Get the free AMERICAN FUNDS STRATEGIC BOND FUND Form N- ...

Get, Create, Make and Sign american funds strategic bond

Editing american funds strategic bond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out american funds strategic bond

How to fill out american funds strategic bond

Who needs american funds strategic bond?

A comprehensive guide to the American Funds Strategic Bond Form

Understanding the American Funds Strategic Bond Form

The American Funds Strategic Bond Form is a crucial document for investors looking to manage their fixed-income investments. This form is specifically designed to provide detailed information regarding bond investments recommended by American Funds, allowing for a streamlined process in capturing investment decisions. Its significance extends beyond mere paperwork; it serves as a vital tool in ensuring compliance, transparent decision-making, and efficient management of investment selections.

Key features of the American Funds Strategic Bond Form include structured sections that elicit necessary data points about bond allocation, preferred maturity ranges, and sources of income. The form also aids in keeping all stakeholders informed and accountable, thus enhancing overall investment strategy execution.

Detailed insights into American Funds

American Funds is well-known in the investment community for its comprehensive offerings that span across various asset classes. Their strategic bond investments are an essential component for many portfolios, designed with clear objectives that cater to both income generation and capital preservation. Investors can leverage these funds to benefit from a balanced approach to fixed-income exposure.

Bonds play a pivotal role in a diversified investment portfolio, primarily serving to mitigate risks associated with equity investments while providing steady income through interest payments. By allocating a portion of investments in bonds, individuals and institutions can achieve a more stable return, making strategic bonds an attractive option for risk-conscious investors.

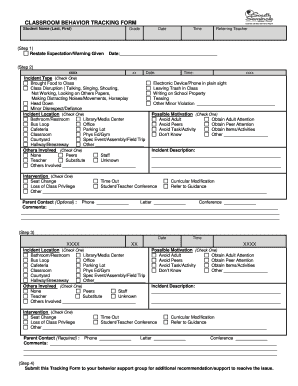

Step-by-step instructions for completing the form

1. Accessing the form

To begin, navigate to the pdfFiller platform, which houses a variety of financial documents, including the American Funds Strategic Bond Form. A quick search or clicking through relevant categories will lead you to this specific form. Ensuring you have the right document is essential for maintaining an organized approach to your investment decisions.

2. Filling out the form

When filling out the form, take note of detailed guidelines provided for each section. It's vital to include accurate data, such as your investment goals, expected returns, and any specific constraints. Be wary of common pitfalls—such as assuming information from past forms still applies or failing to update your financial status—which could lead to inaccurate investment representations. Double-check your entries to ensure they reflect your current investment strategy.

3. Editing the form

pdfFiller offers intuitive tools for making necessary changes to your form. If there’s a need for collaboration, multiple users can work on the form in real-time, enhancing communication and preserving clarity in investment discussions. Make use of commenting options to facilitate feedback and suggestions.

4. Signing the form

Once satisfied with the form's content, you can eSign directly within pdfFiller. The platform supports legally binding electronic signatures, ensuring that your signed document holds legal validity, similar to traditional paper signatures. This streamlines the process of obtaining necessary approvals.

5. Saving and managing your form

Completed forms can be saved directly to your account on pdfFiller’s cloud platform. This method ensures that you have easy access to all your documents whenever required. It’s advisable to implement best practices for organizing your documents—such as creating folders based on project or investment category—to streamline future access.

Interactive tools available in pdfFiller

pdfFiller is equipped with a range of interactive features designed to ease the document management process. Users can utilize pre-made templates for the American Funds Strategic Bond Form, accelerating the creation of necessary documents. With advanced editing capabilities, users can modify existing forms with precision, allowing specific addition or removal of elements to tailor the document to their needs.

These interactive features don't just streamline workflows but also empower teams to collaborate more effectively, ensuring that every stakeholder can contribute to and access required information in real-time.

Understanding fees & expenses associated with American Funds

When investing with American Funds, transparency regarding fees and expenses is paramount. Investors should be fully aware that while there are costs associated with bond investments, understanding the distinctions is crucial. When comparing American Funds to other fixed-income funds, it's beneficial to evaluate the management fees, expense ratios, and any potential sales charges.

Effectively managing fees involves assessing your investment goals against the costs incurred. Consider the long-term benefits versus immediate costs to ensure you're making the most out of your bond investments.

Risk management with American Funds

Investing in strategic bonds does carry inherent risks. It's essential for investors to assess factors such as credit risk, interest rate fluctuations, and market volatility. Understanding these risks provides a solid foundation for developing strategies to address them. pdfFiller can assist by incorporating performance monitoring tools to keep track of your bond investment changes over time.

To mitigate risks effectively, investors should diversify their bond holdings across various types of bonds and maturities. Establishing a review schedule to evaluate investment performance against market trends can highlight potential issues before they escalate.

Portfolio management insights

Managing a bond portfolio necessitates adopting best practices to ensure optimal performance. The American Funds Strategic Bond Form serves as an invaluable tool for tracking your investments, helping to identify shifts in strategy and allocations. By maintaining organized records, investors can better adapt to changing market conditions.

Strategic bonds should align with long-term financial goals and asset allocation frameworks. Understanding your timeframe and risk tolerance will dictate your approach to bond investing, providing clarity on how to structure your portfolio effectively.

Capital ideas and trends in fixed-income investing

Current market trends are critically influencing bond investments, particularly regarding interest rates. As central banks may adjust rates to manage inflation, the bond market experiences corresponding shifts that can affect yields and pricing. Investors should remain aware of these trends to make informed investment decisions.

Going forward, strategic bonds are poised to remain an essential component in a well-balanced portfolio. Those considering fixed-income investments must analyze broader economic indicators and understand how changes in policy and global financial conditions could impact their investments.

Conclusion on effective form management

Accurate completion of the American Funds Strategic Bond Form is crucial for successful investment management. The clarity it offers ensures that all involved parties are aligned with investment strategies and goals. Utilizing pdfFiller's comprehensive suite of document management tools simplifies the entire process, supporting effective collaboration and document handling.

Encouraging disciplined document management through platforms like pdfFiller enhances workflow efficiency, reduces errors, and supports informed decision-making in the dynamic landscape of bond investing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete american funds strategic bond online?

How do I edit american funds strategic bond in Chrome?

How do I edit american funds strategic bond on an iOS device?

What is american funds strategic bond?

Who is required to file american funds strategic bond?

How to fill out american funds strategic bond?

What is the purpose of american funds strategic bond?

What information must be reported on american funds strategic bond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.