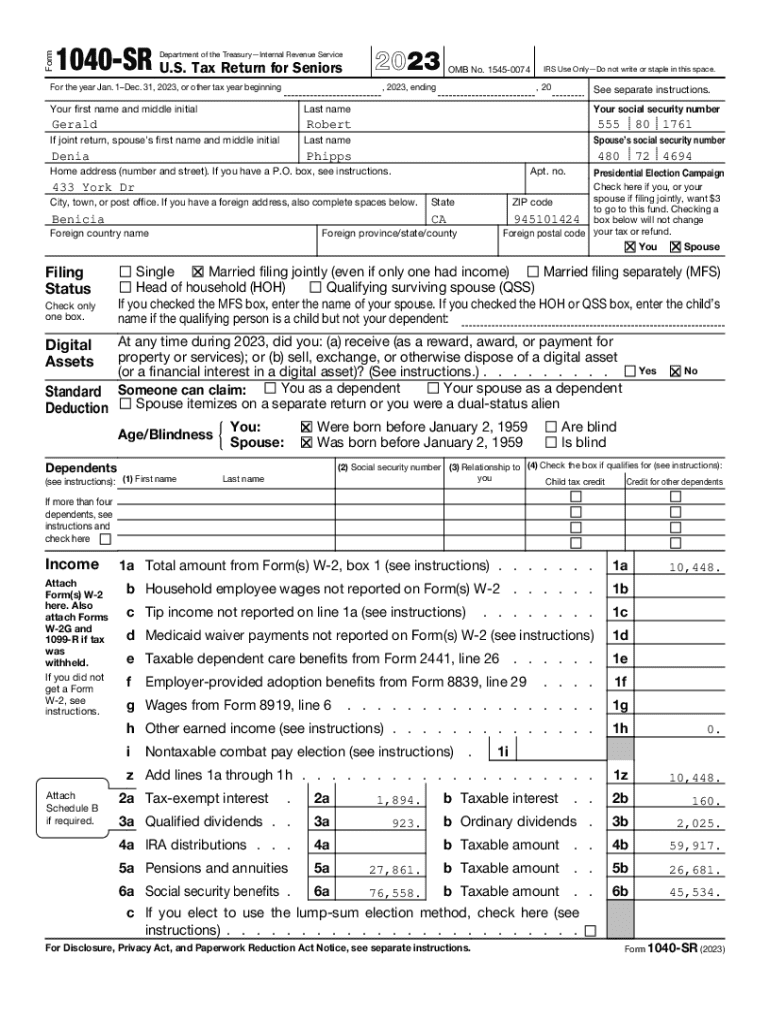

Get the free U.S. Tax Return for Seniors - Form 1040-SR 2023

Get, Create, Make and Sign us tax return for

Editing us tax return for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out us tax return for

How to fill out us tax return for

Who needs us tax return for?

US Tax Return for Form: A Comprehensive Guide

Understanding US tax returns

A US tax return is a formal declaration of income, expenses, and other relevant financial information submitted to the Internal Revenue Service (IRS). It reflects an individual’s or entity's taxation obligations for a specific financial year. Filing a US tax return is not only a legal requirement but also a crucial component of financial planning.

The importance of filing goes beyond compliance. A well-prepared tax return can influence future financial decisions, including investment opportunities and eligibility for loans. Moreover, understanding your tax obligations can help you optimize your deductions and credits, leading to potential tax savings.

Overview of common tax forms

Filing your tax return involves selecting the correct forms. For individual taxpayers, several key forms are frequently utilized. The primary form is Form 1040, the U.S. Individual Income Tax Return, designed for most taxpayers. For seniors, there is Form 1040-SR, which includes larger font sizes and standard deductions beneficial to older individuals.

If you're a nonresident, Form 1040-NR is relevant for reporting your income. In specific situations, you may need to include additional forms such as Form 1099 for miscellaneous income or Schedule C to report profit or loss from business activities. Selecting the right forms sets the foundation for an accurate and compliant tax submission.

