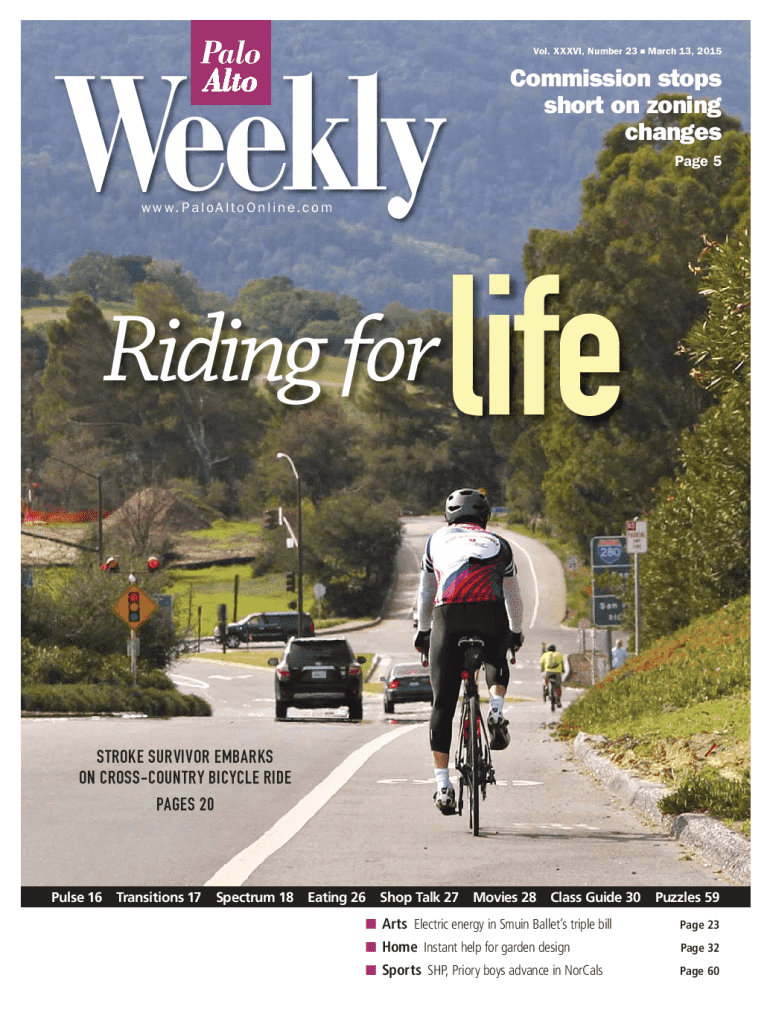

Get the free Commission stops short on zoning changes

Get, Create, Make and Sign commission stops short on

How to edit commission stops short on online

Uncompromising security for your PDF editing and eSignature needs

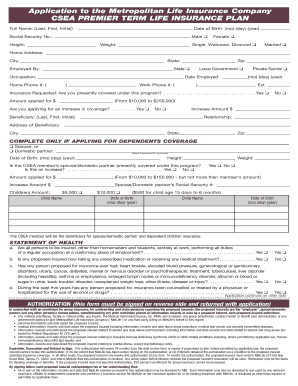

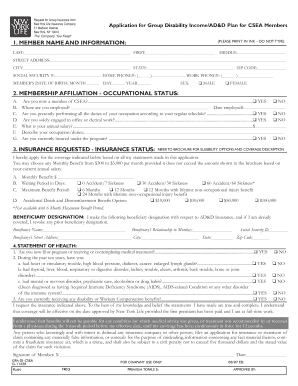

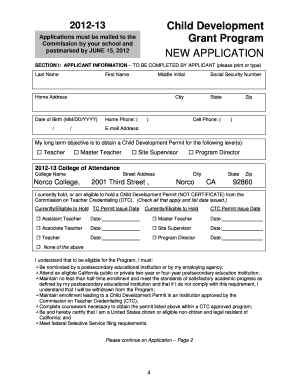

How to fill out commission stops short on

How to fill out commission stops short on

Who needs commission stops short on?