Step-by-step guide to filling out your tax return

Filling out your tax return can seem daunting, but breaking it down into manageable steps simplifies the process. **Step 1** is to gather all required documents, such as W-2 forms from your employer, 1099 forms for freelance work, and any receipts applicable for deductions or credits. Organizing these documents beforehand streamlines the completion of your forms.

In **Step 2**, you'll choose the appropriate form based on your situation—whether it's the standard Form 1040 or a variation like 1040-SR. Make sure to consider supplementary schedules that may apply to you. For **Step 3**, completing the form involves meticulously filling out each section. Take the time to read instructions carefully to avoid common pitfalls like incorrect Social Security numbers or misreported income.

Finally, in **Step 4**, calculate your tax liability. Understanding the current tax brackets and applicable rates can help you determine how much you owe or the refund you can expect. Differentiate between deductions, which reduce your taxable income, and credits, which reduce your tax bill directly!

Utilizing editing and management tools for your tax documents

Navigating the realm of tax forms has never been easier with pdfFiller's extensive features. This platform allows users to edit PDFs effortlessly, ensuring that your forms are both accurate and properly formatted. Its eSignature feature also enables secure submissions by allowing you to sign documents electronically, saving crucial time and mitigating risks associated with postal submissions.

Additionally, pdfFiller simplifies document management through its interactive tools that track form completion progress. With cloud accessibility, you can securely access your documents from anywhere, making it convenient for users who often find themselves on the go.

Collaborating with others

When it comes to tax filings, collaboration can be essential, especially in scenarios like joint filings or when seeking assistance from a tax professional. It's noteworthy to engage with knowledgeable individuals who can provide guidance on complex tax matters. Using pdfFiller can significantly ease this collaboration process.

The platform allows secure sharing of forms with tax advisors or partners, ensuring that everyone involved is on the same page. This way, you can collectively navigate the filing process without the hassle of physical documents being passed around.

Submission guidelines for US tax returns

Once your tax return is complete, the next crucial step is submission. You can file your tax return either electronically (e-filing) or via postal mail. E-filing is recommended as it tends to be faster and can help you receive your refund more quickly. Always be aware of deadlines to avoid penalties, which can add unnecessary financial strain.

For everyone e-filing, ensure you keep an eye on submission statuses through IRS tools that let you check your refund status, so you know when to expect your refund. Moreover, there are resources available from the IRS to assist you throughout the process.

What to do after filing

After submitting your US tax return, understanding the IRS review process is vital. It’s essential to retain a copy of your tax return and associated documents for potential audits. In the event of an audit, responding promptly and accurately based on your filed return and supporting documentation can ease the process significantly.

Best practices include keeping all tax records for at least three years from the filing date. This duration is recommended in case the IRS decides to examine your return, allowing you ample time to provide requested information without the risk of losing valuable documentation.

FAQs about US tax returns

Navigating the world of tax forms can lead to many questions. Common inquiries often revolve around how to report specific income types or what deductions are available. Additionally, many face challenges when attempting to troubleshoot common filing issues such as misplaced forms or incorrect information.

It's beneficial to consult IRS resources and community forums where tax professionals and other taxpayers share experiences and insights while addressing frequently asked questions. Engaging in these platforms can also help you stay updated on changing tax laws and filing best practices.

Interactive tools for managing tax forms

pdfFiller provides an array of interactive templates specifically designed for tax-related documents that can vastly improve your efficiency. By utilizing these templates, users can quickly input required information and adjust any details as needed, significantly reducing the time spent on manual entries.

The advantages of interactive tools over traditional methods are substantial. These tools not only minimize errors but also facilitate easier updates and edits, enhancing accuracy while saving time—key benefits for every taxpayer striving for precision in their filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my us tax return for directly from Gmail?

How do I edit us tax return for in Chrome?

How do I edit us tax return for on an iOS device?

What is US tax return for?

Who is required to file US tax return for?

How to fill out US tax return for?

What is the purpose of US tax return for?

What information must be reported on US tax return for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.