Commission stops short on form: How to fine-tune your commission strategies for success

Understanding commission structures

Sales commissions are incentive-based payments meant to motivate sales teams and align their interests with company revenue goals. These commissions can come in various forms and significantly impact both employee performance and morale. A well-defined commission plan is essential — it not only establishes the parameters of earning potential but also cultivates a sense of transparency and fairness within the team.

Understanding these various structures helps businesses create effective compensation plans. When sales roles are tailored to specific products or market conditions, understanding commission types can lead to optimized performance and greater overall organizational success.

The consequences of capping commissions

Capping commissions can create significant issues for sales teams and the broader organization. While it might seem like a prudent financial decision, there are myriad reasons company leaders should avoid this approach.

Ultimately, capping commissions stops short on form, failing to recognize the value that motivated sales teams contribute to overall business success.

Assessing your current commission plan

Evaluation of current commission plans is crucial for businesses looking to enhance their sales incentives. Key metrics for assessing effectiveness include sales performance against targets, turnover rates, and employee satisfaction surveys, which often reveal the responsiveness of the commission structure.

Once you've gathered substantial data, identifying areas for improvement becomes clearer. Engaging proactively with sales teams can open lines of communication and foster collaboration in refining commission structures.

Crafting a dynamic commission strategy

Creating a commission strategy involves customizing compensation based on the unique responsibilities of different sales roles. Tailoring commissions ensures that incentives align with individual contributions to the organization. Performance data plays a critical role in informing these decisions, where historical data can reveal how various teams respond to adjustments in commission structures.

An adaptable commission plan not only encourages high performance but also creates a culture of accountability wherein team members feel directly connected to overarching company success.

Implementing changes to your commission plan

Revising commission structures isn't a one-size-fits-all process. It requires a methodical approach to ensure stakeholder engagement and acceptance. Here’s a step-by-step guide to effecting changes seamlessly.

Such transparency not only minimizes resistance to change but also fosters trust, ensuring team members align closely with the business's evolving goals.

Utilizing technology in commission management

Technology can greatly enhance how commission plans are managed through tools and software designed for tracking performance and earnings. Automated systems reduce human error and provide real-time updates, which are critical for responding to market changes. Cloud-based solutions allow teams to access commission details from anywhere, fostering the essential flexibility needed in today’s dynamic workplaces.

Incorporating technology into commission management not only boosts efficiency but also enables teams to maintain flexibility in a rapidly changing business landscape.

Engaging with external experts

Recognizing when to consult external experts is an integral part of refining commission strategies. There are times when internal analysis might not uncover all challenges, and an outside perspective can provide additional insights.

Outside help can often bring fresh, innovative solutions to seemingly insurmountable challenges, ensuring that your commission setup truly enhances productivity and drive.

Case studies: Success stories in commission strategy

Examining successful companies that have avoided capping their commissions can provide valuable lessons. For instance, firms that have allowed for unlimited commission potential often see increased productivity and lower turnover rates.

Conversely, companies that implemented cap systems must confront decreased morale and engagement spiraling into lower performance metrics. Learning from both successes and failures can help refine best practices.

Commission management best practices

To stay ahead in competitive markets, regularly reviewing and auditing commission plans is essential. Agile teams must be ready to adapt plans based on market trends and shifting organizational goals.

Establishing such best practices can significantly improve a company’s adaptability and overall performance.

Exploring resources & tools for enhanced commission strategies

A plethora of resources is available for enhancing commission strategies. These tools range from interactive commission planning platforms to insightful industry publications that provide guidance on best practices.

The integration of these resources will bolster strategies, helping businesses avoid pitfalls often associated with poorly managed commission structures.

Establishing a culture of performance and accountability

Building a solid culture of performance hinges on management's commitment to a transparent and empowering commission strategy. Leading by example is vital; if management is engaged and responsive, teams will likely reflect the same dedication.

By fostering such a culture, companies can create motivated teams that contribute to substantial organizational growth and success, elevating overall performance metrics.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify commission stops short on without leaving Google Drive?

How can I send commission stops short on for eSignature?

How do I complete commission stops short on on an iOS device?

What is commission stops short on?

Who is required to file commission stops short on?

How to fill out commission stops short on?

What is the purpose of commission stops short on?

What information must be reported on commission stops short on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.